Gaming Market Size 2025-2029

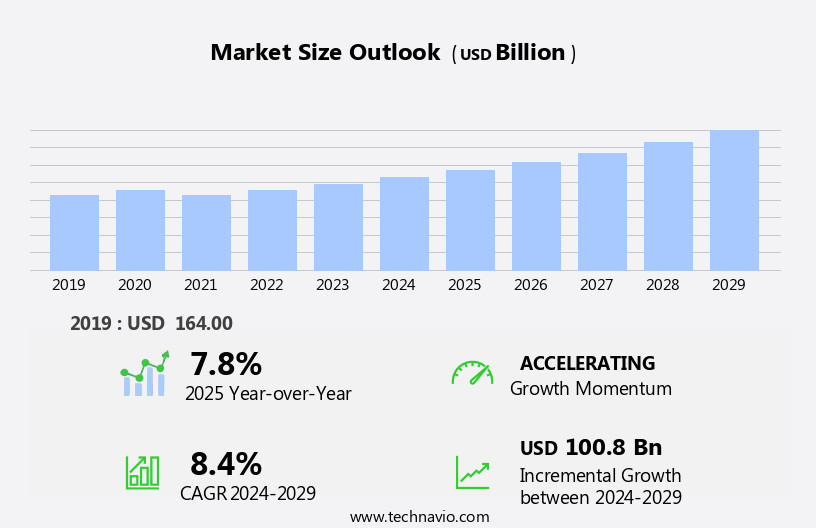

The gaming market size is forecast to increase by USD 100.8 billion, at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by the increasing adoption of augmented reality (AR) and virtual reality (VR) games. These immersive technologies offer players unprecedented levels of engagement and interaction, fueling the demand for more sophisticated and realistic gaming experiences. Additionally, the emergence of cloud gaming is disrupting traditional gaming models, enabling players to access high-performance games on demand and without the need for expensive hardware. However, the market faces challenges as well. Regulation of loot boxes, randomized in-game purchases, is gaining scrutiny from governments and consumer protection agencies, raising concerns over potential addictive behaviors and ethical issues.

- Companies must navigate these challenges by ensuring transparency and fairness in their gaming practices while continuing to innovate and meet the evolving demands of tech-savvy consumers. In summary, the market is poised for continued growth, driven by technological advancements and shifting consumer preferences, while navigating regulatory challenges to maintain a competitive edge.

What will be the Size of the Gaming Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic innovations shaping its various sectors. Game audio integrates advanced technologies, enhancing immersive experiences. Player data analysis fuels personalized game recommendations and targeted advertising. Competitive multiplayer engages players, fostering vibrant gaming communities. Game design embraces procedural generation and mixed reality, offering fresh experiences. Gaming peripherals cater to diverse user preferences, optimizing gameplay. User experience and graphics fidelity remain paramount, pushing technological boundaries. In-game advertising and cloud gaming redefine monetization strategies. Game performance and game engines are continually refined, driving industry advancements. Game programming, game testing, and game development frameworks ensure seamless gameplay. Mobile gaming and console gaming cater to diverse platforms.

Frame rate, game mechanics, and game physics optimize player engagement. Character design, cooperative multiplayer, and subscription models expand the gaming landscape. Game development tools, game localization, game art, and game development platforms facilitate creativity. Artificial intelligence and machine learning revolutionize game AI, non-player characters, and game engine optimization. The market's continuous dynamism reflects the industry's commitment to innovation and growth.

How is this Gaming Industry segmented?

The gaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Casual gaming

- Professional gaming

- Platform

- Online

- Offline

- Device

- Mobile gaming

- Console gaming

- PC gaming

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

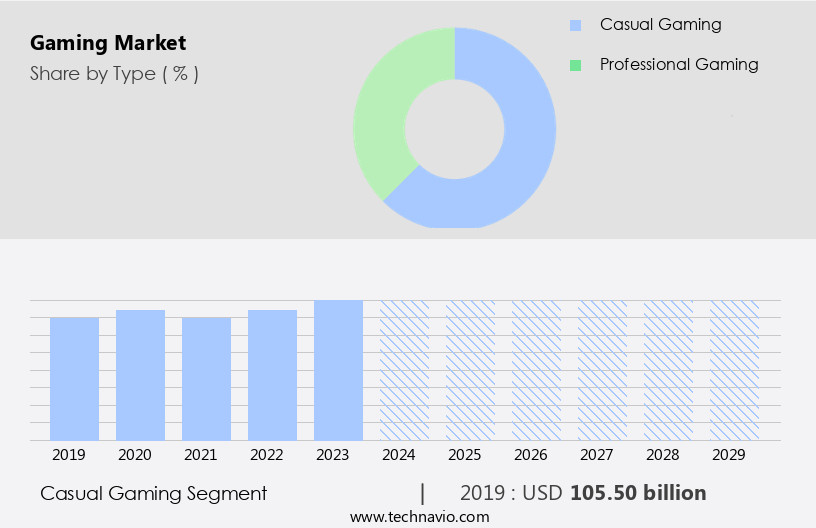

The casual gaming segment is estimated to witness significant growth during the forecast period.

The casual the market is experiencing significant growth due to the increasing popularity of mobile gaming. This segment caters to players who prefer games that do not demand extensive time investment. Game development in this sector focuses on user experience, graphics fidelity, and easy-to-understand game mechanics. Augmented reality and virtual reality technologies are increasingly being integrated into casual games, enhancing immersion. Non-player characters and game physics add realism, while machine learning and artificial intelligence bring a new level of challenge and engagement. Game analytics and live streaming enable developers to gather player data and improve game design.

Social gaming and cooperative multiplayer foster community building. Console gaming and PC gaming still hold a strong presence, but mobile gaming's convenience and accessibility make it a preferred choice for casual gamers. Frame rate and game mechanics are crucial factors in ensuring smooth gameplay. Wearable gaming and cloud gaming are emerging trends, offering new opportunities for developers. Game monetization models, such as subscription services and in-game advertising, provide revenue streams for casual gaming service providers. Game development tools, engines, and platforms facilitate the creation of engaging and immersive experiences.

The Casual gaming segment was valued at USD 105.50 billion in 2019 and showed a gradual increase during the forecast period.

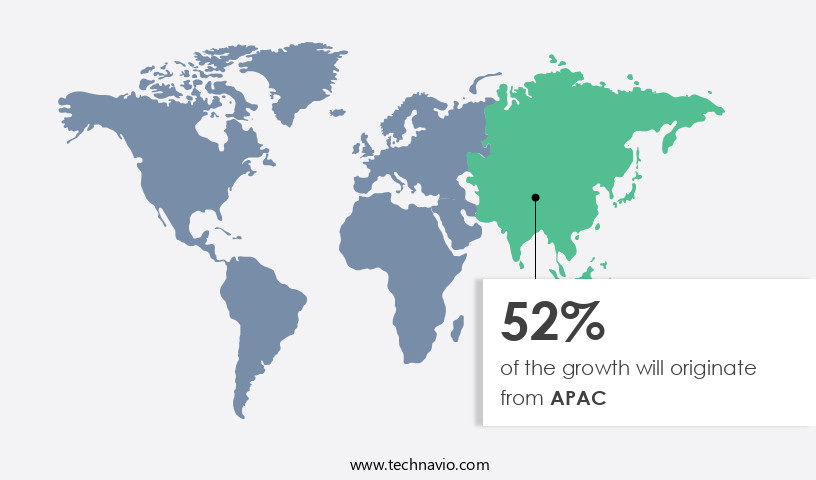

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant advancements, with APAC emerging as a key region due to its large population of professional gamers. E-sports' increasing penetration in countries like Taiwan, Malaysia, and Singapore is driving growth in this area. Notable companies leading the digital gaming industry in APAC include Tencent and GungHo Online Entertainment, based in China. Japan, home to major hardware companies Sony and Nintendo, is at the forefront of gaming technology innovation. The integration of games into smart devices, with varying screen sizes and graphics capabilities, is facilitated by their widespread availability. Advancements in gaming technologies are transforming the landscape.

Augmented reality and virtual reality are increasingly being used to create immersive gaming experiences. Game development involves intricate processes, from programming and AI to level design and character creation. Game engines, such as Unity and Unreal, optimize game performance, while software development kits facilitate customization. Network latency is a critical factor in online gaming, and live streaming platforms like Twitch and YouTube Gaming offer real-time interaction between players. Social gaming and gaming communities foster a sense of competition and cooperation. Console gaming and PC gaming cater to different preferences, while mobile gaming offers convenience and accessibility. Game monetization models include subscription services and in-game advertising, with machine learning and artificial intelligence enabling personalized experiences.

Game development tools, such as game design software and physics engines, streamline the development process. Gaming peripherals enhance the user experience, and graphics fidelity continues to be a priority for developers. Competitive and cooperative multiplayer modes cater to different player preferences. Cloud gaming and video game streaming services offer access to a vast library of games without the need for high-end hardware. In-game advertising and sponsorships provide revenue streams for developers. Game performance optimization and engine optimization are essential for delivering seamless gaming experiences. Character design, level design, and game mechanics are crucial aspects of game development. Game testing ensures the quality of the final product, while game engine optimization and user interface design enhance the user experience.

Frame rate, game physics, and audio are essential components of game development, ensuring a harmonious and engaging gaming experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gaming Industry?

- The increasing prevalence of augmented reality (AR) and virtual reality (VR) games serves as the primary catalyst for market growth in this sector.

- AR and VR gaming represent the next frontier in the gaming industry, offering immersive experiences that blend virtual content with the real world in real time. The adoption of AR/VR devices is expected to grow significantly due to increasing awareness and consumer interest. Game developers are increasingly turning to these technologies, as they offer unique opportunities for game mechanics, physics, and user interface design. Major gaming companies, such as Sony and Microsoft, are investing in advanced 3D technologies to develop gaming platforms for AR and VR devices. For instance, Microsoft's HoloLens 2, which includes sensors for head and eye tracking, was launched in India in January 2022.

- This device enables users to interact with holograms, providing a more immersive gaming experience. Game development for AR and VR requires specialized tools and frameworks, including game engines, software development kits, and game testing tools. Game engine optimization is crucial to ensure smooth gameplay and high frame rates. Procedural generation of game content and realistic game physics are also essential for creating engaging and harmonious gaming experiences. Mobile gaming is another significant segment of the market, with millions of users playing games on their smartphones and tablets. Mobile gaming requires optimization for different screen sizes and processing capabilities, making it a unique challenge for game developers.

- In conclusion, the gaming industry is constantly evolving, with AR and VR technologies and mobile gaming leading the way. Game developers must stay up-to-date with the latest trends and tools to create engaging and immersive gaming experiences for users.

What are the market trends shaping the Gaming Industry?

- Cloud gaming is gaining significant traction in the market, representing an emerging trend in the industry. This shift towards cloud-based gaming solutions is mandatory for staying competitive in today's technological landscape.

- Cloud gaming is a technology that allows users to access and play games on remote servers via Internet-connected devices. This model offers flexibility and convenience, as it eliminates the need for expensive gaming hardware and complicated setups. The rise of social media and mobile gaming has fueled the growth of cloud gaming, as it caters to the cost-effective pricing structure preferred by non-core gamers. Cloud gaming services utilize grid computing to stream content to users' devices through wired or wireless broadband connections. Compared to traditional console gaming, cloud gaming presents several advantages, including fewer hassles. Unlike console gaming, cloud gaming does not necessitate the acquisition of new hardware or the installation of games through discs, digital downloads, or patches.

- Game development tools, such as game art, level design, and character design, are essential components of the cloud the market. Furthermore, advancements in artificial intelligence and machine learning are revolutionizing game development platforms, enabling more immersive and harmonious gaming experiences. Cooperative multiplayer and subscription models are also gaining popularity in cloud gaming, providing users with a more social and cost-effective gaming experience. Game localization is another crucial aspect of the cloud the market, ensuring that games are accessible to a global audience.

What challenges does the Gaming Industry face during its growth?

- Loot boxes, which involve the sale of randomized in-game items, pose a significant regulatory challenge that could impact the growth of the gaming industry.

- The market is experiencing significant growth and innovation, driven by advancements in game audio, user experience, graphics fidelity, and game design. Competitive multiplayer and cloud gaming are popular trends, with user experience being a key differentiator. Gaming peripherals, in-game advertising, and game engines are essential components of the ecosystem. Regulatory scrutiny, however, is increasing, particularly regarding loot boxes. These virtual items, purchased with real money for randomized in-game rewards, have raised concerns over gambling and exploitation, leading regulators in several countries to take action.

- Developers and publishers must adapt to comply with these regulations, which could impact their business models. Game performance is another critical factor, with players demanding immersive and harmonious experiences. Overall, the gaming industry continues to evolve, presenting opportunities and challenges for stakeholders.

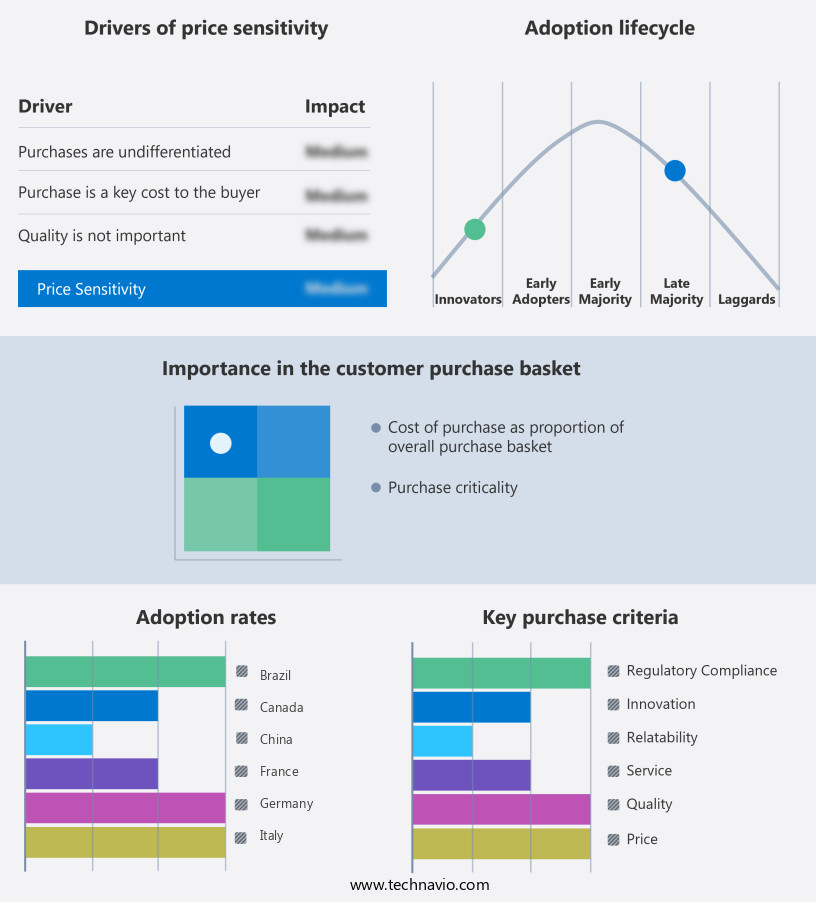

Exclusive Customer Landscape

The gaming market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Activision Blizzard Inc. - This company specializes in the development and distribution of a diverse range of engaging video games. Among its offerings are Call of Duty titles, including Call of Duty 17, Call of Duty Warzone, and Call of Duty Vanguard. Additionally, the company provides Tony Hawk's Pro Skater 1 plus 2 and Crash Bandicoot. Each game provides unique experiences for players, contributing to the company's extensive catalog and elevating its presence in the global gaming industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Activision Blizzard Inc.

- Apple Inc.

- Bandai Namco Holdings Inc.

- Bowlero Corp.

- Chicago Gaming Co.

- DeNA Co. Ltd.

- Electronic Arts Inc.

- Epic Games Inc.

- GungHo Online Entertainment Inc.

- Microsoft Corp

- NetEase Inc.

- Netmarble Corp.

- Niantic Inc.

- Nintendo Co., Ltd.

- Rovio Entertainment Corp.

- Sony Group Corp.

- Square Enix Holdings Co. Ltd.

- The Walt Disney Co.

- Ubisoft Entertainment SA

- Zeptolab UK Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gaming Market

- In February 2023, Sony Interactive Entertainment, a leading gaming company, announced the launch of its new gaming console, PlayStation 5, marking a significant leap in console gaming with its advanced features such as haptic feedback and 3D audio (Sony Interactive Entertainment, 2023). In June 2024, Microsoft's gaming division, Xbox, unveiled its strategic partnership with Bethesda Softworks, a renowned game developer, to expand its gaming portfolio and create exclusive games for Xbox consoles and PC (Microsoft, 2024).

- In November 2024, Electronic Arts (EA), a prominent gaming company, raised USD1.1 billion through a senior secured notes offering to fuel its growth in areas like cloud gaming, live services, and mobile gaming (Electronic Arts Inc., 2024). In March 2025, Apple, entering the market, launched its subscription gaming service, Apple Arcade, with over 100 exclusive games, challenging established players like Google Stadia and Microsoft's Xbox Game Pass (Apple, 2025). These developments reflect the ongoing competition, innovation, and expansion in the market.

Research Analyst Overview

- The gaming industry continues to evolve, with various genres such as simulation games, adventure games, VR games, sports games, puzzle games, strategy games, AR games, mobile games, role-playing games, shooter games, and fighting games capturing the attention of consumers. Game design patterns influence the development of new titles, while cloud computing enables access to games on personal computers and mobile devices. Digital distribution platforms and game marketing strategies drive game sales, with gaming news and reviews shaping consumer decisions.

- Gaming events and e-sports events showcase the latest trends, fostering a vibrant gaming culture. Indie games and niche genres challenge the dominance of mainstream titles. Game design, advertising, and sales strategies adapt to the evolving market landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gaming Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 100.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

China, US, Japan, South Korea, Canada, Germany, France, Italy, UAE, Brazil, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gaming Market Research and Growth Report?

- CAGR of the Gaming industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gaming market growth of industry companies

We can help! Our analysts can customize this gaming market research report to meet your requirements.