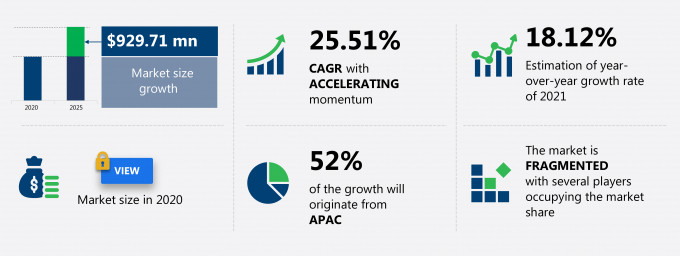

The gesture recognition market share for consumer electronic devices is expected to increase by USD 929.71 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 25.51%.

This gesture recognition market for consumer electronic devices research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers gesture recognition market for consumer electronic devices segmentations by technology (2D and 3D), product (smartphones, PCs, smart TVs, and tablets), and geography (APAC, North America, Europe, South America, and MEA). The gesture recognition market for consumer electronic devices report also offers information on several market vendors, including Cipia Vision Ltd., Crunchfish AB, Elliptic Laboratories AS, GestureTek, Infineon Technologies AG, Intel Corp., Motion Gestures, PointGrab Inc., Samsung Electronics Co. Ltd., and Sony Group Corp. among others.

What will the Gesture Recognition Market Size for Consumer Electronic Devices be During the forecast Period?

Download the Free Report Sample to Unlock the Gesture Recognition Market Size for Consumer Electronic Devices for the forecast Period and Other Important Statistics

Gesture Recognition Market for Consumer Electronic Devices: Key Drivers, Trends, and Challenges

Based on our research output, there has been a neutral impact on the market growth during and post-COVID-19 era. The increase in the number of patent-related activities among market vendors is notably driving the gesture recognition market growth for consumer electronic devices, although factors such as lack of standardization in gestures and movements may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the gesture recognition industry for consumer electronic devices. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Gesture Recognition Market Driver for Consumer Electronic Devices

The increase in the number of patent-related activities among market vendors is one of the key drivers supporting the gesture recognition market growth for consumer electronic devices. An increase in patent-related activity indicates that more firms are focusing on commercializing gesture recognition technology on a larger scale by incorporating touchless gesture features on several consumer electronic devices such as smartphones, tablets, smart TVs, and PCs. This indicates that gesture recognition technology is a key enabler for several new developments across the consumer electronic devices market. Hence, the increase in the number of patent-related activities will compel more vendors to design and create their own gesture recognition technology, thereby driving the growth of the market.

Key Gesture Recognition Market Trend for Consumer Electronic Devices

An increase in the number of process manufacturers incorporating gesture recognition technology is one of the key gesture recognition market trends that is contributing to the market growth. For instance, in 2017, Google announced that it has begun shipping gesture recognition kits based on Soli. A 9x12.5-mm radar chip from Infineon Technologies has been used in Project Soli. The chip sends and receives waves that reflect off the user's finger. Moreover, with the advent of technologies such as Intel's RealSense, gesture recognition is likely to penetrate smartphones, tablets, and other devices during the forecast period. RealSense uses 3D depth cameras that are small enough to fit into smartphones and tablets. Thus, with processor manufacturers increasingly focusing on the integration of gesture recognition in their processors, the global gesture recognition market for consumer electronic devices is expected to grow during the forecast period

Key Gesture Recognition Market Challenge for Consumer Electronic Devices

Lack of standardization in gestures and movements is one of the key drivers supporting the gesture recognition market growth for consumer electronic devices. Gesture recognition-enabled consumer electronic devices require individuals to move their hands, eyes, and lips to initiate the action needed. For instance, on a smart TV, a user can move his palm from left to right or from right to left to switch channels. This movement is read by the camera and the sensor and then analyzed by a gesture recognition-enabled device to carry out the specific action. These movements need to be subtle and not vigorous, primarily because the camera might not be able to detect or understand the movement, thereby resulting in the wrong action being followed. Such challenges will limit the market growth during the forecast period.

This gesture recognition market for consumer electronic devices analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the gesture recognition market as a part of the global application software market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the gesture recognition market for consumer electronic devices during the forecast period.

Who are the Major Gesture Recognition Market for Consumer Electronic Devices Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Cipia Vision Ltd.

- Crunchfish AB

- Elliptic Laboratories AS

- GestureTek

- Infineon Technologies AG

- Intel Corp.

- Motion Gestures

- PointGrab Inc.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

This statistical study of the gesture recognition market for consumer electronic devices encompasses successful business strategies deployed by key vendors. The gesture recognition market for consumer electronic devices is fragmented and the vendors are deploying growth strategies such as product portfolio, product quality, and reliability to compete in the market.

Product Insights and News

- Cipia Vision Ltd. - The company offers Human Machine Interface with attentiveness detection with gesture control.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The gesture recognition market for consumer electronic devices forecast report offers in-depth insights into key vendor profiles. The profiles include information on the leading companies' production, sustainability, and prospects.

Gesture Recognition Market for Consumer Electronic Devices Value Chain Analysis

Our report provides extensive information on the value chain analysis for the gesture recognition market for consumer electronic devices, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Gesture Recognition Market for Consumer Electronic Devices?

for more insights on the market share of various regions Request for a FREE sample now!

52% of the market’s growth will originate from APAC during the forecast period. China, Japan, and South Korea (Republic of Korea) are the key markets for gesture recognition market for consumer electronic devices in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The increasing demand for smartphones will facilitate the gesture recognition market for consumer electronic devices growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The market is witnessing certain challenges due to COVID-19. China, India, Japan, and Australia are some countries that have been the most affected by the pandemic in the region. However, consumer electronic manufacturing plants across the region are slowly resuming their normal operations, owing to COVID-19 vaccination drives. As the demand for and production of electronics recover, the demand for gesture recognition systems will increase. Therefore, the regional market will witness growth during the forecast period

What are the Revenue-generating Technology Segments in the Gesture Recognition Market for Consumer Electronic Devices?

To gain further insights on the market contribution of various segments Request for a FREE sample

The gesture recognition market for consumer electronic devices share growth by the 2D segment will be significant during the forecast period. Consumer electronic devices such as PCs, smartphones, smart TVs, and tablets are being integrated with gesture recognition technology. Most of these devices use an in-built 2D camera. The primary reason for this is because of the lower cost of integration than 3D technology. This allows numerous consumer electronic device manufacturers to integrate a basic level of gesture recognition technology within their devices. Moreover, 2D gesture recognition will continue to dominate in consumer electronic devices rather than 3D gesture recognition during the forecast period. This is primarily because consumer electronic devices with gesture recognition have failed to gain popularity among mass consumers

This report provides an accurate prediction of the contribution of all the segments to the growth of the gesture recognition market for consumer electronic devices size and actionable market insights on the post-COVID-19 impact on each segment.

|

Gesture Recognition Market for Consumer Electronic Devices Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.51% |

|

Market growth 2021-2025 |

$929.71 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

18.12 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 52% |

|

Key consumer countries |

China, US, Japan, South Korea (Republic of Korea), and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Cipia Vision Ltd., Crunchfish AB, Elliptic Laboratories AS, GestureTek, Infineon Technologies AG, Intel Corp., Motion Gestures, PointGrab Inc., Samsung Electronics Co. Ltd., and Sony Group Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Gesture Recognition Market for Consumer Electronic Devices Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive gesture recognition market for consumer electronic devices growth during the next five years

- Precise estimation of the gesture recognition market for consumer electronic devices size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the gesture recognition market for consumer electronic devices industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of gesture recognition market for consumer electronic devices vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch