Ghana Seed Market Size 2024-2028

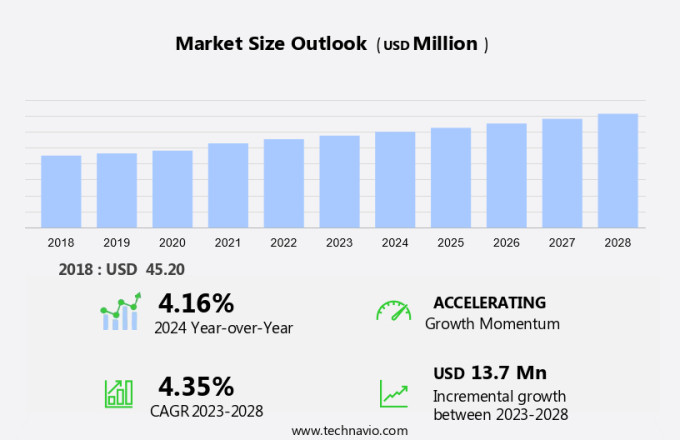

The Ghana seed market size is forecast to increase by USD 13.7 million, at a CAGR of 4.35% between 2023 and 2028. Market expansion hinges on various factors such as the burgeoning urban farming sector, enhanced by increasing government support through farm subsidies and financial aid, alongside the rising adoption of genetically modified (GM) seeds in Ghana. Urban farming activities are on the rise as more individuals and communities engage in agriculture within urban environments, contributing to local food production and economic resilience. Government initiatives such as subsidies and financial aid further bolster agricultural development by providing essential resources and incentives to farmers, thereby fostering productivity and sustainability. Additionally, the growing acceptance and utilization of GM seeds in Ghana's agricultural practices represent a significant shift towards enhancing crop yields and resilience against environmental challenges. These combined factors not only stimulate market growth but also promote agricultural innovation and food security, positioning Ghana's agricultural sector for sustained expansion and resilience in a dynamic global market landscape.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The seed sector in Ghana plays a crucial role in the country's agricultural production, particularly in the adoption of improved seed varieties to enhance farm productivity and mitigate the effects of population expansion and land degradation. With a growing population and increasing demand for food, the area under cultivation for vegetables and other crops is expanding. Farmers rely on both conventional seed sources and packaged seeds from multinational corporations to cultivate high-yielding crops. The seed industry in Ghana is influenced by various market facets, including dietary preferences, cash flows, and urban farming activities. The government also plays a significant role through support and farm subsidies. According to the Agrihouse Foundation, the seed industry is expected to witness significant growth due to the increasing focus on sustainable agriculture and the need for food security. Despite these opportunities, the seed sector faces challenges such as low adoption rates and limited access to finance and technology. To address these issues, industry influencers are emphasizing the importance of investing in research and development to produce more efficient and effective seed varieties.

Key Market Driver

The rising urban farming activities are a key factor driving the seed market growth in Ghana. Urban agriculture utilizes vacant community spaces such as backyards, rooftops, balconies, parking lots, and roadside spaces for crop cultivation. The growing popularity of urban farming projects such as the Ghana Peri-urban Vegetables Value Chain Project (GPVVCP) has increased public awareness about urban farming.

Additionally, owing to its potential to contribute to household food security, urban agriculture has grown in prominence, especially over the last few years. Thus, such factors will drive the growth of the global seeds market during the forecast period.

Primary Market Trends

The innovations in seed technology will be a major trend driving the seed market growth in Ghana. Manufacturers across the world are developing many innovative seed technologies to meet the increasing demand for food production. These technologies are developed to improve production yields and nutrition profiles, lower the costs of production, and offer value-added traits. Innovative seed technologies are tested to be in tandem with ongoing global trends. The cultivation of GM seeds provides better quality and high resistance to pests and insects.

Private seed companies in Africa, including Ghana, are working to come up with a new herbicide-coated maize seed variety to help the seed gain resistance against Striga, which is a parasitic weed responsible for infesting up to 50 million hectares of Sub-Saharan African land. KSC sells StrigAway through a partnership with Feed the Future and the African Agricultural Technology Foundation (AATF). These developments in seed technologies are expected to pave the way for the development of seed standards and drive the growth of the global seeds market during the forecast period.

Major Market Challenge

The rising seed prices will be a major challenge for the seed market share growth in Ghana. Seed breeding is an expensive process, which increases the cost of seeds. Players in the seed market in Ghana are investing more in breeding seeds with advanced traits or genes that are sourced from Genentech companies. However, the use of advanced technology for cultivation increases the cost of seeds. For instance, Monsanto increases the overall prices of its seeds by 5%-10% every year to provide seeds with modified traits at premium prices. The costs of commercialization for these products with international legal protection also increase seed costs.

Moreover, the advent of genetically engineered crops has corresponded to an increased state of seed monopolization by huge biotechnology companies, thereby resulting in higher seed costs. This has gradually pushed conventional and non-GM seeds out of the market, thereby reducing farmers' options. Vendors that have a stronghold over the market can determine the prices of seeds. The agricultural inputs sector has also been witnessing concentration, further adding to farmers' woes, which, in turn, will hamper the growth of the seed market in Ghana during the forecast period.

Exculsive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Agriseeds Pvt Ltd.: The company offers maize, soybean, sugar bean, sorghum, and vegetable seeds.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cargill Inc.

- Corteva Inc.

- Groupe Limagrain

- M and B Seeds and Agricultural Services Ltd.

- Meridian Seeds and Nurseries Ghana Ltd.

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- RMG Ghana Ltd.

- Seed Co Group

- Syngenta Crop Protection AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Product Type

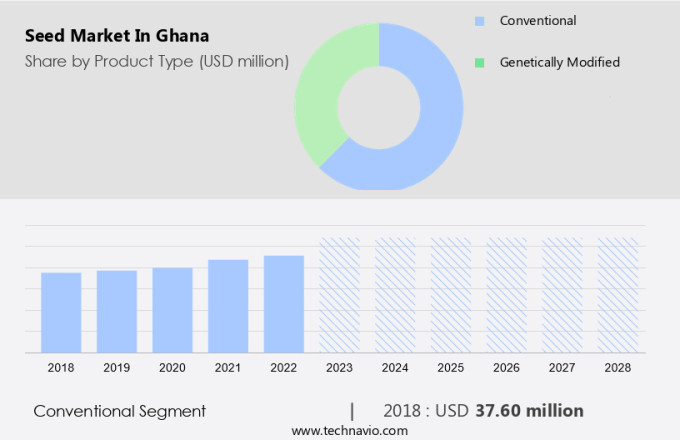

The seed market segmentation in Ghana by product type consists of conventional and genetically modified. The market share growth by the conventional segment will be significant during the forecast period. The conventional segment has been the largest growing product segment of the seed market in Ghana owing to the presence of allergens in other types of seeds, including GM seeds. Conventional seeds include all open-pollinated and hybrid varieties of seeds developed naturally and not through modern biotechnology.

Get a glance at the market share of various regions Download the PDF Sample

The conventional segment was valued at USD 37.60 million in 2018. Conventional seeds in farming are increasingly prevalent in African countries, including Ghana, owing to the surging demand for organically-produced seeds and crops. In addition, farmers are increasingly shifting away from the use of synthetic and chemical fertilizers owing to a growing demand for natural, organic produce and stringent regulatory and compliance requirements. Such regulations are estimated to increase the demand for conventional seeds in Ghana, which, in turn, will prompt the growth of the market during the forecast period.

Segment Overview

The market research report provides comprehensive data, with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type Outlook

- Conventional

- Genetically modified

- Crop Type Outlook

- Cereals and grains

- Fruits and vegetables

- Oilseeds and pulses

- Others

- Type Outlook

- Herbicide-tolerance (HT)

- Insect-resistance (IR)

- Others

You may also interested in below market reports:

Market Analyst Overview:

Enhancing Agricultural Productivity and Nutritional Value through Improved Seed Varieties The seed industry plays a pivotal role in ensuring food security and improving agricultural productivity by providing farmers with high-yielding, disease-resistant, and improved seed varieties. The increasing population expansion and land degradation rate have necessitated the adoption of better seed technologies to increase the area under cultivation, particularly for staple crops like wheat. Farmers are increasingly turning to multinational corporations for high-quality seeds, which offer enhanced nutritional value, improved yields, and technological advancements such as genetic engineering. The shift towards sustainable agriculture practices and urban farming activities has also led to a growing demand for packaged seeds. The seed industry's market facets extend beyond cash flows for farmers.

Further, public research institutions and government support, including farm subsidies, play a crucial role in driving innovation and ensuring the availability of improved seed varieties. Vegetables, a significant component of dietary preferences, are also undergoing a seed revolution. Technological advancements in seed production have led to the development of seeds with enhanced nutritional value and disease resistance, catering to the evolving needs of consumers. The seed industry's impact on the environment and human health is significant. Co-products from seed refining, such as oilseeds, have found applications in the animal feed industry, making it a circular economy success story. In conclusion, the seed industry's role in enhancing agricultural productivity, improving crop yield, and ensuring food security is indispensable.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

128 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.35% |

|

Market growth 2024-2028 |

USD 13.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.16 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agriseeds Pvt Ltd., Cargill Inc., Corteva Inc., Groupe Limagrain, M and B Seeds and Agricultural Services Ltd., Meridian Seeds and Nurseries Ghana Ltd., Rijk Zwaan Zaadteelt en Zaadhandel BV, RMG Ghana Ltd., Seed Co Group, and Syngenta Crop Protection AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Ghana

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies