GIS Market Size 2025-2029

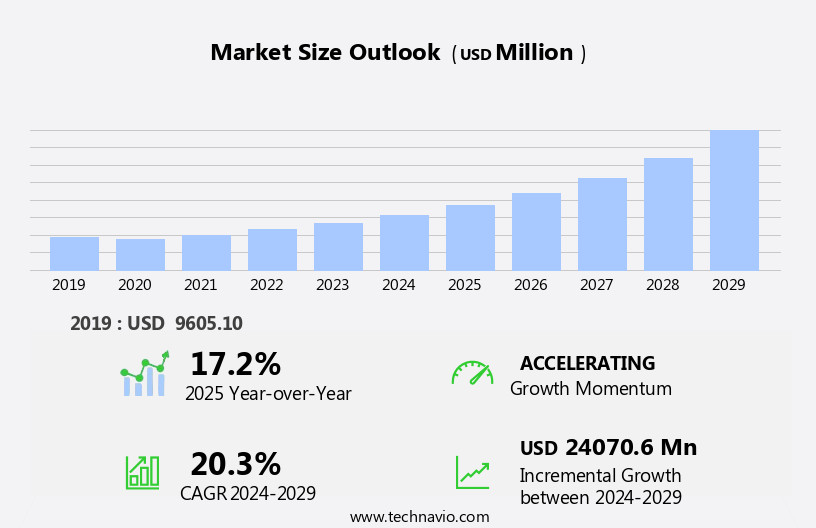

The GIS market size is forecast to increase by USD 24.07 billion, at a CAGR of 20.3% between 2024 and 2029.

- The Global Geographic Information System (GIS) market is experiencing significant growth, driven by the increasing integration of Building Information Modeling (BIM) and GIS technologies. This convergence enables more effective spatial analysis and decision-making in various industries, particularly in soil and water management. However, the market faces challenges, including the lack of comprehensive planning and preparation leading to implementation failures of GIS solutions. Companies must address these challenges by investing in thorough project planning and collaboration between GIS and BIM teams to ensure successful implementation and maximize the potential benefits of these advanced technologies.

- By focusing on strategic planning and effective implementation, organizations can capitalize on the opportunities presented by the growing adoption of GIS and BIM technologies, ultimately driving operational efficiency and innovation.

What will be the Size of the GIS Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The global Geographic Information Systems (GIS) market continues to evolve, driven by the increasing demand for advanced spatial data analysis and management solutions. GIS technology is finding applications across various sectors, including natural resource management, urban planning, and infrastructure management. The integration of Bing Maps, terrain analysis, vector data, Lidar data, and Geographic Information Systems enables precise spatial data analysis and modeling. Hydrological modeling, spatial statistics, spatial indexing, and route optimization are essential components of GIS, providing valuable insights for sectors such as public safety, transportation planning, and precision agriculture. Location-based services and data visualization further enhance the utility of GIS, enabling real-time mapping and spatial analysis.

The ongoing development of OGC standards, spatial data infrastructure, and mapping APIs continues to expand the capabilities of GIS, making it an indispensable tool for managing and analyzing geospatial data. The continuous unfolding of market activities and evolving patterns in the market reflect the dynamic nature of this technology and its applications.

How is this GIS Industry segmented?

The GIS industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Software

- Data

- Services

- Type

- Telematics and navigation

- Mapping

- Surveying

- Location-based services

- Device

- Desktop

- Mobile

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

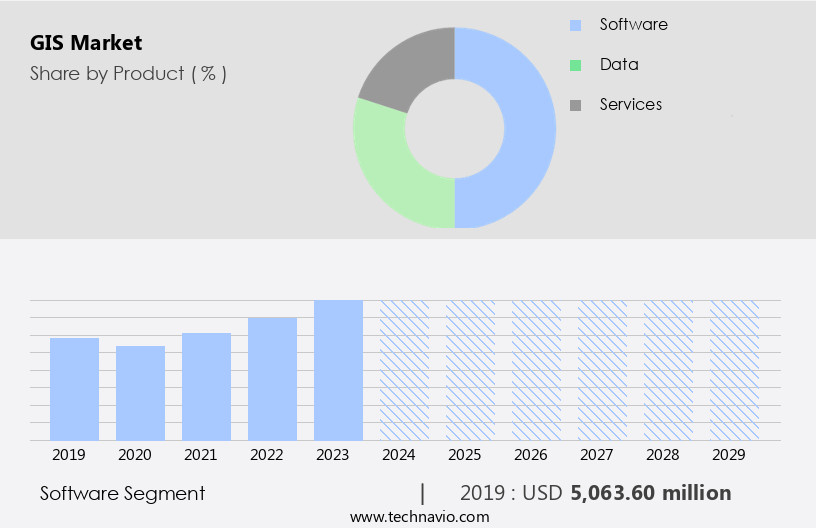

The software segment is estimated to witness significant growth during the forecast period.

The Global Geographic Information System (GIS) market encompasses a range of applications and technologies, including raster data, urban planning, geospatial data, geocoding APIs, GIS services, routing APIs, aerial photography, satellite imagery, GIS software, geospatial analytics, public safety, field data collection, transportation planning, precision agriculture, OGC standards, location intelligence, remote sensing, asset management, network analysis, spatial analysis, infrastructure management, spatial data standards, disaster management, environmental monitoring, spatial modeling, coordinate systems, spatial overlay, real-time mapping, mapping APIs, spatial join, mapping applications, smart cities, spatial data infrastructure, map projections, spatial databases, natural resource management, Bing Maps, terrain analysis, vector data, Lidar data, and geographic information systems.

The software segment includes desktop, mobile, cloud, and server solutions. Open-source GIS software, with its industry-specific offerings, poses a challenge to the market, while the adoption of cloud-based GIS software represents an emerging trend. However, the lack of standardization and interoperability issues hinder the widespread adoption of cloud-based solutions. Applications in sectors like public safety, transportation planning, and precision agriculture are driving market growth. Additionally, advancements in technologies like remote sensing, spatial modeling, and real-time mapping are expanding the market's scope.

The Software segment was valued at USD 5.06 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

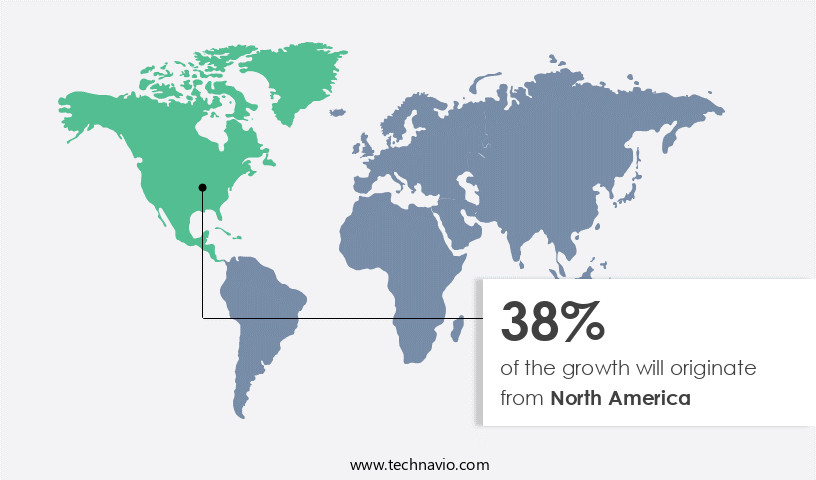

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic and technologically advanced North American market, Geographic Information Systems (GIS) solutions have gained significant traction. Google Maps, a leading location-based platform, integrates various GIS functionalities such as geocoding APIs, routing APIs, and real-time mapping. Raster data, satellite imagery, and aerial photography are crucial components of GIS, enabling applications in urban planning, precision agriculture, and disaster management. ESRI, a prominent player in the US, offers comprehensive GIS software and services, including geospatial analytics, spatial data infrastructure, and network analysis. The Canadian market is also experiencing rapid growth, driven by the adoption of GIS in sectors like government, utilities, and telecommunications.

The region's industrially developed and technologically mature sectors foster a fertile ground for GIS innovation. Key applications include asset management, infrastructure management, and spatial modeling. OGC standards, spatial indexing, and spatial data infrastructure facilitate seamless data exchange and integration. Public safety, transportation planning, and land use planning are other sectors benefiting from GIS. Remote sensing, hydrological modeling, and spatial statistics offer valuable insights for environmental monitoring and natural resource management. Bing Maps and other competitors contribute to the market's competitive landscape. The integration of location-based services, data visualization, and mapping applications further enhances the value proposition of GIS. Overall, the North American market is characterized by continuous innovation and expanding applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of GIS Industry?

- The integration of Building Information Modeling (BIM) and Geographic Information Systems (GIS) is a significant market trend, driving innovation and efficiency in the construction industry by enabling seamless data exchange and analysis between architectural designs and geographic locations.

- The market is experiencing significant growth due to the increasing adoption of Geographic Information Systems (GIS) in various industries. One of the key drivers is the integration of GIS with Building Information Modeling (BIM). At the primary level, GIS and BIM software work together to organize and standardize 2D and 3D design data. For instance, ESRI's ArcGIS for AutoCAD allows the input of GIS data into AutoCAD software. At the secondary level, GIS adds value to BIM by visualizing and analyzing data related to buildings and their surrounding features, such as environmental and demographic information. Moreover, GIS plays a crucial role in field data collection, transportation planning, precision agriculture, infrastructure management, disaster management, network analysis, and spatial analysis.

- OGC standards ensure interoperability between different GIS systems, enabling seamless data sharing and collaboration. Remote sensing technology enhances the capabilities of GIS by providing accurate and timely information from satellite and airborne sensors. Location intelligence is another area where GIS excels, providing insights into customer behavior, market trends, and operational efficiency. Asset management and infrastructure management also benefit from GIS by enabling real-time monitoring, maintenance scheduling, and performance analysis. In conclusion, the market is poised for continued growth, driven by its ability to provide valuable insights through spatial data analysis and visualization. Recent research emphasizes the importance of GIS in various industries, including transportation, agriculture, and infrastructure management.

What are the market trends shaping the GIS Industry?

- The use of Geographic Information Systems (GIS) for soil and water management is becoming increasingly prevalent in the current market. This trend signifies a significant shift towards advanced technologies in addressing environmental concerns.

- GIS (Geographic Information Systems) solutions play a crucial role in environmental monitoring and management, particularly in the area of water resource management. These systems enable the creation of spatial models, coordinate systems, and spatial overlays for mapping water resources, facilitating agricultural and conservation purposes. For instance, the Kerala Water Authority in India implemented a GIS project in 2015 to manage water loss. Big Raster and IBM's GIS analytic tools were employed for monitoring water loss, aiming for a 100% success rate in equitable water supply during the forecast period.

- IBM's big data and analytics wing is also planning to develop GIS solutions for managing water supply in India. Spatial join, mapping APIs, mapping applications, and real-time mapping are integral components of these GIS solutions, contributing to the development of smart cities and spatial data infrastructures. Map projections and spatial databases are essential for accurate and efficient spatial data management.

What challenges does the GIS Industry face during its growth?

- The absence of proper planning is a significant challenge that can result in the failure of GIS solution implementations, thereby impeding the growth of the industry.

- Geographic Information Systems (GIS) have become essential tools for businesses managing natural resources. GIS enables terrain analysis through vector and Lidar data, offering insights for hydrological modeling and spatial statistics. Spatial indexing and route optimization are crucial for location-based services, while data visualization enhances decision-making. Bing Maps and other GIS platforms facilitate these functions, making it easier for businesses to manage and analyze geographic data. However, the successful implementation of a GIS system necessitates proper planning to avoid mismatches between the system's capabilities and the end-user's requirements.

- In industries like disaster management, precise and updated data is vital for accurate analysis. The importance of thorough planning and testing before implementing a GIS system the system's effectiveness and efficiency in meeting the organization's needs.

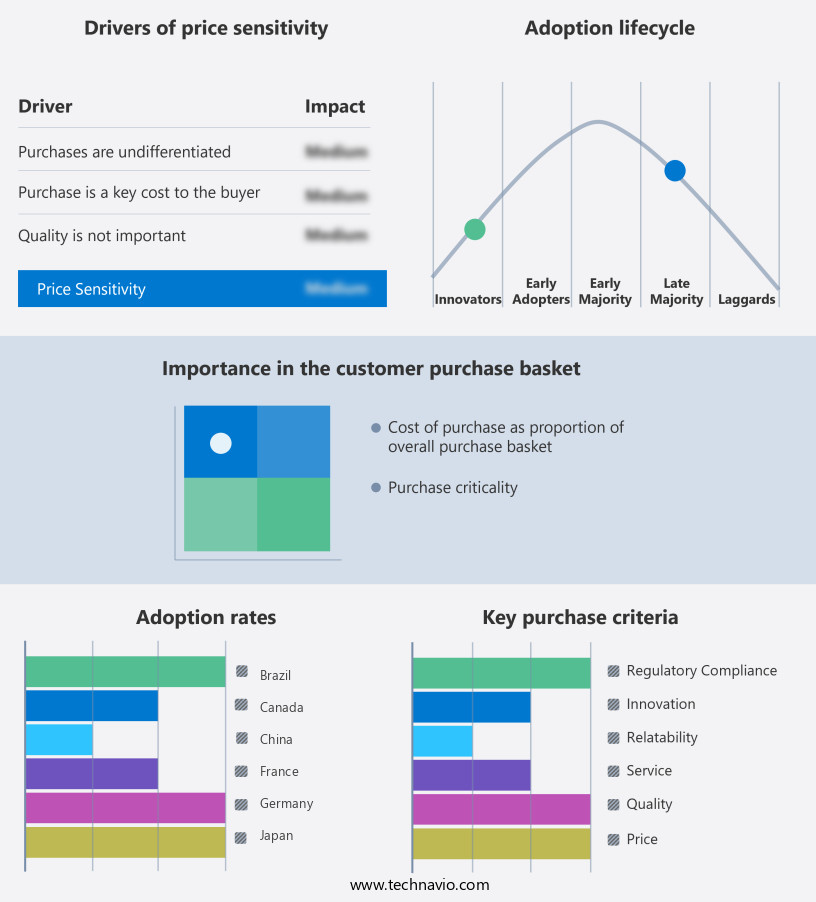

Exclusive Customer Landscape

The GIS market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the GIS market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gis market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AmigoCloud Inc. - This company specializes in Geographic Information Systems (GIS), providing expert analysis and mapping services, data collection, and efficient data management solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AmigoCloud Inc.

- Autodesk Inc.

- Bentley Systems Inc.

- Caliper Corp.

- Cadcorp Ltd.

- Esri Global Inc.

- General Electric Co.

- Google LLC

- Hexagon AB

- Hi Target

- Mapbox Inc.

- Maxar Technologies Inc.

- Pitney Bowes Inc.

- Rolta India Ltd.

- Scanpoint Geomatics Ltd.

- Takor Group Ltd.

- TomTom NV

- Topcon Corp.

- Trimble Inc.

- UrtheCast Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in GIS Market

- In January 2024, Esri, a leading GIS software company, announced the launch of its ArcGIS Enterprise 10.9 version, which introduced advanced analytics capabilities and improved cloud support (Esri Press Release, 2024).

- In March 2024, Hexagon AB, a global technology company, acquired Intergraph Corporation's GIS business, expanding its geospatial solutions portfolio and strengthening its position in the market (Hexagon AB Press Release, 2024).

- In April 2025, Google Maps Platform and Microsoft Azure signed a strategic partnership, enabling seamless integration of GIS services between their platforms, providing enhanced capabilities for businesses (Microsoft News Center, 2025).

- In May 2025, the European Union approved the Copernicus Regulation, a â¬15.4 billion funding program for Earth observation and GIS services, demonstrating a significant commitment to advancing geospatial technology in Europe (European Commission Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant advancements in spatial optimization, predictive analytics, and geospatial data integration. Businesses are leveraging GIS workflows to assess vulnerability and mitigate risks, utilizing artificial intelligence and machine learning for climate change modeling and spatial relationships. Prescriptive analytics and business intelligence provide insights for resource allocation and optimization, while data consistency is ensured through cloud-based GIS and data governance. Data mining and spatial queries enhance data accuracy and completeness, enabling scenario analysis and risk assessment.

- Geospatial intelligence is further advanced through virtual reality and augmented reality, offering immersive experiences for spatial simulation and data interoperability. Optimization algorithms and data security are crucial components of the market, ensuring efficient operations and protecting sensitive information. Overall, the market is transforming the way businesses make informed decisions by integrating geospatial data and advanced analytics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled GIS Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.3% |

|

Market growth 2025-2029 |

USD 24070.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.2 |

|

Key countries |

US, China, Germany, UK, Canada, Brazil, Japan, France, South Korea, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this GIS Market Research and Growth Report?

- CAGR of the GIS industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gis market growth of industry companies

We can help! Our analysts can customize this gis market research report to meet your requirements.