Integrated Building Management Systems Market Size 2025-2029

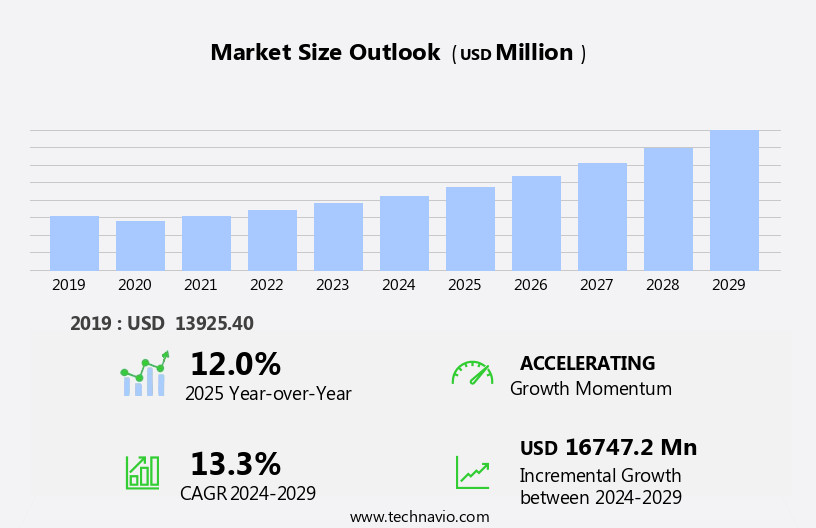

The integrated building management systems market size is forecast to increase by USD 16.75 billion at a CAGR of 13.3% between 2024 and 2029.

- The Integrated Building Management Systems (IBMS) market is experiencing significant growth due to the increasing demand for greater ease in monitoring and controlling building operations. This trend is particularly prominent in the commercial sector, where the need for energy efficiency, cost savings, and improved occupant comfort is driving adoption. Another key driver is the growing popularity of coworking spaces, which require advanced building management systems to optimize resources and create flexible work environments. However, the IBMS market also faces challenges, including vulnerability issues and cyber security threats. As buildings become more connected, the risk of cyber attacks and data breaches increases, necessitating security measures.

- Companies seeking to capitalize on market opportunities must prioritize cyber security and invest in advanced technologies to mitigate risks. Navigating these challenges effectively will require a strategic approach, with a focus on innovation, collaboration, and risk management. By staying abreast of market trends and addressing key challenges, businesses can position themselves for long-term success in the dynamic and evolving IBMS market.

What will be the Size of the Integrated Building Management Systems Market during the forecast period?

- The integrated building management systems (IBMS) market in the US is experiencing significant growth, driven by the increasing adoption of technology to optimize operational life and reduce costs for various industries and residential users. IBMS enables the centralized management of data centers, lighting systems, HVAC, and other building infrastructure through engineering solutions. A bottom-up approach to maintenance, utilizing preventive measures and smart devices, is increasingly popular to minimize maintenance costs and rectify issues before they escalate. The market's size is substantial, with revenues expected to expand due to the integration of IoT technology, energy management initiatives, and energy savings.

- The US market is witnessing a shift towards energy efficiency, driven by legislations and the need to address peak energy demand and equipment failure. Commercial and industrial users are investing in IBMS to simplify operations, reduce operating costs, and enhance system efficiency. The integration of IBMS with energy usage monitoring and HVAC systems is a key trend, enabling users to optimize energy consumption and improve overall system performance.

How is this Integrated Building Management Systems Industry segmented?

The integrated building management systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- Services

- End-user

- Commercial

- Residential

- Government

- Application

- Energy management

- Lighting control

- HVAC control

- Others

- Communication Technology

- BACnet

- LONWorks

- Modbus

- Ethernet/IP

- Others

- Geography

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- Europe

By Component Insights

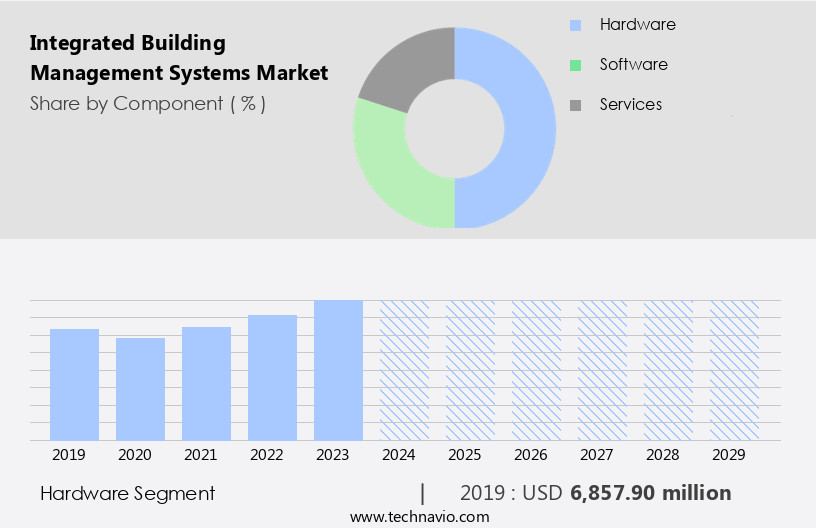

The hardware segment is estimated to witness significant growth during the forecast period.

Integrated Building Management Systems (IBMS) are essential for both industrial facilities and commercial establishments, including office buildings, hospitals, and distribution centers. These systems enable simplified operations, energy efficiency, and resource management. The hardware segment of IBMS consists of controllers, sensors, switches, cameras, storage devices, and gauges. Controllers manage various types of equipment and devices and different sections of the network, while sensors provide input data. Most hardware devices are installed on building premises, contributing significantly to the overall cost of IBMS implementation. Equipment failure can lead to significant operating costs and potential safety issues. IBMS provides critical information on HVAC systems, lighting, and energy consumption, enabling preventive maintenance and rectifying issues before they escalate.

The technology also facilitates IoT integration, enhancing system efficiency and energy savings. Commercial users, including industrial facilities and large residential complexes, and healthcare facilities, benefit from engineering solutions that ensure safety and security, optimize peak energy demand, and provide energy management capabilities. Operational life, maintenance costs, and system efficiency are crucial factors in the decision-making process. Cloud-based solutions offer flexibility, scalability, and cost savings. Energy consumption data can be analyzed to identify initiatives and comply with legislations. Smart devices and networking enable servicing and monitoring of residential premises, data centers, educational institutes, warehouses, production plants, and airport and railway facilities.

Trained personnel are essential for the successful implementation and servicing of IBMS. The lifespan of the system, energy savings, and revenues generated are significant considerations for both industrial and commercial users. Infrastructure facilities, such as factories and distribution centers, require a top-down approach, while residential users may prefer a bottom-up approach. In , IBMS plays a vital role in managing energy usage, optimizing operational life, and ensuring safety and security in various industries. The hardware segment accounts for the highest share of installation costs due to the high volume of components required. Preventive maintenance and energy savings are essential benefits for commercial and industrial users.

Cloud-based solutions offer flexibility and cost savings, while trained personnel are essential for successful implementation and servicing.

Get a glance at the market report of share of various segments Request Free Sample

The Hardware segment was valued at USD 6.86 billion in 2019 and showed a gradual increase during the forecast period.

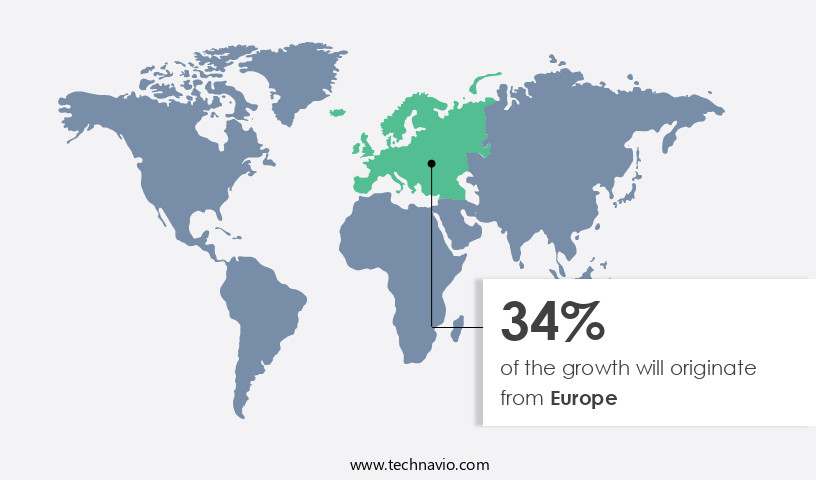

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Integrated Building Management Systems (IBMS) market is experiencing significant growth due to the increasing adoption of smart buildings and the focus on energy efficiency. Europe leads the way in technology adoption, with countries such as Sweden, Finland, Denmark, and the Netherlands having implemented policies promoting smart homes and buildings. Germany, in line with the EU directive, has installed smart home systems in approximately three-quarter of all light commercial buildings. Property owners are investing in IBMS to simplify operations, reduce maintenance costs, and minimize energy consumption. Commercial users, including office buildings, hospitals, distribution facilities, and industrial facilities, are major consumers of these systems.

The market is driven by the need for energy savings, operational life extension, and preventive maintenance to rectify issues before they lead to equipment failure and peak energy demand. IBMS enables energy management, resource management, and the integration of smart devices, such as HVAC, lighting systems, and IoT sensors. Computer software solutions play a crucial role in designing, networking, and servicing these systems. The market's growth is further fueled by initiatives and legislations aimed at reducing carbon emissions and improving safety and security. Infrastructure facilities, such as data centers, educational institutes, and production plants, also benefit from IBMS.

The market's revenue growth is attributed to the increasing demand for energy management, system efficiency, and the bottom-up approach to implementing these systems in residential premises, large residential complexes, and factories. The market's future potential lies in energy savings, networking, and the integration of smart devices to enhance the overall efficiency of buildings and reduce operating costs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Integrated Building Management Systems Industry?

- Greater ease in monitoring and controlling building operations is the key driver of the market.

- The Integrated Building Management Systems (IBMS) market is experiencing significant growth due to the increasing demand for efficient building operations and maintenance. IBMS functions as a central control system, managing and regulating various building sub-systems to maintain optimal performance and ensure adherence to pre-defined parameters. This enables property owners and managers to streamline building management, reducing operational costs and enhancing overall efficiency. Moreover, companies are introducing innovative products and services to monitor and manage building operations more effectively. For instance, Johnson Controls offers a comprehensive solution for companies aiming to achieve net-zero carbon and renewable energy targets.

- IBMS plays a crucial role in facilitating these goals by optimizing energy usage and automating building processes. By simplifying building management and promoting energy efficiency, IBMS is becoming an essential tool for property owners and managers worldwide.

What are the market trends shaping the Integrated Building Management Systems Industry?

- Growing popularity of coworking spaces is the upcoming market trend.

- The proliferation of coworking spaces globally can be attributed to the increasing number of start-ups and the cost-effective option of leasing space on a membership basis as opposed to renting a full office. In a coworking environment, occupants share various facilities such as furniture, printers, phones, and technical support, while also jointly bearing property-related expenses and utilities. Technological advancements have significantly contributed to the expansion of coworking spaces. With the integration of building management systems, coworking spaces offer enhanced security, energy efficiency, and flexibility. These systems allow for remote monitoring and management of facilities, ensuring optimal energy usage and reducing operational costs.

- Furthermore, they provide a seamless experience for tenants by automating various functions, including HVAC control, lighting, and access management. The adoption of these systems is expected to continue as coworking spaces increasingly become the preferred choice for businesses and entrepreneurs seeking flexibility and cost savings. The integration of advanced technologies in building management systems is set to revolutionize the way we work, making coworking spaces more efficient, productive, and attractive to tenants.

What challenges does the Integrated Building Management Systems Industry face during its growth?

- Vulnerability issues and cyber security threats in IBMS is a key challenge affecting the industry growth.

- The integration of an Integrated Building Management System (IBMS) involves complexities that surpass managing traditional, independent systems in a building, such as HVAC, lighting, and safety. As a building's infrastructure expands, integrating various units performing distinct functions becomes a challenge. Any weakness in this integration process leaves the IBMS susceptible to both physical and cyber threats. Historically, IBMS were not designed with future integration and hyperconnectivity in mind, resulting in a lack of logical security and safety features. External network access to IBMS poses a significant concern, particularly for facilities with substantial information technology infrastructures linked to various business systems.

- Ensuring the secure and seamless integration of these systems is crucial to mitigate potential risks and maintain optimal building performance.

Exclusive Customer Landscape

The integrated building management systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the integrated building management systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, integrated building management systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in implementing advanced building management systems, including ABB i bus KNX, ABB i bus EIB, and ABB Ability for automation. These integrated solutions optimize energy consumption, enhance safety, and improve overall building performance. By leveraging open communication protocols, these systems enable seamless integration of various building functions, from lighting and HVAC to security and access control. With a focus on interoperability and scalability, the company empowers clients to future-proof their infrastructure and adapt to evolving building automation trends.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Advantech Co. Ltd.

- Azbil Corp.

- Beijer Electronics Group AB

- Carrier Global Corp.

- Cisco Systems Inc.

- Convergint Technologies LLC

- Delta Electronics Inc.

- Emerson Electric Co.

- Honeywell International Inc.

- Johnson Controls International Plc

- Kieback and Peter GmbH and Co. KG

- Lutron Electronics Co. Inc.

- Messung Group of Companies

- OBERIX Group

- Prism Enterprise Electrical Trading LLC

- Schneider Electric SE

- Siemens AG

- Snap One LLC

- Vitrex

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Integrated Building Management Systems (IBMS) have gained significant traction in various sectors due to their ability to streamline operations, enhance energy efficiency, and ensure safety and security. IBMS enables the centralized control and management of multiple building systems, including HVAC, lighting, and energy consumption, among others. The implementation of IBMS in industrial facilities requires trained personnel to oversee the installation and configuration of the system. The initial costs of implementing IBMS can be substantial, but the long-term operational savings and system efficiency make it a worthwhile investment for infrastructure facilities. Equipment failure is a common challenge faced by commercial and industrial users, leading to increased operating costs and potential safety hazards.

IBMS can help prevent equipment failure by providing real-time monitoring and predictive maintenance capabilities. The integration of IBMS with IoT technology and cloud-based platforms has simplified operations for office buildings, hospitals, and other large infrastructure facilities. Energy-efficient solutions have become a top priority for all types of users, from residential premises to large residential complexes, data centers, and educational institutes. The use of IBMS in distribution facilities and production plants has led to significant energy savings and initiatives to reduce peak energy demand. Legislation and regulations have also played a role in driving the adoption of IBMS in various sectors, including healthcare facilities and airports and railways.

Maintenance costs are a significant concern for commercial and industrial users, and IBMS can help reduce these costs by enabling preventive maintenance and rectifying issues before they become major problems. Safety and security are essential considerations for all types of facilities, and IBMS can help ensure these requirements are met through advanced monitoring and control capabilities. The lifespan of IBMS can be extended through regular servicing and upgrades, making it a cost-effective solution for the long term. Energy management is a critical component of IBMS, and the system's ability to optimize energy usage and resource management has led to significant savings for users.

The implementation of IBMS can be approached from a top-down or bottom-up perspective, depending on the size and complexity of the facility. Factories and production plants may require a more comprehensive top-down approach, while smaller facilities may benefit from a more targeted bottom-up approach. In , Integrated Building Management Systems offer numerous benefits for various sectors, including energy savings, operational efficiency, safety and security, and cost savings. The integration of IBMS with IoT technology, cloud platforms, and advanced engineering solutions has made it an essential tool for managing the complex infrastructure needs of modern facilities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

254 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.3% |

|

Market growth 2025-2029 |

USD 16747.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.0 |

|

Key countries |

US, China, UK, Germany, Japan, Canada, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Integrated Building Management Systems Market Research and Growth Report?

- CAGR of the Integrated Building Management Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the integrated building management systems market growth of industry companies

We can help! Our analysts can customize this integrated building management systems market research report to meet your requirements.