Gluten-Free Beer Market Size 2025-2029

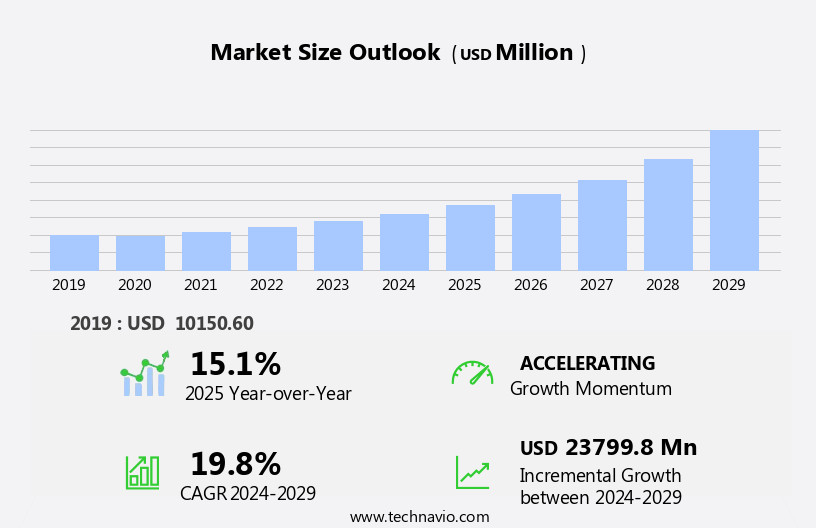

The gluten-free beer market size is forecast to increase by USD 23.8 billion at a CAGR of 19.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing awareness of the health benefits associated with gluten-free food products. This trend is particularly prominent among individuals with celiac disease or gluten intolerance, as well as those following a gluten-free diet and mead beverage for other health reasons. However, this market is not without challenges. One of the most pressing issues is the distribution complexities that come with catering to a niche consumer base. Due to the unique production requirements of gluten-free beer, traditional distribution channels may not be suitable.

- As a result, online retailing has emerged as a viable solution, enabling brewers to reach consumers directly and overcome logistical challenges. Despite these obstacles, the market presents numerous opportunities for companies to capitalize on the growing demand for gluten-free beer. By addressing distribution challenges and focusing on innovation, brewers can differentiate themselves and capture a larger share of this expanding market.

What will be the Size of the Gluten-Free Beer Market during the forecast period?

- The market continues to evolve, driven by consumer demand for health-conscious options and the ongoing education of those with gluten intolerance or celiac disease. Brewers are innovating with various ingredients, such as gluten-free corn, rice, and sorghum, to create new beer styles that cater to this demographic. Wheat beer, a traditional style, is being reimagined with gluten-free alternatives, including rice and corn-based versions. Brand awareness is a key focus for breweries, with many investing in certification programs and sustainable brewing practices to meet industry regulations. Consumers seek out certified gluten-free beers, ensuring quality control and peace of mind.

- Taste testing and sensory analysis play a crucial role in product development, as brewers strive to maintain the unique flavor profiles of traditional beer styles. Online Retail channels, including specialty beer stores and grocery stores, are expanding their offerings to meet consumer demand. Beer festivals and competitions provide opportunities for breweries to showcase their gluten-free offerings and connect with consumers. Low-carb beer is another growing segment, appealing to those with dietary restrictions. The supply chain is adapting to meet the demands of the market, with distribution networks expanding and organic ingredients becoming more prevalent. Breweries are experimenting with gluten-free barley and oats, as well as vegan and non-alcoholic beer options.

- The brewing process itself is being refined to minimize cross-contamination and ensure a truly gluten-free product. As the market continues to unfold, breweries must remain agile and responsive to consumer needs and preferences. The ongoing evolution of the market offers opportunities for product innovation and growth across various sectors.

How is this Gluten-Free Beer Industry segmented?

The gluten-free beer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Off-trade store

- On-trade store

- Type

- Sorghum corn and rice

- Buckwheat and others

- Packaging

- Bottles

- Cans

- Kegs

- Product

- Craft Gluten-Free Beer

- Mass-Produced Gluten-Free Beer

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

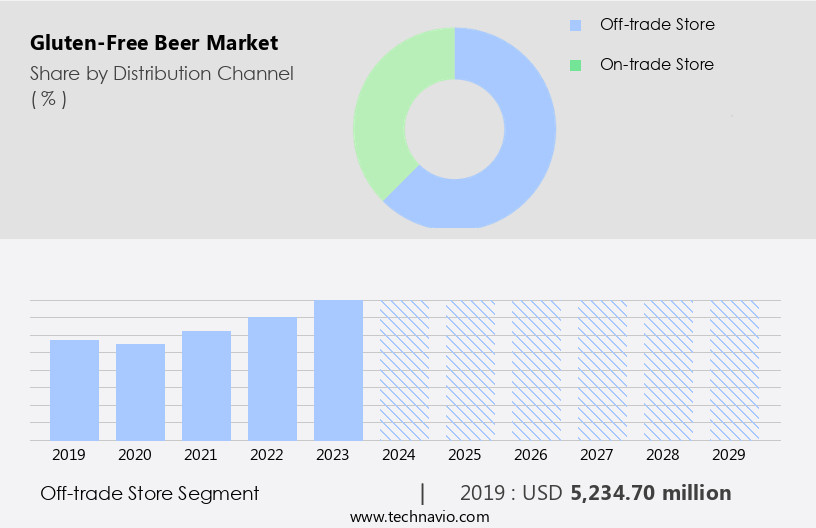

By Distribution Channel Insights

The off-trade store segment is estimated to witness significant growth during the forecast period.

In the expanding the market, off-trade distribution channels have gained significant traction. These channels include the sale of gluten-free beer through retail outlets like supermarkets, hypermarkets, convenience stores, liquor stores, and online marketplaces. Consumers prefer buying gluten-free beer from these channels for home consumption or non-brewery locations. The convenience of finding a diverse range of gluten-free beer options at nearby retailers or online platforms has contributed to the segment's growth. Health-conscious consumers, including those with gluten intolerance or celiac disease, are driving the demand for gluten-free beer. To cater to this growing market, breweries focus on product innovation, using alternative grains such as sorghum, rice, and corn, or organic ingredients.

Sustainable brewing practices and gluten-free certification are also essential considerations for consumers. Beer festivals and competitions serve as platforms for brand awareness and taste testing, allowing consumers to explore various gluten-free beer styles, including wheat beer, pale ale, sour beer, and specialty brews. Craft beer enthusiasts and vegan consumers also seek out gluten-free and vegan beer options. The supply chain, from farming to distribution, plays a crucial role in maintaining quality control and adhering to industry regulations. Retail channels, such as specialty beer stores and grocery stores, play a vital role in ensuring the availability of gluten-free beer.

The brewing process and sensory analysis are essential elements in creating unique flavor profiles for gluten-free beer. In conclusion, the off-trade distribution channel segment of the market is experiencing substantial growth due to the increasing demand for gluten-free products and their growing availability in retail stores and e-commerce platforms. Breweries are responding to this trend by focusing on product innovation, using alternative grains, and adhering to sustainable brewing practices and industry regulations. Consumers can now easily access a diverse range of gluten-free beer options, contributing to the market's continued expansion.

The Off-trade store segment was valued at USD 5.23 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

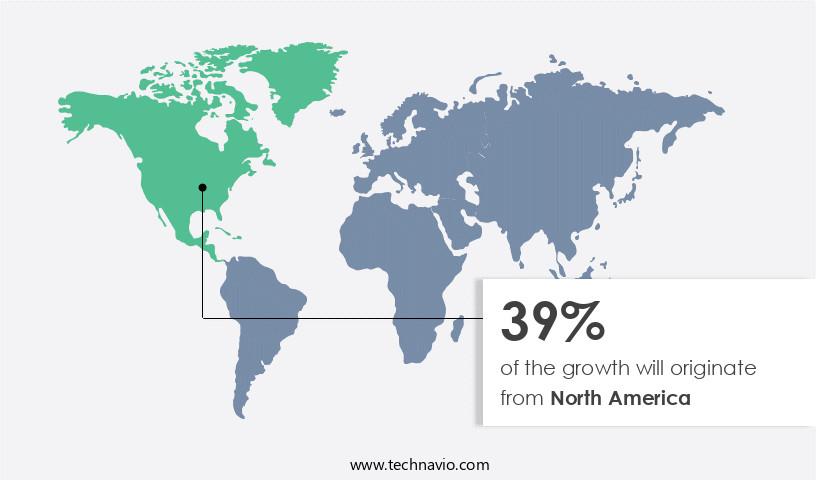

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is witnessing continuous expansion, catering to the needs of individuals with gluten intolerance or celiac disease. This segment represents a niche portion of the overall beer market, as people with these conditions cannot consume beer made from grains containing gluten, such as barley, wheat, and rye. The increasing awareness of celiac illness and gluten intolerance, coupled with the growing preference for gluten-free diets due to health-related reasons or personal choice, is driving market growth. Approximately 1% of North Americans are diagnosed with celiac disease, and many more follow gluten-free diets for various reasons. Consumers are increasingly seeking out gluten-free alternatives at beer festivals, retail channels, and specialty beer stores.

Breweries are innovating with gluten-free ingredients like sorghum, rice, corn, and oats, and implementing sustainable brewing practices. Taste testing and sensory analysis play a crucial role in ensuring the quality of these beers, which come in various styles, including wheat, pale ale, sour, and non-alcoholic. Industry regulations mandate gluten-free certification, ensuring that these beers meet specific standards. Brands are focusing on product innovation, organic ingredients, and distribution networks to meet the demands of health-conscious consumers. Craft beer enthusiasts and vegans also find gluten-free beer appealing, expanding the market's reach.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gluten-Free Beer Industry?

- The increasing recognition of the health advantages associated with gluten-free food products serves as the primary catalyst for market growth.

- Gluten-free beer has gained significant attention in the market due to the rising prevalence of celiac disease and the increasing number of health-conscious consumers. Celiac disease, an autoimmune disorder, affects the intestinal lining when individuals consume gluten, primarily found in barley, rye, and wheat. With no cure available, those diagnosed must adhere to a gluten-free diet. The global prevalence of celiac disease has grown from approximately 0.03% in the 1970s to nearly 1% of the global population today, driving the demand for gluten-free food and beverages, including beer. Quality control is crucial in the production of gluten-free beer to ensure the absence of gluten contamination.

- Two common alternatives used in brewing gluten-free beer are rice and corn. Consumer education is essential to increase brand awareness and trust, as some may believe that gluten-free beer does not taste as good as traditional beer. Beer festivals provide an excellent platform for brands to showcase their gluten-free offerings and engage with consumers. Low-carb beer is another category that has gained popularity among health-conscious consumers. As the market for gluten-free beer continues to grow, it is essential for breweries to prioritize quality control, consumer education, and innovation to meet the evolving needs and preferences of their customers.

What are the market trends shaping the Gluten-Free Beer Industry?

- The increasing prevalence of online retailing represents a significant market trend. This shift towards e-commerce is mandated by growing consumer preferences for convenience and accessibility.

- The market is experiencing significant growth due to the rising prevalence of gluten intolerance among consumers. According to recent research, an estimated 1.8 million Americans have been diagnosed with celiac disease, and an additional 5.5 million may have a gluten sensitivity. This consumer demographic is driving the demand for gluten-free beer, which is projected to reach USD1.5 billion by 2026. Brewers are responding to this trend by offering a wide range of gluten-free beer styles, including pale ale, lager, and stout. Sustainable brewing practices, such as the use of organic ingredients, are also gaining popularity in the market.

- In terms of distribution, retail channels, both online and offline, are crucial for reaching consumers. Effective supply chain management and robust distribution networks are essential for ensuring the availability of gluten-free beer in various retail outlets. Moreover, the increasing emphasis on sustainable and eco-friendly practices in the brewing industry is also influencing the market dynamics. Consumers are increasingly demanding transparency in the sourcing and production processes of their food and beverage products, including beer. As a result, brewers are focusing on using locally sourced and organic ingredients to cater to this demand. In conclusion, the market is expected to continue its growth trajectory, driven by the increasing prevalence of gluten intolerance, the wide range of beer styles available, and the emphasis on sustainable brewing practices.

- Effective distribution networks and retail channels will be crucial for reaching consumers and meeting the growing demand for gluten-free beer.

What challenges does the Gluten-Free Beer Industry face during its growth?

- The distribution challenges represent a significant hurdle to the expansion and growth of the industry. Gluten-free beer has gained significant traction in the market due to the rising prevalence of food sensitivities. Manufacturers are innovating their production methods, such as gluten-free brewing using alternative grains like sorghum and gluten-free barley, to cater to this growing demand. Flavor profiles, including sour beer and specialty beer, are also being explored to differentiate offerings. Retail establishments, including supermarkets and large chains of discount or convenience stores, play a crucial role in distribution. However, manufacturers face challenges such as margin pressures due to lower profit margins in the e-commerce retail sector and increasing demands for frequent and smaller product deliveries to reduce warehousing costs.

- Additionally, retailers are requesting innovative merchandising units, like movable shelves, to minimize replenishment costs. Despite these challenges, the market continues to grow as consumers seek out gluten-free options.

Exclusive Customer Landscape

The gluten-free beer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gluten-free beer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gluten-free beer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anheuser-Busch InBev - This company specializes in producing gluten-free beers boasting an amber hue and distinctive aroma and flavor profile. The unique character of these beers derives from the use of molasses, resulting in a complex, sharp taste experience for consumers. By prioritizing gluten-free production methods and leveraging the natural qualities of molasses, this organization sets itself apart in the beer industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anheuser-Busch InBev

- Heineken N.V.

- The Boston Beer Company

- New Belgium Brewing Company

- Glutenberg

- Ground Breaker Brewing

- Ghostfish Brewing Company

- Two Brothers Artisan Brewing

- Burning Brothers Brewing

- Omission Brewing Co. (Craft Brew Alliance)

- Lakefront Brewery Inc.

- Green's Gluten Free Beers

- Epic Brewing Company

- Duck Foot Brewing Co.

- Holidaily Brewing Company

- Moonlight Brewing Company

- Joseph James Brewing Co.

- Redbridge (Anheuser-Busch)

- New Planet Beer Company

- Alt Brew

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gluten-Free Beer Market

- In March 2024, Heineken, a leading international brewer, announced the launch of its new gluten-free beer brand, "Heineken 0.0 Gluten Free," in the United States. This expansion marked a significant move to cater to the growing consumer base with gluten intolerance or celiac disease (Heineken, 2024).

- In June 2025, Anheuser-Busch InBev, the world's largest brewer, entered into a strategic partnership with Bold Brewery, a Canadian gluten-free craft brewery. The collaboration aimed to develop and market new gluten-free beer brands under Anheuser-Busch InBev's umbrella (Anheuser-Busch InBev, 2025).

- In October 2024, Molson Coors Beverage Company, a major player in the beer industry, completed the acquisition of Crispin Cider Company, a US-based gluten-free cider and beer producer. This acquisition was a strategic move to expand its gluten-free beer offerings and strengthen its position in the niche market (Molson Coors Beverage Company, 2024).

- In February 2025, the European Union's European Commission approved new regulations allowing the use of the term "gluten-free" on beer labels if the gluten content is below 20 parts per million. This approval was a significant milestone, as it provided clarity for brewers and consumers in the European market (European Commission, 2025).

Research Analyst Overview

The market exhibits dynamic trends, with digital marketing strategies playing a pivotal role. Social media platforms and event marketing help breweries engage with their target audiences, primarily health-conscious consumers making lifestyle choices. E-commerce platforms and digital advertising expand market penetration, while content marketing showcases flavor profiles and sustainability initiatives. Bitterness levels and alcoholic content are carefully managed to cater to consumer preferences. Breweries prioritize research and development, experimenting with alternative grains and gluten-free malts to differentiate their brands. Brand loyalty is fostered through social responsibility, ensuring food safety and quality assurance.

Shelf life, brewery operations, and pricing strategies are crucial elements in supply chain management. Aroma profiles and environmental impact are also considered in the development of new products. Consumer demographics continue to shift, influencer marketing plays a role, and breweries adapt to meet the evolving needs of the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gluten-Free Beer Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.8% |

|

Market growth 2025-2029 |

USD 23799.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.1 |

|

Key countries |

US, UK, Canada, Germany, Spain, China, Brazil, India, Japan, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gluten-Free Beer Market Research and Growth Report?

- CAGR of the Gluten-Free Beer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gluten-free beer market growth of industry companies

We can help! Our analysts can customize this gluten-free beer market research report to meet your requirements.