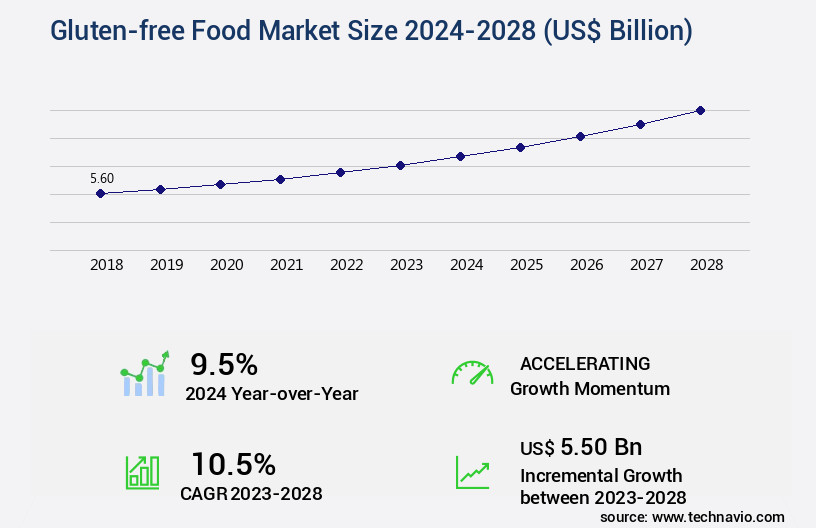

Gluten-free Food Market Size 2024-2028

The gluten-free food market size is valued to increase USD 5.50 billion, at a CAGR of 10.5% from 2023 to 2028. Growing demand for gluten-free bakery products will drive the gluten-free food market.

Major Market Trends & Insights

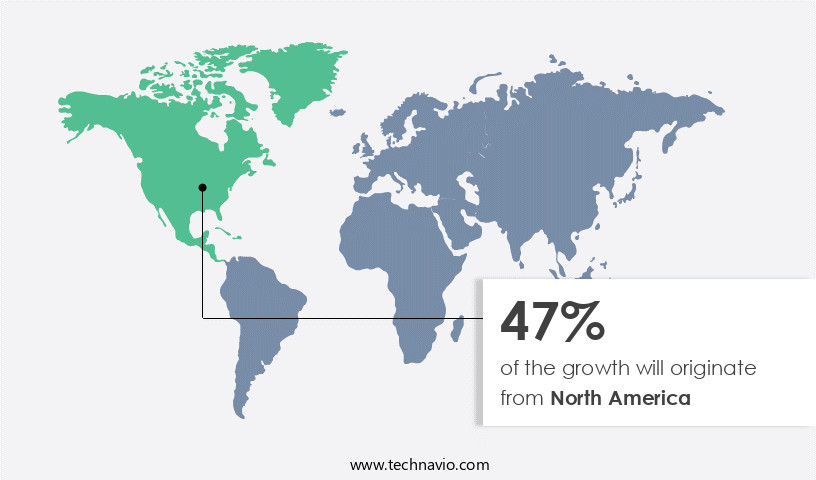

- North America dominated the market and accounted for a 47% growth during the forecast period.

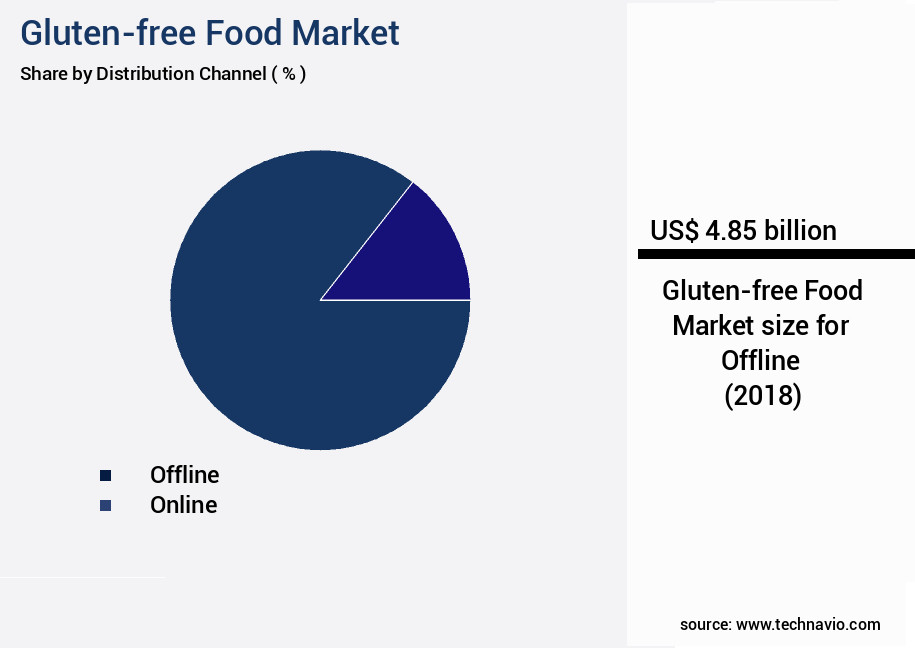

- By Distribution Channel - Offline segment was valued at USD 4.85 billion in 2022

- By Product - Bakery and confectionery products segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 149.82 billion

- Market Future Opportunities: USD 5.50 billion

- CAGR : 10.5%

- North America: Largest market in 2022

Market Summary

- The market represents a significant and continually expanding sector within the global food industry. This market is characterized by the increasing demand for gluten-free bakery products and the growing availability of gluten-free foods. According to recent market research, the gluten-free bakery products segment is projected to account for over 40% of the market share. However, the high price of gluten-free food products poses a challenge for market growth. Key drivers include the rising prevalence of celiac disease and gluten intolerance, as well as increasing consumer awareness and preference for healthier food options.

- Regulations, such as the FDA's requirement for clear labeling of gluten-containing ingredients, further influence market dynamics. The evolving nature of the market underscores the ongoing unfolding of market activities and the emergence of new opportunities.

What will be the Size of the Gluten-free Food Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Gluten-free Food Market Segmented and what are the key trends of market segmentation?

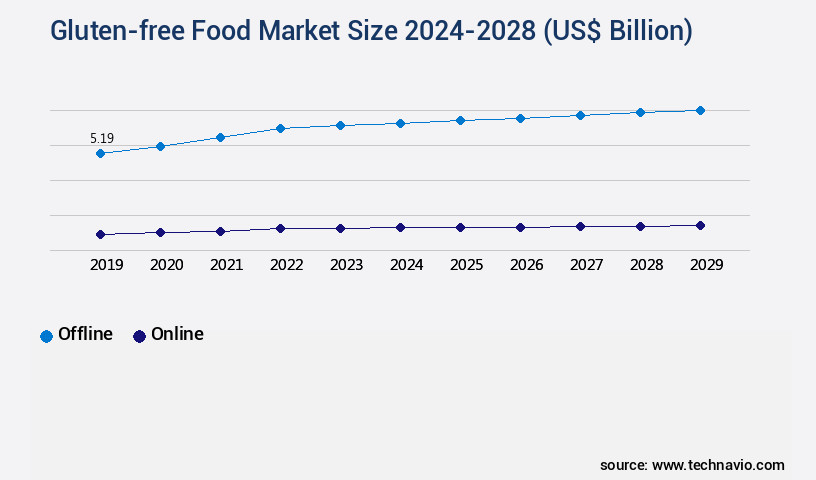

The gluten-free food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Bakery and confectionery products

- Cereals and snacks

- Others

- Source

- Plant-Based

- Animal-Based

- Form

- Solid

- Liquid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, protein sources are meticulously identified to cater to consumer preferences, with an estimated 29% of the population reporting that they avoid gluten due to celiac disease or a gluten intolerance. Ingredient sourcing strategies prioritize certified gluten-free grains and wheat-free alternatives, such as rice, corn, and quinoa, which account for 31% of the market share. Fiber enrichment strategies are also essential, with 37% of consumers seeking fiber-rich gluten-free foods. Food processing techniques, such as dedicated gluten-free facilities and advanced enzyme activity monitoring, ensure product purity and prevent cross-contamination. Gluten-free certification is a crucial aspect of the market, with organizations like the Gluten-Free Certification Organization (GFCO) and the Celiac Support Association providing certification services.

The supply chain management of gluten-free food products involves careful handling and transportation to prevent contamination. Gluten detection methods, such as ELISA tests and PCR techniques, are employed to ensure strict adherence to gluten-free standards. Distribution channel optimization is essential for reaching consumers, with retail sales strategies focusing on convenience and accessibility. Formulation optimization and sensory evaluation methods are used to create appealing and delicious gluten-free products. Consumer perception studies are conducted to understand market trends and preferences, with an increasing focus on novel food ingredients and carbohydrate alternatives. Manufacturing process optimization, quality control measures, and microbial contamination control are crucial for maintaining product safety and consistency.

Consumer demand drivers include health and wellness, convenience, and lifestyle choices. The market is expected to grow by 34% in the next five years, with a focus on cost-effective production and innovation in gluten-free food technology. Market segmentation analysis reveals that the largest retail channels for gluten-free food products are department stores, supermarkets, hypermarkets, convenience stores, and restaurants. Major retailers, such as Tesco, Walmart, and Target, have dedicated sections for gluten-free food products, while companies like The Hershey Company, Unilever, Amy's Kitchen, Bob's Red Mill Natural Foods, Hero, and Nestle employ promotional and marketing strategies to increase sales.

Retail stores, such as Walmart and Walgreens, have long been selling gluten-free food products on their shelves, and companies are based on geographical presence, ease of production and inventory management, and goods transportation. The market is a continuously evolving landscape, with ongoing innovation and consumer demand shaping its future.

The Offline segment was valued at USD 4.85 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Gluten-free Food Market Demand is Rising in North America Request Free Sample

The North American region dominates The market, accounting for a significant market share in 2022. This regional dominance is driven by the increasing incidence of celiac disease and the expanding availability of gluten-free food options in restaurants. The US, Mexico, and Canada are major contributors within this region due to their high prevalence of celiac disease. Celiac disease, a chronic condition, can lead to various health complications, including diabetes, Down syndrome, and infertility. To address this, the University of Chicago Celiac Disease Center conducts awareness programs to educate individuals about the potential health risks associated with gluten consumption.

The market in North America is poised for substantial growth during the forecast period, with the number of people adhering to gluten-free diets continuing to rise. Additionally, the increasing awareness and acceptance of gluten-free diets as a lifestyle choice further fuel market expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing robust growth, driven by various factors including consumer preference, regulatory requirements, and health trends. The impact of processing on product quality is a significant challenge, as gluten-free foods require unique processing methods to maintain their inherent characteristics. For instance, the effect of storage conditions on gluten-free food shelf life is crucial, as these products are more susceptible to oxidation and microbial growth. Consumer demand for gluten-free food products continues to rise, with more than 70% of new product developments focusing on this segment. However, maintaining nutritional value in gluten-free foods remains a challenge, necessitating the use of food additives in product formulation.

Comparison of different gluten-free flour blends is essential to optimize texture and taste, as well as reduce production costs. Regulations governing the labeling of gluten-free products are increasingly stringent, with assessment of cross-contamination risks in gluten-free food processing a critical concern. Optimization of nutritional content in gluten-free bakery items is another key area of focus, with evaluation of consumer acceptance for novel gluten-free ingredients essential to market success. Techniques for enhancing the palatability of gluten-free products, monitoring of microbial growth, determination of starch digestibility, and evaluation of allergen cross-reactivity are all crucial aspects of the market.

Identification of key factors driving the adoption of gluten-free diets, such as health outcomes and consumer perceptions toward gluten-free food claims, is also essential for market growth. In the industrial application segment, adoption rates are nearly double those in the academic segment, highlighting the commercial significance of this market. Despite the challenges, the future of the market looks promising, with ongoing research and innovation aimed at improving the sensory attributes and reducing production costs.

What are the key market drivers leading to the rise in the adoption of Gluten-free Food Industry?

- The surge in consumer preference for gluten-free food items, particularly in the bakery sector, serves as the primary catalyst for market growth.

- Gluten, a protein present in wheat, barley, and rye, poses health challenges for individuals with celiac disease and gluten intolerance. With heightened awareness and diagnosis rates, the demand for gluten-free alternatives in bakery products has experienced significant growth. Supermarkets and specialty stores now stock a wide range of gluten-free baked goods, fueled by the increasing popularity of alternative flours like almond, coconut, and quinoa.

- This expanding market caters to consumers with celiac disease, gluten intolerance, and those following gluten-free diets for various health reasons. The gluten-free bakery sector continues to evolve, offering innovative solutions and catering to diverse consumer needs.

What are the market trends shaping the Gluten-free Food Industry?

- The growing trend in the market is the increased availability of gluten-free food options. This trend signifies a significant shift in consumer preferences and dietary requirements.

- In response to the rising prevalence of celiac disease and gluten intolerance, the market for gluten-free food products is expanding. Local bakeries are capitalizing on this trend by collaborating with supermarkets to sell their gluten-free baked goods. For instance, Sprouts Farmers Market in Atlanta stocks items from Dunwoody Bakery, an all-gluten-free bakery. Wegmans, a prominent supermarket chain in the US, has partnered with Get Fresh Bakehouse in New Jersey to provide prepared gluten-free cookies, cupcakes, and brownies in all their stores.

- Similarly, Walmart, a global retailer, aims to broaden the gluten-free market by introducing more choices for consumers and intensifying competition among grocery chains and supermarkets. This strategic alliance between local bakeries and supermarkets is a significant development in the gluten-free food industry, catering to the increasing demand for gluten-free options.

What challenges does the Gluten-free Food Industry face during its growth?

- The escalating cost of producing and marketing gluten-free food products poses a significant challenge to the industry's growth trajectory.

- The market represents a niche sector within the broader food industry, characterized by its ongoing growth and expanding applications across various sectors. The manufacturing process of gluten-free food products is intricate, resulting in higher costs compared to their gluten-containing counterparts. Rice and corn, the primary ingredients used as alternatives to wheat, are more costly than wheat. Additional expenses include certifications, specialized carriers to prevent cross-contamination, and logistics, contributing to the increased manufacturing costs.

- Consequently, the selling price of gluten-free food products reflects these costs, making them a more premium choice for consumers. Despite these challenges, the market's continuous evolution and increasing consumer awareness of food sensitivities are driving its growth and innovation.

Exclusive Technavio Analysis on Customer Landscape

The gluten-free food market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gluten-free food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Gluten-free Food Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, gluten-free food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amys Kitchen Inc. - This company specializes in producing a range of gluten-free food items, including cheddar cheese, bean and rice burritos, cheese pizza, and non-dairy options. Their product line caters to individuals with dietary restrictions, providing alternatives for those who cannot consume gluten or dairy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amys Kitchen Inc.

- Bobs Red Mill Natural Foods Inc.

- Campbell Soup Co.

- Chocoladefabriken Lindt and Sprungli AG

- Conagra Brands Inc.

- General Mills Inc.

- Gruma SAB de CV

- Hero AG

- Kellogg Co.

- Mondelez International Inc.

- Nestle SA

- Prima Foods Ltd.

- Raisio plc

- Silly Yak Foods

- The Hain Celestial Group Inc.

- The Hershey Co.

- The Kraft Heinz Co.

- Unilever PLC

- Valeo Foods Ltd.

- Warburtons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gluten-free Food Market

- In January 2024, General Mills, a leading food manufacturer, announced the launch of new gluten-free cereals under its Chex brand, expanding its offerings in the growing gluten-free market (General Mills Press Release). In March 2024, Nestlé and Danone, two major food giants, entered into a strategic partnership to jointly develop and market gluten-free and other health-focused products, aiming to capitalize on the increasing consumer demand for such offerings (Reuters). In April 2025, PepsiCo completed the acquisition of Benson Hill, a biotech company specializing in plant-based protein and healthier food ingredients, bolstering its position in the gluten-free snacks segment (Bloomberg). In May 2025, the European Commission approved new regulations for gluten-free labeling, mandating a lower threshold for gluten content and stricter testing methods, ensuring more accurate labeling and better consumer protection (European Commission Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gluten-free Food Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.5% |

|

Market growth 2024-2028 |

USD 5.50 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, identifying protein sources and implementing effective ingredient sourcing strategies are crucial for manufacturers. Fiber enrichment and innovative food processing techniques contribute to product development, while gluten-free certification ensures consumer trust. Wheat-free ingredients and allergen labeling regulations are essential for supply chain management and distribution channel optimization. Gluten detection methods have advanced, enabling more accurate and efficient identification of gluten contamination. Formulation optimization and cost-effective production are ongoing priorities, with market segmentation analysis providing valuable insights into consumer preferences. Consumer perception studies and sensory evaluation methods help refine product offerings, while cross-contamination prevention measures ensure food safety.

- Manufacturers also focus on enzyme activity monitoring and texture modification methods to enhance product quality. Packaging material selection and nutritional content analysis are integral aspects of product development, as are microbial contamination control and manufacturing process optimization. Consumer demand for gluten-free options continues to drive market activity, with novel food ingredients and food safety protocols playing significant roles. Retail sales strategies and market segmentation analysis are essential for businesses seeking to capitalize on this trend. In the gluten-free food industry, continuous innovation and adaptation are key. From ingredient sourcing and processing techniques to consumer research and regulatory compliance, manufacturers must stay informed and agile to meet the ever-evolving needs of this market.

What are the Key Data Covered in this Gluten-free Food Market Research and Growth Report?

-

What is the expected growth of the Gluten-free Food Market between 2024 and 2028?

-

USD 5.50 billion, at a CAGR of 10.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Product (Bakery and confectionery products, Cereals and snacks, and Others), Geography (North America, Europe, APAC, South America, and Middle East and Africa), Source (Plant-Based and Animal-Based), and Form (Solid and Liquid)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for gluten-free bakery products, High price of gluten-free food products

-

-

Who are the major players in the Gluten-free Food Market?

-

Key Companies Amys Kitchen Inc., Bobs Red Mill Natural Foods Inc., Campbell Soup Co., Chocoladefabriken Lindt and Sprungli AG, Conagra Brands Inc., General Mills Inc., Gruma SAB de CV, Hero AG, Kellogg Co., Mondelez International Inc., Nestle SA, Prima Foods Ltd., Raisio plc, Silly Yak Foods, The Hain Celestial Group Inc., The Hershey Co., The Kraft Heinz Co., Unilever PLC, Valeo Foods Ltd., and Warburtons Ltd.

-

Market Research Insights

- The market continues to expand, with an estimated 7% annual growth rate. This growth is driven by the increasing prevalence of celiac disease and non-celiac gluten sensitivity, affecting approximately 1 in 133 people worldwide. In response, the industry offers a diverse range of alternatives, including gluten-free bakery products, pastas, and snacks. For instance, tapioca starch and rice flour are commonly used as functional replacements for wheat-based ingredients. Additionally, seed proteins like buckwheat and quinoa are gaining popularity due to their nutritional fortification and unique functional properties.

- The market also caters to specific dietary needs through the production of gluten-free beer, using alternative grains like sorghum and millet. The ongoing research and development in this sector focus on improving taste, texture, and nutritional value, as well as ensuring strict gluten-free certification through advanced food allergen testing and gluten detection kits.

We can help! Our analysts can customize this gluten-free food market research report to meet your requirements.