Grease Market Size 2024-2028

The grease market size is forecast to increase by USD 1.27 billion at a CAGR of 3.77% between 2023 and 2028. The market's growth is influenced by various factors, notably the expansion of the shipbuilding sector, the rising prominence of rail trading and logistics operations, and the flourishing automotive industry in the Asia-Pacific (APAC) region. These factors collectively contribute to the increased demand for transportation and infrastructure development, driving growth opportunities in related sectors. The shipbuilding business's growth reflects increased maritime trade activities, while rail trading and logistics activities signify the region's connectivity and trade facilitation efforts. Additionally, the booming automotive industry underscores the region's manufacturing capabilities and consumer demand, further bolstering economic growth and market expansion prospects in APAC. It also includes an in-depth analysis of drivers, trends, and challenges. Our report examines historical data from 2018-2022, besides analyzing the current market scenario.

What will be the Industry Size during the Market Forecast Period?

Market Definition

Grease is a thick and oily lubricant consisting of base oil, thickener, and additives in the composition; it is used to provide lubrication to moving surfaces; prevent leakage; and protect equipment, machinery, or end-user applications from corrosive contaminants and foreign materials.

To Know more about the market report Request a Free Sample

Market Dynamics

The market is witnessing significant growth driven by factors like process automation in various industries, including the automotive sector. The rise of the E-commerce industry has also contributed to increased demand for polyurea grease and lithium grease. However, challenges such as the Lithium supply shortage impact the availability of greases for EV batteries. To address these challenges, grease manufacturing companies are adopting digital market techniques and online campaigns to reach manufacturers, sellers, and distributors in the value chain. The Synthetic oil segment is gaining traction due to its superior qualities over mineral oil, with Metallic soap being a common thickener type, offering a wide operational temperature range and oxidative stability. Our researchers analyzed the market research and growth data with 2023 as the base year, along with the key market growth analysis, trends, and challenges. A holistic analysis of drivers, trends, and challenges will help companies refine their marketing strategies to gain a competitive advantage.

Key Driver

An increase in rail trading and logistics activities is the key factor driving the market. Rail transport is an essential mode of transportation and an essential element of the world economy. Rail transportation is a cost-effective way of transporting people, raw materials, and goods around the world. In 2023, APAC was the most important geographical location for rail passenger transport in the world. The world's railway network is around 1.3 million route-kilometers worldwide. The US has the longest railroad network in the world, followed by Russia, China, India, Canada, Germany, and France. Switzerland and Japan were both ranked number one for the highest-quality infrastructure for railroads in 2023.

Moreover, APAC accounts for the largest rail passenger traffic globally. APAC accounts for the largest rail passenger traffic globally, which has contributed to the growing demand for passenger trains and accelerated the consumption of grease in the rail industry in the region. Similarly, the increase in goods transported by rail reflects the growth of local economic activities. Thus, such activities increase the demand for grease, which, in turn, will fuel the growth of the market during the forecast period.

Significant Trends

Inauguration of new plants for grease production is the primary market trend. Market players are investing in new plants and capacity expansions to fulfill the demand for grease in diverse applications. For instance, in October 2023, the Sintec group undertook expansion of its grease plant in Russia, increasing the production capacity by 12,000 metric tons per year for metallurgy, mining, and agricultural sectors.

Also, in December 2020, Shell started construction of its largest grease manufacturing plant across the world (by volume) at a groundbreaking ceremony in Zhuhai, Guangdong Province, China. The plant is a new addition to Shell's lubricants manufacturing complex at Zhuhai. Therefore, increasing investment in new plants by companies is expected to have a positive impact on the growth of the market trends during the forecast period.

Major Challenge

Fluctuations in oil prices are a major challenge that affects market expansion. Crude oil prices have been fluctuating for the past many years and are likely to be volatile during the forecast period as well. Crude oil prices are affected by currency fluctuations. For example, the price of crude oil in April 2020 dipped to an average price of USD 21.04 per barrel. In November 2021, the price of crude oil reached a record all-time high of USD 82.06 per barrel. Moreover, due to the Russia-Ukraine war in February 2022, the price of crude oil increased exponentially and settled at USD 105.08 per barrel.

Moreover, fluctuations in crude oil prices negatively affect the grease price as these polymers are directly mixed into the base oil. If the price of base oil increases, the price of grease will also rise and can negatively affect consumption. Therefore, the fluctuations in oil prices may hamper the growth of the market during the forecast period.

Market Segmentation

The market is influenced by various factors, including process automation that streamlines production and distribution, particularly in the automotive and E-commerce industries. Different types of greases, such as polyurea grease and lithium grease, are utilized based on specific application requirements. The choice of base oil and regreasing intervals are critical considerations, especially in light of challenges like the Lithium supply shortage impacting the availability of EVs and their lithium batteries. The automotive sector remains a key driver, with EV batteries gaining traction in the mainstream market. In the E-commerce industry, the role of internet platforms cannot be understated, connecting manufacturers, sellers, shops, dealers, and distributors along the value chain. However, margins can be affected by various factors, including competition among grease manufacturing companies and the use of digital market techniques like online campaigns.

End-user Analysis

The market share by the automotive segment will be significant during the forecast years. Automotive grease finds application in the various sub-segments of the segment. The commercial vehicles passenger vehicles, aerospace, and commercial vehicles mainly include heavy-duty vehicles such as trucks, coaches, loaders, and containers. A significant amount is consumed in commercial vehicles as it provides excellent shear stability. High shear stability ensures the high performance of engine oils and protects engines from wear and tear.

Get a glance at the market contribution of the End User segment Request Free Sample

The automotive segment accounted for USD 2.13 billion in 2018. In passenger vehicles, automotive grease ensures high fuel economy and reduces emissions, friction, and the probability of damage caused by wear and tear. As a result, ensures the proper functioning of the engine component. In passenger vehicles, the effectiveness depends on the lubricant formulation, engine design, and operating conditions. Market players such as Bp Plc. and Chevron Corporation offer automotive disease fuel for passenger vehicles and commercial vehicles. Such uses in the automotive industry are mainly formulated with three grease components: base oil, thickener, and additives. Thus, such factors in the automotive segment will drive the growth of the market during the forecast period.

Source Analysis

Mineral oil offers superior cost-effectiveness, surface protection, and flexibility in a variety of applications, such as bearings grease, chains, gear, slides, and more. Some of the key attributes that are driving the growth of the mineral oil segment include its good fluidity, good electrical insulation properties, and non-corrosive nature. Additionally, mineral oil possesses some limitations, such as less reliability for usage in high-temperature applications such as welding, aircraft instruments, and anti-friction ball bearings., due to the relatively low melting points. Furthermore, leading companies, such as DuPont de Nemours Inc, ExxonMobil, and Shell plc, provide mineral oils to the market. Thus, such features and uses of the mineral oil segment will drive the growth of the market during the forecast period.

Region Analysis

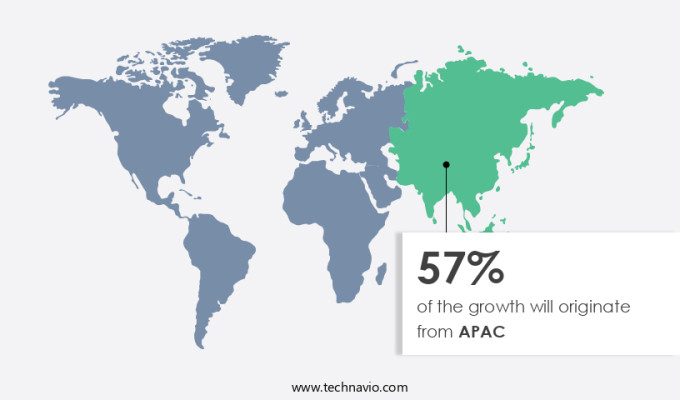

APAC is estimated to contribute 57% to the growth of the global market during the projection period. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the projection period.

For more insights on the market share of various regions Request Free Sample

In 2023, the APAC region dominated the market due to increased automobile production, notably in India and China. Major players like ExxonMobil are investing in the region; ExxonMobil allocated USD 110 million for a lubricant plant in Maharashtra, India. Infrastructure initiatives like China's One Road project and the Japan-Asian Development Bank's collaboration further drive the demand. Industrial applications in APAC utilize grease for various purposes. Emerging trends like bio-based and increased motor oil consumption bolster the global market. APAC's demand stems from the automotive industry's growth, particularly in China, India, and Japan, alongside other sectors like heavy engineering and steel manufacturing. China notably leads in consumption due to its robust industrial and automotive sectors. Hence, such factors are driving the market growth in APAC during the forecast period.

You may also interested in below reports:

Fat, Oil, and Grease Separators Market Size - The market size is expected to grow by USD 195.22 million during 2020-2024, and the growth momentum will accelerate during the forecast period.

Aviation Lubricants Market Size - The market is expected to grow by USD 887.13 million with a CAGR of 6.1% during the forecast period 2021 to 2026.

Automotive Suspension System Lubricants Market Analysis - The market size is estimated to grow USD 27.94 million, at a CAGR of 4.54% between 2023 and 2028.

Key Companies

Companies are implementing various market growth and forecasting strategies by analyzing factors such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product or service launches to enhance their presence in the market.

- BP Plc: The company offers grease, namely Mine Grease LM EP 680, for heavily loaded plain and anti friction bearings used in construction, earthmoving, and mining equipment.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

Balmer Lawrie and Co. Ltd., Berkshire Hathaway Inc., Chevron Corp., DuPont de Nemours Inc., ENEOS Holdings Inc., Exxon Mobil Corp., Freudenberg and Co. KG, FUCHS PETROLUB SE, Indian Oil Corp. Ltd., MOL Group, Morris Lubricants, Normet Group Oy, PJSC LUKOIL, Shell plc, Sinopec Shanghai Petrochemical Co. Ltd., Sintek Group JSC, SK Innovation Co. Ltd., SKF, and TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market report predicts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- End-user Outlook

- Automotive

- Construction and off-highway

- Metal production

- General manufacturing

- Power generation and others

- Source Outlook

- Mineral oil

- Synthetic oil

- Bio-based oil

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview:

The market is undergoing a significant transformation driven by technological advancements and process automation. With the rise of the e-commerce industry, manufacturers and sellers are employing digital market techniques to enhance customer reach. In the automotive sector, Polyurea grease and lithium grease are gaining traction due to their superior qualities and operational temperature range, particularly in EV batteries for the burgeoning electric vehicle industry. However, the lithium supply shortage poses challenges, impacting trade volumes and margins along the value chain. Despite this, developing countries are becoming significant end-use industries, especially in transportation and industrial processing.

Moreover, to adapt, grease manufacturing companies are investing in online campaigns and internet platforms to reach OEMs and RMOs directly. As environmental regulations tighten, product innovations like synthetic oil segments are gaining ground, catering to mainstream markets while addressing supply chain disruptions. From steel mills to wind power and aerospace industries, the grease market's evolution is reshaping commercial fleets, air travel, and beyond, bridging the gap between developed markets and emerging markets.

|

Grease Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.77% |

|

Market Growth 2024-2028 |

USD 1.27 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.43 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 57% |

|

Key countries |

US, China, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Balmer Lawrie and Co. Ltd., Berkshire Hathaway Inc., BP Plc, Chevron Corp., DuPont de Nemours Inc., ENEOS Holdings Inc., Exxon Mobil Corp., Freudenberg and Co. KG, FUCHS PETROLUB SE, Indian Oil Corp. Ltd., MOL Group, Morris Lubricants, Normet Group Oy, PJSC LUKOIL, Shell plc, Sinopec Shanghai Petrochemical Co. Ltd., Sintek Group JSC, SK Innovation Co. Ltd., SKF, and TotalEnergies SE |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market forecast during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough market analysis and report of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch