Gutter Guards Market Size 2024-2028

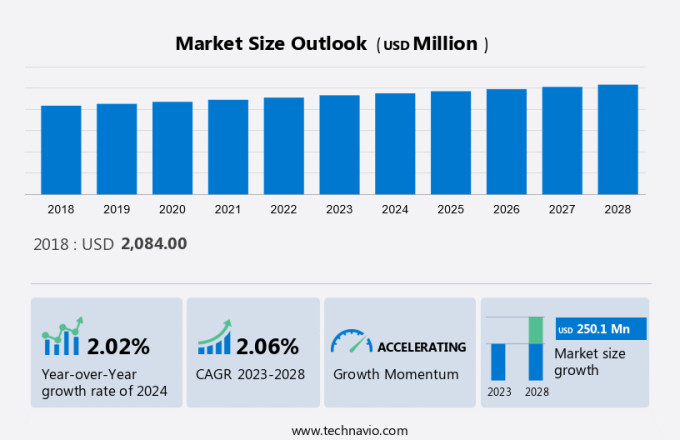

The gutter guards market size is forecast to increase by USD 250.1 million, at a CAGR of 2.06% between 2023 and 2028. The market is witnessing significant growth due to increased investment in both residential and commercial infrastructure development. Expanding manufacturing and distribution facilities globally are enhancing market accessibility, effectively addressing the rising demand, particularly from developing nations. Infrastructure projects, a key driver of this growth, necessitate gutter guards to safeguard buildings from potential water damage. These guards prevent debris accumulation and ensure efficient water flow, thereby reducing maintenance costs and potential structural damage. The establishment of additional manufacturing and distribution centers further bolsters market growth analysis, enabling timely and cost-effective supply to meet increasing demand.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

The market in the residential sector is experiencing significant growth due to the increasing demand for higher value products that enhance living conditions. Older consumers, in particular, are seeking out units with longer lifespans to mitigate the risks of debris, clogs, and water damage. Rainwater harvesting systems, including catchment systems and rainware companies, are driving this trend, as water consumption becomes increasingly water-strained in many regions. Market maturity has led to the emergence of specialized contractors, builders, and roofing contractors who offer gutter guard installation services. DIY products are also gaining popularity, but many homeowners prefer to leave the installation to professionals to ensure proper fitting and functionality. State regulations regarding rainwater harvesting and water consumption are also influencing the market's growth. Copper hoods and other high-end gutter guard materials are increasingly being used for their durability and aesthetic appeal. Future installations are expected to focus on advanced features, such as integrated debris management and seamless integration with catchment systems. The lifespan of gutters is a critical consideration for both homeowners and contractors, making gutter guards an essential investment for the residential market.

Key Market Driver

The surge in investments in both residential and commercial infrastructure is a significant catalyst for market expansion. The market is experiencing notable growth due to the surge in home renovations and the demand for higher-value products. In the residential sector, the number of units installed is projected to increase substantially in the coming years. Moreover, this trend is driven by various factors, including the desire for improved living conditions, particularly among older consumers. As rainwater harvesting gains popularity, rainware companies and contractors are increasingly turning to gutter guards to ensure efficient water collection. These guards prevent debris and clogs, thereby reducing the risk of water damage and prolonging the lifespan of gutters. Moreover, gutter guards offer versatility and lightweight designs, making them an attractive option for both DIY projects and specialized installations by builders and roofing contractors.

Moreover, copper hoods and meshes and screens are popular choices due to their durability and effectiveness in keeping gutters free of debris. State regulations, such as those related to wildfire codes and water consumption, are also driving demand for gutter guards. Raw materials, including plastic resin and metal, are used in the production of these guards, with market maturity leading to advancements in technology and innovation. In the future, gutter guards are expected to play a crucial role in catchment systems, particularly in water-strained regions where human consumption is a concern. As the market continues to evolve, Value terms such as lifespan, corrosion resistance, and ease of installation will become increasingly important to consumers. Hence, such factors fuel market growth during the forecast period.

Significant Market Trend

Increasing applications of rainwater harvesting systems in government sectors is one of the major market trends. In the realm of home renovations, the market for gutter guard systems has gained significant traction, particularly in the residential sector. With a focus on higher-value products, rainwater harvesting has emerged as a key trend, driving the demand for these units. Research experts project future installations to increase, as living conditions become more water-strained and consumers seek to mitigate the risks of water damage. Copper hoods and other advanced gutter guard designs have become popular choices, offering versatility, light weight, and effective debris prevention. Older consumers, in particular, appreciate the convenience and safety these systems provide, eliminating the need for ladders and reducing the risk of clogs. Rainware companies and specialized contractors have capitalized on this trend, offering a range of products and services tailored to various state regulations and rainwater harvesting requirements.

Further, market maturity has led to innovations such as catchment systems, which optimize water consumption and extend the lifespan of gutters. As water strained becomes a pressing issue, DIY products and rainwater harvesting systems have gained popularity. Builders and roofing contractors are increasingly incorporating these solutions into new constructions, ensuring compliance with wildfire codes and raw material regulations. The gutter guard market encompasses a diverse range of raw materials, including plastic resin and metal, catering to various budgets and performance requirements. The future of this market lies in continued innovation, ensuring the longevity and efficiency of these essential home systems. Therefore, these factors will drive the growth market during the forecast period.

Major Market Challenge

Threats of substitutes are major challenges impeding the market. In the realm of home renovations, gutter guards have emerged as higher-value products in the residential market. These innovative solutions prevent debris accumulation and clogs, ensuring the longevity of gutters and averting water damage. Market research experts project a steady increase in units installed and future installations. Copper hoods and other advanced gutter guard systems cater to diverse living conditions, particularly for older consumers seeking safety from ladders. Rainwater harvesting is another significant application, with rainware companies and specialized contractors offering customized solutions. Market maturity is evident in the availability of various gutter guard systems, including catchment systems and water consumption-focused designs for water-strained areas. Value terms such as versatility, light weight, and meshes and screens are essential considerations for homeowners.

Also, wildfire codes and raw material regulations influence the choice between plastic resin and metal options. State regulations regarding rainwater harvesting and DIY products further impact the market landscape. Roofing contractors and builders play a crucial role in gutter guard installations, ensuring compliance with industry standards and regulations. Corrosion resistance and lifespan are essential factors in the selection process, with many systems offering long-lasting performance. Debris prevention and water damage mitigation are primary benefits, making gutter guards an indispensable addition to modern homes. Therefore, the availability of these alternatives will negatively impact the growth of the market during the forecast period.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Almesco Ltd. - The key offerings of the company include gutter guards.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Alumasc Group plc

- Associated Materials LLC

- City Sheet Metal Co. Ltd.

- Clotan Steel Pty Ltd.

- Cornerstone Building Brands Inc.

- Englert Inc.

- Fiberglass Building Products Inc.

- FIRST Corp. Srl

- Gibraltar Industries Inc.

- Grillo Werke AG

- Guangzhou Nuoran Building Material Co. Ltd.

- Hebei Hollyland Co., Ltd.

- Lindab AB

- Panasonic Holdings Corp.

- Precision Gutters Ltd.

- Senox Corp.

- Spectra Gutter Systems

- Standard Industries Inc.

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

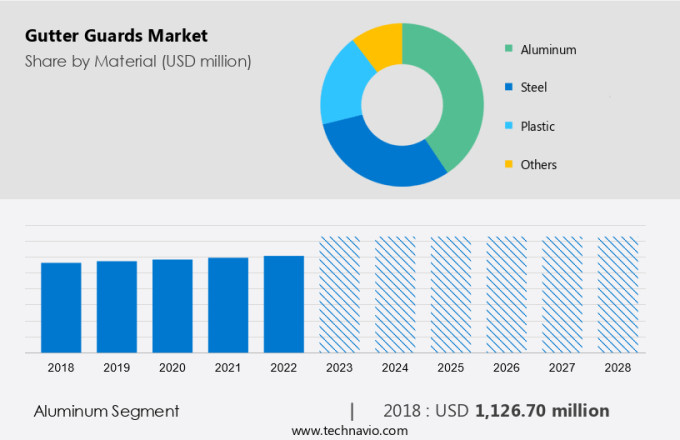

The market share growth by the aluminum segment will be significant during the forecast period. Although different materials are used to make gutter guards, aluminum is the most common and durable one.

Get a glance at the market contribution of various segments View the PDF Sample

The aluminum segment was valued at USD 1.13 billion in 2018. Aluminum gutter guards are frequently the best in terms of performance and quality. The best ones in the business are often made by combining aluminum variants with a certain type of stainless-steel mesh. These are far more robust and long-lasting than those made of plastic. Furthermore, they can also withstand extreme weather conditions and temperature variations without warping, bending, or breaking. Such factors are expected to increase the segment demand which will propel the growth of the global market during the Market forecasting period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

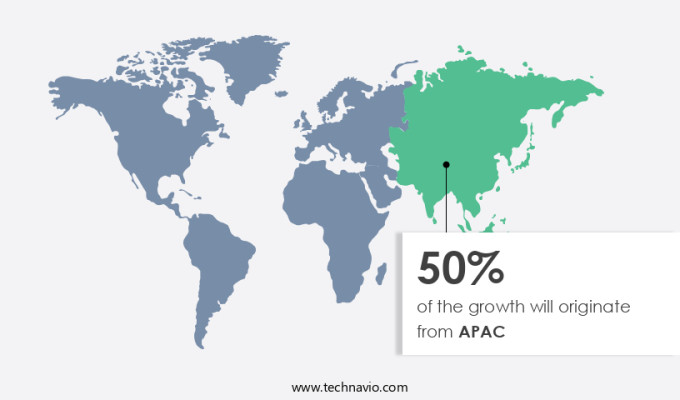

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Another region offering significant growth opportunities to Companies is North America. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Rising residential construction is a significant growth driver of the market in North America. Being one of the most developed regions of the world, many industries in North America have growth prospects. The growing hotel industry in the US has increased the demand for the construction of new hotels. The growth of the market in North America is also owing to the increasing number of new premium hotels in the region. Premium-classed hotels require exclusive quality, and hence they prefer aluminum variants. Therefore, such factors will drive the demand for faucets in the region during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material Outlook

- Aluminum

- Steel

- Plastic

- Others

- End-user Outlook

- Residential

- Commercial

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

You may also be interested in:

- Exterior Silicone Caulk Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, India, Germany, UK - Size and Forecast

- Siding Market by End-user, Material, and Geography - Forecast and Analysis

- Recycled Concrete Aggregates Market By Product, Application And Geography - Forecast And Analysis

Market Analyst Overview

The market is a significant sector within the construction industry, focusing on the production and installation of protective covers for gutter systems. These covers prevent debris, leaves, and other elements from entering and obstructing the flow of water. The primary goal is to ensure efficient water drainage and reduce the need for frequent cleaning. Homeowners and businesses alike value the benefits of gutter guards, including convenience, time savings, and potential cost reductions. The market for these products is diverse, with various materials and designs available to cater to different needs and preferences. Some common materials include copper, aluminum, and vinyl. Producers and installers of gutter guards face competition from one another, as well as from other related industries such as roofing and gutter repair services.

Further, to stand out in the market, companies focus on product innovation, quality, and customer service. In the realm of rain harvesting and water management, gutter guards have emerged as a crucial solution for maintaining efficient drainage systems. These innovative devices, such as omnimax gutter guards, prevent debris accumulation and ensure the smooth flow of rainwater. By safeguarding against rodents and infestations, gutter guards also minimize the risk of future repairs and replacements. With various roof designs in consideration, they offer a long-term investment for homeowners, enhancing the functionality and durability of linear feet of gutter systems.

Additionally, they may target specific customer segments, such as those in areas with heavy rainfall or large homes with extensive gutter systems. The market is driven by factors such as increasing awareness of the benefits of these products, growing demand for water conservation, and the need for low-maintenance home solutions. Consumers are also becoming more environmentally conscious, leading to a preference for eco-friendly materials and production methods. In conclusion, the gutter guards market is a dynamic and growing sector within the construction industry, driven by consumer demand for efficient, low-maintenance, and eco-friendly solutions. Companies in this market must focus on innovation, quality, and customer service to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2017 - 2021 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.06% |

|

Market growth 2024-2028 |

USD 250.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.02 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

US, China, Germany, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Almesco Ltd., Alumasc Group plc, Associated Materials LLC, City Sheet Metal Co. Ltd., Clotan Steel Pty Ltd., Cornerstone Building Brands Inc., Englert Inc., Fiberglass Building Products Inc., FIRST Corp. Srl, Gibraltar Industries Inc., Grillo Werke AG, Guangzhou Nuoran Building Material Co. Ltd., Hebei Hollyland Co., Ltd., Lindab AB, Panasonic Holdings Corp., Precision Gutters Ltd., Senox Corp., Spectra Gutter Systems, Standard Industries Inc., and Westlake Corp. |

|

Market dynamics |

Parent market analysis, Market forecast, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market report during the forecast period

- Detailed information of market analysis and report on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the size of the market and its contribution in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.