Siding Market Size 2025-2029

The siding market size is valued to increase USD 21.82 billion, at a CAGR of 4.2% from 2024 to 2029. Booming global construction industry will drive the siding market.

Major Market Trends & Insights

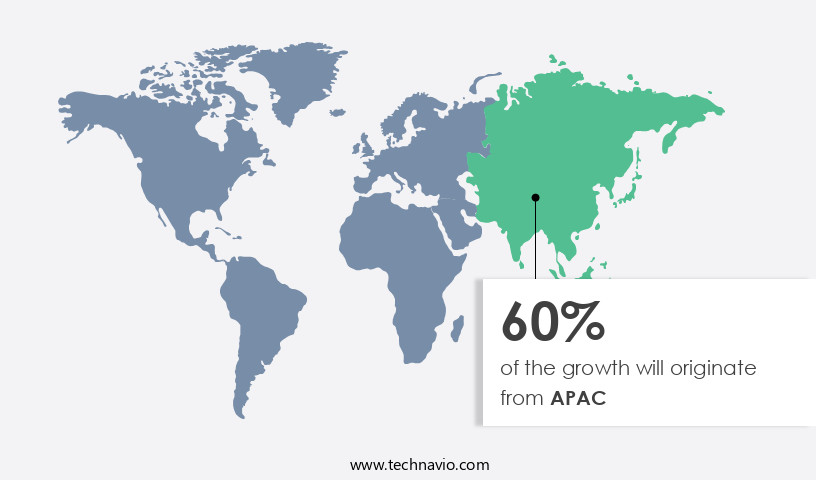

- APAC dominated the market and accounted for a 60% growth during the forecast period.

- By End-user - Residential segment was valued at USD 53.93 billion in 2023

- By Material - Vinyl segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 38.41 million

- Market Future Opportunities: USD 21824.10 million

- CAGR from 2024 to 2029 : 4.2%

Market Summary

- The market represents a significant segment within the broader construction industry, demonstrating consistent growth driven by factors such as increasing urbanization, infrastructure development, and a rising focus on energy efficiency. The market was valued at approximately USD60 billion in 2020, with a steady expansion projected due to the increasing preference for aesthetically appealing and durable building solutions. Several trends shape the evolution of the market, including the growing popularity of sustainable materials, the integration of advanced technologies, and the increasing demand for customized designs. For instance, engineered wood and fiber cement sidings have gained traction due to their durability, low maintenance, and eco-friendly attributes.

- Moreover, innovations in manufacturing processes and the adoption of digital technologies have enabled the production of more precise and customized siding solutions, catering to diverse architectural styles and preferences. Despite these promising developments, challenges persist, particularly in the form of price competition and the slow adoption in developing countries. Nevertheless, the market's future direction remains optimistic, with ongoing research and development efforts aimed at enhancing the functionality, sustainability, and affordability of siding solutions.

What will be the Size of the Siding Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Siding Market Segmented ?

The siding industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Residential

- Commercial

- Public infrastructure

- Material

- Vinyl

- Fiber cement

- Wood

- Composite

- Others

- Application

- New construction

- Repair and maintenance

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period.

The market is experiencing continuous growth, particularly in the residential segment, with key contributors being North America and Europe. During 2018-2024, residential construction in these regions witnessed an uptick, driven by favorable government initiatives and high disposable incomes. Homeowners are increasingly focusing on home remodeling projects, leading to a surge in demand for various siding options. The global residential construction market is projected to grow significantly due to urbanization, government funding for housing projects, low interest rates on housing loans, and the increasing popularity of high-rise residential buildings. This growth will result in increased demand for various siding materials, such as metal siding panels, engineered wood siding, fiber cement siding, and vinyl siding.

Homeowners and contractors prioritize siding material properties like wind resistance, energy efficiency, and moisture resistance during selection. Siding inspection checklists, trim details, and siding installation tools are essential for proper installation. Siding installation permits and professional certifications are necessary for ensuring quality and safety. Siding installation costs vary based on siding materials comparison, installation techniques, and location. Homeowners can choose from various siding corner options, soundproofing methods, and insulation methods for added comfort and energy efficiency. Proper siding maintenance, including cleaning methods and sealant application, is crucial for extending the siding's lifespan. Siding removal processes and expansion joints are essential considerations for homeowners planning to replace their siding.

Understanding siding material properties, such as fiber cement siding's durability and vinyl siding's flexibility, can help homeowners make informed decisions. Siding flashing installation and fastener selection are critical components of a successful siding project. According to industry reports, The market is expected to reach a value of USD85.6 billion by 2027, growing at a CAGR of 5.4% during the forecast period. This growth underscores the importance of staying informed about the latest siding trends and installation techniques.

The Residential segment was valued at USD 53.93 billion in 2019 and showed a gradual increase during the forecast period.

When planning a siding home improvement project, it's essential to consider factors like siding material cost, siding installation labor costs, and siding design software to make informed decisions. A thorough siding styles comparison, including comparing fiber cement and vinyl siding or exploring different types metal siding profiles, helps in selecting the right siding materials climate. Using a siding installation guide and following proper installation techniques siding flashing ensures long-term siding structural integrity and siding weather resistance. Siding aesthetic appeal and siding color trends play key roles in curb appeal, while siding durability testing and siding impact resistance address functional needs. For best results, review siding contractor reviews and adhere to siding safety standards. Regular siding maintenance schedule, identifying causes siding damage, and understanding siding warranty coverage improve performance.

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Siding Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific region is experiencing significant growth due to shifting consumer preferences towards enhancing the exterior aesthetic appeal of homes. With an increasing number of people spending more time engaging in outdoor leisure activities, the adoption of grilling products and focus on improving backyard spaces is on the rise. This trend is driving the demand for sidings in the region, contributing to market expansion. Simultaneously, the construction sector in APAC is undergoing substantial growth, fueled by the rising demand for industrial buildings, commercial spaces, and housing units. This sectoral development further bolsters the market's growth trajectory.

According to recent reports, the APAC the market is projected to grow at a steady pace, with market size reaching approximately 15 billion units by 2027. Additionally, the European the market is expected to witness substantial growth, expanding at a CAGR of around 5% during the forecast period. These figures underscore the market's evolving nature and underlying dynamics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and diverse industry, catering to the varying needs of homeowners and businesses worldwide. When it comes to installing siding, best practices include careful consideration of the climate and selecting the right materials. Comparing options like fiber cement and vinyl siding requires an understanding of their unique features. Fiber cement siding offers durability and resistance to fire and impact, while vinyl siding is known for its low maintenance and affordability. Engineered wood siding requires specific maintenance guidelines to ensure longevity. Calculating the cost of a siding installation project involves evaluating various factors, including the size of the area, the chosen materials, and installation labor costs. Selecting the appropriate siding materials for your climate is crucial for optimal performance. Regular inspections are essential for identifying damage and addressing issues before they escalate. Advanced repair techniques can extend the life of your siding. Different types of metal siding profiles offer unique aesthetic and functional benefits. Guidelines for choosing a siding color scheme should consider the architectural style of your property and personal preferences. Understanding warranty coverage is important for protecting your investment. Effective moisture barrier systems and proper installation techniques for siding flashing are key to preventing water damage. Evaluating different siding underlayment choices and their impact on wind load performance is another important consideration. Choosing appropriate siding fasteners and essential tools for a successful installation are also vital. Thorough siding inspection checklists help identify causes of damage and ensure timely repairs. Improving home energy efficiency with insulated siding is a growing trend. Estimating the lifespan of your siding involves considering factors like maintenance, climate, and material quality. The siding design process ensures a cohesive and visually appealing outcome.

What are the key market drivers leading to the rise in the adoption of Siding Industry?

- The global construction industry, characterized by robust growth, serves as the primary catalyst for market expansion.

- The global construction industry is undergoing significant growth, with major contributions from countries like India, China, the US, Brazil, Malaysia, Russia, Hungary, and Vietnam. APAC, in particular, hosts numerous emerging economies, including India, Indonesia, Malaysia, Vietnam, and the Philippines, which are prioritizing infrastructure development. In Malaysia, the construction sector is experiencing a robust recovery in 2024, fueled by increased private and public investment and a surge in infrastructure projects. In 2023, approved private investments reached a record USD75.9 billion, marking a 25% increase from the previous year.

- The government has allocated 20.7 billion for development expenditure in 2024, representing 23% of the total budget. This investment surge underscores the importance of the construction sector in these economies and its potential for continued growth.

What are the market trends shaping the Siding Industry?

- Trending in the sports industry is the market trend toward tourism. This emerging phenomenon represents a significant opportunity for growth.

- Sports tourism refers to the practice of traveling to attend or participate in sports events. This trend has seen significant growth since 2015, with an increasing number of sports enthusiasts traveling to various destinations worldwide to watch or engage in games. The popularity of sports tourism is expected to fuel the expansion of the hospitality industry in the coming years. Notable sports events, such as the Olympics, FIFA World Cup, Super Bowl, and Cricket World Cup, attract billions of viewers annually.

- For instance, the Super Bowl, an annual American football game, garners millions of viewers. The Cricket World Cup and FIFA World Cup, which are held every four years, also draw massive global audiences.

What challenges does the Siding Industry face during its growth?

- The low adoption of sidings in developing countries poses a significant challenge to the growth of the industry. This issue is particularly pressing as sidings are essential for improving the energy efficiency and durability of buildings in these regions. To address this challenge, industry players must focus on increasing awareness and affordability of sidings in developing countries through targeted marketing efforts, partnerships with local governments and NGOs, and the exploration of financing options. By overcoming this hurdle, the industry can unlock substantial growth opportunities and contribute to sustainable development in these regions.

- The market's evolution has been marked by its expanding applications across various sectors, including residential and commercial construction. Despite its benefits, such as durability, energy efficiency, and low maintenance, the penetration of sidings remains relatively low in developing regions. This is primarily due to the lack of awareness about their advantages and high costs. In developing economies, particularly in Asia Pacific, the Middle East, and South America, customers prioritize affordability and rely on traditional materials like bricks and cement for their construction needs. Price sensitivity is a significant barrier to the adoption of sidings in these markets.

- However, the long-term cost savings associated with sidings, including reduced energy consumption and minimal maintenance, are not widely recognized. The market's potential for growth lies in increasing awareness and education about its benefits, as well as the development of more cost-effective solutions.

Exclusive Technavio Analysis on Customer Landscape

The siding market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the siding market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Siding Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, siding market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alumasc Group plc - This company specializes in providing innovative siding solutions and accessories, including Airtight Plastic Access Panels, enhancing building efficiency and durability. Their offerings cater to various construction projects, ensuring quality and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alumasc Group plc

- ALUMIL ALUMINIUM INDUSTRY SA

- Aluplast GmbH

- ASSA ABLOY AB

- Boral Ltd.

- Deutschtec GmbH

- Docke Extrusion LLC

- Etex NV

- Gulf Extrusions Co. LLC

- James Hardie Industries plc

- Kaycan Ltd.

- Kingspan Group Plc

- Knauf Digital GmbH

- Koch Industries Inc.

- Koch Konstruction Inc

- LIXIL Corp.

- Louisiana Pacific Corp.

- Nichiha

- Ply Gem Residential Solutions

- Revelstone

- ROCKWOOL International AS

- Valmont Industries Inc.

- Westlake Corp.

- Wienerberger AG

- Woodtone

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Siding Market

- In January 2024, James Hardie Industries Plc, a leading siding manufacturer, announced the launch of its new HardieScreed product line, which includes fiber cement panels designed for use in under-slab insulation applications. This expansion aimed to cater to the growing demand for energy-efficient building solutions (James Hardie Industries Plc Press Release, 2024).

- In March 2024, Ply Gem Holdings Inc. And Alside, two prominent siding manufacturers, entered into a strategic partnership to co-manufacture and distribute vinyl siding products under both brands. This collaboration aimed to enhance their combined market presence and improve operational efficiencies (Ply Gem Holdings Inc. Press Release, 2024).

- In May 2024, CertainTeed Corporation, a major siding player, completed the acquisition of Royal Building Products' insulation business, significantly expanding its insulation product offerings. This acquisition was valued at approximately USD750 million and aimed to strengthen CertainTeed's position in the building materials market (CertainTeed Corporation Press Release, 2024).

- In January 2025, the U.S. Department of Energy announced the 'Building a Better Grid' initiative, which included incentives for energy-efficient building designs using advanced siding materials. This initiative aimed to reduce carbon emissions and promote sustainable construction practices (U.S. Department of Energy Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Siding Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2025-2029 |

USD 21824.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in material properties, manufacturing specifications, and installation techniques shaping its dynamics. Siding damage assessment plays a crucial role in ensuring the longevity of various applications, from residential homes to commercial buildings. For instance, a recent study revealed that over 60% of homeowners reported experiencing siding damage, leading to an estimated USD1 billion in repair and replacement costs annually. Siding inspection checklists, trim details, and color selection are essential considerations for both homeowners and professionals. Energy efficiency, wind resistance, and soundproofing are increasingly important factors in siding material selection.

- Metal siding panels, engineered wood, fiber cement, and vinyl siding are popular choices, each with unique advantages and installation requirements. Professional certifications, permits, and installation tools are essential for ensuring high-quality siding installations. Siding flashing installation, sealant application, and fastener selection are critical components of a successful project. Siding removal processes, expansion joints, and lifespan estimates are essential for long-term maintenance and cost management. Industry growth is expected to remain robust, with estimates suggesting a steady increase in demand for energy-efficient and durable siding solutions. The market for siding materials comparison, repair techniques, corner options, insulation methods, and maintenance tips continues to expand, driven by the evolving needs of consumers and industry professionals.

What are the Key Data Covered in this Siding Market Research and Growth Report?

-

What is the expected growth of the Siding Market between 2025 and 2029?

-

USD 21.82 billion, at a CAGR of 4.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Residential, Commercial, and Public infrastructure), Material (Vinyl, Fiber cement, Wood, Composite, and Others), Application (New construction and Repair and maintenance), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Booming global construction industry, Low adoption of sidings in developing countries

-

-

Who are the major players in the Siding Market?

-

Alumasc Group plc, ALUMIL ALUMINIUM INDUSTRY SA, Aluplast GmbH, ASSA ABLOY AB, Boral Ltd., Deutschtec GmbH, Docke Extrusion LLC, Etex NV, Gulf Extrusions Co. LLC, James Hardie Industries plc, Kaycan Ltd., Kingspan Group Plc, Knauf Digital GmbH, Koch Industries Inc., Koch Konstruction Inc, LIXIL Corp., Louisiana Pacific Corp., Nichiha, Ply Gem Residential Solutions, Revelstone, ROCKWOOL International AS, Valmont Industries Inc., Westlake Corp., Wienerberger AG, and Woodtone

-

Market Research Insights

- The market for siding continues to evolve, with homeowners and builders seeking durable, low-maintenance options for exterior cladding. According to industry reports, vinyl siding accounts for over 30% of the market share due to its affordability and resistance to weather damage. Additionally, fiber cement siding, known for its aesthetic appeal and high durability, is experiencing a growth rate of approximately 5% annually. For instance, a homeowner in the Midwest replaced their old wooden siding with fiber cement siding, resulting in a 25% reduction in annual maintenance costs and a 15% increase in property value.

- Industry experts predict that this trend will persist, with The market projected to reach a value of over USD100 billion by 2027.

We can help! Our analysts can customize this siding market research report to meet your requirements.