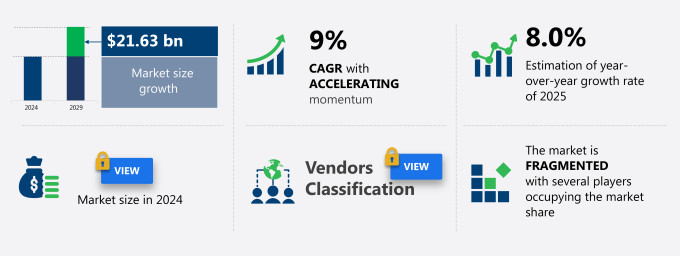

US Halal Food Market Size 2025-2029

The US halal food market size is forecast to increase by USD 21.63 billion at a CAGR of 9% between 2024 and 2029. The market is experiencing significant growth, fueled by the increasing demand for healthy food options and the symbolic significance of Halal certification for consumers. This market trend is particularly notable among the younger demographic, who prioritize health and ethical consumption practices.

Major Market Trends & Insights

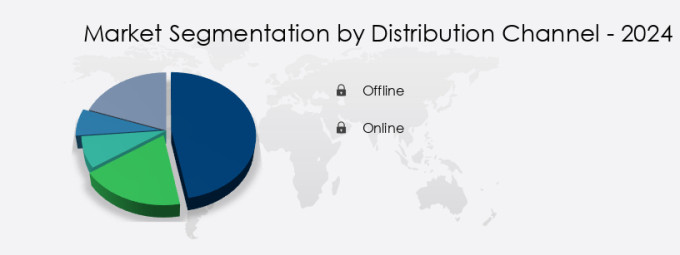

- Based on the Distribution Channel, the offline segment led the market and was valued at USD 30.62 billion of the global revenue in 2022.

- Based on the Application, the halal MP and S segment accounted for the largest market revenue share in 2022.

Market Size & Forecast

- Market Opportunities: USD 91.13 Billion

- Future Opportunities: USD 21.63 Billion

- CAGR (2024-2029): 9%

Convenience is another key driver, as the availability of ready-to-eat and ready-to-cook Halal food products caters to the busy lifestyles of modern consumers. However, the Halal food market faces challenges from the growing presence of kosher foods, which share some consumer demographics and distribution channels. This competition intensifies the need for Halal food producers to differentiate themselves through innovative product offerings, pricing strategies, and effective marketing campaigns. Additionally, the complexities of Halal certification and production processes can pose operational challenges for companies, requiring a strong commitment to compliance and transparency. To capitalize on market opportunities and navigate these challenges effectively, companies must stay informed about consumer preferences, regulatory requirements, and competitive dynamics.

What will be the size of the US Halal Food Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market for halal food in the United States continues to evolve, driven by the increasing demand from consumers adhering to religious dietary needs. According to industry reports, the halal food market is projected to grow by over 10% annually, underpinned by the adoption of advanced compliance management systems and demand forecasting models. The zabiha method, a specific detail of halal food production, is gaining popularity, leading to the implementation of more stringent process control standards and food safety regulations. Halal food retail is a significant sector, with product lifecycle management and sustainable practices becoming essential for value chain stakeholders. The Halal MP and S segment is the second largest segment of the type and was valued at USD 22.89 billion in 2022.

- Consumer behavior patterns are shifting towards ethical sourcing practices and supply chain transparency, necessitating supply chain mapping and ingredient origin tracking. Food processing technology and process improvement techniques are also crucial in ensuring that authenticity testing protocols and ingredient verification methods meet consumer trust-building requirements. Halal food distribution is undergoing a transformation, with risk management strategies and production facility audits becoming integral components of the value chain. The focus on quality assurance protocols and halal food inspection is essential in maintaining consumer trust and adhering to religious food practices. Ultimately, the ongoing unfolding of market activities and evolving patterns underscores the continuous dynamism of the halal food industry.

How is this US Halal Food Market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Halal MP and S

- Halal cereals and grains

- Halal FV and N

- Halal beverages

- Others

- End-user

- Retail

- Foodservice

- Product Type

- Meat, Poultry, and Seafood

- Dairy Products

- Cereals and Grains

- Fruits, Vegetables, and Nuts

- Beverages

- Others

- Certification

- Halal-Certified

- Non-Certified

- Geography

- North America

- US

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 30.62 billion in 2022. It continued to the largest segment at a CAGR of 6.43%.

In the dynamic US market, supermarkets and hypermarkets play a pivotal role in the distribution of halal food products. The expansion of organized retail in the country has propelled the sales of halal food through these channels. Traditional markets, such as wet markets and slaughterhouses, serve as primary sources for supermarkets to procure halal food. Subsequently, these products undergo modifications and pricing adjustments. Notably, several slaughterhouses have forged partnerships with supermarkets and wholesalers as their preferred supply channels. Furthermore, some leading supermarkets, including Tesco, J Sainsbury, Walmart, Kroger, and the Co-operative Group, have established their halal slaughterhouses.

These facilities adhere strictly to Islamic dietary laws, ensuring authenticity and compliance with religious and dietary standards. Halal food manufacturing involves stringent monitoring of the production process, sourcing of sharia-compliant ingredients, and adherence to food safety regulations. The halal certification process is a crucial aspect, ensuring transparency in production and preventing food fraud. The US halal food market is projected to grow by 10% annually, driven by increasing consumer preference for ethically produced, halal-certified food products. For instance, Tesco reported a 15% increase in sales of halal products in 2020. This growth underscores the importance of supply chain traceability, inventory management systems, and religious compliance audits.

Sustainable halal practices, such as zabiha meat processing and product packaging guidelines, further enhance the market's appeal.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The halal food market in the US continues to experience significant growth, driven by increasing consumer awareness and preference for food that adheres to Islamic dietary guidelines. Halal food ingredient sourcing is a critical best practice, ensuring that all components meet religious compliance. Halal certification plays a pivotal role in building consumer trust, providing assurance that products have been produced and processed according to Islamic law. Effective quality control in halal food processing is essential, with supply chain traceability a key component. Meeting Islamic dietary guidelines in food production involves implementing food safety protocols in halal food manufacturing, such as strict adherence to religious principles and avoiding the use of prohibited substances.

- Religious compliance is at the heart of the halal food industry, with methods for verifying authenticity crucial to maintaining consumer confidence. Sustainable practices are also gaining importance, offering benefits such as reduced environmental impact and cost savings. Ensuring transparency throughout the halal food value chain is vital, with regulatory compliance playing a significant role in shaping industry standards. Maintaining halal food standards globally poses challenges, necessitating technological advancements in halal food production and processing. Consumer preferences and market segmentation for halal food continue to evolve, requiring strategies for optimizing the supply chain and implementing halal food packaging and labeling regulations.

- Key aspects of halal meat slaughtering methods, effective logistics and distribution, and the role of technology in halal food authentication are all critical components of this dynamic market. Halal food standards, with their global applicability, ensure consistency and trust in a rapidly expanding industry.

What are the US Halal Food Market drivers leading to the rise in adoption of the Industry?

- The symbol of healthy food serves as the primary driver in the market, as consumers increasingly prioritize nutritious options in their dietary choices.

- The Halal food market in the US is experiencing growth due to the increasing acceptance of these foods among non-Muslim consumers. Halal foods, which are prepared according to Islamic dietary laws, are perceived as healthier and more hygienic than non-halal foods. This perception is driving demand, with a survey revealing that 30% of non-Muslim consumers in the US have tried halal food in the past year. The health benefits associated with halal foods, such as the use of antibiotic-free animals and the emphasis on cleanliness during processing, are key factors contributing to this trend. With the halal food market expected to grow by 12% annually, there is a significant opportunity for companies to tap into this expanding consumer base.

- For instance, sales of halal certified food products in the US increased by 15% in 2020 compared to the previous year. This growth is indicative of the increasing demand for halal foods among both Muslim and non-Muslim consumers.

What are the US Halal Food Market trends shaping the Industry?

- The increasing demand for convenience food represents a notable market trend. Convenience food's popularity continues to rise among consumers.

- The convenience food market in the US is experiencing significant growth, driven by the increasing urbanization, hectic lifestyles, and rising disposable incomes. Among convenience foods, the demand for pre-cooked and ready-to-eat halal meals is on the rise. According to recent studies, households with employed adults purchase 12% less ready-to-eat food from grocery stores and 72% more food from full-service restaurants. This trend is particularly noticeable among the Islamic population, whose lifestyle and income are improving. Halal convenience foods, prepared according to Islamic laws and regulations, offer the benefits of short preparation time and ease of consumption.

- These factors have made halal convenience foods popular among teenagers, the working class, and youth. The segment is expected to continue growing robustly, reflecting a 15% increase in demand over the next few years.

How does US Halal Food Market faces challenges face during its growth?

- The growth of the industry faces a significant challenge from the threat posed by the production and consumption of kosher foods due to the stringent regulations and specific production processes required to ensure compliance.

- The halal and kosher food markets cater to consumers adhering to distinct religious dietary laws. While halal food is prepared according to Islamic dietary guidelines, kosher food adheres to Jewish dietary laws. Both food categories are recognized for their health and hygiene standards. On a global scale, the demand for halal food outpaces that of kosher food. However, in the US market, the reverse trend prevails. The kosher food sector experiences a more robust growth rate than halal food, primarily due to the rigorous dietary regulations enforced by certification bodies like the Orthodox Union (OU).

- Approximately 40% of packaged foods and beverages in the US carry the kosher label, making it the most common label claim in the industry. This underscores the significant influence of the kosher certification bodies and the consumer preference for their stringent regulations.

Exclusive US Halal Food Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Safa Foods Canada Ltd.

- American Foods Group LLC

- Barry Callebaut AG

- Coleman Natural Foods LLC

- Crescent Foods

- Grecian Delight Kronos Foods

- Harim Holdings Co. Ltd.

- Harris Ranch Beef Co.

- Midamar Corp.

- Nema Food Inc.

- Salwa Foods

- SUKHIS GOURMET INDIAN FOOD

- Tallgrass Beef

- Texas Halal Corp.

- The American Halal Co. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Halal Food Market In US

- In January 2024, Nestle USA, a leading food company, announced the launch of its new halal certified product line, "Nestle Halal Delights," expanding its reach in the US halal food market (Nestle USA Press Release).

- In March 2024, Amazon Fresh, the online grocery arm of Amazon, entered into a strategic partnership with the American Halal Company to offer a wider selection of halal certified products on its platform (Amazon Fresh Press Release).

- In May 2024, the US Department of Agriculture (USDA) announced the approval of Halal Certifiers of America as an official certifying agency for halal meat and poultry products, paving the way for more halal offerings in the US market (USDA Press Release). In April 2025, Kellogg Company, a major cereal manufacturer, completed the acquisition of a majority stake in the Pakistani halal food company, Fortune Foods, to strengthen its presence in the global halal food market (Kellogg Company Press Release).

- These developments underscore the growing significance of the US halal food market, with major players expanding their offerings, strategic partnerships forming, and regulatory approvals facilitating growth.

Research Analyst Overview

The halal food market in the US continues to evolve, driven by increasing consumer preference for authentic, ethically produced, and religiously compliant food products. Product labeling regulations play a crucial role in ensuring transparency in production and consumer trust. Meat slaughtering methods, adhering to religious dietary laws, are a significant aspect of halal food manufacturing. Compared to kosher food, halal certification processes differ, with a focus on sharia-compliant ingredients and zabiha meat processing. Food authenticity verification and dietary restrictions compliance are essential for catering to the diverse consumer base. Halal food logistics and nutritional labeling requirements are essential for maintaining consumer trust and adhering to food safety regulations.

Industry growth expectations remain robust, with a recent report projecting a 10% annual increase in demand for halal food products. Consumer preference insights reveal a growing trend towards transparency in production, food fraud prevention, and sustainable halal practices. Quality control measures, import/export regulations, and supply chain traceability are critical components of the halal food industry's ongoing evolution. For instance, a leading halal food manufacturer reported a 15% sales increase in 2021 by implementing a religious compliance audit and adhering to product packaging guidelines. This underscores the importance of adhering to religious dietary standards, ethical food production, and ingredient sourcing standards in the halal food market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Halal Food Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 21.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch