Handbags Market Size 2025-2029

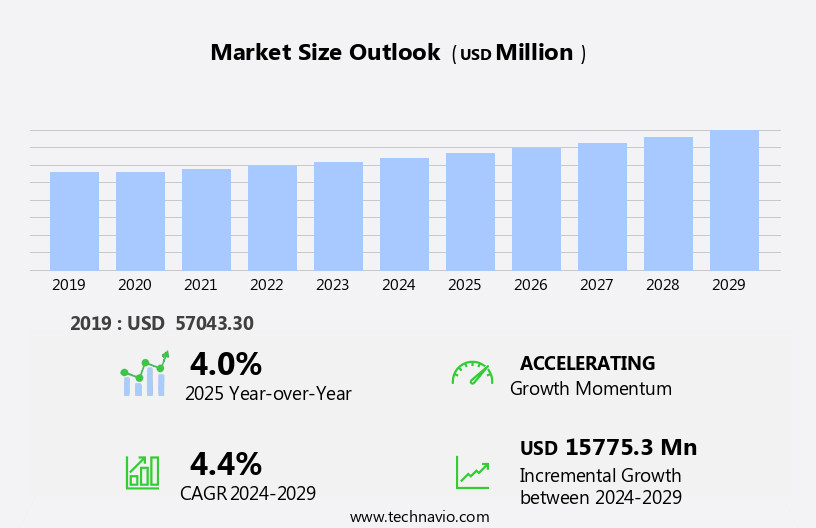

The handbags market size is forecast to increase by USD 15.78 billion at a CAGR of 4.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards personalization and customization. Consumers are seeking unique and stylish handbags that reflect their individuality, leading to a rise in demand for bespoke designs and high-quality materials. This trend is leading to increased innovation in design and materials, resulting in premiumized products that are increasingly available through e-commerce platforms. However, the market is also facing challenges from fluctuating operational costs, particularly in the areas of labor, logistics, and raw materials. Fluctuating operational costs, including labor, logistics, and raw material costs, pose significant risks to profitability. Brands must navigate these cost pressures while maintaining quality and meeting consumer demand for affordable yet high-quality handbags.

- Additionally, the market is becoming increasingly competitive, with new entrants constantly emerging. To succeed, companies must differentiate themselves through innovative design, superior quality, and effective marketing strategies. By staying abreast of these trends and challenges, companies can capitalize on the growing demand for handbags and position themselves for long-term success in this dynamic market.

What will be the Size of the Handbags Market during the forecast period?

- The handbag market is a dynamic and expansive industry, driven by the growing female working population and increasing participation of women in the global workforce. According to the latest omnibus survey, the female working population in emerging economies is projected to continue growing, fueling demand for fashion accessories such as handbags. The market encompasses a wide range of products, from luxury leather handbags to functional synthetic bags, catering to various style preferences and budgets. Raw materials, including leather and synthetic fabrics, play a significant role in the handbag industry. Designer handbags and luxury wear continue to dominate the market, with celebrity endorsements further driving demand.

- However, the market is witnessing a shift towards more sustainable and eco-friendly alternatives, such as recycled materials and organic fabrics. The handbag industry is not just limited to essential carryalls; it also includes luxury handbags. Online retail channels have disrupted traditional brick-and-mortar stores, offering consumers greater convenience and accessibility. Handbag trends evolve rapidly, with functional design, premium quality, and durability being key factors. Consumers seek bags that cater to their lifestyle needs, from tote bags and crossbody bags for everyday use to satchel and clutch bags for formal occasions. Counterfeit products remain a challenge for the industry, with consumers urged to prioritize authenticity and brand reputation when making purchases. Overall, the handbag market is poised for continued growth, reflecting consumers' enduring love for fashion accessories.

How is this Handbags Industry segmented?

The handbags industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Leather

- Fabric

- Distribution Channel

- Offline

- Online

- End-user

- Women

- Men

- Product Type

- Tote bags

- Satchels

- Clutches

- Bucket bags

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- South America

- Middle East and Africa

- APAC

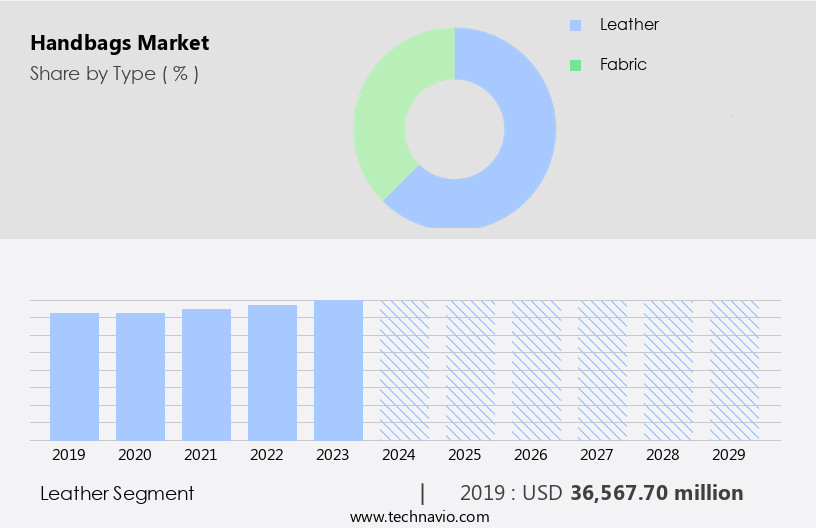

By Type Insights

The leather segment is estimated to witness significant growth during the forecast period. The women's handbag market is experiencing growth due to the increasing participation of working women worldwide. According to an omnibus survey, the female working population is a significant consumer base for fashion accessories like handbags. In the North American region, the United States, Canada, and Mexico represent the largest market for leather handbags. Leather handbags come in various types, with the demand for these items driven by their unique textures, quality, and feel. The satchel bag market, in particular, is gaining popularity due to its functionality and versatility. Leather handbags continue to dominate the market, with the industry witnessing a rise in demand for leather goods. However, there is a resource crunch in the raw material sector, leading manufacturers to explore alternative sources such as ostrich, banana, and vegan leather. Luxury handbags remain a preferred choice for many consumers, with celebrity endorsements and fashion bloggers influencing purchasing decisions.

Furthermore, the increasing preference for eco-friendly and sustainable materials is also influencing the handbag market, with satchel bags and tote bags gaining popularity in the fabric handbag segment. The bag industry is embracing technology, with mobile phones and personalized products driving customer interaction on e-commerce platforms. The World Tourism Organization's promotion of sustainable fashion is also impacting the market, with an increasing preference for ethically sourced and eco-friendly products. Counterfeit products continue to pose a challenge to the market, with companies investing in advanced technologies to combat this issue. The market is expected to grow significantly, driven by these trends and the evolving needs of consumers.

Get a glance at the market report of share of various segments Request Free Sample

The Leather segment was valued at USD 36.57 billion in 2019 and showed a gradual increase during the forecast period.

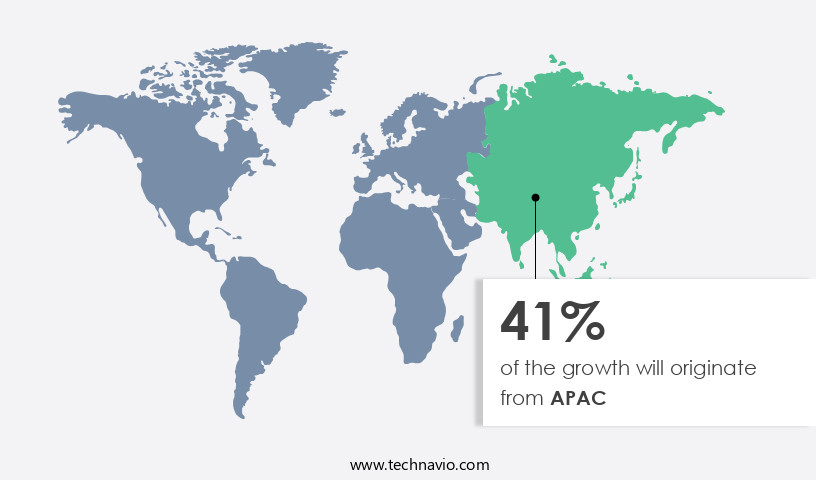

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant growth, driven by the increasing participation of women in the workforce and the expanding female working population. Chinese consumers play a crucial role in this growth, as they contribute substantially to handbag sales in the region. The fashion industry's expansion, fueled by an increase in fashion events and celebrity endorsements, particularly among Gen Z consumers, is further boosting demand. Additionally, the growing target population and rising disposable income are driving the demand for handbags of all categories, including premium and luxury ranges. Tourism in the region also plays a vital role in the market's growth, as travelers often purchase handbags as fashion accessories during their trips.

The market dynamics include the growing popularity of raw materials like vegan and banana leather handbags, the rise of mobile phones and customer interaction platforms, and the increasing presence of e-commerce platforms. The World Tourism Organization's sustainable fashion initiatives are also influencing consumer preferences towards eco-friendly and ethical handbags.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Handbags Industry?

- Personalization and customization of handbags is the key driver of the market. Handbags continue to be a popular accessory in the fashion industry, with various materials and designs gracing runways and retail stores. Among the trending options are vegan leather handbags, such as those made from banana leaves, as well as mesh, nylon, and straw bags. Customization and personalization have become significant factors influencing consumer preferences in developed markets like the United States and Canada.

- Top market players offer customizable features, allowing consumers to select straps, and buckles, and even add embroidery or name tags to their handbags. This level of customization caters to individual tastes and preferences, adding value to the product. Emerging economies, including India and China, are also witnessing a growing demand for personalized luxury goods, including handbags. By providing customized options, market leaders aim to enhance the visual appeal of their products and cater to diverse consumer needs.

What are the market trends shaping the Handbags Industry?

- Increasing design and material innovation, leading to product premiumization, is the upcoming trend in the market. In the dynamic handbag market, companies are introducing new designs and styles to cater to the increasing competition and shifting consumer preferences in the fashion sector. Handbags are sought after for various occasions, including formal events and casual outings. To address this diverse demand, companies are expanding their product offerings.

- High-end and luxury handbags are often crafted from exotic materials such as crocodile skin, snakeskin, and lambskin. For example, Prada's Sidonie suede bag, priced at USD3,100, features two-tone suede calfskin. The production of these premium handbags involves intricate processes, including tanning andthe conversion of raw materials into the finished product. Ethanol and adipic acid are essential components in the production of leather, while various chemicals and dyes are used in the tanning process.

What challenges does the Handbags Industry face during its growth?

- Fluctuating operational costs, including labor, logistics, and raw material costs is a key challenge affecting the market growth. International handbag manufacturers, including Prada and Tapestry, have outsourced production to countries like China, Indonesia, Bangladesh, and Vietnam due to lower labor costs. However, the rapid increase in labor costs in these countries is causing concern for companies.

- Labor expenses in China, Indonesia, Bangladesh, and Vietnam have been escalating, leading to higher production costs for international handbag brands. Moreover, economic instability in other countries from which companies source their supplies is further exacerbating production expenses. The following factors are contributing to the increasing production costs in the handbag industry: Labor costs in developing countries have been escalating, making it less economical for international brands to maintain factories in these regions.

Exclusive Customer Landscape

The handbags market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the handbags market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, handbags market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Authentic Brands Group LLC - The company offers handbags such as forever21 metallic crescent crossbody bag, Nautica bean crossbody bag, and Lucky Brand checkered crochet tote.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Authentic Brands Group LLC

- Burberry Group Plc

- Capri Holdings Ltd.

- Cartier SA

- Chanel Ltd.

- Dolce and Gabbana Srl

- Fossil Group Inc.

- Hermes International SA

- Kanmi

- Kering SA

- Macys Inc.

- MCM Products USA Inc.

- Michael Kors Switzerland GmbH

- Prada S.p.A

- PVH Corp.

- Samsonite International S.A.

- Tapestry Inc.

- The LVMH group

- Tory Burch LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to be a significant segment of the global fashion accessories industry, with women's participation reaching an all-time high in the workforce of emerging economies. This demographic shift has led to a swell in demand for handbags, particularly satchel bags, among the female working population. The satchel bag market has witnessed steady growth due to its versatility and functionality. These bags offer ample space for carrying work essentials and are suitable for both formal and casual settings. The trend towards luxury wear has further fueled the demand for high-end satchel bags, which are often endorsed by celebrities and fashion influencers.

The bag industry is undergoing a transformation, with an increasing focus on raw materials and sustainable production methods. Consumers are becoming more conscious of the environmental impact of their purchases and are seeking out eco-friendly alternatives. Vegan leather handbags made from banana leaves and other plant-based materials have gained popularity among Gen Z consumers, who are also driving the trend towards personalized products and customer interaction platforms. The rise of mobile phones and e-commerce platforms has revolutionized the way consumers shop for handbags. They can now browse and purchase handbags from the comfort of their homes, making the market more accessible than ever before.

However, the increasing prevalence of counterfeit products poses a significant challenge to the industry. The World Tourism Organization's promotion of sustainable tourism has also had an impact on the market. Travelers are seeking out authentic, locally-made handbags as souvenirs, creating new opportunities for artisans and small businesses in various regions. The market is a dynamic and evolving industry, driven by changing consumer preferences, technological advancements, and sustainability concerns. The trend towards personalized products, customer interaction platforms, and e-commerce is expected to continue, while the demand for sustainable and eco-friendly alternatives is gaining momentum. The market is also witnessing increased competition from counterfeit products, making it essential for brands to focus on product quality, authenticity, and customer service to differentiate themselves.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 15.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Japan, Canada, Germany, India, UK, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Handbags Market Research and Growth Report?

- CAGR of the Handbags industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the handbagsmarket growth and forecasting

We can help! Our analysts can customize this handbags market research report to meet your requirements.