Hazardous Waste Management Market Size 2025-2029

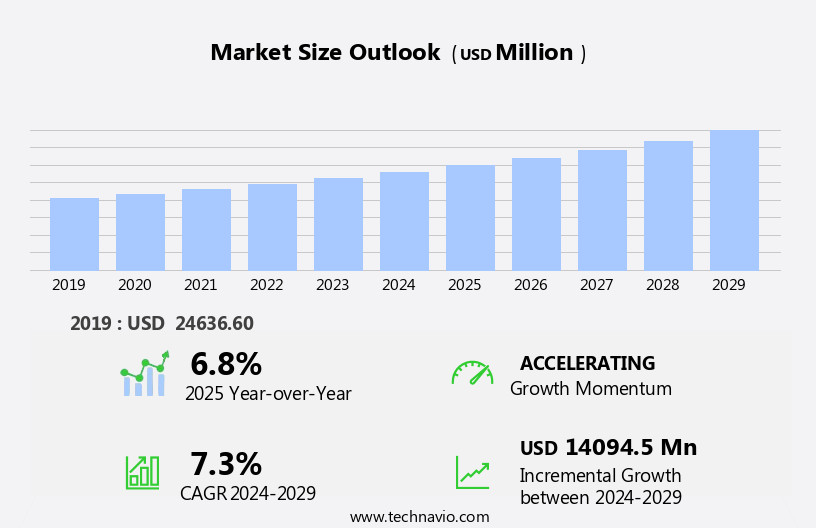

The hazardous waste management market size is forecast to increase by USD 14.09 billion at a CAGR of 7.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing industrial activities worldwide. This trend is driven by the rise in manufacturing sectors, particularly in emerging economies, leading to a surge in the generation of hazardous waste. Additionally, there is a growing awareness and stringent regulations to control the illegal movement of hazardous wastes, further boosting market growth. However, the high cost involved in hazardous waste management remains a major challenge for market participants. Despite this, opportunities exist for companies to capitalize on advanced technologies, such as incineration, landfills, and recycling, to reduce costs and improve efficiency.

- Furthermore, the development of sustainable solutions for hazardous waste management is gaining traction, presenting significant opportunities for market expansion. Companies seeking to capitalize on these opportunities must navigate regulatory complexities, manage costs, and invest in innovative technologies to stay competitive in the market.

What will be the Size of the Hazardous Waste Management Market during the forecast period?

- The market is a critical sector for environmental compliance specialists, as waste management compliance becomes increasingly essential for businesses and industries. Waste transfer stations play a pivotal role in this market, facilitating the safe transportation and disposal of hazardous waste. Waste data management is another key area of focus, with the need for accurate analysis and reporting to ensure environmental liability and adherence to regulations. Environmental permitting and waste analysis are crucial components of waste management innovation, allowing for effective pollution control and risk assessment. Life cycle analysis and environmental technology are also integral to the sector, enabling waste audits and tracking systems to optimize waste management processes.

- Zero waste initiatives and waste generators, particularly in manufacturing industries, healthcare facilities, and construction industries, are driving demand for advanced waste management solutions. Landfill operations and recycling plants are also significant contributors to the market, with circular economy models and green waste management gaining traction. Hazardous waste regulations and standards continue to evolve, necessitating waste management certification and insurance for facilities. Treatment facilities and site cleanup are essential services in managing hazardous waste liability, while environmental impact assessment and remediation are crucial for minimizing risks. Industrial facilities and municipal solid waste also contribute to the market's dynamics, with waste management consultants providing valuable insights and expertise.

- Overall, the market is a complex and evolving landscape, requiring continuous innovation and adaptation to meet the changing needs of businesses and industries.

How is this Hazardous Waste Management Industry segmented?

The hazardous waste management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Industrial

- Medical

- Others

- Type

- Solid

- Liquid

- Sludge

- Sector

- Corrosive

- Flammable

- Infectious

- Radioactive

- Toxic

- Service

- Collection

- Disposal services

- Storage

- Transportation

- Waste treatment

- Capacity

- Large quantity hazardous waste generators

- Medium quantity hazardous waste generators

- Small quantity hazardous waste generators

- Geography

- North America

- US

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Rest of World (ROW)

- North America

By Product Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The generation of hazardous waste is an unavoidable byproduct of various industrial activities, encompassing manufacturing processes and discarded commercial items. This waste can stem from sources such as iron and steel mills, petroleum and coal manufacturing facilities, and heavy construction activities, which yield asphalt, petroleum distillates, used oil, and other potentially hazardous substances. To effectively manage this hazardous waste, regulatory bodies like the Environmental Protection Agency (EPA) provide guidelines for potential generators. The EPA maintains lists of hazardous waste produced by specific industries, along with recommendations for treatment and pollution control measures. Hazardous waste can take various forms, including biohazardous waste from healthcare facilities, pharmaceutical waste, and industrial waste.

Waste management solutions encompass a range of techniques, from thermal treatment and chemical treatment to biological treatment and waste recovery. Regulatory compliance is essential in waste management, with environmental regulations guiding the handling, storage, transportation, and disposal of hazardous waste. Waste management infrastructure includes waste management equipment, software for reporting and tracking waste, and consulting services for waste reduction, minimization, and auditing. Green technologies and sustainable waste management practices are increasingly important, with a focus on circular economy principles and waste characterization to optimize waste management systems. Waste management contracts and outsourcing can help businesses navigate the complexities of waste management, ensuring compliance with regulations and minimizing environmental impact.

Waste storage and transportation require specialized handling due to the hazardous nature of the materials, with waste segregation crucial for efficient processing and treatment. Chemical waste, industrial wastewater, and radioactive waste pose unique challenges in waste management, necessitating specialized treatment methods and waste management systems. Waste characterization and tracking are essential for ensuring the proper handling and disposal of these materials, while waste recovery and recycling offer opportunities for reducing the overall volume of waste generated. In summary, the efficient management of hazardous waste is a critical aspect of industrial activities, with regulatory compliance, waste reduction, and sustainable practices playing essential roles in minimizing environmental impact.

Waste management solutions encompass a range of techniques and technologies, from waste characterization and reporting to treatment and disposal.

Get a glance at the market report of share of various segments Request Free Sample

The Industrial segment was valued at USD 15.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

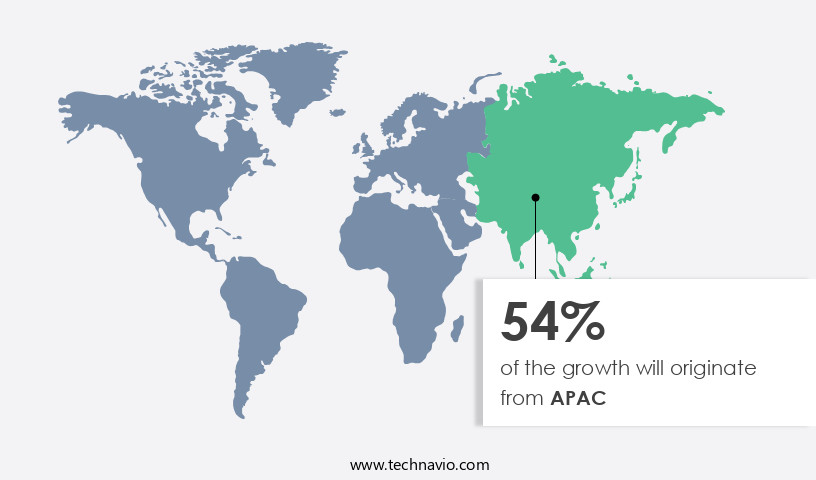

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

In the realm of industrial development, governments in Asia Pacific (APAC) have been spearheading significant infrastructure projects. For instance, Japan's investment of approximately USD18 billion in Hong Kong's new airport terminal and third runway by 2024, and a USD1 billion loan to Indonesia for a port construction project in West Java, due for completion by 2027. These projects generate substantial quantities of hazardous waste, thereby fueling the growth of the market in APAC. Furthermore, environmental sustainability is a priority in these developments, with waste reduction, recycling, and green technologies being integral components. Waste management solutions, including waste characterization, waste treatment, and waste disposal, are essential for handling various types of waste such as industrial, medical, electronic, and hazardous.

Regulations governing waste management, environmental compliance, and hazardous materials management are stringent, necessitating the adoption of advanced waste management systems and consulting services. Waste management contracts, waste auditing, and waste tracking are crucial for maintaining regulatory compliance and optimizing waste management operations. The circular economy concept is gaining traction, with waste recovery and waste processing becoming key focus areas for businesses and governments alike. Biohazardous waste, pharmaceutical waste, and chemical waste require specialized handling and treatment, necessitating the use of waste management equipment and waste management software for effective waste segregation and reporting. Waste remediation and waste storage are also critical aspects of waste management, particularly for radioactive waste and other hazardous materials.

Overall, the APAC market for waste management is dynamic and evolving, driven by the need for sustainable waste management practices and regulatory compliance.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hazardous Waste Management Industry?

- Increase in industrial activities is the key driver of the market.

- The global market for hazardous waste management has witnessed significant growth due to the increasing industrial activities and consumer spending. The automotive sector, in particular, has experienced a surge in production in Southeast Asia, leading to an increase in waste generation. Economic development has boosted consumer confidence, resulting in higher demand for goods and increased industrial activities. This trend has been observed in various sectors, including electronics, where several multinational companies have established manufacturing bases in the region. The production and sales of automobiles have also risen due to high buyer confidence.

- However, the depletion of raw materials as a result of increased demand necessitates effective hazardous waste management practices. Consequently, the automobile industry has adopted waste management solutions to minimize waste and ensure sustainable production processes. Overall, the growing industrial activities and consumer spending are driving the demand for hazardous waste management services worldwide.

What are the market trends shaping the Hazardous Waste Management Industry?

- Increasing development of measures to control illegal movement of hazardous wastes is the upcoming market trend.

- The improper management of hazardous waste poses significant environmental risks, with Eurostat reporting a non-compliance rate of 25% in relation to illegal waste movements. In January 2025, Stericycle, Inc. Agreed to pay a USD9.5 million civil penalty for violating hazardous waste management regulations between 2014 and 2020. During this period, the company failed to properly manage hazardous waste, lost track of shipments, and did not maintain required manifest records. These violations led to the transport of hazardous waste without proper documentation and disposal at incorrect facilities.

- Effective regulation of hazardous waste disposal and management is crucial at an international level to mitigate the negative impacts on the environment, particularly the quality of land and water. Ensuring compliance with regulations is essential to prevent such incidents and safeguard public health and the environment.

What challenges does the Hazardous Waste Management Industry face during its growth?

- High cost involved in hazardous waste management is a key challenge affecting the industry growth.

- Hazardous waste management involves handling and disposing of substances that pose potential risks due to their volume, characteristics, and disposal methods. For instance, medical waste, such as items contaminated with blood or other potentially infectious materials, requires specialized handling and disposal, which is 22 times more costly than regular trash disposal. Strict regulations mandate the segregation of hazardous waste and the use of regulated containers for disposal. Adhering to these regulations adds to the overall cost of hazardous waste management.

- In response to these regulations, service providers have adopted new processes, technologies, and techniques to efficiently manage hazardous waste. These include advanced segregation methods, automated disposal systems, and the use of eco-friendly disposal methods. The effective management of hazardous waste is crucial to ensure public health and safety, as well as to comply with regulatory requirements.

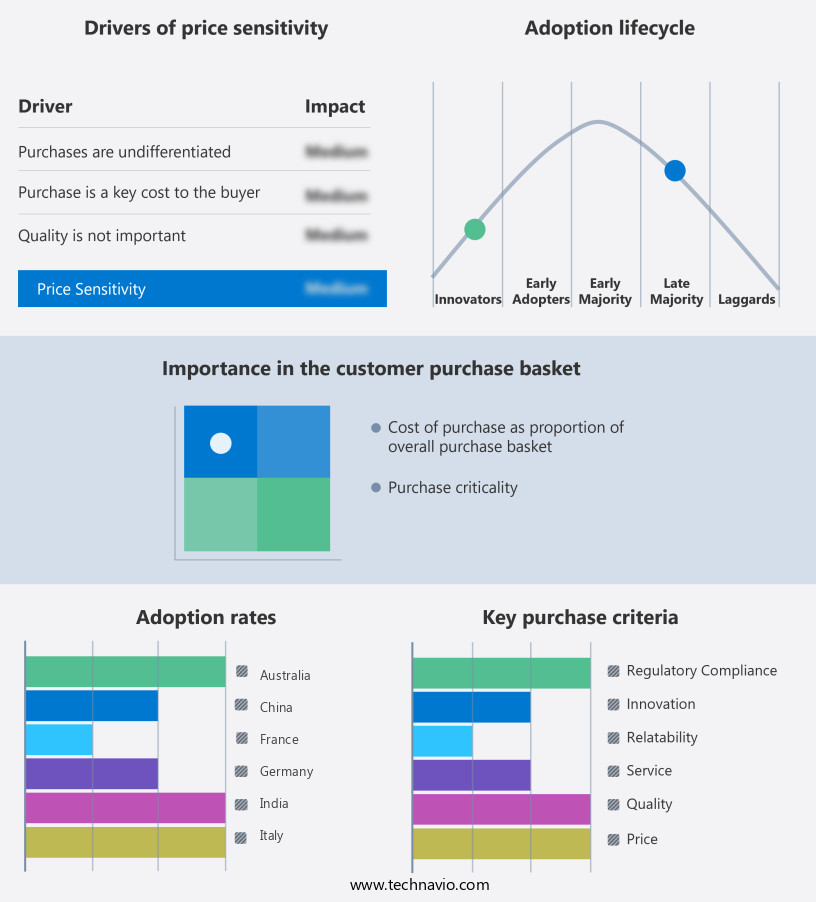

Exclusive Customer Landscape

The hazardous waste management market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hazardous waste management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hazardous waste management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Waste Management Services Inc. - The company specializes in hazardous waste management, providing solutions for transportation and disposal to ensure compliance with regulations and minimize environmental risks. Our services encompass safe handling, transportation in compliance with DOT regulations, and disposal in approved facilities. We prioritize sustainability and adhere to stringent safety protocols to protect both our team and the communities we serve. Our expertise in hazardous waste management enables us to provide comprehensive solutions for various industries, ensuring the secure and responsible handling of their waste streams.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Waste Management Services Inc.

- Averda

- Bechtel Corp.

- Chloros Environmental Ltd.

- Clean Harbors Inc.

- Daniels Health

- Environ India

- GreenTech Environ Management Pvt. Ltd.

- Grupo Tradebe Medioambiente SL

- Morgan Industries Ltd.

- Recology Inc.

- REMONDIS Medison GmbH

- Republic Services Inc.

- Seche Environnement SA

- Sharps Medical Waste Services

- SMS Envocare Ltd.

- Veolia

- Waste Connections Inc.

- Waste Management Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of activities aimed at handling, transporting, treating, and disposing of hazardous waste in a manner that ensures environmental sustainability and regulatory compliance. This market is characterized by the implementation of various waste management solutions, including physical treatment, waste handling, and waste reporting. Physical treatment processes, such as thermal and chemical treatment, play a crucial role in rendering hazardous waste safe for disposal or recycling. Waste handling involves the transportation and storage of hazardous materials, requiring specialized waste management equipment and adherence to strict safety protocols. Waste management software and consulting services are essential tools for managing the complexities of hazardous waste management.

These solutions facilitate waste minimization, waste reduction, and waste recovery efforts, as well as ensure regulatory compliance and efficient waste management systems. Biohazardous waste and pharmaceutical waste pose unique challenges in the market. Proper handling, treatment, and disposal of these wastes are essential to prevent potential health risks and environmental contamination. Environmental sustainability is a key driver in the market. Green technologies, such as biological treatment and waste remediation, are increasingly being adopted to minimize the environmental impact of hazardous waste management activities. Industrial waste, including industrial wastewater, is another significant segment of the market. Effective waste management systems are essential for ensuring regulatory compliance and minimizing the environmental footprint of industrial operations.

Electronic waste and waste characterization are also gaining attention in the market. Proper handling and disposal of electronic waste are crucial to prevent potential health and environmental risks, while waste characterization is essential for effective waste management and resource recovery. The market is subject to a complex regulatory landscape. Environmental regulations and compliance requirements are evolving continually, necessitating ongoing adaptation and innovation in waste management practices and technologies. Waste management contracts and outsourcing are common strategies for managing the costs and complexities of hazardous waste management. Waste auditing and tracking are essential components of effective waste management, ensuring that waste is managed efficiently and cost-effectively while minimizing environmental impact.

In the circular economy, waste is viewed as a resource rather than a liability. Waste management services and solutions that prioritize waste recovery and resource recovery are becoming increasingly important in the market. The market is characterized by ongoing innovation and adaptation to meet the evolving needs of businesses and regulatory requirements. Effective waste management is essential for minimizing environmental impact, ensuring regulatory compliance, and reducing costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

270 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 14094.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

China, US, Japan, India, South Korea, Germany, UK, Australia, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hazardous Waste Management Market Research and Growth Report?

- CAGR of the Hazardous Waste Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hazardous waste management market growth of industry companies

We can help! Our analysts can customize this hazardous waste management market research report to meet your requirements.