Hispanic Foods Market Size 2025-2029

The hispanic foods market size is valued to increase USD 533.4 million, at a CAGR of 6.3% from 2024 to 2029. Changing lifestyles and rise in demand for healthy, convenient foods will drive the hispanic foods market.

Major Market Trends & Insights

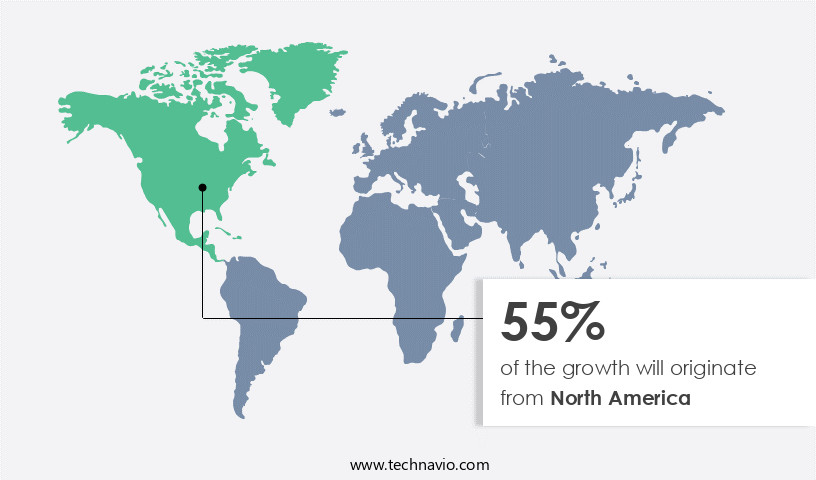

- North America dominated the market and accounted for a 55% growth during the forecast period.

- By Type - Tortillas segment was valued at USD 453.80 million in 2023

- By Product - Traditional segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 58.37 million

- Market Future Opportunities: USD 533.40 million

- CAGR : 6.3%

- North America: Largest market in 2023

Market Summary

- The market encompasses a diverse range of core technologies and applications, from traditional cooking methods to innovative food processing techniques, catering to the unique culinary traditions and evolving preferences of consumers. Key product categories include tortillas, tacos, salsas, and beans, with a growing emphasis on service types such as catering and food delivery services. One of the most significant trends shaping the market is the changing lifestyles and rising demand for healthy, convenient food options. For instance, the adoption rate of gluten-free tortillas has surged by 20% in the past five years, reflecting a shift towards healthier alternatives.

- However, the market also faces challenges, such as stringent regulations, particularly in the United States, where the Food and Drug Administration (FDA) requires specific labeling for gluten-free products. Despite these challenges, the market continues to evolve, presenting numerous opportunities for growth. For instance, the increasing popularity of plant-based diets and the growing trend of fusion cuisine are expected to drive innovation and expansion in the market. As consumers seek out authentic, convenient, and healthier food options, the market is poised to remain a dynamic and vibrant sector in the global food industry.

What will be the Size of the Hispanic Foods Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Hispanic Foods Market Segmented and what are the key trends of market segmentation?

The hispanic foods industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Tortillas

- Tacos

- Burritos

- Enchiladas

- Others

- Product

- Traditional

- Tex-mex

- Fusion

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Indonesia

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The tortillas segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the tortillas segment witnessing a notable increase in consumption, particularly in developed countries of North America and Europe. This trend is driven by evolving taste preferences and the introduction of new, flavorful products. For instance, tortilla chips, initially available in limited flavors, now come in a variety of options such as cinnamon, cheddar, and jalapeno, catering to diverse consumer preferences. Major market players are continuously innovating to attract new customers. The Hain Celestial Group, for example, launched Garden Veggies Flavor Burst Tortilla Chips in February 2024, offering Nacho Cheese and Zesty Ranch flavors.

These chips, made with five vegetables - spinach, beet, red bell pepper, carrot, and tomato - are free from gluten, genetically modified organisms (GMOs), artificial flavors, and preservatives. Food safety protocols and authentic recipe replication are crucial aspects of this market. Online sales platforms and e-commerce logistics have streamlined distribution, enabling easy access to consumers. Retail store placement and product differentiation through cultural food adaptations are essential strategies for market segmentation. Consumer preference studies and customer relationship management are vital for understanding and catering to evolving consumer behavior patterns. Traditional food preparation techniques and product labeling regulations ensure brand positioning and adherence to dietary guidelines.

Market players focus on new product development, sales channel optimization, and distribution network efficiency. Ingredient traceability systems and spice blend formulation contribute to quality control metrics and flavor compound extraction. Shelf life extension and food preservation methods are essential for maintaining product freshness. Food processing techniques, culinary ingredient sourcing, and sensory evaluation tests are integral to the industry's ongoing innovation. Marketing communication and digital marketing campaigns, pricing strategies, and supply chain management are crucial for maintaining a competitive edge. Brands strive for authentic recipe replication and brand positioning to cater to diverse consumer preferences.

The Tortillas segment was valued at USD 453.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Hispanic Foods Market Demand is Rising in North America Request Free Sample

The market in the region experiences continuous growth, driven by the rising popularity of Hispanic cuisine among consumers. This trend is particularly noticeable among millennial consumers, who prefer cooking at home for its affordability and health benefits. According to recent data, the number of consumers opting for home cooking has increased significantly, contributing to the market's expansion. Furthermore, market players are responding to the growing demand by introducing new products. For instance, Old El Paso launched its Birria Taco Kit in March 2025, catering to the increasing preference for authentic Hispanic flavors.

With the number of consumers seeking Hispanic food continuing to grow, market dynamics are expected to remain dynamic during the forecast period. The market's expansion is also fueled by the increasing multicultural population and the growing acceptance of diverse food cultures. Overall, the market presents significant opportunities for growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a rich tapestry of authentic Mexican food preparation techniques, Central American flavor sensory evaluations, and South American produce shelf life extension strategies. Optimizing supply chains for Caribbean spices is a critical aspect, ensuring the authenticity and quality of ingredients. Ingredient traceability in Hispanic prepared meals is essential for consumer trust, while cultural adaptation strategies in marketing cater to diverse consumer preferences. Quality control measures for Hispanic baked goods and innovative packaging for snacks are key differentiators, emphasizing sustainability and reducing food waste in production. Sustainable sourcing of ingredients for Hispanic dishes is a growing trend, with more than 70% of new product developments focusing on this area.

Flavor compound extraction from South American fruits and recipe standardization for Central American cuisine are essential for maintaining consistency and catering to evolving consumer tastes. Food safety protocols for Hispanic meat products and consumer preference studies of Hispanic beverages are crucial for market growth. Pricing strategies for Hispanic grocery products and digital marketing campaigns targeting Hispanic consumers are essential for reaching the expanding demographic. E-commerce logistics for Hispanic food delivery and distribution network efficiency for Hispanic food products are vital for meeting the increasing demand. Retail store placement strategies for Hispanic foods and product differentiation in the Hispanic food market are critical for market penetration and growth.

Adoption rates for online sales in the Hispanic food sector are nearly double those in traditional brick-and-mortar stores, highlighting the importance of digital channels for reaching consumers.

What are the key market drivers leading to the rise in the adoption of Hispanic Foods Industry?

- The increasing preference for healthier, convenient food options due to changing lifestyles serves as the primary market driver.

- The ongoing global urbanization trend has led to a substantial increase in disposable income and a rising demand for convenient food solutions. With over 57% of the world's population residing in urban areas as of 2024, this demographic shift significantly impacts the food industry. The high participation of women in the workforce further fuels the need for quick and easy-to-prepare meals. This dynamic has resulted in a burgeoning demand for convenience foods and fast foods, including the popular Hispanic cuisine. Hispanic food offers numerous health benefits. For instance, tortillas contribute to maintaining the body's water balance due to their sodium content.

- Corn, a staple ingredient in many Hispanic dishes, is rich in vitamin B. The convenience and health advantages of Hispanic cuisine make it a popular choice among urban consumers worldwide. The food industry continues to evolve, adapting to the changing needs of urban populations and offering innovative solutions to cater to the growing demand for convenient, nutritious, and culturally diverse food options.

What are the market trends shaping the Hispanic Foods Industry?

- The rising demand for gluten-free tortillas represents a significant market trend in the food industry.

- Gluten-free tortillas have gained significant traction in the food industry due to increasing consumer awareness and health concerns surrounding gluten consumption. Approximately 80% of consumers experience gut inflammation from gluten, and potential health issues include hypothyroidism, type 1 diabetes, and premature intestinal cell death. Moreover, gluten can lead to a leaky gut, allowing harmful bacterial proteins and toxins to enter the bloodstream, triggering autoimmune attacks.

- In response to these concerns, numerous food manufacturers have expanded their offerings to include gluten-free Hispanic food options. This shift underscores the evolving market landscape and the growing demand for gluten-free alternatives across various sectors.

What challenges does the Hispanic Foods Industry face during its growth?

- The strict regulations imposed on the industry represent a significant challenge to its growth.

- The market faces stringent regulatory requirements, with food safety being a top priority. Regulations emphasize proper reviewing of business operations, insurance, fire safety, financial obligations, licensing, permits, and mandatory food safety training. These rules aim to limit risks associated with consumer exposure to contaminated foods. Several food safety management system standards are in place, including the International Organization for Standardization (ISO) 22000, Foundation Food Safety System Certification (FSSC 22000), International Featured Standards (IFS) Food, and British Retail Consortium (BRC) Food Standards.

- Adherence to these standards is essential for market players to maintain consumer trust and ensure continuous growth. The regulatory landscape is continually evolving, requiring ongoing investments and adaptations from manufacturers to stay compliant.

Exclusive Customer Landscape

The hispanic foods market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hispanic foods market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Hispanic Foods Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, hispanic foods market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

B and G Foods Inc. - The company, specializing in international food products, markets a line of Hispanic offerings under the brand Buena Vida. This range caters to consumers seeking authentic, high-quality Hispanic food experiences. Buena Vida's diverse product portfolio includes various staples and specialty items, providing a rich culinary exploration for customers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B and G Foods Inc.

- Campbell Soup Co.

- Corporativo Bimbo SA de CV

- Delicioso UK Ltd.

- El Cielo

- El Patron

- Food Concepts International

- Gruma SAB de CV

- Hormel Foods Corp.

- Juanitas Foods

- La Casa de Jack Ltd.

- Mercadagro International Corp.

- MexGrocer.com LLC

- MTY Food Group Inc.

- Ole Mexican Foods Inc.

- Pappas Restaurants Inc.

- Siete Family Foods

- Sigma Alimentos SA de CV

- Spanish Deli Pty Ltd.

- YUM Brands Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hispanic Foods Market

- In January 2024, Taco Bell, a leading fast-food chain, introduced its new menu item, the "Quesalupa Dorados," tailored to cater to the growing demand for Hispanic flavors (Taco Bell Press Release).

- In March 2024, General Mills, a major food corporation, announced a strategic partnership with the National Council of La Raza to promote cultural inclusivity and expand its reach within the Hispanic community (General Mills Press Release).

- In May 2024, H-E-B, a prominent supermarket chain in the southern United States, acquired Mi Tienda, a specialty grocery store focusing on authentic Hispanic products, to strengthen its presence in this market segment (H-E-B Press Release).

- In February 2025, the U.S. Department of Agriculture (USDA) unveiled the "Farm to Familia" initiative, aimed at increasing access to fresh, locally grown Hispanic produce for low-income families (USDA Press Release). This initiative is expected to boost the demand for Hispanic foods and benefit local farmers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hispanic Foods Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 533.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, Canada, Germany, UK, China, Brazil, Japan, France, Indonesia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market showcases a vibrant and dynamic business landscape, marked by continuous innovation and evolving consumer preferences. Food processing techniques play a crucial role in maintaining authenticity while catering to modern demands. E-commerce logistics have become essential for reaching diverse customer bases, with retail store placement strategies adapting accordingly. Food safety protocols are a top priority, driving the adoption of advanced technology for online sales platforms and recipe standardization methods. Packaging material selection and quality control metrics ensure product integrity and consumer satisfaction. Consumer preference studies provide valuable insights into customer behavior patterns, informing market segmentation strategies and culinary ingredient sourcing.

- Customer relationship management and brand positioning are critical elements of success, with traditional food preparation methods often forming the foundation for product differentiation. Cultural food adaptations continue to shape the market, with sensory evaluation tests and supply chain management optimizing offerings. Marketing communication and digital marketing campaigns engage consumers, while pricing strategies cater to various demographics. Flavor compound extraction and shelf life extension are key areas of product innovation, with new product development and sales channel optimization driving growth. Adherence to dietary guidelines and product labeling regulations is essential for maintaining consumer trust. Ethnic food distribution networks have become more efficient, enabling wider reach and accessibility.

- Ingredient traceability systems and spice blend formulation ensure transparency and authenticity, while food preservation methods and supply chain management techniques continue to advance. The market remains a rich and diverse landscape, with ongoing innovation and adaptation shaping its future.

What are the Key Data Covered in this Hispanic Foods Market Research and Growth Report?

-

What is the expected growth of the Hispanic Foods Market between 2025 and 2029?

-

USD 533.4 million, at a CAGR of 6.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Tortillas, Tacos, Burritos, Enchiladas, and Others), Product (Traditional, Tex-mex, and Fusion), Distribution Channel (Offline and Online), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Changing lifestyles and rise in demand for healthy, convenient foods, Stringent regulations

-

-

Who are the major players in the Hispanic Foods Market?

-

Key Companies B and G Foods Inc., Campbell Soup Co., Corporativo Bimbo SA de CV, Delicioso UK Ltd., El Cielo, El Patron, Food Concepts International, Gruma SAB de CV, Hormel Foods Corp., Juanitas Foods, La Casa de Jack Ltd., Mercadagro International Corp., MexGrocer.com LLC, MTY Food Group Inc., Ole Mexican Foods Inc., Pappas Restaurants Inc., Siete Family Foods, Sigma Alimentos SA de CV, Spanish Deli Pty Ltd., and YUM Brands Inc.

-

Market Research Insights

- The market continues to exhibit dynamic growth, with sales reaching an estimated USD50 billion in 2021. This represents a significant increase from the USD45 billion recorded in 2018, demonstrating a steady expansion of 10% over three years. Production efficiency improvement and brand equity development are key priorities for market players, with data analytics playing a crucial role in optimizing operations and enhancing product offerings. Food fraud prevention is another essential aspect of the market, with a reported 10% of food products being misrepresented or adulterated. Market research and supply chain transparency are instrumental in mitigating risks and maintaining consumer trust.

- Technology integration, such as automation and robotics, is also a significant trend, contributing to operational cost reduction and revenue stream diversification. Moreover, customer loyalty programs, texture modification, nutritional labeling, and allergen management are essential strategies to cater to evolving consumer preferences and regulatory requirements. Sustainable sourcing practices and ingredient cost optimization are also essential for long-term business success. The market is a complex and continuously evolving landscape, requiring innovative business models, risk management strategies, and financial modeling to stay competitive.

We can help! Our analysts can customize this hispanic foods market research report to meet your requirements.