HIV Drugs Market Size 2024-2028

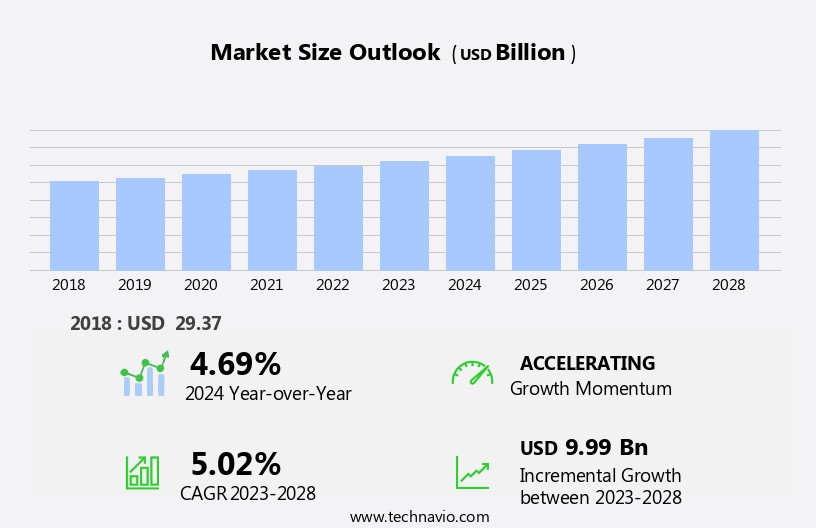

The hiv drugs market size is forecast to increase by USD 9.99 billion at a CAGR of 5.02% between 2023 and 2028.

What will be the Size of the HIV Drugs Market During the Forecast Period?

How is this HIV Drugs Industry segmented and which is the largest segment?

The hiv drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Therapy

- Combination HIV medicines

- Integrase inhibitors

- Non-nucleoside reverse transcriptase inhibitors

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Distribution Channel Insights

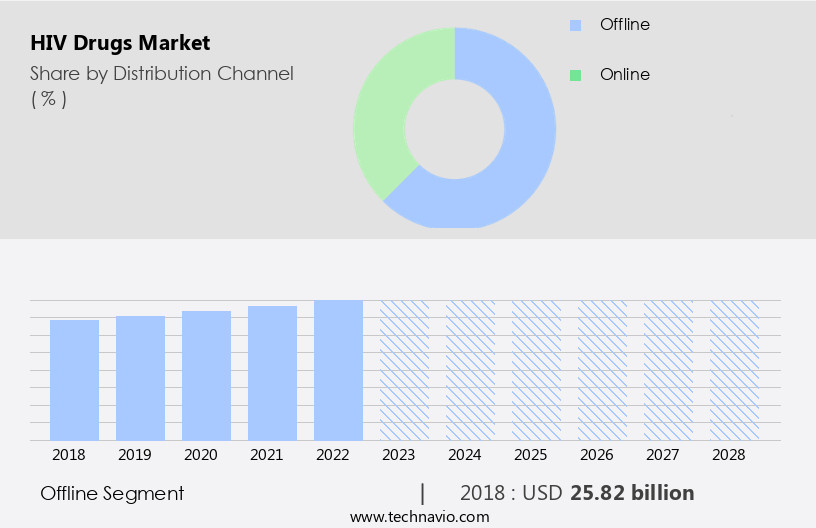

- The offline segment is estimated to witness significant growth during the forecast period.

Offline distribution channels, including pharmacies, drugstores, hospitals, and clinics, remain a significant segment In the market. Pharmacies and drugstores serve as crucial points of sale for HIV medications, particularly antiretroviral therapy (ART), which is essential for managing HIV/AIDS. The offline distribution segment caters to various patient populations, including those in regions with limited internet access or who prefer face-to-face interactions with healthcare professionals. Key HIV drugs, such as Atripla, Complera, Prezcobix, Stribild, Genvoya, Odefsey, Symtuza, Triumeq, Descovy, Dovato, Emtriva, Epivir, Epzicom, Truvada, Biktavir, Edurant, Aptivus, Kaletra, Lexiva, Norvir, Viracept, Selzentry, Fuzeon, Rukobia, Isentress, Tivicay, Apretude, and Juluca, are distributed offline through these channels.

The offline distribution segment's growth is influenced by factors like the prevalence of HIV, testing procedures, and the availability of various HIV medications. Import and export regulations, as well as the increasing demand for healthcare products, further impact this market.

Get a glance at the HIV Drugs Industry report of share of various segments Request Free Sample

The Offline segment was valued at USD 25.82 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

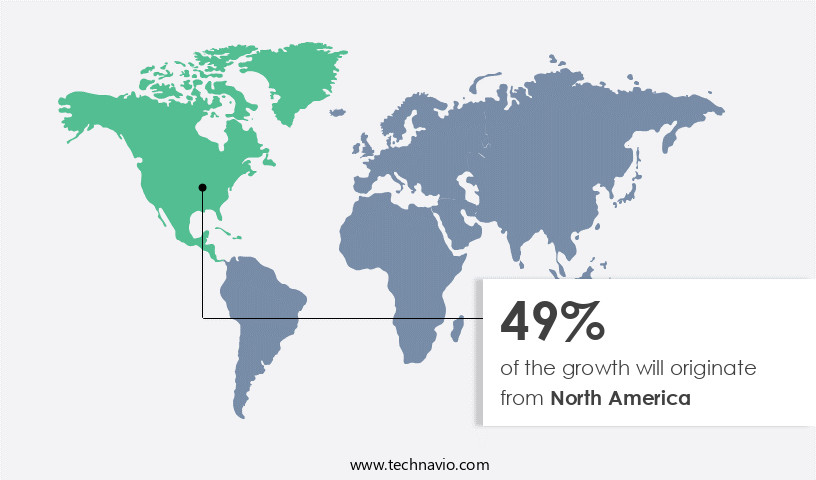

- North America is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market has experienced substantial growth due to advancements in medical research, enhanced healthcare infrastructure, and heightened awareness about HIV/AIDS. With a significant patient population and established healthcare systems In the United States, Canada, and Mexico, North America is a leading market for HIV drugs. Key trends include the development of combination HIV medicines, such as Atripla, Complera, Prezcobix, Stribild, Genvoya, Odefsey, Symtuza, Triumeq, Descovy, Dovato, Emtriva, Epivir, Epzicom, Truvada, Biktavir, Edurant, Aptivus, Kaletra, Lexiva, Norvir, Viracept, Selzentry, Fuzeon, Rukobia, Isentress, Tivicay, Apretude, and Juluca. Government initiatives and partnerships with private organizations have bolstered market growth. HIV drugs, including Efavirenz tablets, fall into various classes, including integrase inhibitors, protease inhibitors (PIs), fusion inhibitors, CCR5 antagonists, and post-attachment inhibitors, as well as pharmacokinetic enhancers.

Hospital pharmacies, drug stores, retail pharmacies, and online pharmacies distribute these essential healthcare products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of HIV Drugs Industry?

Increasing prevalence of HIV AIDS worldwide is the key driver of the market.

What are the market trends shaping the HIV Drugs Industry?

Expanding access to HIV treatment is the upcoming market trend.

What challenges does the HIV Drugs Industry face during its growth?

Drug resistance among individuals is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The hiv drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hiv drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hiv drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AbbVie Inc. - The company specializes in providing a range of HIV drugs, including Kaletra and Aluvia, to address the global demand for effective treatments against the virus. These antiretroviral therapies play a crucial role in managing HIV infection and improving patient outcomes. With a focus on innovation and accessibility, the company is dedicated to contributing to the ongoing efforts to combat HIV/AIDS and improve the lives of those affected by the disease.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Aspen Pharmacare Holdings Ltd.

- Aurobindo Pharma Ltd.

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb Co.

- Cadila Pharmaceuticals Ltd.

- Cipla Inc.

- Emcure Pharmaceuticals Ltd.

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Hetero Labs Ltd.

- Johnson and Johnson Services Inc.

- Lupin Ltd.

- Macleods Pharmaceuticals Ltd.

- Merck and Co. Inc.

- Strides Pharma Science Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of pharmaceutical products designed to manage and suppress the progression of Human Immunodeficiency Virus (HIV) infection. These medications play a crucial role in improving the quality of life for those diagnosed with HIV and reducing the transmission of the virus. HIV drugs can be categorized into various classes based on their mechanism of action. Combination HIV medicines, which consist of multiple drugs from different classes, are a common treatment approach due to their ability to suppress the virus more effectively than a single drug. Integrase inhibitors, protease inhibitors (PIs), fusion inhibitors, CCR5 antagonists, post-attachment inhibitors, and pharmacokinetic enhancers are among the primary classes of HIV drugs.

Integrase inhibitors prevent the viral DNA from integrating into the host's DNA, while protease inhibitors block the action of the HIV protease enzyme, preventing the virus from replicating. Fusion inhibitors prevent the virus from entering the host cell, CCR5 antagonists block the action of a specific receptor on the surface of immune cells, and post-attachment inhibitors prevent the virus from uncoating once it has entered the cell. Pharmacokinetic enhancers improve the bioavailability and effectiveness of other HIV drugs. The patient population for HIV drugs is significant, with a growing number of individuals diagnosed with HIV each year. The prevalence of HIV continues to be a concern, with new cases reported globally.

The need for effective HIV medications is, therefore, a pressing requirement. The market is characterized by continuous innovation and new product launches. Pharmaceutical companies invest heavily in research and development to bring new and improved HIV drugs to market. The import and export of HIV drugs also play a vital role in ensuring access to these life-saving medications for patients worldwide. HIV drugs are available through various channels, including hospital pharmacies, drug stores, retail pharmacies, and online pharmacies. The choice of distribution channel depends on various factors, including patient preference, accessibility, and convenience. The market is a dynamic and complex ecosystem, with various stakeholders, including patients, healthcare providers, pharmaceutical companies, and regulatory agencies, all playing essential roles.

The market is subject to various market forces, including regulatory requirements, pricing pressures, and competition. In conclusion, the market is a critical sector In the healthcare products industry, with a significant impact on public health. The ongoing innovation and new product launches reflect the commitment of pharmaceutical companies to improving the lives of those diagnosed with HIV. The market's complexity and dynamic nature require a nuanced understanding of various market forces and stakeholders.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.02% |

|

Market growth 2024-2028 |

USD 9.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.69 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this HIV Drugs Market Research and Growth Report?

- CAGR of the HIV Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hiv drugs market growth of industry companies

We can help! Our analysts can customize this hiv drugs market research report to meet your requirements.