Australia Home Care Packaging Market Size and Trends

The Australia home care packaging market size is forecast to increase by USD 38.9 million at a CAGR of 5.4% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for convenient and efficient solutions for air care, dishwashing, bleach, laundry care, insecticides, surface care, and sanitary care products in the US. As living standards improve, consumers are prioritizing home hygiene and sustainability. This trend is driving the demand for eco-friendly and sustainable consumer products. Moreover, environmental concerns are influencing consumers to opt for packaging that minimizes waste and reduces carbon footprint. Air care products, such as air fresheners, are gaining popularity due to their ability to improve indoor air quality and create a pleasant living environment. Dishwashing and laundry care products continue to be essential household items, with consumers seeking convenient and eco-friendly packaging solutions. Bleach and insecticides are also in high demand for maintaining cleanliness and preventing pests. Surface care and sanitary care products are essential for maintaining personal and home hygiene. Overall, the market is expected to grow steadily, driven by these trends and the increasing demand for convenient and sustainable packaging solutions.

Market Analysis

The market is witnessing significant growth, driven by the increasing demand for convenient and sustainable solutions in various consumer goods sectors. This trend is particularly prominent in the cleaning products, hygiene, and health awareness industries. Flexible packaging, compact packages, and small pack sizes are gaining popularity in the home care sector due to their ease of use and portability. Plastic packaging remains a dominant choice due to its durability and cost-effectiveness. However, there is a growing emphasis on sustainability, leading to the adoption of bioplastics and recycling initiatives. Consumer preferences for tamper-evident caps ensure safety and security, particularly in the health and hygiene segment. Home care products, such as toilet cleaners, laundry care, and dishwashing solutions, are increasingly being packaged in these caps to maintain product quality and consumer trust. The interior design and commercial construction industries also contribute to the market. Air care products, such as air fresheners, are gaining popularity due to their ability to enhance indoor air quality and create a pleasant living environment. Sustainable consumer products, including home care items, are on the rise as consumers become more conscious of their environmental impact. Smart packaging, such as antimicrobial coatings, is another trend that is expected to gain traction in the market. Raw materials used in home care packaging, such as PVC, PET, and PP, are subject to continuous innovation to meet evolving consumer demands. For instance, the development of biodegradable and compostable materials is a significant trend in the market. The market is expected to experience steady growth due to the increasing demand for convenient, sustainable, and effective packaging solutions across various consumer goods sectors. The market is expected to remain dynamic, with ongoing innovation and technological advancements shaping its future.

Market Segmentation

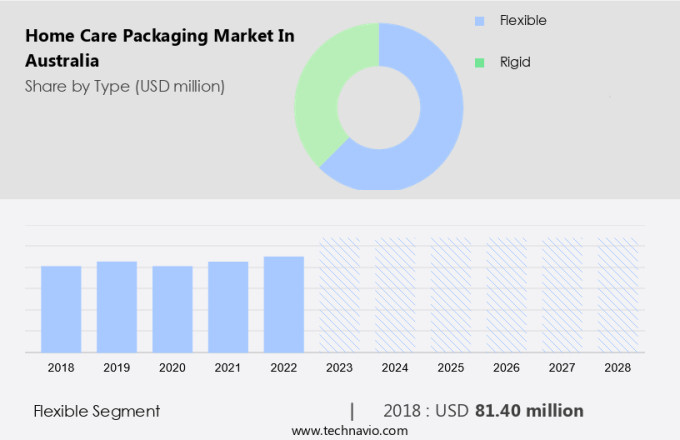

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Flexible

- Rigid

- Application

- Cleaners

- Air fresheners

- Cleaning tools

- Others

- Geography

- Australia

- Australia

- Australia

By Type Insights

The flexible segment is estimated to witness significant growth during the forecast period. Home care packaging refers to the use of flexible, non-rigid materials for packaging items in the health and hygiene sector. This packaging solution has gained significant traction due to its cost-effectiveness and adaptability. Flexible home care packaging employs various materials such as foil, plastic, and paper to create pouches, bags, and other malleable product containers.

Get a glance at the market share of various segments Download the PDF Sample

The flexible segment was the largest segment and was valued at USD 81.40 million in 2018. This packaging method is particularly beneficial for industries that demand diverse packaging options, including health and hygiene, food and beverages, personal care, and pharmaceuticals. Some advantages of flexible home care packaging include enhanced production efficiency, environmental sustainability, innovative design, extended product shelf life, and user-friendly features. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Australia Home Care Packaging Market Driver

Increased demand for home care essentials is notably driving market growth. Home care packaging, including that for cleaning products and hygiene items, has witnessed notable growth in the market. This expansion is primarily attributed to the heightened health awareness and the increasing prioritization of maintaining cleanliness in households.

Consumers are increasingly opting for compact, flexible packages and small pack sizes for their home care essentials. Plastic packaging, with its durability and ease of use, remains a popular choice. Moreover, tamper-evidence caps have become a crucial feature for home care products, ensuring safety and peace of mind for consumers. Manufacturers have responded to this trend by introducing innovative home care solutions. Thus, such factors are driving the growth of the market during the forecast period.

Australia Home Care Packaging Market Trends

Improving standards of living is the key trend in the market. The market is experiencing significant growth due to rising disposable incomes and increasing consumer focus on home hygiene. This trend is evident in the increasing demand for high-quality cleaning supplies, laundry detergents, and personal hygiene items.

Consumers are increasingly seeking eco-friendly and sustainable packaging options, leading manufacturers to develop innovative solutions. Additionally, with hectic lifestyles, there is a growing preference for convenient packaging, such as resealable pouches and easy-to-dispense bottles. Thus, such trends will shape the growth of the market during the forecast period.

Australia Home Care Packaging Market Challenge

Environmental concerns is the major challenge that affects the growth of the market. The market is driven by the versatility and utility of plastic in the industry. Plastic's ability to be molded into various shapes makes it an ideal choice for packaging a wide range of consumer goods, including toilet cleaners and homecare products.

The retail sector's growing demand for cost-effective and efficient packaging solutions, as well as the increasing number of dual-income households, contribute to the market's expansion. Moreover, the adoption of advanced technologies, such as tamper-evident caps and closures, enhances the value proposition for brand owners. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amcor Plc: The company offers solutions for home care packaging that helps people around the world easily and safely keep their homes and businesses clean and welcoming, under the brand name of Amcor.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AptarGroup Inc.

- Ball Corp.

- CANPACK SA

- DS Smith Plc

- Econopak

- Food Packaging Solutions Inc.

- Logos Pack

- Mondi Plc

- Orora Ltd.

- Pact Group Holdings Ltd.

- Silgan Holdings Inc.

- Sonoco Products Co.

- Tetra Laval SA

- Visy Industries Australia Pty Ltd.

- Weltrade Pty Ltd.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Home care packaging plays a crucial role in the consumer goods industry, particularly in the sectors of cleaning products and hygiene. With increasing health awareness and the demand for upscale services, home care packaging has evolved to cater to various needs. Flexible packaging, compact packages, and small pack sizes have gained popularity due to their convenience and ease of use. Plastic packaging remains a common choice due to its durability and tamper-evidence features, but there is a growing trend towards sustainable consumer products and recycling. Bioplastics and biodegradable materials are increasingly being used to reduce plastic pollution. Home care packaging innovation continues with the integration of machine learning, artificial intelligence and smart packaging, such as antimicrobial coatings and child-resistant closures. The market for home care packaging is diverse, encompassing toilet cleaners, air care, dishwashing, bleach, laundry care, insecticides, surface care, sanitary care, and more. Premium packaging and sustainable packaging solutions are essential for branding and maintaining product integrity in the e-commerce era. Paper packaging, such as cartons, is also a versatile option for home care products. Overall, home care packaging continues to evolve to meet the changing needs of consumers and the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2024-2028 |

USD 38.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amcor Plc, AptarGroup Inc., Ball Corp., CANPACK SA, DS Smith Plc, Econopak, Food Packaging Solutions Inc., Logos Pack, Mondi Plc, Orora Ltd., Pact Group Holdings Ltd., Silgan Holdings Inc., Sonoco Products Co., Tetra Laval SA, Visy Industries Australia Pty Ltd., Weltrade Pty Ltd., and Winpak Ltd. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Australia

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch