Home Service Market Size 2022-2026

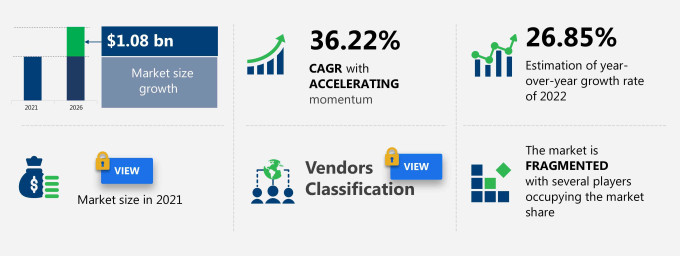

The US Home Service Market Size study is a comprehensive report with in-depth qualitative and quantitative research evaluating the current scenario and analyzing the growth of 26.85 and a CAGR of 36.22% with market size of USD 1.08 billion during the forecast period 2021 to 2026.

ThisUS Home Service Market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers the US Home Service Market segmentation by distribution channel (online and offline) and type (home care and design, repair and maintenance, HW and B, and others). The US Home service market report also offers information on several market vendors, including Ace Handyman Services, Amazon.com Inc., American Home Shield Corp., Angi Inc., Chemed Corp., Handy Technologies Inc., Handyman Connection, HOMEE Inc., HomeServe Plc, Ingka Holding B.V., Mister Sparky Franchising SPE LLC, Reliance Network and Home Services of America, Smiths Plumbing Services, TechCrunch, The Home Depot Inc., USA Plumbing Service, and Yelp Inc among others.

What will the Home Service Market Size In US be During the Forecast Period?

Download Home Service Market Report Sample

The home service market in the US is experiencing rapid growth, driven by the increasing demand for on-demand service apps that offer convenience and efficiency. Home services marketplace platforms are becoming popular, providing a range of reliable home services, including home cleaning services, HVAC maintenance tips, and home wellness solutions. These platforms, often subscription-based platforms, cater to the growing need for convenient home services and fast home services. As smartphone usage continues to rise, users rely on apps for home surveillance, home assembly, and even DIY projects with the help of energy saving tips and home energy efficiency solutions.

In the realm of mental health, telepsychiatry platforms are revolutionizing care with virtual therapy services and mental health self-care tools like mental health chatbots. As mental health research grows, mental health policies are evolving to integrate these digital solutions into mainstream healthcare, including primary care service offerings. In parallel, the demand for green building materials and energy-efficient solutions in green home design is increasing, with consumers seeking sustainable living through renewable energy sources, eco-friendly building practices, and green home certification.

US Home Service Market Dynamic

The researcher studied the historical data considered for years, with 2021 as the base year and 2022 as the estimated year, and produced drivers, trends, and challenges for the US Home Service Market .The home service market is also seeing innovation through payment processing integration, enhancing customer retention and simplifying transactions, whether using credit debit cards or other forms of booking and payment solutions. The ongoing urbanization trend, coupled with home improvement financing and home renovation costs, is shaping the market, with a focus on building permits, building codes, and energy conservation strategies. With trusted home services and reliable home services increasingly in demand, professional home services are critical to meeting the needs of consumers who seek affordable home services and local home services. This market's growth is supported by commission-based platforms and energy audits, driving the adoption of home improvement trends and home maintenance innovations across the nation.

Key Home Service Market Driver

The increasing influence of digital media is notably driving the US Home Service Market ' growth. With the proliferation of Internet-enabled smartphones, digital media has emerged as a key communication and marketing channel for vendors operating in the US Home Service market. Service visibility is one of the principal factors in the marketing strategy implemented by home service providers. Therefore, several online home service providers are widely adopting digital media marketing strategies to increase service visibility and promote sales. Several innovative features in technologically-advanced smartphones help online on-demand home service providers increase their visibility. For instance, push messages and e-mails that contain the details of new home service launches and discounts offered are sent to consumers for service promotions. These promotions help increase awareness about the availability of new home services among consumers. Vendors use various social media platforms such as YouTube, Facebook, Twitter, Instagram, and Google+ for service promotions and campaigns. These platforms enable consumer engagement with popular brands and help increase consumer awareness about several new services offered by home service brands. The rising popularity of social media is expected to expand rapidly, which will boost the growth of the home service market in US during the forecast period.

Key US Home Service Market Trends

The increasing number of advertising and marketing campaigns is the key trend driving the US Home Service Market growth. Marketing and advertising campaigns are crucial for the growth of vendors operating in different industries. Currently, vendors operating in the home service market in US focus on launching advertisement campaigns through various platforms to generate customer awareness and retain a strong customer base. Vendors have started using various strategic marketing tools to gain the attention of customers. For instance, Amazon Home Services guarantees the quality of its services under the Happiness Guarantee. If the company fails to provide quality services, it pays an amount as compensation. The focus on launching new advertisement campaigns by vendors is expected to drive the growth of the home service market in US during the forecast period.

Key US Home Service Market Challenge

High competition among vendors is the major challenge impeding the US Home Service Market ' growth. TheUS Home Service Market is dynamic due to the presence of several regional and global players that compete based on acquisitions, expansions, and marketing and advertising campaigns. The competition among the existing players in the market in focus is expected to increase during the forecast period with the entry of new start-ups such as Zimbber Inc., AtoZ services, and others. The presence of numerous vendors is increasing the competition and increasing the price wars among vendors. Such price wars potentially erode profit margins and lead to smaller businesses exiting the market. The US Home service market is highly fragmented due to the presence of numerous unorganized vendors. There are several issues associated with unorganized vendors, such as the incapability to maintain standard quality of service and ensure transparency and on-time performance, which adversely affect the overall business. Moreover, the US Home service market faces tough competition from various small local brick-and-mortar stores. All these factors are expected to hamper the growth of theUS Home Service Market during the forecast period.

This US Home service market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

What are the Revenue-generating Distribution Channel Segments in the Home Service Market in the US?

To gain further insights on the market contribution of various segments Request a PDF Sample

The home service market share growth in US by the online segment will be significant during the forecast period. The online segment of the home service market in the US is growing, driven by the ease of convenience of availing and accessibility provided by these services. Therefore, theUS Home Service Market is expected to register steady growth through the online segment during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the home service market size in the US and actionable market insights on the post-COVID-19 impact on each segment.

Parent Market Analysis

Technavio categorizes the US Home service market as a part of the global specialized consumer services market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the US Home service market during the forecast period.

Who are the Major Home Service Market Vendors in US?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- Ace Handyman Services

- Amazon.com Inc.

- American Home Shield Corp.

- Angi Inc.

- Chemed Corp.

- Handy Technologies Inc.

- Handyman Connection

- HOMEE Inc.

- HomeServe Plc

- Ingka Holding B.V.

- Mister Sparky Franchising SPE LLC

- Reliance Network and Home Services of America

- Smiths Plumbing Services

- TechCrunch

- The Home Depot Inc.

- USA Plumbing Service

- Yelp Inc

This statistical study of the US Home Service Market encompasses successful business strategies deployed by the key vendors. The home service market in the US is fragmented, and the vendors are deploying organic and inorganic growth strategies such as to compete in the market.

To make the most of the opportunities and recover from the post-COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments while maintaining their positions in the slow-growing segments.

The home service market in the US forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

US Home Service Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the US Home Service Market , which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Research Analyst Overview

The home services market has experienced significant growth, driven by an increasing demand for on-demand home services across a wide range of needs. With the rise of technologically progressive apps, consumers now have comfortable accessibility to services like pest control, carpentry, electrical repairs, roofing, and home installation. The mobile segment of the market, facilitated by internet penetration, has expanded rapidly, enabling household chores and daily chores to be handled efficiently through ecommerce platforms and mobile technology.

In the healthcare sector, on-demand virtual care is becoming a vital part of mental health services, offering psychiatrists and therapists the ability to provide timely services. Mental health professionals, including licensed psychiatrists, can now offer primary-care service and virtual care through healthcare apps, addressing the immediate care demand for patients seeking timely services.

With population expansion and urbanization, there is also growing demand for eco-friendly home services like energy-efficient HVAC systems, solar energy installations, and green house upgrades that align with environmental sustainability. Homeowners are increasingly focused on affordability, comfort, and energy-efficient solutions in the face of economic downturns, labour shortages, and disposable income concerns.

Additionally, property managers and small businesses are adopting these technologically advanced applications to offer efficient services while navigating licence requirements and regulatory difficulties. The flexibility of independent contractors and franchises helps meet diverse needs, whether it's childcare services, pet care services, or luxury home care. As more homeowners embrace smart homes, the use of automation and AI technologies is enhancing the functionality and scalability of home services, making them more accessible for working women and families. This evolving landscape provides a significant opportunity for large enterprises and medical partners to expand into the home services market, offering affordable and convenient solutions with payment options like net banking and cash on delivery to cater to all customer needs.

|

US Home Service Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 36.22% |

|

Market growth 2022-2026 |

USD1.08 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

26.85 |

|

Regional analysis |

US |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

Ace Handyman Services, Amazon.com Inc., American Home Shield Corp., Angi Inc., Chemed Corp., Handy Technologies Inc., Handyman Connection, HOMEE Inc., HomeServe Plc, Ingka Holding B.V., Mister Sparky Franchising SPE LLC, Reliance Network and Home Services of America, Smiths Plumbing Services, TechCrunch, The Home Depot Inc., USA Plumbing Service, and Yelp Inc |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in thisUS Home Service Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive the home service market growth in the US during the next five years

- Precise estimation of the home service market size in the US and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the home service industry in the US

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of home service market vendors in the US

We can help! Our analysts can customize this report to meet your requirements. Get in touch