Homeware Market Size 2025-2029

The homeware market size is forecast to increase by USD 77 billion, at a CAGR of 2.8% between 2024 and 2029.

- The market is driven by the relentless pursuit of innovation and portfolio extension, leading to the growing trend of premiumization. Consumers are increasingly seeking high-quality, unique, and functional homeware products that enhance their living spaces and lifestyles. This demand has given rise to an increase in the availability of private-label brands, offering competitive pricing and differentiated offerings. The market encompasses a range of products, including refrigerators, microwave ovens, air conditioners, and various accessories. However, the market is not without challenges. The volatility of raw material prices poses significant risks to manufacturers and retailers alike, requiring effective supply chain management and pricing strategies.

- Producers of kitchenware, bedding, and tableware must navigate these dynamics to capitalize on market opportunities and mitigate risks. To stay competitive, companies must focus on product innovation, sustainable sourcing, and strategic partnerships. Market trends include the adoption of smart home technologies, electrification, and bulk purchases in developing economies. By addressing these trends and challenges, players in the market can effectively meet evolving consumer demands and thrive in this dynamic industry.

What will be the Size of the Homeware Market during the forecast period?

- The market encompasses a diverse range of products, from outdoor furniture and garden decor to kitchen appliances and bathroom fixtures. A notable trend is the rise of homeware subscription services, providing consumers with regular deliveries of curated items, including artisan goods and vintage pieces. Sustainable sourcing and ethical manufacturing practices are increasingly important, with a growing preference for upcycled products, handcrafted items, and fair trade practices. Luxury homeware and personalized items continue to attract affluent consumers, while pet supplies cater to the expanding pet ownership trend.

- Innovations in technology include smart lighting and home security systems, while 3D printing enables the production of custom-made furniture and unique home decor pieces. Home staging services help sellers showcase properties effectively, and social responsibility remains a key consideration for many consumers. Children's products and bathroom fixtures complete the market landscape, offering solutions for families and individuals seeking to enhance their living environments. Overall, the market reflects the evolving needs and preferences of consumers, driven by trends in design, sustainability, and technology.

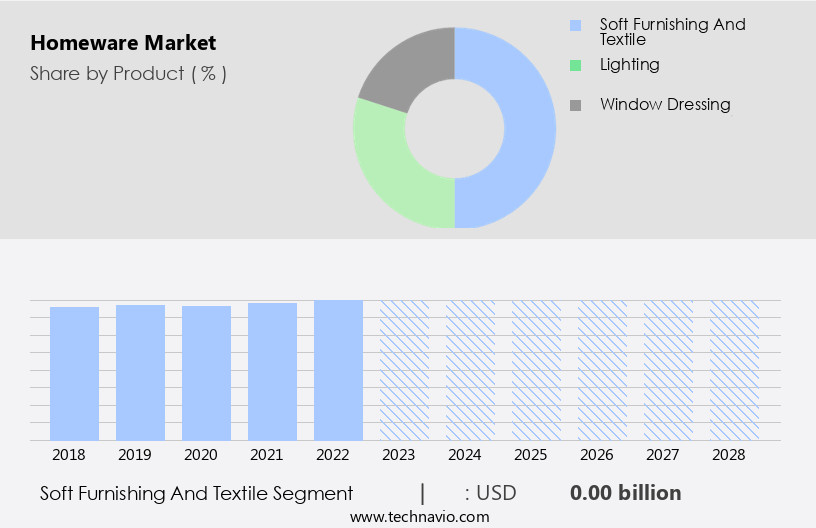

How is this Homeware Industry segmented?

The homeware industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Hardware

- Soft furnishing and textile

- Lighting

- Window dressing

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The hardware segment is estimated to witness significant growth during the forecast period. The market encompasses a range of products including cookware and bakeware, kitchen tools and accessories, dinnerware, glassware, flatware, home cleaning tools and supplies, and kitchen weighing scales. The market is witnessing significant growth due to the introduction of innovative designs and color palettes that cater to customers' desire for stylish and unique homeware. Industrial chic and bohemian styles are popular trends, while traditional designs continue to hold appeal. Companies are leveraging artificial intelligence and emerging technologies, such as the Internet of Things and home automation, to enhance product functionality and customer experience. Supply chain management and quality control are crucial aspects of the homeware industry, ensuring timely delivery and consistent product quality.

Home appliances and sustainable homeware, including eco-friendly products and recycled materials, are gaining popularity among consumers. Brick-and-mortar stores and e-commerce platforms serve as key retail channels, with consumers increasingly relying on customer reviews and brand loyalty to inform their purchasing decisions. Product differentiation, pricing strategies, and material trends, such as wood finishes and metal finishes, are essential factors influencing consumer behavior. Home organization, bathroom accessories, storage solutions, and DIY projects are other areas of growth within the market. The market is also seeing an increased focus on contemporary design, interior design, and mid-century modern styles. Home staging and target audience segmentation are important considerations for companies looking to effectively reach and engage their customers.

The Hardware segment was valued at USD 208.80 billion in 2019 and showed a gradual increase during the forecast period.

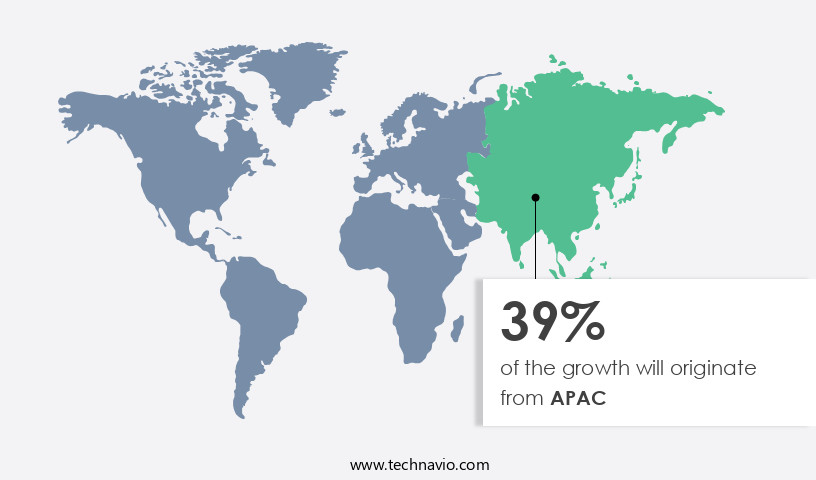

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing dynamic trends and innovations, with several entities shaping its growth. In the realm of product development, artificial intelligence is increasingly being integrated into home appliances, leading to the creation of smart home devices. Industrial chic and traditional design continue to coexist, with consumers favoring a blend of modern and classic styles. Home improvement projects are driving demand for ceramic finishes and natural materials, while supply chain management ensures efficient distribution. Emerging technologies, such as the Internet of Things, are revolutionizing homeware, with Scandinavian design and contemporary trends influencing color palettes and material trends. Product innovation is a key focus, with eco-friendly products, recycled materials, and biodegradable alternatives gaining popularity. Technological innovation continues to drive the market, with digitization and online retail sectors, including e-commerce and online shopping, playing increasingly significant roles.

Consumer behavior and preferences are shaping pricing strategies, with brand loyalty and customer reviews influencing purchasing decisions. Home organization and DIY projects are on the rise, with storage solutions and bathroom accessories becoming essential home decor items. Home staging and target audience demographics are also important considerations for retail channels, including brick-and-mortar stores and e-commerce platforms. Product lifecycle and home automation are key areas of development, with mid-century modern and bohemian styles adding to the market's diversity. The market is a vibrant and evolving landscape, with sustainability and design trends intertwined. As consumer preferences continue to shift, companies are focusing on product differentiation and brand identity to meet the demands of their diverse customer base. Home appliances, cleaning supplies, and decorative items are all seeing innovation, with quality control ensuring the delivery of superior products. Overall, the market is an exciting space, with numerous opportunities for growth and development.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Homeware market drivers leading to the rise in the adoption of Industry?

- The primary catalyst for market growth is the fusion of innovation and portfolio expansion, resulting in the creation of premium offerings. The market is experiencing growth due to the introduction of innovative designs and colors in homeware products. Interior design services and home decor consulting are also in demand, as consumers seek professional guidance for creating stylish and functional living spaces. Companies are focusing on enhancing the functionality and aesthetics of their offerings to cater to customers' demand for stylish and unique homeware items. For instance, the production of carpets with odor-reducing properties is gaining popularity. These carpets not only provide warmth and comfort but also prevent the growth of microbes that cause bad odors. Additionally, they can be easily washed without compromising their odor-reducing properties.

- Furthermore, the market is witnessing an expansion of product portfolios, offering consumers a wider range of choices. The demand for homeware products that reflect individual styles and preferences is on the rise, making the market an attractive investment opportunity for businesses.

What are the Homeware market trends shaping the Industry?

- The rising prevalence of private-label brands represents a significant market trend. This trend signifies an increasing number of consumers opting for these brands due to their affordability and quality. The market is witnessing significant growth due to the increasing popularity of private-label brands. These products offer lower prices compared to their branded counterparts, making them an attractive option for price-conscious consumers. Supermarkets and retailers are responding to this trend by expanding their private-label offerings and implementing marketing strategies to boost sales. This shift is particularly noticeable in developing countries, where private-label homeware products hold a substantial market share. Artificial intelligence and technology are also influencing the homeware industry, with smart home appliances and home organization solutions gaining traction. Industrial chic and bohemian styles continue to be popular, while ceramic finishes and natural materials remain staples in traditional design.

- Supply chain management and quality control are essential elements of the market, ensuring the delivery of high-quality products to consumers. Product innovation and design are key drivers in the market, with companies focusing on creating deep collections that cater to various lifestyles and preferences. The home improvement sector is also a significant contributor to the market, as consumers seek to enhance their living spaces with functional and aesthetically pleasing homeware solutions. Overall, the market is expected to continue its growth trajectory, driven by consumer demand for affordable, innovative, and stylish products.

How does Homeware market face challenges during its growth?

- The volatility of raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain profitability and competitiveness, businesses must effectively manage price fluctuations and adapt to market conditions. This requires a proactive approach to supply chain management, risk assessment, and pricing strategies. Additionally, staying informed about market trends and regulatory changes can help mitigate the impact of price volatility on the industry. The market is influenced by various factors, including design trends, lifestyle preferences, and emerging technologies. Color palettes and wood finishes are popular design elements, while Scandinavian design and mid-century modern styles continue to be trending. Emerging technologies, such as home automation and the Internet of Things, are transforming the industry, allowing for deep living experiences. Eco-friendly products are also gaining popularity, as consumers prioritize sustainability in their purchasing decisions. However, the market faces challenges, such as the volatility of raw material prices. The rising costs of superior-quality raw materials, like cotton and silk, have led to increased prices for soft home furnishing and textile products.

- This can restrict purchases by end-users. In response, some companies are using low-priced and low-quality raw materials to produce these items. Unusual weather conditions, such as heavy snow, rain, storms, hurricanes, floods, tornados, or extended periods of unseasonable temperatures, can also impact raw material availability and prices. Customer reviews play a crucial role in the market, as consumers rely on the experiences of others to inform their purchasing decisions. Design innovation and lifestyle trends continue to shape the industry, with companies focusing on creating functional, stylish, and sustainable products to meet the evolving needs of consumers.

Exclusive Customer Landscape

The homeware market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the homeware market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, homeware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alibaba Group Holding Ltd. - This company offers an extensive selection of homeware products, encompassing home decor, kitchen and tabletop, bathroom essentials, home textiles, and furniture.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Avenue Supermarts Ltd.

- Bed Bath and Beyond Inc.

- Carrefour

- Lowes Co. Inc.

- Macys Inc.

- Penney IP LLC

- Target Corp.

- Tesco Plc

- The Home Depot Inc.

- Transform Holdco LLC

- Walmart Inc.

- Wayfair Inc.

- Williams Sonoma Inc.

- Zola Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Homeware Market

- In March 2023, Ikea, the global home furnishings retailer, announced the launch of its new line of sustainable homeware products, including furniture made from recycled plastic and renewable materials. This initiative aligns with the growing consumer trend towards eco-friendly and sustainable living (Ikea Press Release, 2023).

- In August 2024, Home Depot, the American home improvement retailer, entered into a strategic partnership with Google to integrate Google's smart home technology into their homeware offerings. This collaboration aims to enhance the customer experience by allowing Home Depot shoppers to control various home systems using Google Assistant (Home Depot Press Release, 2024).

- In November 2024, Wayfair, the online home goods retailer, completed a merger with Joss & Main, a direct-to-consumer home decor brand. This acquisition expanded Wayfair's product offerings and strengthened its position in the market (Wayfair Press Release, 2024).

- In February 2025, the European Union passed new regulations requiring all homeware products sold in the region to meet strict energy efficiency standards. This policy change is expected to drive innovation in energy-efficient homeware design and manufacturing (European Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Product innovation is a key driver, as entities explore new color palettes and design trends. Emerging technologies, such as the Internet of Things and home automation, are increasingly integrated into homeware offerings. Natural materials, including wood finishes, are gaining popularity, reflecting a growing trend towards sustainable living. Contemporary design and industrial chic also hold appeal. Brand identity and customer experience are crucial factors in a highly competitive market. E-commerce platforms and retail channels are reshaping distribution networks, while consumer behavior and preferences continue to evolve.

Home organization and home decor are key areas of focus, with an emphasis on functional and decorative items. Price strategies and brand loyalty are important considerations for entities seeking to differentiate themselves. The market is characterized by a diverse range of product offerings, from home appliances and bathroom accessories to cleaning supplies and DIY projects. Sustainable homeware, including eco-friendly products and recycled materials, is a growing segment. Quality control and supply chain management are essential for ensuring customer satisfaction and maintaining brand reputation. As the product lifecycle evolves, entities must remain agile and responsive to emerging trends and consumer demands.

Customer reviews and ratings play a significant role in shaping consumer perceptions and influencing purchasing decisions. Entities must prioritize customer experience and engagement to build brand loyalty and stay competitive in this ever-evolving market.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Homeware Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.8% |

|

Market growth 2025-2029 |

USD 77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.7 |

|

Key countries |

US, China, Canada, Japan, Germany, India, UK, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Homeware Market Research and Growth Report?

- CAGR of the Homeware industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the homeware market growth of industry companies

We can help! Our analysts can customize this homeware market research report to meet your requirements.