Hybrid Electric Vehicle Market Size 2024-2028

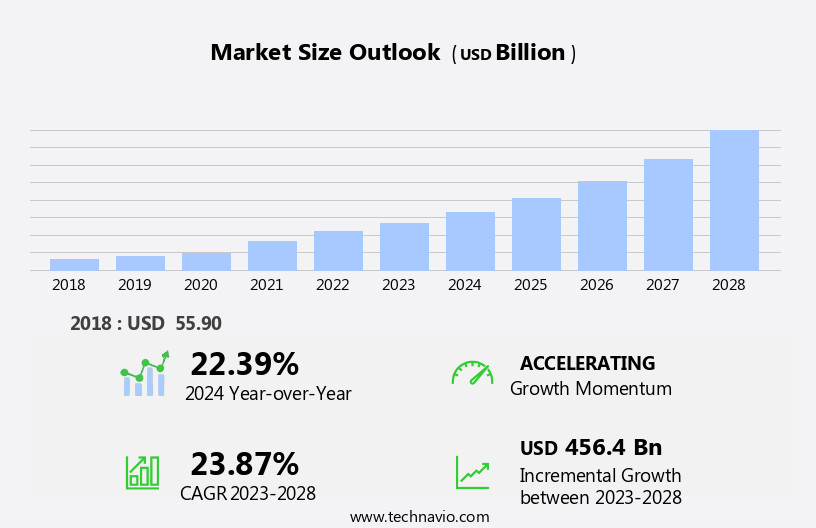

The hybrid electric vehicle (HEV) market size is forecast to increase by USD 456.4 billion at a CAGR of 23.87% between 2023 and 2028.

- The market is experiencing significant growth, driven by the push toward adopting eco-friendly transportation solutions. One emerging trend in this sector is the adoption of fuel cell HEVs, which utilize hydrogen as an alternative fuel. However, the high total cost of ownership of HEVs remains a challenge for mass market adoption. The market analysis also highlights the increasing environmental concerns and stringent regulations, which are compelling automakers to invest in HEV technology. Furthermore, advancements in battery technology and government incentives are expected to boost market growth. Overall, the HEV market is poised for steady expansion, driven by these key factors.

What will be the Size of the Hybrid Electric Vehicle (HEV) Market During the Forecast Period?

- The market represents a significant segment within the global automotive industry, characterized by the integration of both internal combustion engines (ICE) and electric propulsion systems. HEVs employ various configurations, including full hybrids, mild hybrids, parallel hybrids, and series hybrids, which leverage the synergy between ICE and electric motors, as well as regenerative braking systems. Battery technology, primarily lithium-ion batteries, plays a crucial role in HEVs, enabling extended electric-only driving and vehicle-to-grid capabilities. The market's growth is driven by increasing consumer demand for reduced vehicle emissions, advanced technology, and improved fuel efficiency. Traditional OEMs have responded by expanding their HEV offerings, with a shift towards plug-in hybrids and battery-electric vehicles.

- The HEV landscape encompasses a diverse range of applications, from passenger cars to public transit vehicles, and the adoption of electric powertrains continues to reshape the automotive industry. HEVs represent a strategic response to the evolving automotive landscape, offering a balance between conventional ICE vehicles and fully electric vehicles. As battery technology advances and infrastructure for charging and vehicle-to-grid systems develops, the HEV market is poised for continued growth and innovation.

How is this Hybrid Electric Vehicle (HEV) Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Propulsion

- Full HEVs

- Mild HEVs

- PHEVs

- Geography

- APAC

- China

- Europe

- Germany

- UK

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to increasing regulatory pressure to reduce vehicle emissions and customer demand for more eco-friendly transportation options. Hybrid vehicles offer improved efficiency compared to traditional internal combustion engine (ICE) vehicles, as electric motors can operate at any speed, unlike ICEs that require a minimum RPM to generate torque. This efficiency advantage, along with the ability to recharge energy during braking through regenerative braking, makes HEVs an attractive choice for meeting emission standards. Moreover, advancements in battery technology, particularly lithium-ion batteries, have improved the range and performance of electric vehicles (EVs), further boosting the market.

Financial incentives, such as tax incentives, grants, and subsidies, also encourage the adoption of HEVs and EVs. The market includes various types, including full hybrids, mild hybrids, and plug-in hybrids, as well as applications in passenger cars, commercial vehicles, and two-wheelers. The integration of vehicle-to-grid technology enables stored electricity to be fed back into the power grid, making HEVs an essential component of the renewable energy ecosystem. Performance enhancements, such as the integration of infotainment options and renewable energy sources like solar and wind energy, further add to the appeal of HEVs and EVs. Fleet adoption and the transition to low-carbon transportation are key trends driving the market growth.

Get a glance at the Hybrid Electric Vehicle (HEV) Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 51.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

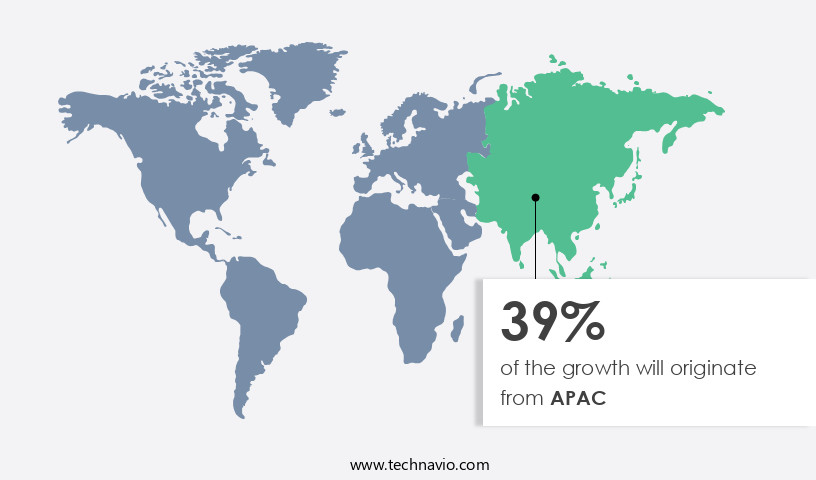

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia Pacific (APAC) region is experiencing significant growth, driven by increasing focus on eco-friendly transportation. China is expected to lead the global HEV market due to strong government and private sector initiatives promoting the adoption of battery electric vehicles (BEVs) and hybrids. The demand for HEVs in APAC is primarily due to the push towards reducing vehicle emissions and addressing climate change, air pollution, and greenhouse gas emissions, including carbon dioxide, nitrogen oxides, and particulate matter. The region's HEV market includes various types, such as full hybrids, mild hybrids, and plug-in hybrids (PHEVs). Sales of PHEVs and mild hybrids may be sluggish in Japan, as the country is following the fuel cell HEV trend.

HEVs integrate both internal combustion engines and electric propulsion systems, using regenerative braking to store electricity. Vehicle-to-grid technology allows HEVs to feed electricity back to the grid. Battery technology, particularly lithium-ion batteries, plays a crucial role In the performance and efficiency of HEVs. Financial incentives, such as tax incentives, grants, and subsidies, also contribute to the market's growth. The market includes various players, including OEMs manufacturing conventional cars and those specializing in electric vehicles. The market also includes various battery, electric motor, and internal combustion engine technologies. Renewable energy sources, such as solar and wind energy, are increasingly being integrated into HEVs for performance enhancements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hybrid Electric Vehicle (HEV) Industry?

The push toward the adoption of green (eco-friendly) vehicles is the key driver of the market.

- Hybrid Electric Vehicles (HEVs) are gaining popularity as a solution to address the environmental concerns arising from the significant carbon dioxide (CO2) emissions from on-road vehicles. These vehicles, which run on electricity, hybrid energy, and other renewable power sources, aim to reduce fuel consumption and, consequently, greenhouse gas (GHG) emissions. HEVs use a combination of an internal combustion engine (ICE) and an electric propulsion system. The electric motor assists the ICE during acceleration, and regenerative braking recaptures energy during deceleration, storing it in batteries for later use. Battery technology, primarily Lithium-ion batteries, powers HEVs. The market offers various types, including full hybrids, mild hybrids, and plug-in hybrids.

- Full hybrids can run on electric power alone for short distances, while mild hybrids assist the ICE during acceleration. Plug-in hybrids can be charged externally, providing a greater electric-only range. HEVs are available in passenger cars, commercial vehicles, and two-wheelers. The integration of HEVs In the transportation sector has significant environmental benefits. They help reduce GHG emissions, primarily CO2, contributing to climate change, air pollution, and traffic congestion. Financial incentives, such as tax incentives, grants, and subsidies, encourage their adoption. HEVs also offer performance enhancements and infotainment options. The future of HEVs lies In their potential to be integrated with vehicle-to-grid systems, allowing stored electricity to be fed back into the power grid during off-peak hours.

What are the market trends shaping the Hybrid Electric Vehicle (HEV) Industry?

Hydrogen as an upcoming alternative fuel is the upcoming market trend.

- Hybrid Electric Vehicles (HEVs) represent the future of sustainable transportation, integrating both internal combustion engines (ICEs) and electric propulsion systems. HEVs utilize a gasoline engine to charge an electric battery, which powers an electric motor and assists the engine during acceleration. Regenerative braking recaptures energy during deceleration, further charging the battery. Vehicle to Grid (V2G) technology allows HEVs to store and sell excess electricity back to the grid. Battery technology, particularly Lithium-ion batteries, plays a crucial role in HEVs. Full hybrids, mild hybrids, and plug-in hybrids (PHEVs) are various HEV categories. Series HEVs use the electric motor to drive the wheels, while parallel HEVs use the electric motor to assist the ICE.

- Combination HEVs can operate in both series and parallel modes. HEVs offer financial incentives, such as tax incentives, grants, and subsidies, to encourage adoption. Strict emission standards addressing climate change, air pollution, and greenhouse gas emissions, as well as concerns over traffic congestion, further boost demand. Infotainment options and performance enhancements are additional benefits. Renewable energy sources, such as solar and wind energy, can recharge HEV batteries, making them more eco-friendly. Fleet adoption and OEMs' continuous innovation in battery, electric motor, and ICE technologies are driving market growth. The market, featuring hydrogen fuel cell vehicles, is an emerging trend, offering zero-emission transportation.

What challenges does the Hybrid Electric Vehicle (HEV) Industry face during its growth?

The high total cost of ownership of HEVs is a key challenge affecting the industry growth.

- Hybrid Electric Vehicles (HEVs) integrate both internal combustion engines (ICE) and electric propulsion systems. The primary difference lies In the use of electric motors, which can be powered by regenerative braking or charged externally. HEVs come in various forms, including full hybrids, mild hybrids, and plug-in hybrids. Full hybrids can run on electric power alone or in combination with a gasoline engine. Mild hybrids use an electric motor only during specific driving conditions, while plug-in hybrids can be charged externally for extended electric-only driving. The use of advanced batteries, such as lithium-ion, and electronics components increases the cost of HEVs compared to conventional ICE vehicles.

- Government financial incentives, such as tax incentives, grants, and subsidies, help offset the higher cost of HEVs. HEVs contribute to reducing vehicle emissions, including greenhouse gases, nitrogen oxides, and particulate matter, making them an essential solution for addressing climate change, air pollution, and traffic congestion. Additionally, HEVs offer infotainment options and performance enhancements, making them an attractive choice for consumers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Bayerische Motoren Werke AG

- BYD Co. Ltd.

- Chongqing Changan Automobile Co. Ltd.

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Li Auto Inc.

- Mercedes Benz Group AG

- Mitsubishi Motors Corp.

- Nissan Motor Co. Ltd.

- Renault SAS

- SAIC Motor Corp. Ltd.

- Stellantis NV

- Suzuki Motor Corp.

- Tata Sons Pvt. Ltd.

- Toyota Motor Corp.

- Volkswagen AG

- Zhejiang Geely Holding Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hybrid Electric Vehicles (HEVs) represent a significant shift In the automotive industry's approach to reducing vehicle emissions and improving fuel efficiency. These vehicles integrate both internal combustion engines (ICEs) and electric propulsion systems, creating a more sustainable and efficient transportation solution. The HEV market encompasses various vehicle types, including passenger cars and commercial vehicles, as well as two-wheelers. The technology's versatility allows for different configurations, such as full hybrids, mild hybrids, and plug-in hybrids. In full hybrids, the electric motor and ICE work together to power the vehicle, while in mild hybrids, the electric motor assists the ICE during acceleration.

Moreover, plug-in hybrids offer the ability to charge the battery externally, extending the vehicle's electric-only range. Series HEVs and parallel HEVs are two primary configurations for these vehicles. In series HEVs, the electric motor is connected to the wheels directly, while in parallel HEVs, the electric motor assists the ICE in powering the vehicle. Combination HEVs employ both series and parallel configurations, offering the benefits of both systems. The integration of HEV technology brings several advantages. Regenerative braking recaptures energy usually lost during braking, storing it In the battery for later use. This stored electricity can be used to power the vehicle or fed back into the power grid, known as Vehicle to Grid (V2G), offering additional revenue streams for vehicle owners.

Furthermore, battery technology plays a crucial role In the success of HEVs. Lithium-ion batteries are commonly used due to their high energy density, long cycle life, and rapid charging capabilities. These advancements enable HEVs to offer a competitive range and performance compared to conventional cars. Financial incentives, such as tax incentives, grants, and subsidies, have been instrumental in driving the adoption of HEVs. Governments worldwide recognize the importance of reducing vehicle emissions and combating climate change, air pollution, and greenhouse gas emissions, including carbon dioxide, nitrogen oxides, and particulate matter. Traffic congestion is another concern addressed by HEVs, as they offer improved fuel efficiency and reduced emissions in stop-and-go traffic.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.87% |

|

Market growth 2024-2028 |

USD 456.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

22.39 |

|

Key countries |

China, US, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hybrid Electric Vehicle (HEV) Market Research and Growth Report?

- CAGR of the Hybrid Electric Vehicle (HEV) industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.

_market_size_abstract_2024_v2.jpg)