Hydraulic Equipment Market Size 2025-2029

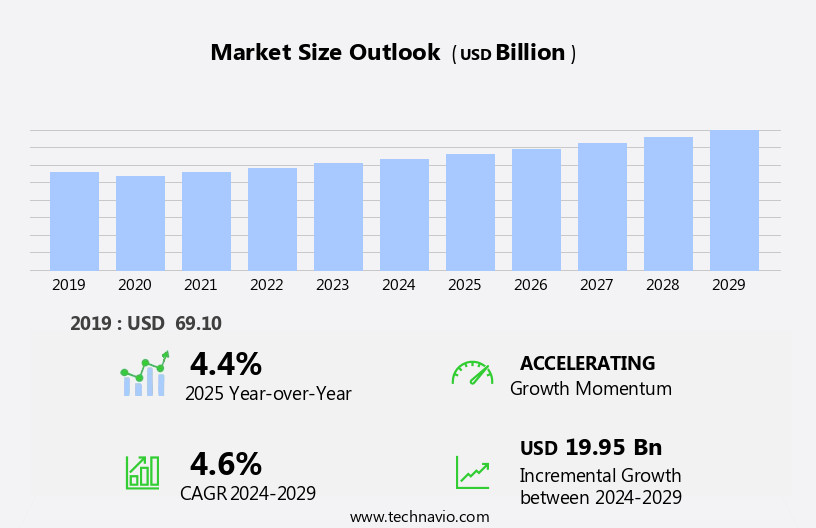

The hydraulic equipment market size is forecast to increase by USD 19.95 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is driven by the ongoing industrial automation trend, which is leading to increased demand for efficient and reliable hydraulic systems. Technological advancements in the hydraulic equipment industry continue to shape the market, with innovations in areas such as energy efficiency, smart controls, and remote monitoring. However, the market faces challenges from the volatile prices of raw materials, particularly steel and oil, which can significantly impact the cost structure of hydraulic equipment manufacturers. Companies in the market must navigate these challenges by implementing cost management strategies and exploring alternative materials and manufacturing processes.

- To capitalize on opportunities, they should focus on developing advanced hydraulic systems that cater to the evolving needs of industries such as manufacturing, construction, and mining. Additionally, collaborations and partnerships with technology providers and raw material suppliers can help mitigate the impact of raw material price fluctuations and enhance product offerings.

What will be the Size of the Hydraulic Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, with various components and applications shaping its intricate landscape. Hydraulic circuit analysis plays a crucial role in optimizing system performance, while hydraulic fittings ensure reliable connections. Construction sites rely heavily on hydraulics for excavation and lifting tasks, and hydraulic actuation powers machinery in numerous sectors. Hydraulic hoses transmit fluid pressure, and automation integrates hydraulics with advanced control systems. Hydraulic system design and hydraulic control systems enable precise control and efficient operation. Electro-hydraulic systems merge electrical and hydraulic technologies, expanding application possibilities. Training programs cater to the workforce, ensuring safety standards are met.

Agricultural hydraulics power farm machinery, and hydraulic torque transmission is essential in various industries. Hydraulic manifolds distribute fluid pressure, and hydraulic motors convert hydraulic energy into mechanical motion. Research and innovation drive advancements, with applications ranging from aerospace to marine industries. Hydraulic components, power units, accumulators, and fluid play essential roles in these systems. Hydraulic certifications ensure safety and compliance, while high-pressure and low-pressure hydraulics cater to diverse requirements. Industrial hydraulics, proportional hydraulics, hydraulic efficiency, and mobile hydraulics are integral to numerous industries. Hydraulic assemblies, cylinders, and clamping systems complete the intricate web of hydraulic applications.

The hydraulic market remains a vibrant and ever-changing landscape, with ongoing developments and trends shaping its future.

How is this Hydraulic Equipment Industry segmented?

The hydraulic equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Pump and motor

- Valve

- Cylinder

- Accumulator and filter

- Others

- Application

- Mobile

- Industrial

- End-user

- Construction

- Mining

- Agriculture

- Packaging

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

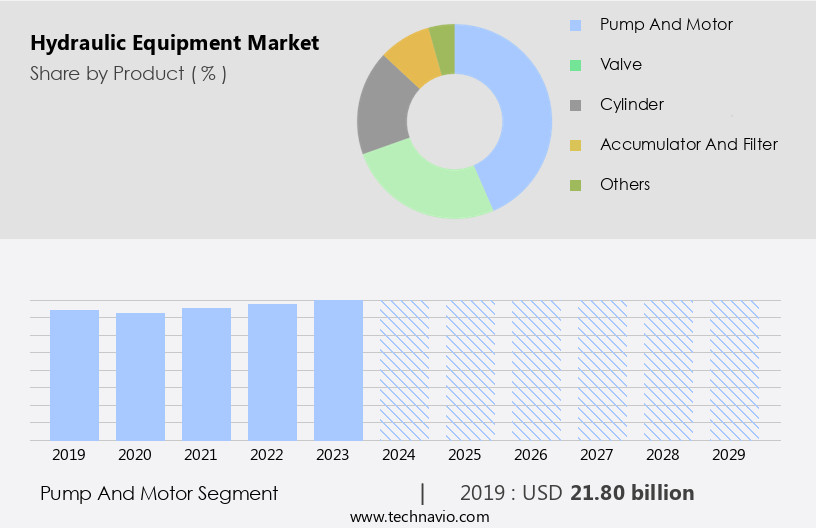

The pump and motor segment is estimated to witness significant growth during the forecast period.

The market encompasses various components and applications, including hydraulic testing, flow rate, actuators, lifting, safety standards, maintenance, repair, pressure, filtration, servo hydraulics, valves, braking, circuit analysis, fittings, construction hydraulics, actuation, hose, automation, system design, control systems, electro-hydraulic systems, training, agricultural hydraulics, torque, manifolds, steering, motors, research, aerospace hydraulics, simulation, components, power units, accumulators, fluid, thrust, electro-hydrostatic drives, marine hydraulics, certifications, high-pressure hydraulics, clamping, and low-pressure hydraulics. Hydraulic pumps and motors, as essential parts of this market, convert mechanical energy into hydraulic or hydrostatic energy. These components are indispensable in construction, agriculture, oil and gas, and material handling machinery.

The escalating demand for such machinery significantly influences the demand for hydraulic pumps and motors, making it the largest segment in the market. Hydraulic pumps are classified into gear pumps, vane pumps, screw pumps, and piston pumps. The agricultural sector's adoption of advanced techniques like smart farming, intelligent pumps, and investments in these innovations propels the demand for pump and motor technology.

The Pump and motor segment was valued at USD 21.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

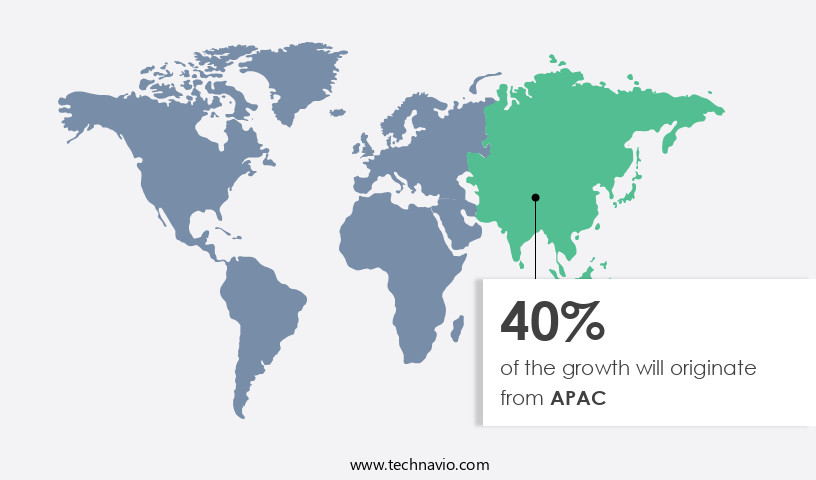

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market experiences steady growth due to the increasing industrialization and production of automobiles and industrial machinery. In the Asia Pacific region, expanding end-use industries, competitive manufacturing costs, and high economic growth fuel market growth in sectors like automotive, aerospace, marine, food and beverage, and construction. This trend encourages global market players to expand their businesses in APAC. The shipping industry's growth in China and South Korea is driving the demand for efficient and corrosion-resistant industrial machinery, further boosting the market. Hydraulic testing, flow rate, actuators, lifting, safety standards, maintenance, repair, pressure, filtration, servo systems, valves, braking, circuit analysis, fittings, actuation, hose, automation, system design, control systems, electro-hydraulic systems, training, agricultural applications, torque, manifolds, steering, motors, research, aerospace, simulation, components, power units, accumulators, fluid, thrust, electro-hydrostatic drives, marine applications, certifications, high-pressure, clamping, and low-pressure hydraulics are all integral parts of this dynamic market.

Industrial hydraulics, proportional systems, efficiency, mobile applications, assemblies, cylinders, innovations, and pumps are essential components that contribute to the market's evolution. The market's continuous development is driven by the increasing demand for advanced hydraulic systems in various industries, leading to the introduction of new technologies and improvements in existing ones.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hydraulic Equipment Industry?

- The emergence of industrial automation serves as the primary catalyst for market growth.

- Hydraulic equipment plays a pivotal role in industrial automation by providing precise and powerful motion control. The automation revolution relies on control systems, robots, and information technologies to streamline manufacturing processes and increase throughput rates. Hydraulic systems offer advantages such as high power density, precise control, and robustness, making them indispensable for various automation applications. The trend towards smart factories and Industry 4.0 initiatives further fuels the demand for hydraulic equipment. Hydraulic testing ensures the optimal performance of hydraulic systems by measuring hydraulic flow rate, pressure, and temperature. Hydraulic safety standards are crucial to prevent accidents and ensure the safety of operators and equipment.

- Hydraulic maintenance and repair are essential to prolong the life of hydraulic components and minimize downtime. Servo hydraulics offer precise control and are widely used in applications requiring high accuracy and repeatability. Hydraulic valves regulate the flow of hydraulic fluid and are essential components of hydraulic systems. Hydraulic lifting applications include cranes, hoists, and elevators, which rely on hydraulic pressure to lift heavy loads. Hydraulic filtration is essential to maintain hydraulic fluid cleanliness and prevent contamination. Hydraulic braking systems are used in heavy machinery and vehicles to provide reliable and efficient braking performance. In conclusion, the demand for hydraulic equipment continues to grow due to the increasing adoption of industrial automation and the trend towards smart factories and Industry 4.0 initiatives.

- Hydraulic testing, maintenance, and repair are essential to ensure the optimal performance and longevity of hydraulic systems. Hydraulic components such as servo hydraulics, hydraulic valves, and hydraulic filtration systems play a crucial role in various automation applications.

What are the market trends shaping the Hydraulic Equipment Industry?

- The hydraulic equipment industry is currently witnessing significant technological advancements, which is becoming a notable market trend. These innovations are shaping the future of hydraulic systems, enhancing efficiency, productivity, and performance.

- The market is experiencing significant advancements due to the integration of electronics and hydraulics, resulting in the development of electro-hydraulic systems. These systems offer precise control, energy efficiency, and advanced features like proportional control, load sensing, and feedback mechanisms. The IoT and smart technologies are revolutionizing the industry by enabling remote monitoring, predictive maintenance, and performance optimization through IoT-connected hydraulic components and systems. Innovations in materials science and manufacturing techniques have led to the creation of lightweight, durable, and high-performance hydraulic components, such as hydraulic hoses, fittings, manifolds, and actuators.

- Hydraulic system design has become more complex with the integration of hydraulic automation and control systems. Key applications include construction hydraulics, agricultural hydraulics, and industrial hydraulics. Hydraulic circuit analysis and training programs are essential for professionals to ensure optimal system performance and safety.

What challenges does the Hydraulic Equipment Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory.

- The market encompasses various components and systems, including hydraulic steering, motors, power units, accumulators, and electro-hydrostatic drives. Hydraulic research and development are crucial in enhancing the efficiency and performance of these systems. In the aerospace industry, hydraulics are essential for controlling flight surfaces and actuating landing gear. Manufacturers of hydraulic equipment face challenges related to raw material prices. Raw materials such as steel, aluminum, plastics, and polymers significantly influence the production costs and overall performance of hydraulic systems. Fluctuations in raw material prices can negatively impact the growth of the market. Moreover, trade policies, tariffs, and import/export restrictions can further complicate the situation by increasing production costs and limiting supply.

- For instance, tariffs on imported steel or aluminum can lead to price hikes in domestic markets, affecting manufacturers' profitability and financial stability. In the marine sector, hydraulics are indispensable for propulsion, steering, and deck machinery. Marine hydraulics face unique challenges due to the harsh operating conditions, including corrosion, saltwater exposure, and extreme temperatures. Hydraulic certifications ensure the safety and reliability of these systems in marine applications. Hydraulic simulation software is another essential tool for manufacturers, enabling the design and testing of hydraulic systems in a virtual environment. This technology can help optimize system performance, reduce development costs, and improve overall efficiency.

- In conclusion, the market is dynamic and complex, influenced by various factors such as raw material prices, trade policies, and technological advancements. Manufacturers must navigate these challenges to maintain profitability and remain competitive in the global market.

Exclusive Customer Landscape

The hydraulic equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydraulic equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydraulic equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2G Engineering - The company specializes in providing advanced hydraulic equipment solutions for subsea applications. One such offering is the Subsea Hydraulic Pressure Unit, an electrically driven, standalone hydraulic pump system. This unit generates fluid power subsea, featuring robust piston pumps capable of producing pressures up to 5000 PSI above ambient levels and flows up to 0.5 GPM. The pumps' design ensures optimal performance in challenging subsea environments, contributing to increased efficiency and reliability for clients in various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2G Engineering

- Caterpillar Inc.

- Daikin Industries Ltd.

- Dana Inc.

- Dyna Flex Inc

- Eaton Corp. plc

- Emerson Electric Co.

- Enerpac Tool Group Corp.

- Flowserve Corp.

- HANNON HYDRUALICS LLC

- HYDAC International GmbH

- Kawasaki Heavy Industries Ltd.

- Komatsu Ltd.

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Siemens AG

- SMC Corp.

- Texas Hydraulics Inc.

- WEBER HYDRAULIK GmbH

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hydraulic Equipment Market

- In March 2024, Eaton Corporation, a leading power management company, introduced its new eMobility Hydraulics product line, designed to support the growing electric and hybrid vehicle market (Eaton Corporation press release). This innovative solution aims to replace traditional hydraulic systems with electric and hybrid alternatives, reducing fuel consumption and emissions.

- In July 2024, Bosch Rexroth, a leading hydraulics technology provider, announced a strategic partnership with Siemens Energy to jointly develop and market hydraulic systems for the renewable energy sector (Bosch Rexroth press release). This collaboration will combine Bosch Rexroth's hydraulic expertise with Siemens Energy's renewable energy solutions, targeting the wind and solar energy markets.

- In November 2024, Parker Hannifin, a global leader in motion and control technologies, completed the acquisition of Mannesmann Demag, a German manufacturer of hydraulic components and systems (Parker Hannifin press release). This acquisition will expand Parker Hannifin's hydraulic product portfolio, strengthening its position in the European market and enhancing its capabilities in the industrial and mobile hydraulics sectors.

- In February 2025, Danfoss, a leading manufacturer of hydraulic components and systems, received approval for its new hydraulic system design for offshore wind turbines from the German Federal Maritime and Hydrographic Agency (Danfoss press release). This approval marks a significant milestone in the development of more efficient and cost-effective hydraulic systems for offshore wind energy applications.

Research Analyst Overview

- The market encompasses various components and systems, including hydraulic contamination, durability, and regulations. Hydraulic seals, for instance, play a crucial role in maintaining system integrity, while hydraulic system modeling and performance analysis help optimize efficiency and identify potential issues. Hydraulic corrosion and wear, however, pose significant challenges to hydraulic durability, necessitating ongoing maintenance and cost analysis. Hydraulic regulations continue to evolve, driving the need for hydraulic compliance and sustainability. Electro-mechanical systems and pneumatic systems offer alternatives to hydraulics, but their integration with hydraulic components in motion control applications necessitates a deep understanding of power transmission and fluid power principles.

- Hydraulic troubleshooting and diagnostics are essential for addressing hydraulic fatigue and reliability concerns. Hydraulic cost analysis, optimization, and lubrication are key factors in maximizing hydraulic ROI. Linear and rotary actuators, essential components of hydraulic systems, require ongoing maintenance and performance analysis to ensure hydraulic life cycle efficiency. Fluid power applications demand continuous improvement in hydraulic efficiency, bearing performance, and compliance with regulations. Hydraulic bearings, a critical component, undergo significant wear and require regular maintenance to ensure hydraulic system reliability. In summary, the market is characterized by a focus on improving hydraulic performance, optimizing costs, and ensuring compliance with regulations.

- Hydraulic system modeling, troubleshooting, and diagnostics are essential for addressing hydraulic challenges and maintaining system reliability. Hydraulic wear, fatigue, and corrosion necessitate ongoing maintenance and cost analysis to maximize hydraulic ROI.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hydraulic Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 19.95 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Japan, Canada, India, South Korea, UK, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydraulic Equipment Market Research and Growth Report?

- CAGR of the Hydraulic Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydraulic equipment market growth of industry companies

We can help! Our analysts can customize this hydraulic equipment market research report to meet your requirements.