Image Guided Radiotherapy Market Size 2024-2028

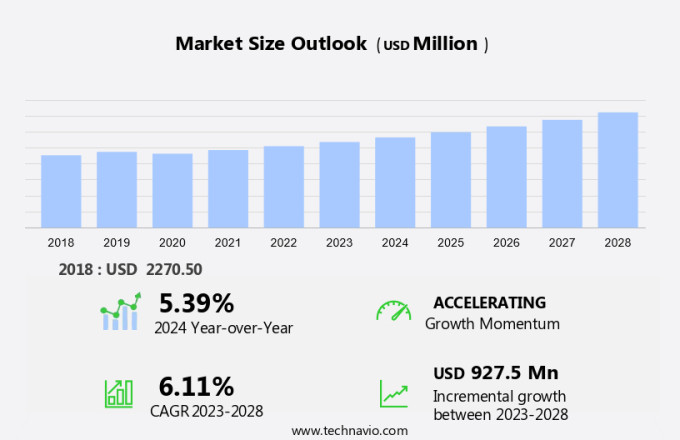

The image guided radiotherapy market size is forecast to increase by USD 927.5 million at a CAGR of 6.11% between 2023 and 2028. Image-guided radiation therapy (IGRT) is a non-invasive cancer treatment technique that utilizes real-time imaging to deliver precise radiation doses to tumors. Hospitals worldwide are increasingly adopting IGRT due to its ability to minimize surgical complications and adverse effects during the post-treatment phase. The market for IGRT is driven by the rising incidence of cancer and the growth of insurance providers covering radiation therapy. Technological advancements in imaging technologies, such as magnetic resonance imaging (MRI) and computed tomography (CT), are also contributing to the market's growth. However, challenges persist, including the high cost of IGRT equipment and the lack of adequate healthcare infrastructure in developing nations.

What will be the Size of the Market During the Forecast Period?

The global image-guided radiotherapy (IGRT) market is evolving with advanced technologies such as Intensity-Modulated Radiation Therapy (IMRT), Stereotactic Body Radiation Therapy (SBRT), and Volumetric Modulated Arc Therapy (VMAT). These techniques offer precision in treating various cancers, including breast, prostate, head and neck, and gynecological cancers while minimizing side effects. Innovations like 4D gating/4D RT and PET/MRI-guided radiation therapy further enhance treatment accuracy, particularly for older adults who may require specialized care. IMRT and stereotactic therapy provide targeted radiation, improving outcomes and reducing treatment expenditure. 3D conformal radiation therapy also remains a cornerstone in cancer care. As the market expands, the demand for personalized, image-guided solutions continues to rise, driven by the need for effective, minimally invasive treatments for diverse cancer types.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Radiation based systems

- Non-radiation based systems

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Japan

- Rest of World (ROW)

- North America

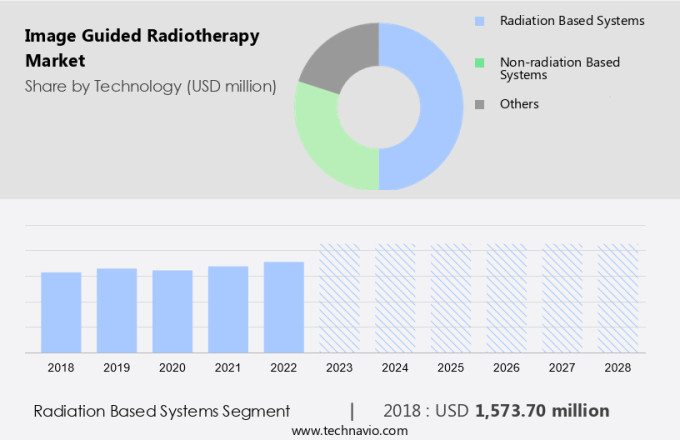

By Technology Insights

The radiation based systems segment is estimated to witness significant growth during the forecast period. Image-guided radiation therapy (IGRT) is a non-invasive cancer treatment technique that utilizes medical imaging to deliver precise radiation dosages to tumors. Hospitals are increasingly adopting IGRT to minimize surgical complications and adverse effects during the post-treatment phase. IGRT ensures accurate tumor localization and reduces the risk of radiation exposure to healthy cells. This technology is gaining popularity in cancer treatment due to its ability to provide real-time imaging during the radiation therapy process. Despite its benefits, continuous radiation exposure can lead to various complications, such as skin irritation, fatigue, and long-term health risks. To mitigate these risks, medical organizations, including the Centers for Disease Control and Prevention (CDC) and the US Preventive Services Task Force (USPSTF), recommend low-dose CT scans for lung cancer detection.

Further, the increasing prevalence of cancer and the rising demand for non-invasive cancer treatment options are the primary factors driving this growth. In conclusion, image-guided radiation therapy is a vital advancement in cancer treatment that offers numerous benefits. However, it is crucial to ensure that patients receive proper care and follow-up to minimize potential complications. With the increasing prevalence of cancer and the rising demand for non-invasive cancer treatment options, the image-guided radiation therapy market is expected to grow significantly in the coming years.

Get a glance at the market share of various segments Request Free Sample

The radiation based systems segment accounted for USD 1.57 billion in 2018 and showed a gradual increase during the forecast period.

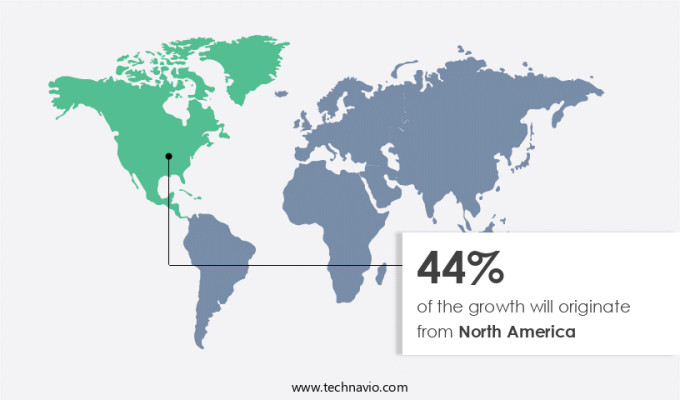

Regional Insights

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Image Guided Radiotherapy (IGRT) market in North America is poised for significant expansion over the coming years. Key drivers of this growth include the increasing prevalence of chronic diseases, advancements in technology, and the launch of new products. Additionally, the growing emphasis on early disease diagnosis and the high healthcare expenditure in the region are significant factors fueling market growth. IGRT technology, which combines imaging and radiation therapy, is increasingly being adopted for the treatment of various cancers, including prostate and lung cancer. The use of imaging technology, such as CT scanning and LINAC (linear accelerator), in conjunction with portal imaging, enables more precise and effective treatment, leading to improved patient outcomes.

Government and nonprofit organizations in North America are actively promoting awareness programs to encourage early diagnosis of chronic diseases. This, in turn, is increasing the demand for IGRT technology in the region. The shift towards personalized medicine and the increasing utilization of imaging equipment across various applications are also contributing to the growth of the market. Overall, the North American IGRT market is expected to experience substantial growth due to these factors.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Drivers

The rising incidence of cardiac diseases and growth of insurance providers is notably driving market growth. Image-guided radiotherapy (IGRT) is an advanced medical technology utilized in cancer care to enhance the precision of radiation therapy treatments. IGRT incorporates real-time imaging, such as Magnetic Resonance Imaging (MRI) and Positron Emission Tomography (PET), to enable healthcare professionals to locate and target soft-tissue structures with greater accuracy. This technology is essential for effective treatment planning and delivery, especially in cases where tumors are difficult to visualize using conventional imaging techniques. IGRT plays a pivotal role in improving patient outcomes and reducing side effects, making it an indispensable tool in modern cancer care. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Technological advancements is the key trend in the market. Image-guided radiotherapy (IGRT) is an advanced medical technology used in cancer care to enhance the precision of radiation therapy treatments. This technique utilizes real-time imaging, primarily MRI and PET, to locate and track the position of soft-tissues and tumors during treatment. Healthcare professionals rely on IGRT to deliver highly targeted radiation doses, reducing the risk of damage to surrounding healthy tissues. The integration of imaging technologies in radiotherapy has significantly improved treatment outcomes and patient safety. In cancer care, IGRT is a crucial component of the overall treatment plan, offering enhanced accuracy and personalized care for patients. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenges

The lack of adequate healthcare infrastructure in developing nations is the major challenge that affects the growth of the market. Image-guided radiotherapy (IGRT) is a revolutionary medical technology that enhances the precision and effectiveness of cancer care. This advanced technique utilizes real-time imaging, such as Magnetic Resonance Imaging (MRI) and Positron Emission Tomography (PET), to guide radiotherapy treatments. By providing soft-tissue imaging during treatment, healthcare professionals can accurately target tumors while minimizing exposure to healthy surrounding tissue. The integration of imaging technology into radiotherapy has significantly improved patient outcomes and is a crucial component of modern cancer care. This medical innovation continues to evolve, offering new possibilities for personalized and effective treatment plans. Hence, the above factors will impede the growth of the market during the market growth and forecasting period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

C RAD AB - The company offers Catalyst system that is a revolutionary solution for Surface Image Guided Radiation Therapy, coupled with application software optimized for work-flow integration.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accuray Inc.

- Allengers Medical Systems Ltd.

- Boston Scientific Corp.

- C RAD AB

- Canon Inc.

- Carestream Dental LLC

- FUJIFILM Corp.

- General Electric Co.

- Hitachi Ltd.

- Hologic Inc.

- iCAD Inc.

- IsoRay Inc.

- Koninklijke Philips N.V.

- Medtronic Plc

- Mevion Medical Systems Inc.

- Panacea Medical Technologies Pvt. Ltd.

- Siemens Healthineers AG

- Varian Medical Systems Inc.

- ViewRay Inc.

- Vision RT Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Image-guided radiotherapy (IGRT) is an advanced form of radiotherapy that utilizes real-time imaging to enhance the precision and accuracy of cancer treatment. IGRT is a non-invasive radiation therapy that is increasingly being adopted in cancer treatment across the world. The technology is used in various types of cancer, including breast, prostate, lung, gynecological, and gastrointestinal cancer. The use of IGRT in cancer treatment has been endorsed by organizations such as the World Health Organization and the American Cancer Society. Radiotherapy and oncology professionals, including radiologists and oncologists, are increasingly recognizing the benefits of IGRT in improving treatment outcomes and reducing surgical complications and adverse effects during the post-treatment phase. IGRT is typically delivered using imaging technology such as computed tomography (CT), stereotactic radiosurgery (SRS), linac (linear accelerator), portal imaging, cone-beam CT, MRI, PET, and other advanced imaging modalities.

Further, the use of IGRT is not limited to hospitals, as independent radiotherapy centers are also offering this advanced form of cancer treatment. The increasing cancer patient population and healthcare spending on cancer treatment are driving the growth of the image-guided radiotherapy market. Training and insurance provisions are important considerations for healthcare systems and patients when adopting IGRT. The older adult population is also a growing segment in the image-guided radiotherapy market due to the increasing prevalence of cancer in this demographic. Medical technology companies are investing in research and development to improve the image-guided radiotherapy technology and expand its applications, including particle therapy and proton beam therapy. Health equity is a key concern in the cancer care industry, and IGRT plays an important role in ensuring equitable access to advanced cancer treatment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.11% |

|

Market growth 2024-2028 |

USD 927.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.39 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 44% |

|

Key countries |

US, Germany, UK, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accuray Inc., Allengers Medical Systems Ltd., Boston Scientific Corp., C RAD AB, Canon Inc., Carestream Dental LLC, FUJIFILM Corp., General Electric Co., Hitachi Ltd., Hologic Inc., iCAD Inc., IsoRay Inc., Koninklijke Philips N.V., Medtronic Plc, Mevion Medical Systems Inc., Panacea Medical Technologies Pvt. Ltd., Siemens Healthineers AG, Varian Medical Systems Inc., ViewRay Inc., and Vision RT Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch