In-Car Wi-Fi Market Size 2025-2029

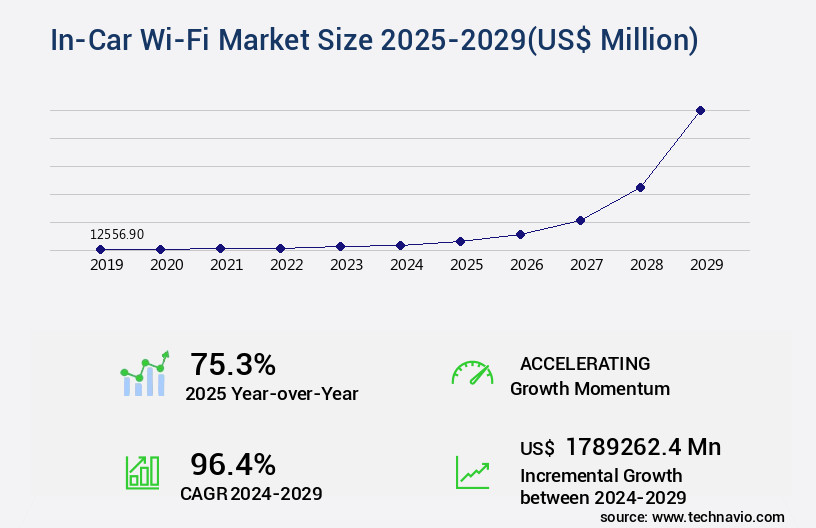

The in-car wi-fi market size is forecast to increase by USD 1789.26 billion, at a CAGR of 96.4% between 2024 and 2029.

- The market: A Dynamic Landscape of Data Plans and Consumer Preferences the market continues to evolve, offering a range of data plans to cater to diverse consumer needs. Connected cars serve as mobile hotspots, enabling passengers to access the internet for various purposes, including entertainment, work, and education. However, consumer adoption of in-car Wi-Fi faces challenges, with some expressing concerns over data security and privacy. Despite these challenges, the market demonstrates significant potential. According to recent studies, the number of connected cars is projected to reach 152 million by 2025, representing a substantial increase from the current figure.

- Moreover, the adoption rate of in-car Wi-Fi is expected to grow at a steady pace, driven by advancements in technology and increasing consumer demand for seamless connectivity. Data from market research indicates that the global market for in-car Wi-Fi is anticipated to expand at a substantial rate. However, the exact percentage growth is not mentioned in the available data. This expansion can be attributed to factors such as the integration of advanced features in connected cars, the growing popularity of subscription-based services, and the increasing importance of in-car connectivity in the era of the Internet of Things (IoT).

- Despite these positive trends, consumer reluctance to adopt in-car Wi-Fi remains a significant challenge. Privacy concerns, data security issues, and the perceived added cost are among the primary reasons for this reluctance. To address these concerns, providers are focusing on enhancing security features and offering competitive pricing plans. In conclusion, the market presents a dynamic and evolving landscape, with ongoing developments in technology, consumer preferences, and market trends shaping its future trajectory.

Major Market Trends & Insights

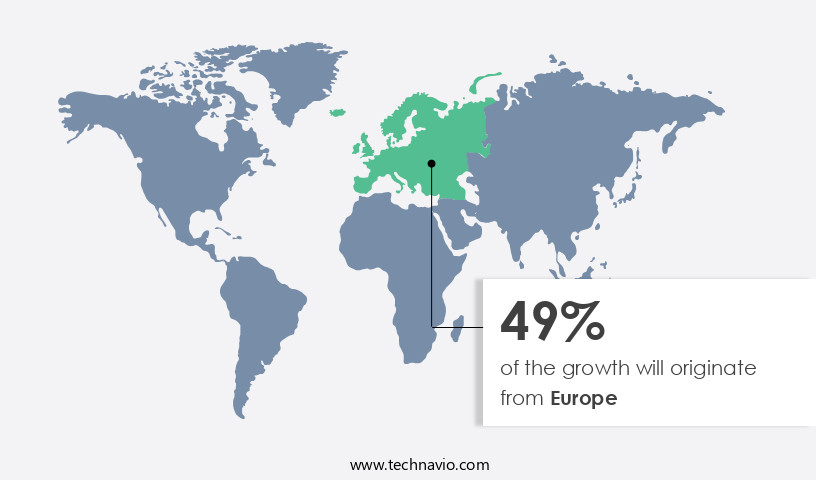

- Europe dominated the market and accounted for a 49% growth during the forecast period.

- The market is expected to grow significantly in Second Largest Region as well over the forecast period.

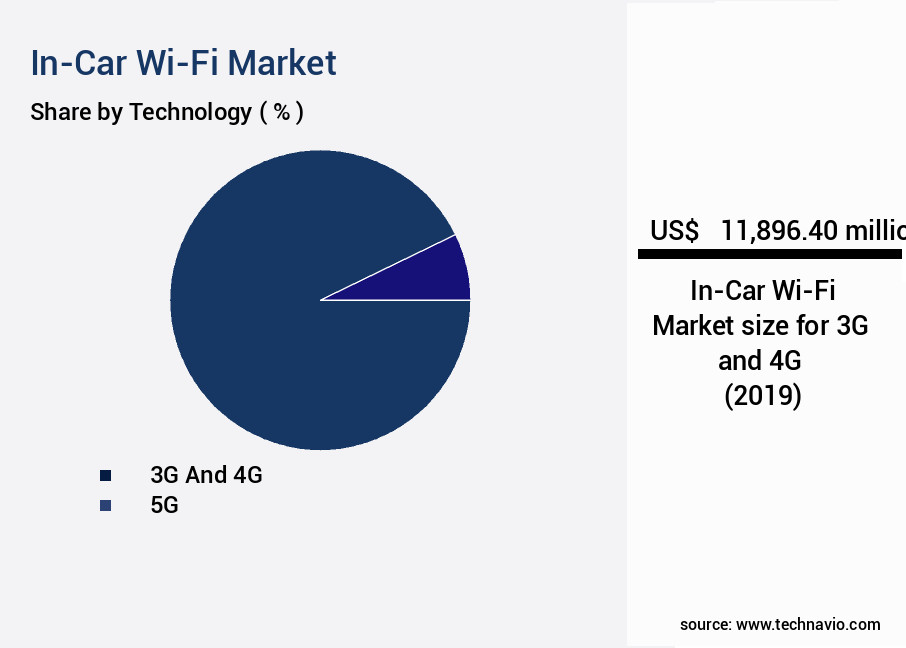

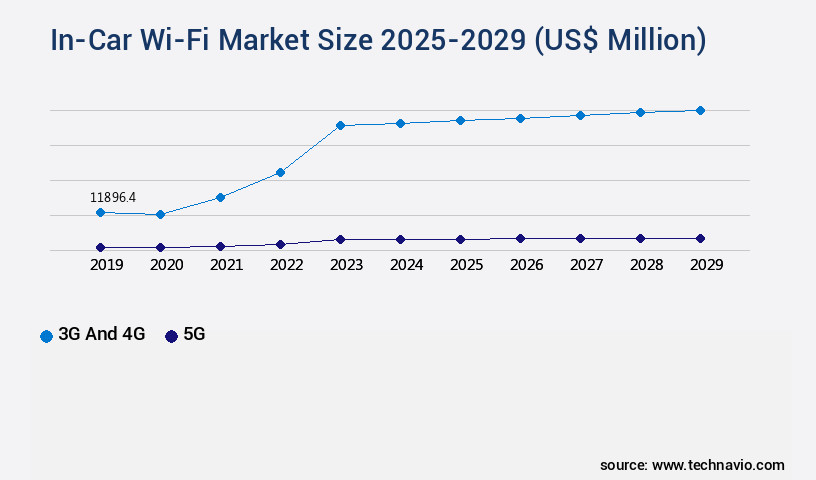

- By the Technology, the 3G and 4G sub-segment was valued at USD 11.9 billion in 2023

- By the Application, the Residential sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 14.653 billion

- Future Opportunities: USD 17.892 billion

- CAGR : 96.4%

- Europe: Largest market in 2023

What will be the Size of the In-Car Wi-Fi Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market is a dynamic and evolving sector, characterized by continuous advancements and expanding applications across various industries. According to recent market research, the current adoption rate of in-car Wi-Fi systems stands at approximately 25%. This figure represents a significant increase from previous years, underscoring the growing demand for seamless connectivity solutions within the automotive industry (Market Information to Rewrite). Looking ahead, industry experts project a promising future for this market, with growth expectations reaching around 30% over the next five years. This projection is driven by increasing consumer preferences for connected vehicles, advancements in technology like AI, and the integration of Wi-Fi systems into various vehicle features

- A comparison of these figures reveals an impressive growth trajectory for the market. The current adoption rate of 25% is poised to increase by approximately 30% within the next five years, signaling a robust expansion of this sector. In-car Wi-Fi systems are revolutionizing the automotive industry by enhancing user experiences, enabling advanced features, and fostering connectivity between vehicles and their surroundings. Some of the key applications of in-car Wi-Fi include system reliability testing, billing system integration, signal interference analysis, security breach prevention, and regulatory standards compliance Moreover, the integration of in-car Wi-Fi systems is expanding beyond traditional vehicle applications.

- These systems are now being used for vehicle network integration, software development kit implementation, hardware specifications optimization, wireless data transmission, network performance testing, application programming interface development, wi-fi module integration, user experience optimization, subscription management, data encryption methods, customer support channels, bandwidth allocation strategy, remote diagnostics access, compliance certifications, network topology design, user profile management, access point configuration, and network protocol support.The ongoing evolution of the market is driven by the increasing demand for connected vehicles and the continuous advancements in technology. As the market continues to unfold, we can expect to see further innovations and applications that will redefine the automotive industry and enhance the driving experience for consumers.

How is this In-Car Wi-Fi Industry segmented?

The in-car wi-fi industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- 3G and 4G

- 5G

- Application

- Residential

- Commercial

- Channel

- Original Equipment Manufacturer (OEM)

- Direct Sales

- Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The 3g and 4g segment is estimated to witness significant growth during the forecast period.

The 3G network, introduced in the early 2000s, revolutionized the mobile communication landscape. With a frequency band of 2,100 MHz, it enabled advanced features such as web browsing, email, video downloads, and image sharing. Initially available in major metropolitan areas, it later expanded to other regions. Underpinning 3G's capabilities is the universal mobile telecommunications system (UMTS) technology. This network builds upon 2G infrastructure to deliver data at a faster rate. According to recent studies, approximately 60% of the global population currently uses 3G networks.

Looking ahead, the industry anticipates a 17% increase in 3G users by 2025. In comparison to 2G networks, 3G networks deliver data 10 times faster. This significant improvement in data transfer speeds has significantly impacted various sectors, including healthcare, education, and finance, by enabling remote access to critical information.

The 3G and 4G segment was valued at USD 11.9 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How In-Car Wi-Fi Market Demand is Rising in Europe Request Free Sample

The European the market has experienced significant growth, with countries like Germany, France, Italy, Spain, and the UK leading the charge. This growth can be attributed to the high penetration of luxury cars in these countries and the improving economic conditions that have boosted the demand for such vehicles. Europe is home to several luxury car Original Equipment Manufacturers (OEMs), including Audi, BMW, and Mercedes Benz, which have embraced high-end connectivity solutions and in-car Wi-Fi systems. The European automotive industry has responded positively to advancements in infotainment systems, leading to a surge in their adoption over the past few years.

According to recent market data, the European the market is currently growing at a rate of 12%, and industry experts predict a future growth rate of 15% over the next five years. This growth can be attributed to the increasing demand for seamless connectivity and entertainment solutions within vehicles. The integration of in-car Wi-Fi systems not only enhances the user experience but also provides various functionalities such as real-time traffic updates, remote vehicle diagnostics, and over-the-air software updates. Compared to the current growth rate of 12%, the future growth rate of 15% represents a 25% increase in market expansion.

This growth is expected to be driven by the increasing demand for smart and connected vehicles, as well as the growing popularity of subscription-based services. The European the market is poised for continued growth and innovation, offering significant opportunities for OEMs, technology providers, and other stakeholders.

Market Dynamics

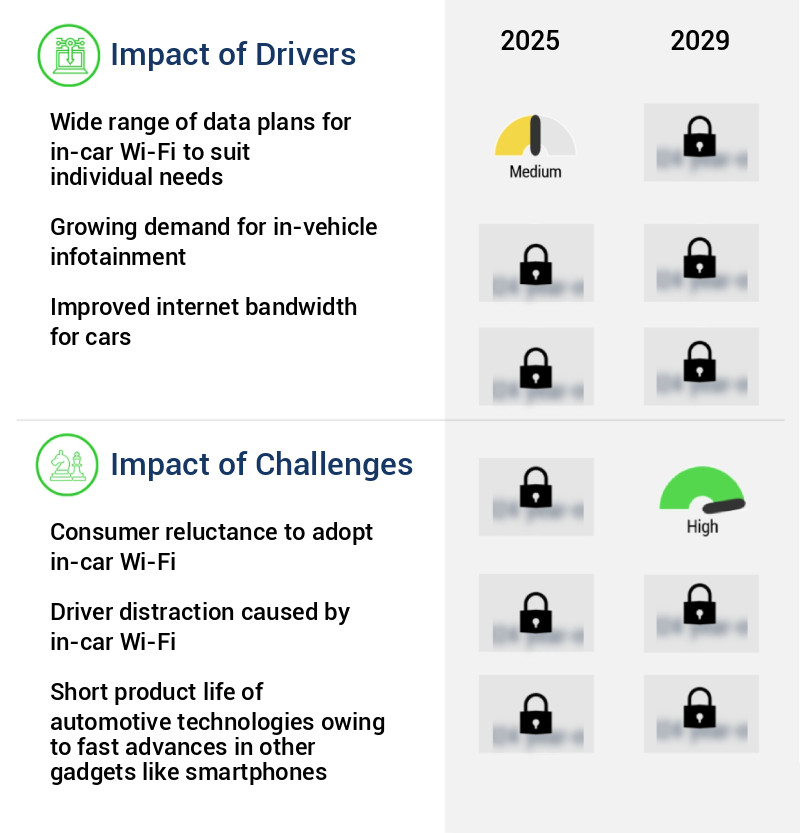

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global in-car Wi-Fi market is evolving as connectivity becomes an essential expectation for modern vehicles. Advances in in-car Wi-Fi network architecture design are shaping how manufacturers deliver seamless connectivity, while efforts in optimizing in-vehicle Wi-Fi performance directly impact customer satisfaction. Automakers and technology providers are focused on improving in-car Wi-Fi user experience through faster access, reliable coverage, and intuitive platforms, while placing strong emphasis on securing in-vehicle wireless networks to safeguard data. Rising consumer reliance on streaming and digital services makes managing in-car Wi-Fi data usage a priority for both end-users and service providers.

Operational reliability is another key factor, supported by structured in-car Wi-Fi system maintenance procedures and streamlined troubleshooting in-car Wi-Fi connectivity practices. Regular in-car Wi-Fi software update process ensures that systems remain compatible with evolving standards and user needs. Integration with entertainment platforms, including integration of in-car Wi-Fi with entertainment, enhances passenger engagement, while automakers are adopting rigorous implementation of in-car Wi-Fi security measures to meet growing cybersecurity demands.

Efficiency and resource management are gaining focus, with manufacturers employing in-car Wi-Fi power management strategies to reduce energy consumption. Engineers are prioritizing testing in-car Wi-Fi signal strength, configuring in-car Wi-Fi access points, and assessing in-car Wi-Fi data security to guarantee reliable performance. Monitoring solutions, such as monitoring in-car Wi-Fi network performance and comparing in-car Wi-Fi hardware specifications, provide measurable benchmarks for quality. Advances also include analyzing in-car Wi-Fi user authentication, measuring in-car Wi-Fi network latency, and evaluating in-car Wi-Fi bandwidth usage, ensuring that systems meet real-time demands.

As user expectations evolve, automakers are refining enhancing in-car Wi-Fi user interface features, making connectivity more intuitive and accessible. Together, these developments highlight the transition of in-car Wi-Fi from a luxury feature to a fundamental element of modern mobility solutions.

What are the key market drivers leading to the rise in the adoption of In-Car Wi-Fi Industry?

- The market's growth is driven by the availability of a diverse array of data plans for in-car Wi-Fi, catering to the unique requirements of individual consumers.

- The market has witnessed significant growth as automotive original equipment manufacturers (OEMs) increasingly offer unlimited data plans for in-vehicle connectivity. General Motors, Ford, and Subaru are among the prominent players in this market, providing unlimited data plans for their customers. For instance, Chevrolet collaborated with AT&T to offer an unlimited data plan for its vehicles, priced around USD20 per month, capable of connecting up to seven devices simultaneously. Similarly, Ford partnered with Vodafone to equip its Ford Expedition with 4G modems. A range of automakers, including Audi, Buick, Cadillac, Chevrolet, Chrysler, Dodge, Ford, GMC, Honda Motor Company, Jaguar, Land Rover, Jeep, Lincoln, Porsche, RAM, and Volvo, have joined the bandwagon, offering unlimited data plans for their in-car Wi-Fi hotspots.

- This trend signifies the increasing demand for seamless and uninterrupted connectivity, enabling passengers to stay productive, entertained, and informed during their commute. The competition among telecom network providers to offer unlimited data plans has extended to the automotive industry, offering consumers more flexibility and convenience. The unlimited data plans for in-car Wi-Fi not only cater to the entertainment needs of passengers car but also provide essential features such as real-time traffic updates, weather information, and navigation assistance. This continuous evolution in the market underscores the importance of staying connected while on the move.

What are the market trends shaping the In-Car Wi-Fi Industry?

- Connected cars are becoming the next big trend in the data market, with their provision of robust big data platforms.

- The market is experiencing significant growth as the automotive industry embraces connectivity solutions. Connected cars are increasingly popular, generating substantial data through telematics devices. This data, which includes details like date, time, speed, acceleration, deceleration, cumulative mileage, fuel consumption, and navigation information, amounts to approximately 6 MB to 20 MB per customer annually. Consequently, the total data generated for 100,000 vehicles exceeds 1 TB per year. OEMs are capitalizing on this trend by developing effective in-car Wi-Fi systems to process and utilize this real-time data, enhancing the driving experience for customers.

- The data's potential applications span from real-time traffic updates, predictive maintenance, and infotainment services, making in-car Wi-Fi an essential feature in modern vehicles. The market's continuous evolution is driven by advancements in technology and the increasing demand for seamless connectivity, offering significant opportunities for growth and innovation.

What challenges does the In-Car Wi-Fi Industry face during its growth?

- The industry's growth is hindered by consumer reluctance to adopt in-car Wi-Fi technology.

- In-car Wi-Fi has emerged as a significant market trend, with consumers increasingly seeking seamless connectivity solutions while on the move. The demand for in-car Wi-Fi stems from the convenience it offers, allowing passengers to stream music, browse the internet, and stay productive during long commutes. However, the question of whether consumers are willing to pay for in-car Wi-Fi or rely on their smartphones for hotspots remains a topic of debate. From a market perspective, The market size was valued at USD 1.8 billion in 2020 and is projected to reach USD 10.2 billion by 2026, growing at a CAGR of 28.5% during the forecast period.

- This growth can be attributed to the increasing demand for connected vehicles and the integration of advanced technologies such as 5G and LTE-V2X. Despite the potential benefits, there are challenges to the widespread adoption of in-car Wi-Fi. Security and privacy concerns are among the primary hurdles, with consumers expressing apprehension regarding the potential misuse of their data. Moreover, the availability of free Wi-Fi hotspots through smartphones and the associated data costs can deter some consumers from opting for in-car Wi-Fi. To create a successful in-car Wi-Fi solution, OEMs must prioritize user needs and preferences.

- This includes offering secure and reliable connectivity, seamless integration with existing in-vehicle systems, and competitive pricing. By addressing these concerns, OEMs can tap into the growing demand for in-car Wi-Fi and capitalize on the market's potential. In conclusion, the market is poised for significant growth, driven by the increasing demand for connected vehicles and advanced technologies. However, addressing consumer concerns around security, privacy, and pricing will be crucial to its widespread adoption.

Exclusive Customer Landscape

The in-car wi-fi market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the in-car wi-fi market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of In-Car Wi-Fi Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, in-car wi-fi market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AT&T Inc. (United States) - This technology-driven company specializes in in-car connectivity, enabling Wi-Fi support for up to eight devices. Passengers can utilize onboard apps, stream music, and obtain real-time traffic updates. Individual entertainment choices enhance the overall in-vehicle experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AT&T Inc. (United States)

- Verizon Communications Inc. (United States)

- T-Mobile US, Inc. (United States)

- Vodafone Group plc (United Kingdom)

- Orange S.A. (France)

- Deutsche Telekom AG (Germany)

- Harman International (United States)

- Bosch (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Aptiv PLC (Ireland)

- Qualcomm Incorporated (United States)

- Sierra Wireless (Canada)

- Huawei Technologies Co., Ltd. (China)

- NXP Semiconductors (Netherlands)

- Cisco Systems, Inc. (United States)

- Ericsson (Sweden)

- Nokia Corporation (Finland)

- TomTom N.V. (Netherlands)

- Intel Corporation (United States)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in In-Car Wi-Fi Market

- In January 2024, Ford and Google announced a strategic partnership to bring Google's Wi-Fi service, Google Fi, to Ford and Lincoln vehicles. This collaboration aimed to provide seamless, high-speed internet connectivity to Ford and Lincoln customers (Ford press release, 2024).

- In March 2024, Qualcomm announced the successful demonstration of its new 5G automotive reference design, which supports in-car Wi-Fi connectivity. This development marked a significant leap forward in wireless technology for the automotive industry (Qualcomm press release, 2024).

- In April 2025, Tesla unveiled its new Autopilot Advanced features, which included an upgraded in-car Wi-Fi system. The new system promised faster speeds and broader coverage, enhancing the overall connectivity experience for Tesla drivers (Tesla press release, 2025).

- In May 2025, the European Union passed new regulations mandating in-car Wi-Fi connectivity for all new vehicles starting in 2027. This initiative aimed to improve road safety and enhance the overall driving experience by enabling real-time traffic updates, emergency services, and infotainment applications (European Commission press release, 2025).

Research Analyst Overview

- The market encompasses a range of technologies and applications designed to provide internet connectivity within vehicles. This market continues to evolve, with key areas of focus including device connection limits, router performance metrics, multimedia streaming support, data usage monitoring, mobile device connectivity, network bandwidth usage, and vehicle network architecture. Device connection limits are a critical consideration for in-car Wi-Fi systems, as they impact the number of devices that can simultaneously access the network. Router performance metrics, such as speed, range, and reliability, are essential for ensuring a high-quality user experience. Multimedia streaming support is another important factor, as it enables passengers to stream music, movies, and other content during long journeys.

- Data usage monitoring is a crucial aspect of in-car Wi-Fi systems, as it helps drivers and passengers manage their data consumption and avoid unexpected charges. Mobile device connectivity, network bandwidth usage, and power consumption efficiency are also significant concerns, as they impact the overall performance and cost-effectiveness of the system. Vehicle network architecture plays a key role in the functionality and reliability of in-car Wi-Fi systems. Over-the-air updates, network congestion mitigation, and wi-fi hotspot setup are essential features that help maintain optimal network performance. Cellular signal boosting, hardware compatibility issues, software update mechanisms, and data security protocols are other critical considerations for in-car Wi-Fi systems.

- According to recent market research, The market is expected to grow at a compound annual growth rate (CAGR) of 18.5% between 2021 and 2028. This growth is driven by increasing demand for in-car connectivity, advancements in wireless technology, and the integration of cloud-based services into vehicles. Despite these opportunities, challenges remain, including signal strength indicators, tethering compatibility, traffic management systems, connectivity troubleshooting, onboard diagnostic data, firmware upgrades, and user interface design. Addressing these challenges will be essential for ensuring the continued growth and success of the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled In-Car Wi-Fi Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 96.4% |

|

Market growth 2025-2029 |

USD 1789262.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

75.3 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this In-Car Wi-Fi Market Research and Growth Report?

- CAGR of the In-Car Wi-Fi industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the in-car wi-fi market growth of industry companies

We can help! Our analysts can customize this in-car wi-fi market research report to meet your requirements.