Incident Response System Market Size 2024-2028

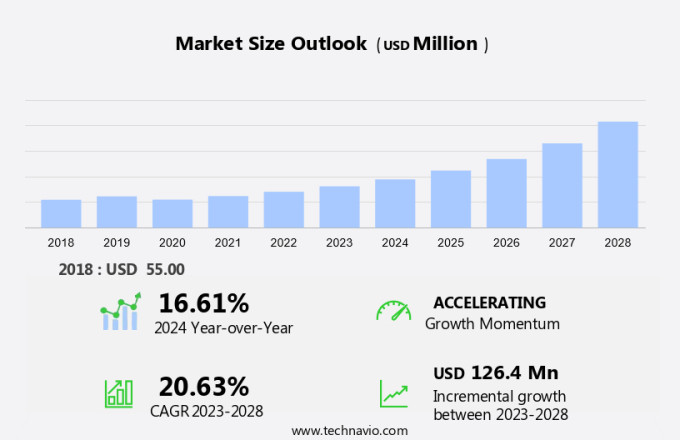

The incident response system market size is forecast to increase by USD 126.4 billion at a CAGR of 20.63% between 2023 and 2028. The market is experiencing significant growth due to several key factors. Advanced threat hunting is becoming increasingly important as cyber threats continue to evolve, making it necessary for organizations to quickly identify and respond to security breaches. Central, state, and local governments, as well as social security funds, are investing in incident response systems to safeguard sensitive data and ensure business continuity. Log analysis and endpoint data security are critical components of incident response systems, enabling organizations to detect and respond to threats in real-time. Network traffic analysis is also essential for identifying anomalous behavior and potential security threats. This is particularly important in sectors such as mobile banking, cashless payments, online shopping, and IoT, where cybersecurity risks are high. Case management, orchestration, automation, intelligence, and log analysis are integral components of a strong incident response system.

What will the size of the market be during the forecast period?

The incident response market is a significant segment of the cybersecurity landscape, focusing on mitigating the impact of information technology (IT) incidents. These incidents, which include cybersecurity breaches, ransomware attacks, and fraudulent activities, can significantly disrupt business operations and compromise sensitive data. Effective incident response is crucial for organizations to minimize downtime and financial losses. Moreover, these features enable security agencies to streamline their response processes, prioritize threats, and make informed decisions. Network traffic analysis and endpoint data analysis are essential elements of incident response, providing valuable insights into potential threats and their sources. By integrating machine learning algorithms, these systems can enhance their ability to detect and respond to advanced threats. Regulatory compliance is another critical factor driving the growth of the incident response market. With increasing data protection regulations, organizations must ensure they have the necessary tools and processes in place to respond effectively to cybersecurity incidents. Cloud services have also become a significant focus area for incident response systems.

Furthermore, as more organizations move their operations to the cloud, the need to secure these environments and respond effectively to incidents becomes increasingly important. Awareness and preparedness are essential components of an effective incident response strategy. Organizations must invest in training their IT staff and implementing policies and procedures to minimize the risk of cybersecurity incidents. The incident response market is expected to grow significantly in the coming years, driven by the increasing number of cybersecurity risks and the need for organizations to enhance their incident response capabilities. By investing in advanced incident response systems, organizations can improve their ability to detect, respond to, and mitigate cybersecurity threats, protecting their sensitive data and maintaining business continuity.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Surveillance systems

- Backup and disaster recovery solutions

- Geospatial technologies

- Threat management systems

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Type Insights

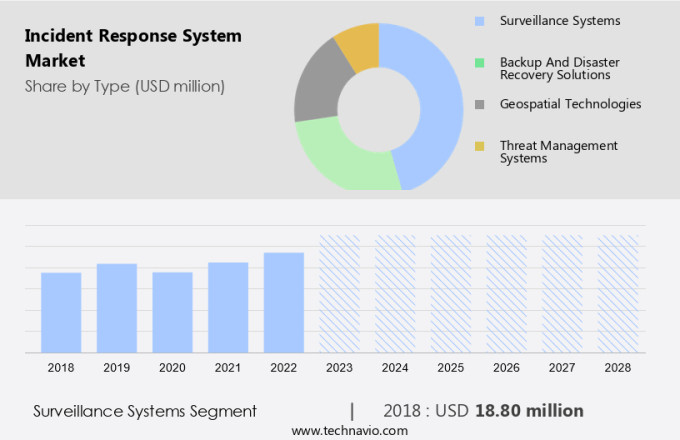

The surveillance systems segment is estimated to witness significant growth during the forecast period. The market for surveillance applications is poised for substantial expansion in the coming years. Advanced technologies such as infrared cameras, wireless CCTV systems, and IP surveillance solutions are fueling market growth in this sector. The heightened risk of security breaches in government entities and businesses is a primary reason for the widespread adoption of surveillance systems. As technology advances, so do the sophistication of security threats. Consequently, organizations are turning to video monitoring solutions to safeguard their premises and detect intruders. In the retail industry, the increasing number of shoplifting incidents has led to a rise in demand for surveillance systems to prevent inventory loss.

Furthermore, government sectors at all levels, including the Central, State, and Local, are significant buyers of these systems due to the heightened need for security. Log and endpoint data analysis, as well as network traffic analysis, are essential components of incident response systems that enable swift identification and mitigation of security threats.

Get a glance at the market share of various segments Request Free Sample

The surveillance systems segment accounted for USD 18.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

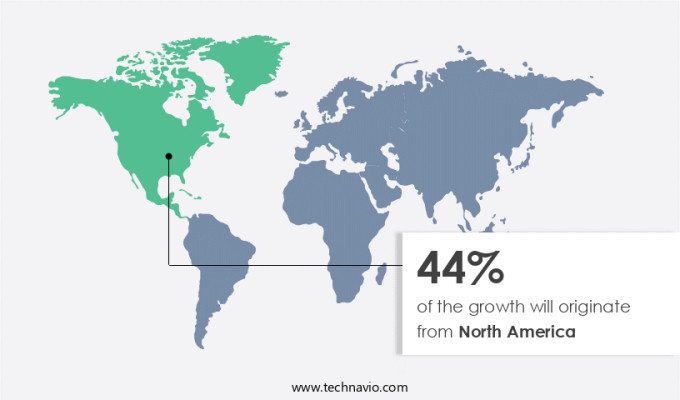

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is projected to expand significantly due to the rising number of e-commerce platforms, data breaches, and cyberattacks. In the US, large enterprises and small businesses across various sectors, including healthcare, retail, and commercial buildings, are prioritizing the implementation of incident response systems to enhance their threat detection process and mitigate security breaches. The region's advanced digital infrastructure, with a high penetration of the internet and cloud computing, makes it a prime target for cybercriminals. The adoption of IoT and AI technologies further increases the need for strong security measures. Incident response systems enable organizations to respond effectively to security incidents, reducing downtime and minimizing potential damage to their reputation and financial losses.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rise in terrorist activities is the key driver of the market. The global security landscape is facing escalating challenges from various threats, with terrorism being a significant concern. Similarly, in August 2020, a motorcycle bomb explosion on a busy street in Jolo, Sulu, Philippines, caused extensive damage and loss of life. Several socio-economic factors contribute to the rise in global terrorism.

These include religious or ethnic strife and corruption in less developed countries, weak laws against terrorism, and social disenfranchisement and exclusion in more developed nations. The COVID-19 pandemic, declared a global health crisis by the World Health Organization in March 2020, has further complicated the situation by exacerbating economic instability and social unrest. As businesses and organizations increasingly rely on digital platforms for their operations, securing web, endpoint, application, network, cloud, and IoT environments against cybersecurity risks becomes crucial. Effective incident response systems are essential in mitigating the impact of these threats and ensuring business continuity. Organizations must stay informed about the latest cybersecurity trends and threats to maintain a strong security posture.

Market Trends

Emergence of wireless IP surveillance is the upcoming trend in the market. The market is witnessing significant growth due to the increasing adoption of advanced technologies such as Orchestration, Automation, and Intelligence in security agencies' operations. An Incident Response Retainer is becoming a popular choice for businesses seeking proactive security measures, enabling Assessment and Response to potential threats more efficiently. Tabletop exercises are also gaining traction as an essential part of IR strategy, allowing teams to prepare for various scenarios and improve their readiness. Wireless IP surveillance is a cutting-edge technology that is transforming the security landscape, particularly in outdoor environments. This technology combines IP video surveillance and wireless data transmission, eliminating the need for costly cabling and network infrastructure in remote locations.

The market for wireless IP surveillance is expanding as more industries recognize its benefits. For instance, shopping malls prioritize customer security in parking lots, while BFSI institutions enhance security at ATMs. Municipalities secure city parks, municipal buildings, and monitor traffic intersections, while transportation sectors protect dams, bridges, highways, and tunnels. Enterprises secure building perimeters and monitor warehouse loading docks. The adoption of wireless IP surveillance systems continues to grow, fueling the market's expansion during the forecast period.

Market Challenge

High initial costs of systems is a key challenge affecting the market growth. In today's digital landscape, the importance of cybersecurity incident response systems cannot be overstated. However, the initial investment required for implementing these solutions can be substantial, particularly for small and medium-sized organizations. The cost of purchasing protection equipment and setting up surveillance systems can reach tens of thousands of dollars. Moreover, the need for periodic upgrades and replacements adds to the ongoing expenses. The integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) into cybersecurity incident response platforms is a game-changer. These technologies enhance the capabilities of networks incident response systems, enabling faster and more accurate threat detection and response.

Additionally, partnering with reputable cybersecurity firms can help organizations navigate the complex landscape of cybersecurity and ensure they have the necessary expertise on hand. In conclusion, cybersecurity incident response systems are an essential component of any organization's digital defense strategy. The integration of AI and ML technologies into these platforms offers significant benefits, making them an investment worth considering. While the initial cost may be high, the long-term benefits, including improved threat detection and response, regulatory compliance, and data protection, make it a worthwhile investment.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accenture Plc - The company offers Kaspersky Incident Response, a comprehensive solution designed to address the entire incident investigation cycle for organizations.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acronis International GmbH

- AO Kaspersky Lab

- BAE Systems Plc

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- CrowdStrike Holdings Inc.

- Elbit Systems Ltd.

- FireEye Security Holdings US LLC

- Fujitsu Ltd.

- Honeywell International Inc.

- HP Inc.

- International Business Machines Corp.

- Lockheed Martin Corp.

- McAfee LLC

- Palo Alto Networks Inc.

- Rapid7 Inc.

- RTX Corp.

- Verizon Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The incident response market is witnessing significant growth due to the increasing number of cybersecurity threats targeting various industries and sectors. Orchestration and automation are key elements of modern incident response systems, enabling quick and effective response to security incidents. Incident response intelligence plays a crucial role in identifying and prioritizing threats, helping security agencies to respond efficiently. Assessment and response, tabletop exercises, advanced threat hunting, and log analysis are essential components of an incident response strategy. Central, state, and local governments, social security funds, and large and small enterprises in sectors such as healthcare, finance, and e-commerce are investing in incident response systems to mitigate cybersecurity risks.

Furthermore, cybersecurity breaches in mobile banking, cashless payments, fraud, ransomware incidents, and patient safety are driving the demand for advanced incident response capabilities. Web security, endpoint security, application security, network security, cloud security, and IoT security are all areas requiring incident response solutions. Awareness and preparedness, AI, and machine learning are also integral to effective incident response. The threat detection process involves identifying, analyzing, and responding to cybersecurity incidents. Cybersecurity breaches can result in significant financial and reputational damage, making incident response a critical component of any organization's cybersecurity strategy. Incident response platforms provide a centralized solution for managing and responding to security incidents across various systems and networks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.63% |

|

Market growth 2024-2028 |

USD 126.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.61 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 44% |

|

Key countries |

US, China, India, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture Plc, Acronis International GmbH, AO Kaspersky Lab, BAE Systems Plc, Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., CrowdStrike Holdings Inc., Elbit Systems Ltd., FireEye Security Holdings US LLC, Fujitsu Ltd., Honeywell International Inc., HP Inc., International Business Machines Corp., Lockheed Martin Corp., McAfee LLC, Palo Alto Networks Inc., Rapid7 Inc., RTX Corp., and Verizon Communications Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch