Industrial Clay Market Size 2024-2028

The industrial clay market size is forecast to increase by USD 2.16 billion at a CAGR of 6.93% between 2023 and 2028.

- The market exhibits significant growth due to the expanding construction industry and the increasing adoption of advanced materials in various sectors. The demand for industrial clay is driven by its extensive applications in industries such as ceramics, cement, glass, mica, rubber, calcium carbonate, lead, catalyst, and specialty chemicals. Key applications include the production of bentonite in drilling fluids, ball clay in ceramics and porcelain, feldspar in glass, and mica in electrical applications. Furthermore, the market is influenced by the volatile prices of raw materials, including industrial clay, which can impact the profitability of manufacturers. In the US, the market is witnessing increased demand for industrial clay in the production of construction materials, insulation, concrete, adhesives, and generator components. Additionally, the market is experiencing growth In the aluminum, organic dyes, magnesium, silicon carbide, paints and coatings, and plastic industries. Overall, the market presents opportunities for growth, particularly In the areas of insulation, advanced ceramics, and concrete production. However, the market is challenged by the volatility of raw material prices and the need for sustainable and cost-effective production methods.

What will be the Size of the Industrial Clay Market During the Forecast Period?

- The market encompasses a diverse range of clay minerals, including hydrated silicates such as kaolinite, montmorillonite, illite, and bentonite, as well as aluminum rich minerals like mica, feldspar, and illite. These minerals, with their unique chemical compositions and properties, play essential roles in various manufacturing applications. Clay's plasticity at room temperature and hardness when fired make it suitable for producing bricks, tiles, and pottery. The high temperatures used In these processes enhance the minerals' hardness and strength, resulting in durable and long-lasting products. Industrial clays are also used In the production of concrete, fireplaces, and boilers, where their ability to absorb water and swell is advantageous.

- Additionally, clays serve as catalysts in various industries, such as glass fusing and the production of chemicals and ceramics. Beyond traditional applications, industrial clays are increasingly utilized in advanced manufacturing processes like 3D printing and the creation of high-performance materials. Mineral additives like sepiolite, metal oxides, and organic dyes expand the versatility of industrial clays, catering to diverse industry needs. The market continues to grow, driven by the increasing demand for sustainable and eco-friendly materials, advancements in technology, and the expanding applications of clay minerals in various industries.

How is this Industrial Clay Industry segmented and which is the largest segment?

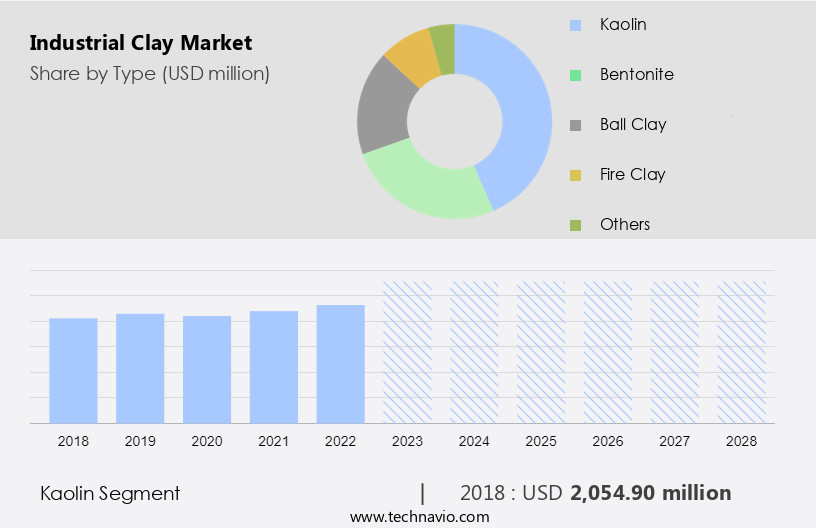

The industrial clay industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Kaolin

- Bentonite

- Ball clay

- Fire clay

- Others

- Application

- Ceramics

- Paper

- Paints and coatings

- Rubber

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

- The kaolin segment is estimated to witness significant growth during the forecast period.

Kaolin, a fine white clay derived from kaolinite minerals, is a valuable resource for various industries, including rubber, paper, paint, and ceramics. Kaolin's unique properties, such as its small particle size, brightness, and non-abrasiveness, make it an essential raw material for these applications. The paper industry uses calcined kaolin as a filler to enhance paper's brightness, smoothness, and printability. In paints and coatings, it improves the gloss and opacity of the final products. Water-washed kaolin is commonly employed In the ceramics industry due to its high plasticity and firing qualities, particularly in porcelain and sanitaryware manufacturing. Different types of kaolin include calcined, water-washed, and surface-modified varieties.

Get a glance at the market report of share of various segments Request Free Sample

The kaolin segment was valued at USD 2.05 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 56% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region's construction industry, the largest In the world, is experiencing steady growth due to population expansion, rising middle-class income, and urbanization. China's rapid development, driven by government infrastructure investments, is a significant contributor to this growth. India and ASEAN countries are also focusing on infrastructure development, leading to increased demand for sanitary ware, wall and floor tiles, and other ceramics. This demand increase is attributed to foreign investment in real estate, hotels, office buildings, and large theme parks In the region. Consequently, the need for clay, a primary component in ceramics production, is anticipated to escalate. Clay, with its chemical composition primarily consisting of minerals like Hydrated silicates, Aluminum, Quartz, Feldspar, Mica, Kaolinite, Montmorillonite, Illite, Bentonite, Chlorite, Smectite, and Kaolin, is extensively used in various manufacturing applications, including bricks, tiles, pottery, ceramic products, paper manufacturing, clay cement, and more.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Clay Industry?

Growing construction industry is the key driver of the market.

- Industrial clays, including kaolin, bentonite, and ball clay, are indispensable raw materials for the manufacturing of various construction applications such as ceramics, cement, bricks, tiles, and pipes. The increase in urbanization, population growth, and infrastructure development have significantly increased the demand for these materials. Industrial clays, recognized for their plasticity, moldability, and heat resistance, play a pivotal role In the production of these essential construction components. Clay minerals, primarily hydrated silicates, consist of aluminum, quartz, feldspar, mica, kaolinite, montmorillonite, illite, bentonite, chlorite, smectite, and kaolin. These minerals, along with metal oxides, organic dyes, and other additives, contribute to the chemical composition of industrial clays.

- Industrial clays are utilized in various applications, including ceramics for bricks, tiles, pottery, and ceramic products; rubber for manufacturing; paints for color and texture; catalysts for chemical reactions; cement for binding; refractories for high-temperature applications; and paper manufacturing for clay cement 1. Additionally, industrial clays are used in 3D printing, concrete, fireplaces, boilers, glass fusing, ceramic furnaces, heat generators, power plants, and fireproof buildings. The economic impact of industrial clays is substantial, with significant domestic output and exports. The manufacturing unit process involves the use of limestone calcined clay, which undergoes various treatments and processing methods to enhance its properties.

What are the market trends shaping the Industrial Clay Industry?

Adoption of new construction materials is the upcoming market trend.

- The market is experiencing significant growth due to the increasing adoption of advanced technologies In the construction industry. New materials, such as durable and high-performance clays, mineral additives, and volcanic tuff, are being developed for use in construction sites. These innovations are driven by technological advancements In their production processes. As the industry shifts towards more automated manufacturing methods, there is a growing need for efficient and comprehensive supply chain management to mitigate product liability risks for construction companies. Nanotechnology is playing a pivotal role In the development of clay-based goods, driving market growth. Industrial clays, including clay minerals like hydrated silicates, aluminum, quartz, feldspar, mica, kaolinite, montmorillonite, illite, bentonite, chlorite, smectite, and kaolin, are integral to various manufacturing applications.

- These minerals are used In the production of bricks, tiles, pottery, ceramic products, environmental impact studies, eco-friendly alternatives, ceramics, rubber, paints, catalysts, cement, refractories, and paper manufacturing. Clay's chemical composition, consisting of minerals, metal oxides, and organic dyes, makes it suitable for various applications at high temperatures. Industrial clays are used in 3D printing, concrete, fireplaces, boilers, glass fusing, ceramic furnaces, heat generators, power plants, and fireproof buildings. The economic impact of the market is significant, with domestic output contributing to various sectors, including construction, engineering, purchasing, investment pockets, and infrastructure spending. Foreign companies are also investing In the market due to its vast potential.

What challenges does the Industrial Clay Industry face during its growth?

Volatile raw material prices of industrial clay is a key challenge affecting the industry growth.

- Industrial clay, comprised of clay minerals such as hydrated silicates, aluminum, quartz, feldspar, mica, and various other minerals, plays a significant role in numerous industries, including ceramics, manufacturing applications, and construction. Kaolinite, montmorillonite, illite, and bentonite are essential clay minerals used in ceramics for producing bricks, tiles, pottery, and various ceramic products. Their chemical composition, which includes metal oxides, organic dyes, and minerals like chlorite, smectite, and kaolin, influences their hardness and heat resistance, making them suitable for high-temperature applications in industries like concrete, fireplaces, boilers, glass fusing, and ceramic furnaces. However, the price volatility of these minerals, including kaolin, is a concern due to factors such as political conflicts, shipping expenses, and mining regulations.

- Kaolin, a key ingredient in paper manufacturing, has seen fluctuating prices due to supply interruptions in major producing countries like Brazil and the US. Industrial clays also find applications in sectors like rubber, paints, catalysts, cement, refractories, and even 3D printing. With the increasing focus on sustainability and eco-friendly alternatives, clay cement 1, a type of industrial clay, has gained popularity as a more environmentally friendly alternative to traditional cement. The economic impact of industrial clay is substantial, with significant domestic output and demand in various industries. Infrastructure spending and the construction sector, in particular, are key investment pockets for industrial clay.

Exclusive Customer Landscape

The industrial clay market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial clay market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial clay market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Active Minerals International LLC

- Ashapura Group of Industries

- Bentonite Performance Minerals LLC

- Burgess Pigment Co.

- Clariant AG

- EICL Ltd.

- Imerys S.A.

- iMinerals Inc.

- LASSELSBERGER Group GmbH

- Lhoist SA

- Old Hickory Clay Co.

- Quartz Works GmbH

- SCR Sibelco NV

- US Silica Holdings Inc.

- Wyo Ben Inc.

- Zimco Group Pty Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial clays, a vital category of minerals, encompass a diverse range of hydrated silicates, aluminum silicates, and other minerals such as quartz, feldspar, mica, kaolinite, montmorillonite, illite, bentonite, chlorite, smectite, and sepiolite. These minerals exhibit varying degrees of plasticity, making them indispensable in numerous manufacturing applications. The manufacturing sector utilizes industrial clays In the production of bricks, tiles, pottery, ceramic products, and various other industries. The ceramics industry, in particular, relies heavily on clay minerals for the creation of diverse products, including rubber, paints, catalysts, cement, refractories, and more. Clay minerals, with their unique chemical compositions, are characterized by their minerals and metal oxides, organic dyes, hardness, and ability to withstand high temperatures.

In addition, their versatility extends to various applications, including 3D printing, concrete, fireplaces, boilers, glass fusing, and ceramic furnaces, among others. Industrial clays play a significant role in heat generators, power plants, and fireproof buildings, contributing to the economic impact of the industries that utilize them. Domestic output in this sector is influenced by various factors, including production capacity, efficiency, and infrastructure spending. The demand for industrial clays is driven by the construction sector, engineering projects, and purchasing trends. In recent years, there has been a growing emphasis on operational sustainability and efficiency, leading to an increased interest in eco-friendly alternatives to traditional clay-based products.

Furthermore, bauxite, calcium carbonate, and talc are among the other minerals that find applications in industries that use industrial clays. The quartz/silica and plasticine derivatives of clay minerals are also gaining popularity in various manufacturing processes. The market for industrial clays is diverse and dynamic, with numerous players, both domestic and foreign, vying for a share. Prices for industrial clays can fluctuate based on various factors, including supply and demand, production costs, and market trends. The use of industrial clays extends beyond traditional applications, with emerging technologies such as bioceramics and sustainable supply chains gaining traction. These developments are expected to shape the future of the industrial clays market, as the industry continues to evolve and adapt to changing market dynamics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.93% |

|

Market growth 2024-2028 |

USD 2.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.85 |

|

Key countries |

China, France, US, Brazil, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Clay Market Research and Growth Report?

- CAGR of the Industrial Clay industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial clay market growth of industry companies

We can help! Our analysts can customize this industrial clay market research report to meet your requirements.