Industrial Sensors Market Size 2024-2028

The industrial sensors market size is forecast to increase by USD 14.3 billion at a CAGR of 9.44% between 2023 and 2028.

- The industrial sensors market is driven by the rise in demand for smart factories and the Industrial Internet of Things (IIoT), which require advanced sensing technologies for automation and real-time data collection. An emerging trend in the market is the increasing demand for sensors for remote monitoring.

- As industries move towards more automated and flexible operations, there is a growing need for sensors that can provide remote, real-time data on machinery, equipment, and environmental conditions to improve efficiency and safety. Sensors play a crucial role in these applications by enabling real-time monitoring and data collection. Additionally, the need for remote monitoring and predictive maintenance is leading to increased demand for sensors.

What will be the Size of the Industrial Sensors Market During the Forecast Period?

- The market is experiencing significant growth, driven by the increasing adoption of Internet of Things (IoT) technology and the demand for real-time data in various industries. Transparency and efficiency are key priorities for businesses seeking to improve profitability through predictive maintenance and automated machinery. Sensors play a crucial role in this trend, enabling condition monitoring of operational equipment and facilitating machine uptime. A diverse range of sensors are utilized in industrial applications, including level sensors, pressure sensors, image sensors, and various electronic devices. These sensors employ advanced technologies such as machine learning algorithms, platinum sensors, and IPX8 waterproofing. The market for industrial sensors is vast, encompassing various sectors and applications, from semiconductor manufacturing to storage corporations.

- Sensing technology continues to evolve, with innovations in CMOS image sensors and the development of cost-effective facilities for mass production. The integration of IoT and advanced analytics enables more sophisticated data collection and analysis, enhancing the overall value proposition of industrial sensors. The market is expected to continue its upward trajectory, fueled by the ongoing digital transformation and the increasing importance of data-driven decision-making in industrial communities.

How is this Industrial Sensors Industry segmented and which is the largest segment?

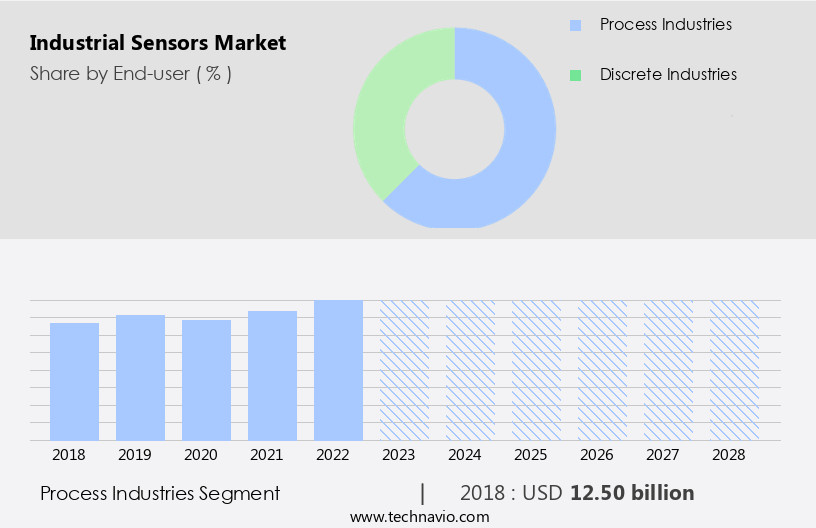

The industrial sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Process industries

- Discrete industries

- Product

- Pressure

- Temperature

- Proximity

- Flow

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The process industries segment is estimated to witness significant growth during the forecast period.

Industrial sensors play a crucial role in process industries, including oil and gas, food and beverage, pharmaceuticals and healthcare, and water and wastewater treatment. In the oil and gas sector, sensors facilitate effective supply chain management, production optimization, and quality control, while ensuring minimal environmental impact. The integration of renewable energy sources and fossil fuels is a priority for industry players, making sensors essential for monitoring and managing energy production. Industrial sensors are utilized in process equipment, control units, storage management, logistics, and terminal automation. Real-time data generated from these sensors enhances operational efficiency, profitability, and predictive maintenance capabilities.

Machine learning algorithms and automated machinery enable condition monitoring, level sensors, pressure sensors, and temperature sensors provide precise process control and quality control. Infrastructure development in smart cities, renewable energy, and legacy machinery also benefits from the implementation of industrial sensors. Industrial sensors are integral to factory automation, enhancing machine uptime, industrial automation, and sensing technology. Data collection on manufacturing floors enables cost-effective facilities and improved industrial communities. Advanced software and connected devices enable remote sensing, monitoring capabilities, material sorting, inventory counting, and real-time pictures for quality inspection. Wireless connectivity and robotics further expand the capabilities of industrial sensors, facilitating liquid pressure measurement, monitoring vacuum pumps, and industrial process control.

Get a glance at the Industrial Sensors Industry report of share of various segments Request Free Sample

The Process industries segment was valued at USD 12.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to government initiatives, increasing automobile manufacturing, and the robust manufacturing sector. Key contributors to the global market include China, India, Japan, and South Korea. To address challenges such as outdated equipment, production instability, and reliance on manual labor, manufacturers are adopting automation. Countries like Japan, China, Taiwan, South Korea, Singapore, Thailand, Vietnam, and the Philippines are leading this trend, focusing on efficient processes for cleanliness and environmental control. Industrial sensors play a crucial role in various applications, including real-time data collection, transparency, predictive maintenance, and profitability. Technologies such as machine learning algorithms, pressure sensors, level sensors, process control, quality control, and image sensors are essential for advanced automation systems and industrial processes.

Additionally, infrastructure development in smart cities, renewable energy, and legacy machinery are further driving market growth. Wireless autonomous sensors, temperature sensors, motion sensors, and flow sensors are integral components of industrial automation, enabling machine uptime, cost-effective facilities, and improved productivity.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Sensors Industry?

Rise in demand for smart factories and IIoT is the key driver of the market.

- The market is experiencing significant growth due to the increasing adoption of the Internet of Things (IoT) in factories worldwide. This trend is driven by the need for transparency, efficiency, and profitability in industrial processes. Industrial sensors play a crucial role in this transformation by providing real-time data for predictive maintenance, machine learning algorithms, and condition monitoring. These sensors are used in various applications, including level sensors, pressure sensors, image sensors, and motion sensors, among others. They enable automated machinery to perform tasks such as liquid pressure measurement, monitoring vacuum pumps, and detecting gas leakages. Additionally, sensors are used in quality control, process control, and inventory counting, ensuring machine uptime and optimizing operational equipment.

- Infrastructure development in sectors such as smart cities, renewable energy, and legacy machinery also contributes to the market's growth. The integration of advanced automation systems, digital technologies, and connected devices enhances monitoring capabilities and improves productivity. Wireless connectivity and robotics applications further expand the market's scope. Overall, the market is expected to continue its growth trajectory, providing valuable insights and optimizing industrial processes.

What are the market trends shaping the Industrial Sensors Industry?

Increasing demand for sensors for remote monitoring is the upcoming market trend.

- The market is experiencing significant growth due to the increasing adoption of Internet of Things (IoT) technology in various industries. Real-time data transparency, efficiency, profitability, and predictive maintenance are key drivers for this market. Machine learning algorithms and automated machinery are revolutionizing condition monitoring, level sensors, process control, and quality control. Infrastructure development in sectors such as smart cities, renewable energy, and industrial communities is also fueling the demand for advanced sensing technology. Legacy machinery in industries like manufacturing, factory automation, and operational equipment management can benefit from the integration of sensors for machine uptime improvement and industrial process optimization.

- Pressure sensors, image sensors, and electronic devices are essential components in various applications, including liquid pressure measurement, monitoring vacuum pumps, and temperature sensing. Sensor technology plays a crucial role in monitoring potential anomalies and optimizing machine performance. Wireless autonomous sensors from companies like Hiber BV and Viezo enable remote sensing and monitoring capabilities for various industries. Predictive maintenance and high-accuracy asset tracking using advanced software and smart sensors are essential for reducing facility stoppages, false detection, and raw material wastage. Connected devices and digital technologies are transforming industrial processes by providing real-time pictures for quality inspection and wireless connectivity for robotics applications.

- Liquid pressure measurement, gas leakages, flammable gases, ethanol, and breathalyzer tests are some of the applications where sensors play a vital role. Flow sensors, motion sensors, and proximity sensors help monitor changes in temperature, movements, and quantity, ensuring cost-effective facilities and increased productivity.

What challenges does the Industrial Sensors Industry face during its growth?

Growing challenges in delivering high quality at low cost is a key challenge affecting the industry growth.

- Industrial sensors play a crucial role in enhancing the efficiency and profitability of industrial processes by providing real-time data for predictive maintenance and condition monitoring. The integration of Internet of Things (IoT) technology in industrial automation systems has led to the development of smart sensors, enabling transparency and improving machine performance. Machine learning algorithms and automated machinery utilize these sensors for level sensing, process control, quality control, and infrastructure development in various sectors such as smart cities, renewable energy, and legacy machinery. Sensor companies face the challenge of balancing cost-effectiveness with technological advancement, as customized sensors for specific industrial applications can be more expensive due to their advanced features.

- However, the falling cost of off-the-shelf sensors has made industrial automation more accessible. Industrial sensors are essential for various applications, including pressure sensors, image sensors, and motion sensors, which monitor changes in temperature, movements, flow rates, and potential anomalies. These sensors are integrated into advanced automation systems to optimize machine uptime, reduce facility stoppages, and improve productivity. Industrial communities, including manufacturers, rely on these sensors for digital technologies, connected devices, and advanced software to ensure high-accuracy asset tracking, material sorting, inventory counting, and quality inspection. Wireless connectivity and robotics applications further enhance the capabilities of industrial sensors, enabling remote sensing and monitoring.

Exclusive Customer Landscape

The industrial sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amkor Technology Inc.

- Amphenol Advanced Sensors

- Analog Devices Inc.

- Broadcom Inc.

- Excelitas Technologies Corp.

- Hamamatsu Photonics KK

- Honeywell International Inc.

- Itron Inc.

- Maxim Integrated Products Inc.

- Motion Solutions

- Murata Manufacturing Co. Ltd.

- NXP Semiconductors NV

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Rockwell Automation Inc.

- ROHM Co. Ltd.

- Sensata Technologies Inc.

- Siemens AG

- STMicroelectronics International N.V.

- TDK Corp.

- TE Connectivity Ltd.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for real-time data and transparency in various industries. The integration of sensors into automated machinery and infrastructure development is leading to increased efficiency and profitability. Predictive maintenance through machine learning algorithms is becoming increasingly popular, allowing for early detection of potential anomalies and reducing downtime. Sensing technology plays a crucial role in various industrial processes, from condition monitoring in manufacturing floors to quality control in production lines. Level sensors, pressure sensors, and temperature sensors are essential components in ensuring optimal machine performance and preventing facility stoppages and slowdowns.

The use of advanced automation systems and digital technologies in industrial processes is driving the demand for cost-effective facilities and smart sensors. Smart sensors enable remote sensing and monitoring capabilities, providing real-time pictures for quality inspection and inventory counting. The integration of sensors into industrial communities, such as smart cities and renewable energy, is also on the rise. Wireless autonomous sensors are being used to monitor gas leakages, flammable gases, and changes in temperature in various applications. Motion sensors are used for material sorting and root error detection in various industrial processes. The use of sensors is not limited to new machinery but also extends to legacy machinery.

Sensors can be used to monitor the performance of automated machinery and identify potential issues before they become major problems. The use of sensors in industrial processes also extends to robotics applications, where they are used for liquid pressure measurement and monitoring vacuum pumps. The integration of sensors into industrial processes is also leading to the development of advanced software and connected devices. This enables real-time data collection and analysis, allowing for more informed decision-making and improved productivity. The use of sensors in industrial processes is also leading to the development of new applications, such as trace sensors for high-accuracy asset tracking and flow sensors for measuring quantity and flow rate in moving liquids and gases.

In conclusion, the market is experiencing significant growth due to the increasing demand for real-time data and transparency in various industries. The integration of sensors into industrial processes is leading to increased efficiency, profitability, and productivity. The use of sensors is not limited to new machinery but also extends to legacy machinery, and the development of advanced software and connected devices is enabling new applications and improving operational equipment performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.44% |

|

Market growth 2024-2028 |

USD 14.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.37 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Sensors Market Research and Growth Report?

- CAGR of the Industrial Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial sensors market growth of industry companies

We can help! Our analysts can customize this industrial sensors market research report to meet your requirements.