Industrial Vibration Sensor Market Size 2024-2028

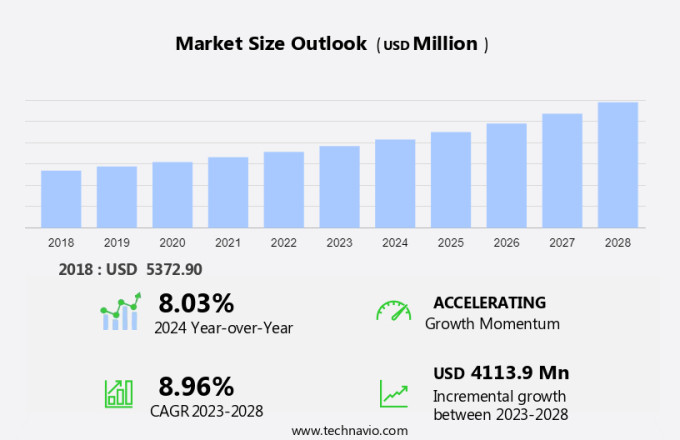

The industrial vibration sensor market size is forecast to increase by USD 4.11 billion at a CAGR of 8.96% between 2023 and 2028. The market is witnessing significant growth due to the increasing need for workplace safety and the adoption of predictive maintenance strategies. Vibration sensors play a crucial role in detecting anomalies in machinery, enabling early identification and prevention of potential failures. Additionally, the market is witnessing innovation in vibration sensors, leading to the development of advanced technologies such as wireless sensors and smart sensors. These sensors offer benefits such as real-time monitoring, increased accuracy, and ease of installation. Furthermore, the availability of other vibration-measuring devices, such as accelerometers and proximity probes, is driving market growth. However, challenges such as high initial investment costs and the need for skilled personnel to install and interpret sensor data may hinder market growth. Despite these challenges, the market is expected to grow steadily due to the increasing demand for reliable and accurate vibration monitoring solutions in various industries.

The market is experiencing significant growth due to the increasing adoption of industrial automation and the integration of predictive maintenance solutions. Vibration sensors play a crucial role in condition monitoring solutions for various industries, including automotive, aerospace and defense, and robotic machinery. The market can be segmented into accelerometers, displacement sensors, and piezoresistive sensors based on technology. Accelerometers are widely used in high-speed operations due to their ability to measure the acceleration of motion. Displacement sensors, on the other hand, measure the displacement or position of an object. Piezoresistive sensors are known for their temperature stability, resolution, and mechanical strength, making them suitable for various industrial applications.

Furthermore, the automobile segment is a significant contributor to the vibration sensor market, with the increasing use of AI, IoT, and telematics in vehicles. Microelectromechanical systems (MEMS) are gaining popularity due to their simple installation and cost-effectiveness. Vibration sensors are also used in simple installation applications, such as automobile engine monitoring and condition-based maintenance of machinery. Vibration sensors are essential in industries that require precise condition monitoring, such as robotics and aerospace and defense, where even minor vibrations can cause significant damage. STMicroelectronics is one of the leading manufacturers of vibration sensors, providing high-performance solutions for various applications.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for 2024-2028 and historical data from 2018 - 2022 for the following segments.

- End-user

- Process industries

- Discrete industries

- Product

- Acceleration sensor

- Displacement sensor

- Velocity sensor

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

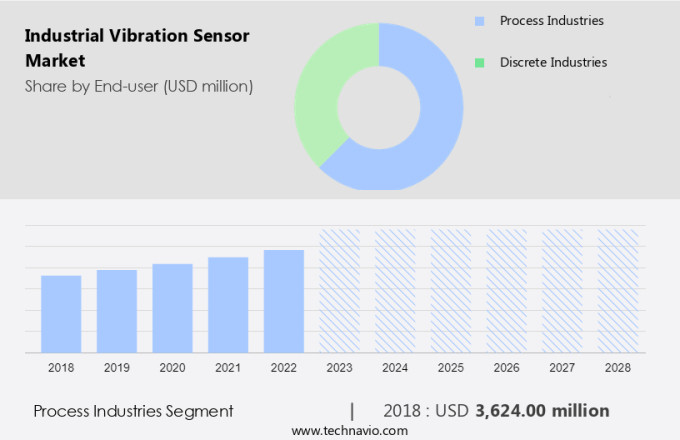

The process industries segment is estimated to witness significant growth during the forecast period. The vibration sensor market plays a significant role in industrial automation, particularly in predictive maintenance solutions. The market consists of various segments, including accelerometers, displacement sensors, and piezoresistive sensors. The accelerometers segment dominates the market due to its high accuracy and ability to measure vibrations in high-speed operations. SMEs and large enterprises in the automobile, aerospace and defense sectors increasingly adopt vibration sensors for condition monitoring solutions. Advancements in technology have led to the development of microelectromechanical systems (MEMS) and self-diagnostic sensors, enabling simple installation and wireless connectivity. AI and IoT technologies have further enhanced the capabilities of vibration sensors, allowing for real-time data analysis and machine learning algorithms.

Furthermore, stringent safety regulations in industries such as automotive applications necessitate the use of vibration sensors for contactless monitoring. Vibration sensors are also used in robotics machinery, telemetrics infotainment systems, and inertial measurement units in self-driving cars, tablets, and smartphones. The COVID-19 pandemic has impacted the demand for vibration sensors in process industries, including oil and gas, food and beverage, pharmaceuticals, and power, due to reduced operational capacity. However, the market is expected to recover as industries resume normal operations and invest in advanced technologies for improved efficiency and safety. Key players in the market offer temperature-stable, high-resolution, and mechanically strength vibration sensors for various applications. Other notable developments include the use of doped silicon sensors for high sensitivity and Doppler radar for non-contact vibration measurement.

Get a glance at the market share of various segments Request Free Sample

The process industries segment was valued at USD 3.62 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

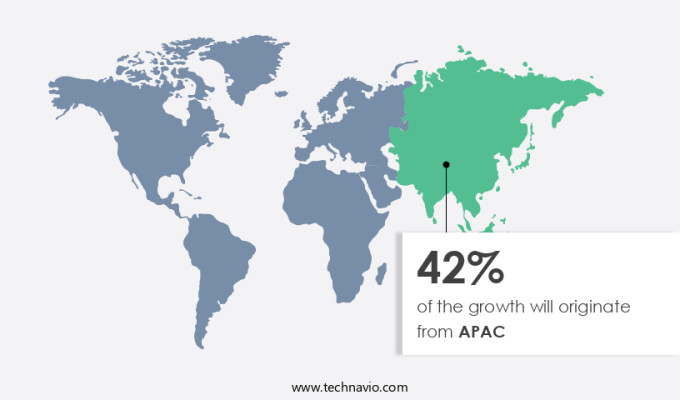

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is experiencing significant growth due to the increasing adoption of advanced technologies in various sectors. Angular rate and gravity sensors are crucial components in electronic stability control systems and lane-keeping assistance features in autonomous vehicles. Vibration sensor manufacturers are leveraging technologies such as quartz, doped silicon, and piezoelectric ceramics to produce high-precision sensors for the automotive sector and railway networks. In addition, the use of tri-axial accelerometers in rail asset management and automation is driving market demand. Fracking operations and medical personnel also rely on vibration sensors for intravascular blood pressure monitoring and velocity and displacement sensing, respectively. These applications underscore the versatility and importance of industrial vibration sensors in diverse industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Industrial Vibration Sensor Market Driver

The growing need for workplace safety is the key driver of the market. The market is experiencing significant growth due to the increasing prioritization of industrial automation and predictive maintenance solutions in various industries. The market is segmented into Accelerometers, Displacement sensors, and Piezoresistive sensors. The Automobile segment is a major consumer of these sensors, with applications in AI and IoT-based condition monitoring solutions, microelectromechanical systems, and wireless sensors. SMEs and large enterprises alike are adopting these technologies to ensure machine performance and prevent potential accidents. Strict safety regulations, such as those set by ANSI, ISO, and the European Commission, necessitate the use of industrial vibration sensors in robotic machinery and high-speed operations.

Furthermore, companies in the automotive, aerospace, and defense sectors are integrating these sensors into their offerings, from Inertial Measurement Units in self-driving cars to Doppler radar in spacecraft and aircraft. Microelectromechanical systems, machine learning algorithms, and silicon chips are essential components of advanced vibration sensors. Simple installation and strength are crucial factors driving the market's growth. Temperature stability, resolution, and mechanical strength are essential features of these sensors, making them suitable for various applications, from tablets and smartphones to heavy machinery and construction equipment.

Industrial Vibration Sensor Market Trends

The growing innovation in vibration sensors is the upcoming trend in the market. The vibration sensor market is experiencing significant growth due to the increasing adoption of industrial automation and the implementation of predictive maintenance solutions. Sensors play a crucial role in various industries such as electric power, oil and gas, iron and steel, petrochemicals, pulp and paper, pharmaceuticals, chemicals, food, water supply and wastewater treatment, and metal. Advanced sensing technology, including accelerometers, displacement sensors, and piezoresistive sensors, is being utilized to enhance process efficiency and reliability. In the automobile segment, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in condition monitoring solutions is driving the demand for vibration sensors.

Moreover, microelectromechanical systems (MEMS) and self-powered sensors are gaining popularity due to their simple installation and mechanical strength. SMEs are also adopting these sensors to comply with stringent safety regulations and improve operational efficiency. Innovative vibration sensors are being developed using advanced technologies such as doped silicon sensors, wireless sensors, and contactless vibration sensors based on microelectromechanical systems, piezoelectric, and accelerometers. These sensors are being used in various applications, including robotic machinery, high-speed operations, and automotive applications such as inertial measurement units, telematics infotainment, and self-driving cars. Additionally, vibration sensors are being used in aerospace and defense, spacecraft, aircraft, tablets, and smartphones, further expanding their market reach.

Furthermore, vibration sensors are being designed to meet the demands of various industries, with features such as high-temperature stability, resolution, and mechanical strength. STMicroelectronics, among others, is a leading manufacturer of vibration sensors that cater to diverse applications. The future of vibration sensors lies in the integration of advanced technologies such as machine learning algorithms, Doppler radar, and silicon chips to improve their performance and functionality.

Industrial Vibration Sensor Market Challenge

The availability of other vibration measuring devices is a key challenge affecting the market growth. The vibration sensor market plays a significant role in industrial automation, particularly in predictive maintenance solutions. Vibration sensors, including accelerometers, displacement sensors, and piezoresistive sensors, are essential for monitoring machine health and preventing potential failures. The accelerometers segment dominates the market due to its ability to measure acceleration in various directions. SMEs and large industries alike utilize these sensors in automobile manufacturing, robotics, and high-speed operations. Advancements in technology have led to the development of contactless vibration sensors, microelectromechanical systems, and AI-powered condition monitoring solutions. IoT and wireless vibration sensors enable real-time data transmission, while machine learning algorithms facilitate predictive analysis.

Furthermore, doped silicon sensors offer temperature stability, resolution, and mechanical strength, making them suitable for automotive applications and telematics infotainment systems. Stringent safety regulations in industries such as aerospace and defense, automobile, and automotive applications necessitate the use of vibration sensors. STMicroelectronics and other leading manufacturers provide advanced sensors, ensuring high-performance and reliability. Inertial Measurement Units (IMUs) using silicon chips and Doppler radar are integral components in self-driving cars, tablets, smartphones, and spacecraft. Despite the benefits, the adoption of industrial vibration sensors faces competition from alternative measuring devices like sensor tags, which offer simplicity in installation and cost-effectiveness. These wireless sensors connect machines to smart devices, providing real-time data on motion, vibration, and other parameters. However, the precision and reliability offered by industrial vibration sensors remain unmatched, ensuring their continued relevance in various industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB SKF - The company offers industrial vibration sensors that deliver adequate measurement and physical characteristics for condition monitoring programs, where data is trended for change and absolute precision is important.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- ABB Ltd.

- Analog Devices Inc.

- CEC Vibration Products

- Electro Sensors Inc.

- Hansford Sensors Ltd.

- Hofmann Mess und Auswuchttechnik GmbH and Co. KG

- ifm electronic gmbh

- Metra measurement and frequency technology in Radebeul eK

- Monitran Ltd.

- Montronix GmbH

- Murata Manufacturing Co. Ltd.

- OMRON Corp.

- PCB Piezotronics Inc.

- ROGA Instruments

- Safran SA

- Schaeffler AG

- Sensonics Ltd.

- StrainSense Ltd.

- TE Connectivity Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing adoption in industrial automation and predictive maintenance solutions. Vibration sensors play a crucial role in condition monitoring solutions, enabling early detection of machine failures and reducing downtime. The market can be segmented into accelerometers, displacement sensors, and piezoresistive sensors. The accelerometers segment holds a major share in the market, owing to their high sensitivity and ability to measure vibrations in multiple axes. The displacement sensors segment is expected to grow at a steady pace due to their simple installation and application in robotic machinery and high-speed operations. The piezoresistive sensors segment is also gaining popularity due to its microelectromechanical systems (MEMS) technology, which offers advantages such as temperature stability, resolution, and mechanical capability.

Furthermore, the automobile segment is a significant end-user industry, with the increasing use of vibration sensors in automotive applications, telematics infotainment, self-driving cars, and AI-powered systems. The IoT and AI technologies are driving market growth, enabling wireless vibration sensors and contactless vibration sensors. The market also caters to industries such as aerospace and defense, automobile, and SMEs. Stringent safety regulations in various industries are also fueling the demand for vibration sensors with doped silicon sensors and doppler radar technology. Silicon chips are widely used in manufacturing vibration sensors due to their small size, high performance, and low power consumption. Vibration sensors are used in various applications such as inertial measurement units, tablets, smartphones, and spacecraft. The future of the market lies in the development of advanced vibration sensors with improved performance and cost-effectiveness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.96% |

|

Market Growth 2024-2028 |

USD 4.11 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.03 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB SKF, ABB Ltd., Analog Devices Inc., CEC Vibration Products, Electro Sensors Inc., Hansford Sensors Ltd., Hofmann Mess und Auswuchttechnik GmbH and Co. KG, ifm electronic gmbh, Metra measurement and frequency technology in Radebeul eK, Monitran Ltd., Montronix GmbH, Murata Manufacturing Co. Ltd., OMRON Corp., PCB Piezotronics Inc., ROGA Instruments, Safran SA, Schaeffler AG, Sensonics Ltd., StrainSense Ltd., and TE Connectivity Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch