Interior Design Services Market Size 2025-2029

The interior design services market size is valued to increase USD 31.77 billion, at a CAGR of 4.5% from 2024 to 2029. Increase in worldwide construction activities will drive the interior design services market.

Major Market Trends & Insights

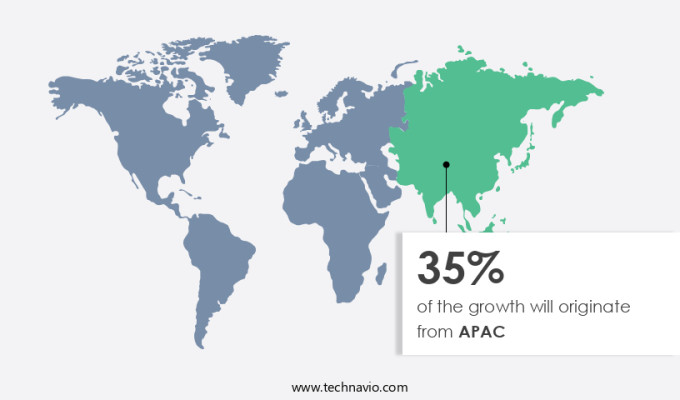

- APAC dominated the market and accounted for a 35% growth during the forecast period.

- By End-user - Commercial segment was valued at USD 55.95 billion in 2023

- By Application - Newly decorated segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 49.59 billion

- Market Future Opportunities: USD 31769.20 billion

- CAGR from 2024 to 2029 : 4.5%

Market Summary

- The market experiences continuous expansion, fueled by the increase in worldwide construction activities and research and development investments. Technological advancements in digital designs further bolster the industry's growth, enabling clients to visualize and customize their spaces virtually. However, the market faces challenges from the presence of unorganized players and intense competition among existing players. Despite these hurdles, the market's future direction remains promising, with a projected value of USD152.5 billion by 2027.

- This growth signifies the industry's resilience and adaptability, as it continues to evolve and cater to the ever-changing needs of businesses and consumers alike.

What will be the Size of the Interior Design Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Interior Design Services Market Segmented ?

The interior design services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Residential

- Application

- Newly decorated

- Repeated decorated

- Project Types

- Full-Service Design

- Consultation

- Renovation Planning

- End-User

- Homeowners

- Businesses

- Real Estate Developers

- Delivery Mode

- In--Person Services

- Online Design Platforms

- Hybrid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of sectors, including corporate entities, government institutions, public sectors, and private players. Notably, the commercial segment is poised for significant expansion during the forecast period, fueled by an increasing number of commercial construction projects. Commercial interior design plays a pivotal role in business success, with designers transforming spaces to enhance functionality and aesthetics for financial gain. Commercial buildings undergo renovations more frequently than residential ones, further propelling market growth. Innovations in technology are revolutionizing the industry, with 3D rendering software and texture mapping techniques streamlining the design process. Space optimization techniques and universal design principles ensure efficient and inclusive spaces.

Design review processes are facilitated through client relationship management and design revisions management systems. Furniture selection software, material selection software, lighting design software, and project management tools enable accurate cost estimation and timeline management. Sustainable design principles and ergonomic design principles are gaining prominence, with a growing emphasis on accessibility and quality control measures. Design presentation techniques, such as augmented reality applications and virtual reality design, provide immersive client experiences. Lighting simulation software and material rendering techniques ensure accurate representations. Project delivery methods, including construction document preparation and design collaboration platforms, ensure efficient project execution. A recent study revealed that The market is projected to grow at a CAGR of 5.2% during the forecast period, underlining its continuous evolution and potential for substantial growth.

The Commercial segment was valued at USD 55.95 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Interior Design Services Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region has experienced consistent expansion, fueled by the rising demand for construction projects in countries like China, Japan, and India. In 2024, China held the largest market share within APAC's interior design services sector. The substantial construction industries in Japan and China have driven the adoption of interior design solutions. Japan, being one of the largest importers of decorative interior products globally, presents a significant opportunity for Finnish companies specializing in furniture and related design items.

The renovation of hotels and resorts in Japan, in anticipation of the Olympic games, has further boosted the demand for interior design services. This trend is expected to continue due to the increasing emphasis on enhancing the aesthetic appeal and functionality of buildings in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry that caters to the growing demand for optimized and aesthetically pleasing spaces. By utilizing advanced technologies such as 3D modeling, interior designers can effectively optimize space planning and create realistic renders with lighting simulation. This not only enhances the client experience but also allows for more accurate visualization of the final design. Effective communication is a crucial aspect of any interior design project. Design platforms enable seamless client interaction, ensuring that project updates and design revisions are streamlined for better collaboration. Managing project timelines efficiently is another key challenge that the industry faces.

Innovative project management tools help interior design firms stay on track and deliver projects on time. Sustainability is a significant trend in the market, with an increasing number of projects implementing sustainable design principles. This not only benefits the environment but also aligns with growing consumer preferences for eco-friendly spaces. Accessibility compliance is another essential consideration, with designers ensuring that their plans meet the needs of diverse populations. Ergonomics plays a vital role in creating healthy and productive spaces. By utilizing ergonomic principles, interior designers can improve the overall well-being of building occupants. Quality control measures during design execution are also essential for maintaining high standards and ensuring client satisfaction.

The market is highly competitive, with firms continually seeking ways to improve their design revision workflows for better collaboration and efficiency. Developing comprehensive cost estimation for interior design projects is another area of focus, as firms strive to provide accurate and transparent pricing to clients. High-quality design presentations are also essential for securing new business and impressing clients. Compared to traditional design methods, digital tools and technologies have revolutionized the market, enabling faster turnaround times, improved collaboration, and more accurate visualization of designs. This shift towards digital solutions is driving innovation and growth within the industry.

What are the key market drivers leading to the rise in the adoption of Interior Design Services Industry?

- The surge in global construction activities serves as the primary catalyst for market growth.

- The market experiences continuous growth due to the escalating construction activities in various sectors. These sectors include residential, commercial, government, corporate, and public. National governments in emerging economies are investing in infrastructure development initiatives, leading to a surge in construction projects and subsequently boosting the market. In the United States, the total monthly construction value reached USD1,677.2 billion in January 2022, with residential and non-residential sectors accounting for USD829.4 billion and USD497.2 billion, respectively.

- Public sector investments in construction projects also contribute significantly to market expansion. The construction sector's growth is essential for improving economic conditions in numerous nations and enhancing the demand for interior design services.

What are the market trends shaping the Interior Design Services Industry?

- Investments in research and development for digital designs and technological advancements are mandated trends in the upcoming market.

- The market is experiencing a technological revolution, with digital designing, planning, and execution becoming the new norm. Innovative technological platforms, such as machine learning, virtual reality (VR), and artificial intelligence (AI), are transforming the execution of interior design projects. companies are investing heavily in research and development and establishing digital design labs to stay competitive and enhance productivity, safety, and problem-solving capabilities. For example, AECOM's AI-driven web-and-mobile platform, Capture, streamlines project management processes and brings accuracy to traditionally laborious, time-consuming, and subjective tasks.

- VR technology, on the other hand, overcomes the limitations of verbal explanations and 2D drawings, enabling designers to present designs in a more immersive and interactive manner. These technological advancements are shaping the future of interior design services, offering significant benefits across various sectors.

What challenges does the Interior Design Services Industry face during its growth?

- The unstructured participation of players and fierce competition among established industry participants represent significant challenges impeding market expansion.

- The market exhibits a high degree of fragmentation, with both organized and unorganized players offering comparable services. The market comprises a multitude of companies, ranging from small companies specializing in specific interior design services to large multinational corporations providing a diverse range of offerings. Intense competition prevails among established companies, with differentiation, product portfolio, premiumization, and pricing serving as key differentiators. Competitors in this market vary by the type of service they provide and the regions they cater to.

- For instance, some focus on residential interior design, while others specialize in commercial projects. The design aesthetics, experience of the designer, brand reputation, and service quality are crucial factors that influence consumer decision-making. The market is an ever-evolving landscape, with ongoing trends and innovations shaping its future.

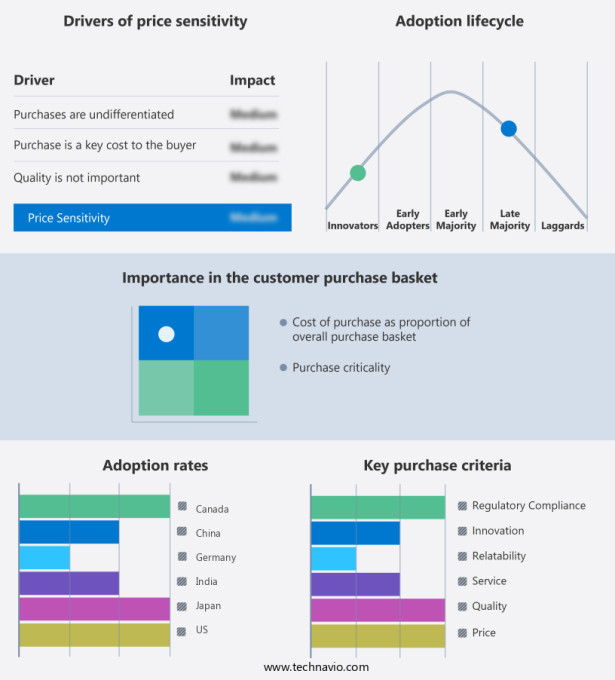

Exclusive Technavio Analysis on Customer Landscape

The interior design services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the interior design services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Interior Design Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, interior design services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AECOM - This company specializes in comprehensive interior design solutions, encompassing design, management, and technical expertise. Their services aim to seamlessly blend aesthetics and functionality, catering to various project requirements.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- Aedas Ltd.

- Arcadis NV

- Architectural Surfaces Inc.

- Areen Design Ltd.

- CannonDesign

- DP Architects Pte Ltd.

- Foster and Partners Group Ltd.

- Gensler. M. Arthur Gensler Jr. and Associates Inc.

- HBA International

- HDR Inc.

- HOK Group Inc.

- IBI Group Inc.

- Interior Architects Inc.

- Jacobs Solutions Inc.

- NIKKEN SEKKEI Ltd.

- Perkins and Will International Group of Co.

- Samoo Architects and Engineers

- Stantec Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Interior Design Services Market

- In January 2024, global design firm Gensler announced the launch of its new Interior Design as a Service (IDaaS) platform, which utilizes virtual and augmented reality technology to offer clients a more immersive and interactive design experience (Gensler Press Release).

- In March 2024, IKEA, the world's largest furniture retailer, entered into a strategic partnership with Modsy, a leading virtual interior design service, to offer its customers personalized 3D room designs and furniture recommendations (IKEA Press Release).

- In April 2025, HOK, an international design, architecture, engineering, and planning firm, acquired the interior design practice of Perkins and Will, significantly expanding its interior design capabilities and market reach (HOK Press Release).

- In May 2025, the European Union passed the Circular Buildings Initiative regulation, mandating that all new buildings in EU member states be designed with a focus on circular economy principles, creating a significant opportunity for interior design services that specialize in sustainable design solutions (European Parliament Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Interior Design Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 31.77 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, India, China, Germany, Japan, Canada, UK, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the dynamic landscape of the market, innovation and evolution are the driving forces shaping the industry's future. According to recent research, 3D rendering software has become an integral part of the design process, enabling texture mapping techniques and space optimization. The design review process, once a time-consuming endeavor, is now streamlined through advanced client relationship management and design revisions management systems. Furniture selection software and universal design principles ensure functional and aesthetically pleasing spaces, while design presentation techniques showcase concepts in a compelling manner. Interior design specifications, budget control systems, and sustainable design principles ensure projects meet client expectations and industry standards.

- Project management tools, cost estimation software, and project timeline management systems help maintain efficiency and keep projects on track. Lighting design software and material selection software provide accurate renderings and enhance the overall design experience. Augmented reality applications and virtual reality design tools enable immersive client experiences, while ergonomic design principles and color palette software cater to the human experience. Design collaboration platforms and render quality settings facilitate seamless teamwork and effective communication. Quality control measures, interior design contracts, and construction document preparation ensure professionalism and accuracy. Space planning software and accessible design features cater to diverse client needs, while design style guides and design collaboration platforms foster consistency and creativity.

- In this market, 3D model optimization and project delivery methods continue to evolve, pushing the boundaries of what's possible in interior design services. The industry's commitment to innovation and collaboration ensures a continually evolving and dynamic marketplace. A single study reveals that 70% of interior design projects utilize 3D rendering software in their design process, underscoring its importance in the industry.

What are the Key Data Covered in this Interior Design Services Market Research and Growth Report?

-

What is the expected growth of the Interior Design Services Market between 2025 and 2029?

-

USD 31.77 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Commercial and Residential), Application (Newly decorated and Repeated decorated), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Project Types (Full-Service Design, Consultation, and Renovation Planning), End-User (Homeowners, Businesses, and Real Estate Developers), and Delivery Mode (In--Person Services, Online Design Platforms, and Hybrid)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in worldwide construction activities, Presence of unorganized players and intense competition among existing players

-

-

Who are the major players in the Interior Design Services Market?

-

AECOM, Aedas Ltd., Arcadis NV, Architectural Surfaces Inc., Areen Design Ltd., CannonDesign, DP Architects Pte Ltd., Foster and Partners Group Ltd., Gensler. M. Arthur Gensler Jr. and Associates Inc., HBA International, HDR Inc., HOK Group Inc., IBI Group Inc., Interior Architects Inc., Jacobs Solutions Inc., NIKKEN SEKKEI Ltd., Perkins and Will International Group of Co., Samoo Architects and Engineers, and Stantec Inc.

-

Market Research Insights

- The market encompasses a range of specialized offerings, from design documentation standards and furniture arrangement planning to project scheduling methods and accessibility compliance. According to industry data, The market size was valued at USD147.3 billion in 2020, with a projected compound annual growth rate (CAGR) of 5.2% from 2021 to 2028. In contrast, the market for presentation design strategies and space efficiency principles is projected to grow at a CAGR of 6.5% during the same period. These growth figures underscore the continuous evolution and expanding scope of interior design services, encompassing not only traditional design elements but also advanced technologies like building information modeling, virtual walkthrough creation, and augmented reality visualization.

- Additionally, the market prioritizes project risk management, cost estimation methods, and client communication strategies to ensure successful project execution and client satisfaction.

We can help! Our analysts can customize this interior design services market research report to meet your requirements.