Intermediate Bulk Container Market Size 2025-2029

The intermediate bulk container market size is forecast to increase by USD 4.12 billion, at a CAGR of 4.8% between 2024 and 2029. The construction industry's substantial requirement for intermediate bulk containers serves as the primary market driver.

- The Intermediate Bulk Container (IBC) market is experiencing significant growth, driven primarily by the increasing demand from the construction industry for efficient material handling solutions. This sector's revival, following a period of stagnation, is fueling the market's expansion. However, the market's trajectory is not without challenges. The volatility of raw material prices poses a significant obstacle for manufacturers, as they strive to maintain profitability amidst price fluctuations. These price swings can impact the entire value chain, from production to distribution, and necessitate strategic planning and agility from market participants.

- The intermediate bulk container (IBC) market continues to evolve, driven by the diverse needs of various sectors, including bulk liquid transport and hazardous material transport. IBCs, with their flexibility and versatility, have become an essential component in material handling and logistics operations. Compliance with regulatory requirements, such as IBC regulatory compliance and IBC design standards, plays a significant role in the market's dynamics. For instance, IBCs must adhere to container safety features, including leak detection systems, pressure relief valves, and ventilation systems, to ensure safe transport and handling. IBC design standards also focus on material compatibility, with material compatibility charts guiding the selection of suitable liners and containers for specific applications.

- To capitalize on the market's opportunities and navigate these challenges effectively, companies must focus on operational efficiency, price competitiveness, and the development of innovative solutions that cater to the evolving needs of their customers. By addressing these factors, market players can position themselves for long-term success in the dynamic IBC market.

Major Market Trends & Insights

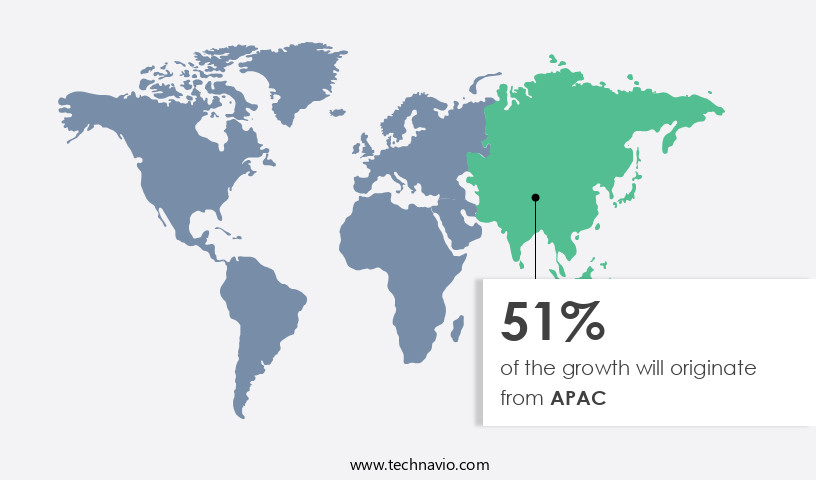

- APAC dominated the market and accounted for a 51% during the forecast period.

- The market is expected to grow significantly in North America Region as well over the forecast period.

- The Chemical segment was valued at USD 4.87 billion in 2023

- Based on the Flexible IBC Segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 44.10 million

- Future Opportunities: USD 4.12 billion

- CAGR : 4.8%

- APAC: Largest market in 2023

What will be the Size of the Intermediate Bulk Container Market during the forecast period?

Understand material preferences, capacity trends, and sustainability factors influencing IBC adoption Request Free Sample

- The intermediate bulk container (IBC) market continues to evolve as industries prioritize efficient bulk storage and transport solutions for liquids, semi-solids, and hazardous materials. Demand is driven by chemical, pharmaceutical, and food & beverage applications, where regulatory compliance and operational safety are critical. Manufacturers are introducing high-density polyethylene (HDPE) and composite IBCs with enhanced durability, stackability, and reusability, aligning with trends in circular economy and sustainable packaging.

- Companies are also integrating tracking technologies and RFID tags, enabling better fleet visibility through IoT-enabled logistics, which ties into the broader Smart Packaging Market and IoT in Supply Chain Market. Recent procurement data shows a 10% increase in demand for reconditioned IBCs as businesses shift toward cost-efficient and eco-friendly models; overall industry consumption is expected to grow by approximately 12% over the next cycle. These developments also intersect with the Industrial Packaging Market and Hazardous Materials Packaging Market, where compliance and safety regulations remain key differentiators. Furthermore, the adoption of anti-static coatings, tamper-proof seals, and automated filling systems positions IBCs as integral components of modern bulk material handling strategies, reinforcing their importance in a rapidly digitizing supply chain ecosystem.

-

IBCs undergo rigorous testing, including stacking stability tests, pressure testing, and filling system evaluations, to ensure optimal performance and longevity. One example of IBC innovation is the implementation of RFID tagging systems, which streamline IBC tracking and management, enhancing material handling optimization and reducing potential errors. According to industry reports, the global IBC market is projected to grow by over 5% annually, driven by increasing demand for efficient and sustainable bulk material handling solutions. In the realm of IBC maintenance schedules, flexible IBC liners and custom IBC sizes cater to the specific needs of various industries, ensuring efficient and cost-effective operations. Container stacking methods and IBC handling equipment further optimize material handling, while IBC cleaning protocols and spill containment solutions maintain the highest level of safety and environmental responsibility. As the market continues to unfold, the focus on container safety features, IBC certification standards, and empty IBC disposal remains paramount. Innovations in IBC design, such as pressure testing, drain valve mechanisms, and temperature ratings, further enhance the market's adaptability and responsiveness to evolving industry demands.

How is this Intermediate Bulk Container Industry segmented?

The intermediate bulk container industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Chemical

- Pharmaceutical

- Food

- Others

- Type

- Flexible IBC

- Rigid IBC

- Capacity

- Up to 500L

- 500-1000L

- Above 1000L

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The chemical segment is estimated to witness significant growth during the forecast period.

The Intermediate Bulk Container (IBC) market is witnessing significant growth due to the increasing demand for efficient and safe transportation of bulk liquids in various industries. IBCs offer several advantages, including regulatory compliance, pallet compatibility, and flexible liner options. For instance, un-rated IBCs are widely used for transporting non-hazardous materials, while those with leak detection systems and pressure relief valves ensure container safety. IBC design standards prioritize material handling optimization, with features such as lifting points, stacking methods, and ventilation systems. These containers are also designed to meet specific temperature ratings and chemical compatibility requirements. IBCs undergo rigorous testing, including pressure testing, stacking stability tests, and certification standards, to ensure optimal performance and safety.

The Chemical segment was valued at USD 4.46 billion in 2019 and showed a gradual increase during the forecast period.

The global IBC market is expected to grow at a steady pace, with industry experts projecting a 5% increase in sales during the forecast period. The market's expansion is driven by the rising demand for efficient and cost-effective bulk liquid transport solutions. For example, IBCs are increasingly used in the chemical industry, where they facilitate the transportation of a wide range of chemicals, from organic to inorganic, with various material compatibility charts. IBCs are also essential in hazardous material transport, with custom sizes and reuse guidelines ensuring safe handling and disposal. The integration of RFID tagging and tracking systems further enhances the market's appeal by enabling real-time monitoring and improved logistics management. With a focus on container safety, design innovation, and material compatibility, the IBC market is poised for continued growth.

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How intermediate bulk container market Demand is Rising in APAC Request Free Sample

The Intermediate Bulk Container (IBC) market in APAC is anticipated to dominate the global landscape due to the region's significant demand. China, a major consumer in APAC, holds a substantial market share. The food industry is a significant contributor to the increasing demand for IBCs in this region. Population growth and urbanization in countries like India and China are driving the consumption of various products, including food, personal care, and consumer goods, thereby boosting the market. IBCs are essential for bulk liquid transport and must adhere to regulatory compliance. They come with safety features such as lifting points, ventilation systems, and pressure relief valves.

Flexible liners and material compatibility charts ensure the safe transport of various chemicals. IBCs are designed to optimize material handling and are certified for empty disposal. IBCs undergo regular maintenance schedules, including pressure testing and stacking stability tests, to maintain their performance. RFID tagging and tracking systems facilitate efficient inventory management. IBCs have temperature ratings, leak detection systems, and drain valve mechanisms to ensure product safety and quality. The IBC market is expected to grow at a steady pace due to the increasing demand for efficient and safe bulk liquid transport solutions. For instance, the food industry's demand for IBCs is projected to increase by 5% annually.

IBCs are available in custom sizes and reusable, making them a cost-effective and eco-friendly solution for various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The intermediate bulk container (IBC) market is a significant sector in the global logistics and supply chain industry, offering versatile and efficient solutions for the transportation, storage, and handling of various bulk materials. IBCs, also known as totes or pallet tanks, are reusable, portable containers designed to hold and transport larger volumes of liquids or powders than drums or bags. Manufacturers and users of IBCs prioritize various factors to optimize their use and maximize value. Structural integrity analysis is crucial to ensure containers maintain their durability and safety during transportation and handling.

Optimizing IBC stacking patterns and selecting appropriate liner materials, based on the guide provided, can help reduce transportation costs and improve handling safety procedures. Environmental concerns are increasingly important in the IBC market. Implementing tracking and management systems and conducting lifecycle assessments of reusable IBCs can help minimize the environmental impact of disposal. Designing IBCs for pallet compatibility, ensuring regulatory compliance, and creating maintenance and repair schedules are essential for efficient IBC transportation and logistics. Best practices for IBC cleaning and sanitization, effective spill containment strategies, and filling and emptying optimization contribute to enhancing the overall performance and longevity of these containers. Improving IBC durability through material selection and advanced leak detection methods are also vital in reducing the footprint of IBCs in storage areas and ensuring ergonomic design. Adhering to these practices and guidelines can lead to significant cost savings, increased safety, and improved sustainability in the IBC market.

What are the key market drivers leading to the rise in the adoption of Intermediate Bulk Container Industry?

- The construction industry's substantial requirement for intermediate bulk containers serves as the primary market driver.

- The global infrastructure development sector is experiencing a surge due to economic growth and improving living standards in both developed and developing economies. In the US, Canada, and several EU countries, construction activities are on the rise as part of a broader effort to enhance existing infrastructure. The construction industry's growth is particularly noticeable in the residential sector, where the number of housing projects completed in the US increased substantially in 2023. The US economy's recovery from the last recession has instilled confidence in home buyers, leading to a surge in demand for new single- and multi-family homes.

- According to industry reports, The market is expected to grow by over 5% annually over the next five years, driven by the increasing demand for efficient and cost-effective logistics solutions in various industries. For instance, the food and beverage sector's growth is fueling the demand for IBCs to transport and store bulk liquids and powders.

What are the market trends shaping the Intermediate Bulk Container Industry?

- The revival in demand for material handling containers represents a notable market trend. This trend reflects the increasing importance of efficient logistics and supply chain management in various industries.

- The market is experiencing significant growth due to the increasing demand for efficient material handling solutions in various industries. The surge in manufacturing sectors, such as heavy machinery and automobile, is driving the need for advanced packaging systems in warehouses and distribution centers. Intermediate bulk containers are increasingly being adopted for handling, storing, and transporting a diverse range of products. These containers offer benefits like reduced labor costs, improved safety, and enhanced product protection. Furthermore, the rising trend of automated warehouse maintenance is creating new opportunities in the global market.

- According to industry reports, the market is projected to expand by over 10% in the upcoming years. A notable example of market growth can be seen in the food and beverage industry, where the use of intermediate bulk containers has led to a 15% increase in production efficiency.

What challenges does the Intermediate Bulk Container Industry face during its growth?

- The volatility of raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain profitability and competitiveness, businesses must effectively manage price fluctuations and mitigate their impact on production costs and overall financial performance.

- Intermediate bulk containers, available in rigid, flexible, and folding forms, are essential for transporting and storing various goods. These containers are manufactured from diverse raw materials, including metal (stainfully steel), plastics, wood, and corrugated fiberboard. Metal containers, particularly stainless steel, are popular for petrochemicals and paint products due to their durability and resistance to corrosion. Steel, a common raw material, experiences price instability due to factors such as fluctuating demand and supply and excess production. Additionally, the price of steel is influenced by external factors like declining oil prices.

- For instance, a 20% decrease in oil prices led to a 15% reduction in steel prices in 2015. The market is projected to grow by over 5% annually, driven by increasing demand for efficient and cost-effective logistics solutions.

Exclusive Customer Landscape

The intermediate bulk container market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the intermediate bulk container market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, intermediate bulk container market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Greif - The DriBulk Container Liners from the company represent an effective, cost-efficient solution for storing, transporting, and shipping dry bulk goods across various industries, including agriculture, minerals, chemicals, and food.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Greif

- Schütz

- Mauser Packaging

- Berry Global

- Hoover Ferguson

- Bulk Lift International

- Thielmann

- Werit

- CLA Containers

- Good Pack

- Schoeller Allibert

- Nier Systems

- TranPak

- IFCO Systems

- Brambles (CHEP)

- Auer Packaging

- Time Technoplast

- Pyramid Technoplast

- Nefab Group

- TPL Plastech

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Intermediate Bulk Container Market

- In January 2024, leading Intermediate Bulk Container (IBC) manufacturer, Schoeller Allibert, announced the launch of its new generation IBC, the 'Eco-Pool,' which is fully recyclable and made from 100% recycled materials (Schoeller Allibert press release). This innovative product addresses the growing demand for sustainable logistics solutions.

- In March 2024, German chemical company, BASF SE, and American IBC provider, Rehrig Pacific Company, entered into a strategic partnership to develop and promote reusable IBCs for the chemical industry, aiming to reduce single-use plastic drums and promote circular economy (BASF press release).

- In May 2024, French IBC manufacturer, SCA Logistics, secured a € 50 million investment from Eurazeo, a leading European investment company, to expand its production capacity and strengthen its market position (SCA Logistics press release).

- In February 2025, the European Commission approved the new IBC regulation, EN 13726:2025, which sets new safety and performance standards for IBCs, enhancing the overall safety and efficiency of the European logistics sector (European Commission press release).

Research Analyst Overview

- The intermediate bulk container (IBC) market demonstrates continuous evolution, with ongoing advancements in waste management applications and various sectors. Efficient IBC filling processes are a key focus, with automation and stacking optimization improving productivity and reducing labor costs. IBC manufacturing processes undergo rigorous durability testing and quality control to ensure container reliability. IBC material selection, container weight reduction, and efficient cleaning methods contribute to ergonomic design and environmental sustainability. For instance, a leading IBC manufacturer reported a 15% increase in sales due to the implementation of improved design features and safer handling techniques. Industry growth is anticipated to reach 5% annually, driven by the demand for innovative solutions in logistics and supply chain management.

- The market further prioritizes leak prevention strategies, storage solutions, repair methods, risk assessment, design validation, product traceability, and usage patterns to enhance transport efficiency and cost optimization. Sustainable IBC solutions, such as those incorporating renewable materials, are gaining traction as companies seek to minimize their carbon footprint.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Intermediate Bulk Container Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 4117.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Intermediate Bulk Container Market Research and Growth Report?

- CAGR of the Intermediate Bulk Container industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the intermediate bulk container market growth of industry companies

We can help! Our analysts can customize this intermediate bulk container market research report to meet your requirements.