Islamic Clothing Market Size 2025-2029

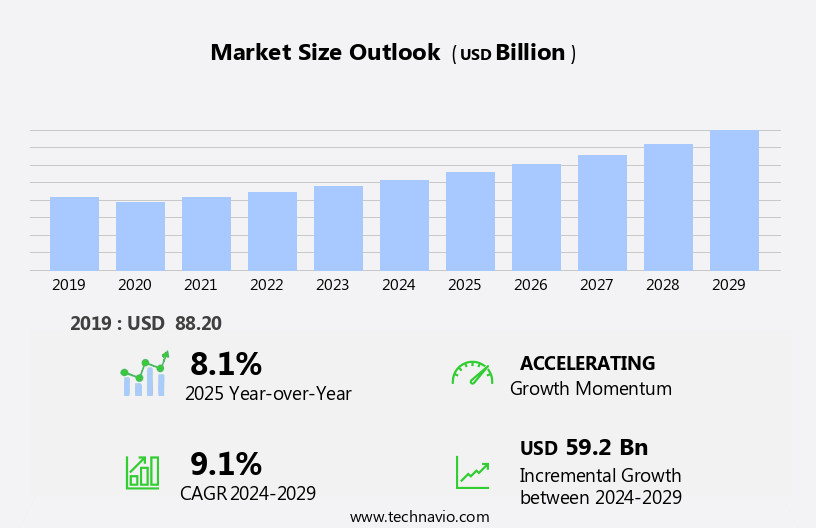

The Islamic clothing market size is forecast to increase by USD 59.2 billion, at a CAGR of 9.1% between 2024 and 2029.

- The market, encompassing apparel, sports apparel, swimwear, and ethnic wear, is experiencing significant growth in the digital realm. Key drivers include the rise in product visibility and accessibility through e-commerce platforms, as well as the increasing adoption of omni-channel retailing. However, challenges persist, such as the availability of counterfeit Islamic clothing items online. Brands and retailers must prioritize logistics and security measures to ensure authenticity and customer satisfaction. In the US and North American markets, labels specializing in Islamic clothing continue to expand their online presence, catering to the needs of a growing consumer base seeking modest and culturally appropriate attire. The use of technology, including computers and mobile devices, facilitates seamless shopping experiences for this demographic.

What will be the Size of the Islamic Clothing Market During the Forecast Period?

- The market, also known as the Muslim consumer segment within the Islamic fashion industry, caters to the unique needs and preferences of the global Islamic population. This market encompasses a diverse range of apparel, including abayas, hijabs, prayer outfits, thobes, jubbas, and various forms of head coverings such as the burqa and niqab. The market's growth is driven by the increasing global Islamic population, which is projected to reach 2.2 billion by 2030, and the rising demand for modest fashion that adheres to Islamic dress codes. Online retail distribution channels have significantly influenced the market's expansion, providing convenience and accessibility to consumers.

- The lifestyle apparel sector, which includes sportswear for both Islamic men and women, has also gained traction due to the growing interest in health and fitness. Multinational fashion brands have increasingly entered this market, recognizing the potential for consumer investments and product consumption. Despite the growth, challenges persist, including negative reviews and the need for improved product quality and authenticity. Overall, the market continues to evolve, reflecting the diverse needs and preferences of its global consumer base.

How is this Islamic Clothing Industry segmented and which is the largest segment?

The Islamic clothing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Ethnic wear

- Sustainable fashion

- Sports wear

- End-user

- Islamic women

- Islamic men

- Distribution Channel

- Online

- Offline

- Material Type

- Cotton

- Polyester

- Silk

- Blended Fabrics

- Geography

- North America

- US

- Middle East and Africa

- Egypt

- Turkey

- APAC

- India

- Indonesia

- Pakistan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

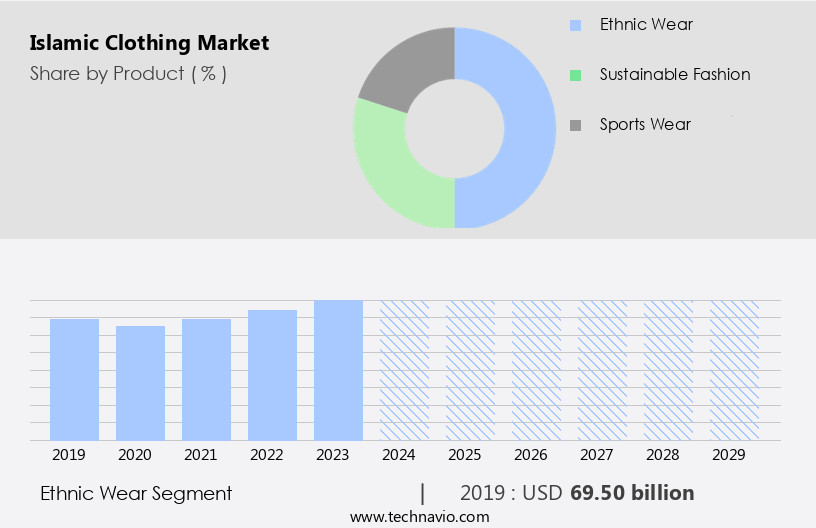

- The ethnic wear segment is estimated to witness significant growth during the forecast period.

The market caters to the unique needs of Muslim consumers, offering apparel that adheres to Islamic principles. This market encompasses various segments, including abayas, hijabs, prayer outfits, burqas, and niqabs for women, and thobes, jubbas, and sports and fitness wear for men. The Muslim population, estimated at 1.8 billion, presents a significant potential customer base for this industry. Islamic fashion industry growth is driven by cultural and lifestyle factors, particularly in Muslim majority economies. Younger generations are increasingly embracing innovative clothing designs that blend traditional Islamic clothing with contemporary styles, creating a demand for modest fashion wear. Ethnic wear, a popular segment, is particularly sought after during cultural events and significant occasions.

The sports industry also presents opportunities for the market growth, with the increasing popularity of sports hijabs. Consumer investments in sustainable fashion are also influencing the industry. Multinational fashion brands and high street brands are increasingly catering to this market, offering a range of options from luxury to affordable prices. E-commerce platforms are facilitating online retail distribution, addressing logistical issues and expanding market reach.

Get a glance at the market report of the share of various segments Request Free Sample

The ethnic wear segment was valued at USD 69.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market, a significant segment of the global fashion industry, experienced substantial growth, particularly in Muslim-majority economies. In 2024, the Middle East and Africa (MEA) region accounted for the largest market share due to the high Muslim population and increasing consumer investments in modest fashion. Key contributors to revenue in MEA include Saudi Arabia and the UAE, where the growing internet penetration and awareness of trendy Islamic clothing for women have fueled market growth. However, companies face challenges in marketing due to price-sensitive consumers. Simultaneously, the demand for Islamic clothing, including abayas, hijabs, prayer outfits, thobes, jubbas, and sportswear, is increasing in African countries due to rising fashion awareness.

Muslim men and women in young generations seek innovative clothing designs that adhere to core Islamic principles, leading to changing fashion trends. The sports industry, including sports hijabs, has also contributed to the market's expansion. Multinational fashion brands and high street labels have recognized the potential customer base in the Muslim population and have started offering ethnic wear and sustainable fashion options. The luxury and sports sectors have also entered the market, catering to the diverse needs of Muslim consumers. E-commerce platforms have addressed logistical issues, making it easier for consumers to access these products online.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Islamic Clothing Industry?

Rise in product visibility and accessibility through online retailing is the key driver of the market.

- The market caters to the unique needs of the Islamic population, specifically Muslim consumers, who adhere to the core principles of modesty and coverage in their apparel choices. The fashion industry for Islamic clothing has seen significant growth, with a focus on innovative designs for both Islamic women and men. Shia and Sunni Muslims, along with other Muslim communities, represent a substantial potential customer base for this market. Online retail distribution has become increasingly popular due to the convenience it offers, particularly for busy consumers. International games and events have further boosted the demand for Islamic clothing, including abayas, hijabs, prayer outfits, burqas, and niqabs, as well as thobes, jubbas, and sportswear for men.

- The sports industry has also contributed to the growth of the market, with the introduction of sports hijabs and other modest fashion wear catering to the changing trends among young Muslim generations. Consumer investments in sustainable fashion and the growing popularity of luxury and high street brands have further expanded the market. Despite the numerous opportunities, challenges such as logistics issues and negative reviews can impact the success of e-commerce platforms. It is essential for businesses to address these concerns while maintaining the authenticity and ethnic heritage of their Arab-inspired designs.

What are the market trends shaping the Islamic Clothing Industry?

Growing adoption of omni-channel retailing is the upcoming market trend.

- The market caters to the unique fashion needs of the growing Islamic population, primarily consisting of Muslim consumers. The Islamic fashion industry has witnessed significant growth, driven by the increasing demand for modest fashion wear among Muslim women and men. Shia and Sunni Muslims, as well as other Islamic communities, represent a substantial potential customer base for this market. International games and events, such as the Olympics, have brought international attention to Islamic clothing, including abayas, hijabs, prayer outfits, burqas, niqabs, thobes, jubbas, and sportswear for both Islamic men and women. The lifestyle apparel segment, including sustainable fashion, is gaining popularity among young Muslim generations, who are embracing changing fashion trends while preserving core Islamic principles.

- Multinational fashion brands and high street labels are increasingly catering to this market, offering innovative clothing designs and luxury options. Online retail distribution platforms have become essential for reaching a broader audience, with e-commerce platforms addressing logistical issues and offering convenient home delivery. The sports industry has also recognized the potential of this market, with the introduction of sports hijabs and other athletic wear for Muslim women. Consumer investments in Islamic clothing have been on the rise, with food and lifestyle becoming increasingly interconnected in Muslim majority economies. While online reviews can impact consumer decisions, some Muslim consumers may prefer offline channels for purchasing apparel due to cultural and religious considerations.

What challenges does the Islamic Clothing Industry face during its growth?

Availability of counterfeit products for Islamic clothing is a key challenge affecting the industry growth.

- The market caters to the unique needs of the Islamic population, specifically Muslim consumers, within the global fashion industry. This market encompasses various apparel categories, including Abayas, Hijabs, Prayer outfits, Burqas, Niqabs, Thobes, Jubbas, and Sportswear, designed to adhere to the modest fashion principles of Islam. Both Shia and Sunni Muslims, representing diverse ethnic backgrounds and cultures, form a significant potential customer base for this market. Counterfeit products pose a challenge to the market, leading to market fragmentation and an uneven competitive landscape. These fake brands, which lack durability and quality, offer lower prices to attract low-income consumers. However, their presence dilutes the reputation of authentic brands, making it difficult for key competitors to penetrate the market effectively.

- Moreover, consumers may mistakenly purchase counterfeit products, further eroding market share for genuine brands. The market extends beyond traditional apparel to include Sportswear, catering to the lifestyle needs of Islamic men and women. Consumer investments in this sector are driven by changing fashion trends, the growing influence of young Muslim generations, and the increasing popularity of sustainable fashion. The sports industry, in particular, presents a significant opportunity for growth, with rising demand for sports hijabs and other modest fashion wear. Multinational fashion brands and high street labels are increasingly recognizing the potential of the market, introducing innovative clothing designs that cater to the unique needs and preferences of Muslim consumers.

Exclusive Customer Landscape

The Islamic clothing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Islamic clothing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, Islamic clothing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aab UK Ltd. - The company offers Islamic clothing products such as abayas, maxi dresses, midis, kimonos, trousers, slip dresses, and modest swimwear.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aaliya Collections Ltd.

- Al Mujalbaba

- Alhannah Islamic Clothing

- ANNAH HARIRI

- Arabic Attire

- Artizara

- Bargello.com

- EastEssence

- Haute Hijab Inc.

- Inaya Collections

- INNERMOD PTE LTD.

- Modanisa Elektronik Magazacilik ve Ticaret AS

- Mushkiya Lifestyle Pvt. Ltd.

- MyBatua

- Niswa Fashion

- SHUKR

- Sunnah Style Inc.

- Urban Modesty Inc.

- Veiled Collection

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market, a segment of the broader fashion industry, caters to the unique needs and preferences of the Muslim consumer population. This market encompasses a diverse range of apparel types, including abayas, hijabs, prayer outfits, thobes, jubbas, and various forms of modest fashion wear. The market dynamics are influenced by several factors, including the increasing global Muslim population, evolving lifestyle trends, and the growing demand for sustainable and innovative clothing designs. The Muslim consumer base, comprised of Shia and Sunni Muslims, represents a significant and expanding potential customer base for the fashion industry. According to various estimates, the global Muslim population is projected to reach over 1.8 billion by 2030, making it a substantial market for businesses.

This demographic is diverse, with varying cultural and regional influences, contributing to the richness and complexity of the market. The market is characterized by a growing preference for modest fashion, driven by the core Islamic principles of modesty and privacy. This trend is particularly prominent among Muslim women, who make up a significant portion of the market. Young generations, in particular, are leading the charge towards innovative and stylish modest fashion designs, challenging the stereotype of traditional and conservative clothing. The market is also influenced by the changing fashion trends and lifestyle preferences of Muslim men and women.

For instance, there is a growing demand for sports hijabs, allowing Muslim women to participate in sports activities while maintaining their religious commitments. Similarly, there is a growing interest in sustainable fashion, with many Muslim consumers expressing a preference for eco-friendly and ethically-produced clothing. Despite the potential for growth, the market faces several challenges. Logistical issues, such as the distribution of products through online retail channels and e-commerce platforms, can pose significant hurdles for businesses. Additionally, negative reviews and perceptions of certain clothing items, such as the burqa and niqab, can impact consumer investments in the market. The market is also influenced by the presence of multinational fashion brands and high street retailers, who are increasingly catering to the Muslim consumer base with their ethnic wear lines.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 59.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

Indonesia, Saudi Arabia, Pakistan, Turkey, US, United Arab Emirates, India, Egypt, South Korea, and Nigeria |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Islamic Clothing Market Research and Growth Report?

- CAGR of the Islamic Clothing industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, Europe, North America, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the islamic clothing market growth of industry companies

We can help! Our analysts can customize this islamic clothing market research report to meet your requirements.