IT Asset Disposition (ITAD) Market Size 2025-2029

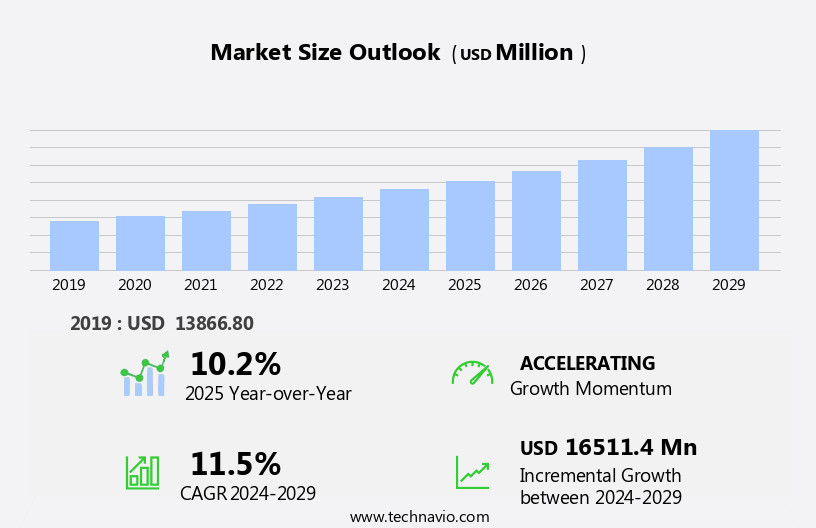

The ITAD market size is forecast to increase by USD 16.51 billion, at a CAGR of 11.5% between 2024 and 2029. The market is experiencing significant growth and transformation, driven by the increasing implementation of regulatory compliances concerning data security

Major Market Trends & Insights

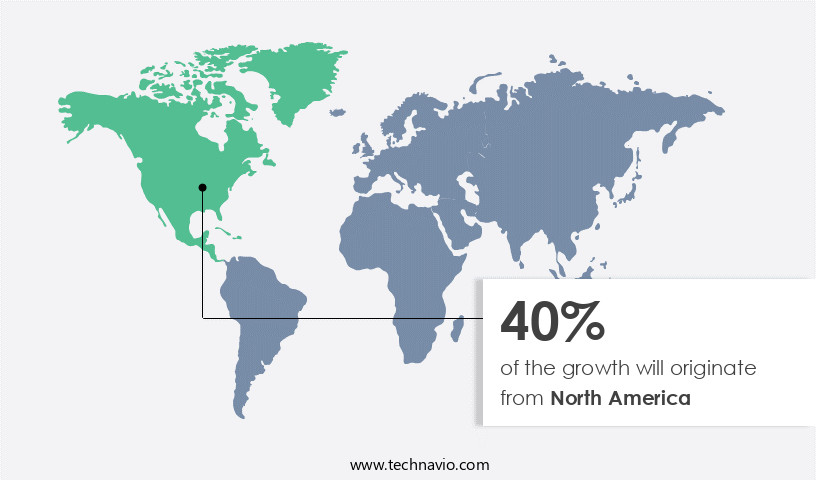

- North America dominated the market and accounted for a 40% during the forecast period.

- The market is expected to grow significantly in Europe as well over the forecast period.

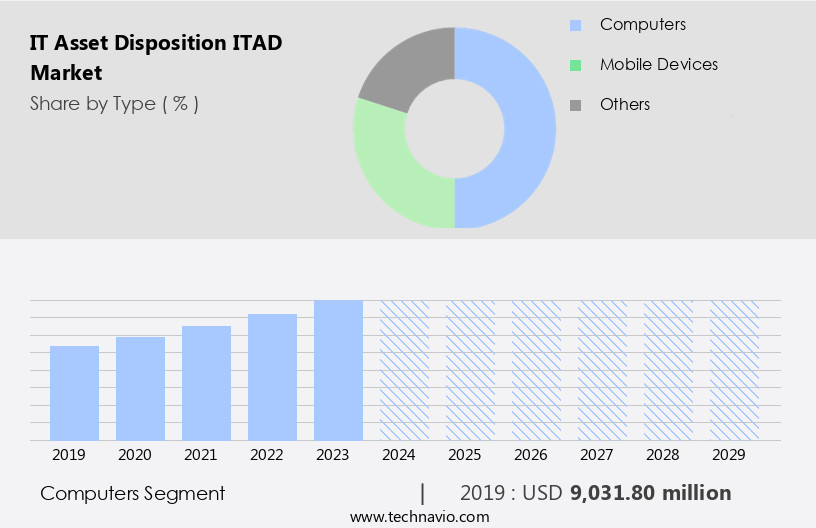

- Based upon the Type, Computers segment was valued at USD 9.03 billion in 2023

- Based on the Industrial Application, the Large organizations accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 0.18 Billion

- Future Opportunities: USD 16.511 Billion

- CAGR : 11.5%

- Europe : Largest market in 2023

With the heightened emphasis on data privacy and protection, businesses are increasingly turning to ITAD solutions to ensure secure disposal of their end-of-life IT services and assets. This trend is further fueled by the growing awareness of the potential risks associated with data breaches and the financial and reputational consequences that follow. However, the ITAD market also faces challenges. One of the most notable obstacles is the low awareness of ITAD and its benefits among businesses. Many organizations are unaware of the importance of ITAD and the potential risks of not implementing proper disposal processes.

Additionally, the market is witnessing an increasing number of strategic partnerships and acquisitions by companies, which may lead to increased competition and market consolidation. Navigating this complex landscape requires companies to stay informed of market trends and developments and to adopt a proactive approach to ITAD to capitalize on opportunities and mitigate risks.

What will be the Size of the IT Asset Disposition (ITAD) Market during the forecast period?

The market continues to evolve, driven by the constant refresh of technology and the increasing focus on environmental compliance and data security. ITAD services encompass a range of activities, including material recovery, data sanitization, logistics and transportation, compliance auditing, on-site data destruction, and off-site data destruction. ISO standards, such as R2 and e-Stewards certification, play a crucial role in ensuring the secure and responsible handling of IT assets. Zero-waste initiatives and carbon footprint reduction are also key considerations, with ITAD providers implementing reverse logistics and optimizing inventory management, parts harvesting, and precious metal recovery. Regulatory compliance remains a critical factor, with ITAD providers offering secure transportation, data wiping, chain of custody, and physical security to mitigate risks and prevent data breaches.

Data destruction certification and e-waste recycling are essential components of ITAD services, ensuring the secure and responsible disposal of end-of-life IT assets. RMA processing and data center decommissioning are also part of the ITAD landscape, with providers offering asset tracking, IT asset retirement, and hard drive destruction to help organizations manage their IT lifecycle effectively and sustainably. The ongoing unfolding of market activities and evolving patterns underscore the importance of ITAD services in today's digital economy.

How is this IT Asset Disposition (ITAD) Industry segmented?

The it asset disposition (itad) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Computers

- Mobile devices

- Others

- Industry Application

- Large organizations

- Small organizations

- End-User

- De-manufacturing and Recycling

- Remarketing and Value Recovery

- Data Destruction/Data Sanitization

- Logistics Management and Reverse Logistics

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The computers segment is estimated to witness significant growth and was valued at USD 9.03 billion in 2019 and showed a gradual increase during the forecast period.

The market for computer equipment is gaining traction due to the increasing demand for computers and laptops in today's digital world. With the rise of multifunctional devices and the Bring Your Own Device (BYOD) trend, businesses are retiring and disposing of IT assets more frequently. ITAD services ensure secure and responsible disposal, addressing data security concerns and regulatory requirements. Data breaches and cyber threats have heightened awareness around the importance of securely disposing of computers to protect sensitive information. ITAD providers offer data sanitization or destruction before decommissioning devices, mitigating risks. Environmental consciousness is another driving factor, as ITAD services enable ethical and sustainable practices through material recovery, precious metal recycling, and carbon footprint reduction.

Reverse logistics, secure transportation, and physical security further enhance the process. ISO standards, e-stewards certification, R2 certification, and data destruction certification ensure compliance with regulatory frameworks and industry best practices. ITAD services also offer inventory management, parts harvesting, asset tracking, and IT asset retirement. In conclusion, the ITAD market for computers is evolving in response to data security concerns, regulatory requirements, environmental consciousness, and the availability of specialized services. Businesses can efficiently navigate the process while adhering to ethical and sustainable practices.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is experiencing significant growth due to the increasing adoption of new technologies, stringent regulatory standards, and a heightened focus on environmental conservation. These services are essential for businesses to manage their end-of-life IT assets in a secure, compliant, and environmentally responsible manner. Dell Technologies, for instance, provides IT asset recovery services that ensure data security and help customers achieve their sustainability goals.

As the IT industry continues to evolve, the demand for ITAD services is expected to increase, driven by the need for secure data erasure, regulatory compliance, and efficient handling of IT assets. The market's growth is further fueled by the shift towards a circular economy, where waste is minimized, and resources are reused or recycled. Overall, the US ITAD market is poised for continued growth, as businesses increasingly recognize the importance of securely managing their IT assets while minimizing their environmental footprint.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The rising importance of sustainable IT operations has led businesses to adopt secure data erasure techniques for ITAD alongside responsible recycling practices in ITAD. With increasing regulatory oversight, ensuring ITAD compliance with environmental regulations and following global standards for responsible e-waste recycling is critical for enterprises seeking accountability.

Companies are embracing cost-effective ITAD solutions for businesses that include data center decommissioning and ITAD services and IT asset recovery value maximization strategies. A thorough chain of custody documentation for ITAD ensures full traceability and security throughout the disposal lifecycle. Choosing the right partner through effective ITAD service provider selection is essential for maintaining integrity and value. As concerns over security escalate, organizations are reinforcing best practices in secure data destruction and implementing data wiping techniques for hard drive destruction to reduce breach risks. Risk mitigation strategies for data breaches further support data privacy compliance efforts.

In parallel, ITAD software solutions for asset tracking and ITAD audit procedures and compliance checks streamline asset lifecycle management. Many firms are maximizing asset utility via reuse and refurbishment options for IT assets and IT asset remarketing strategies. Lastly, aligning ITAD initiatives with environmental compliance in ITAD operations, hardware decommissioning best practices, and efficient e-waste logistics and processing ensures long-term sustainability and responsible e-waste management.

What are the key market drivers leading to the rise in the adoption of IT Asset Disposition (ITAD) Industry?

- The increasing importance of adhering to regulatory compliances with respect to data security serves as the primary catalyst for market growth. The IT Asset Disposition (ITAD) market is being driven by rising regulatory pressure around data security protocols, environmental sustainability, and material recovery. With global regulations such as GDPR, HIPAA, and NIST 800-88, companies are required to demonstrate strict adherence to proper secure data removal, data sanitization tools, and responsible disposal methods during the IT asset lifecycle.

- Organizations now rely on integrated ITAD software solutions and compliance tracking systems to ensure accuracy in inventory management, improve risk mitigation strategies, and document the IT asset disposition lifecycle thoroughly.

- In addition, the growing demand for environmental impact assessments, asset lifecycle management, and recycling facility auditing reflects a broader shift toward responsible and sustainable technology practices. With data centers undergoing rapid transformation, data center migration and third-party vendor management also contribute to the increasing complexity and importance of comprehensive ITAD strategies.

- Businesses today are also emphasizing itad contract negotiation, reuse potential assessment, and cost recovery analysis to protect asset value and achieve financial sustainability through e-waste reduction strategies. These evolving priorities have made ITAD a core part of enterprise IT governance, asset accountability, and regulatory compliance.

What are the market trends shaping the IT Asset Disposition (ITAD) Industry?

- The trend in the market involves companies expanding their strategic partnerships and making acquisitions to enhance their offerings. Current trends in the ITAD market reflect a shift toward automation, accountability, and global standardization. Companies are increasingly investing in inventory management software and advanced ITAD software solutions to streamline operations, support subscription-based service level agreements, and improve audit readiness.

- There's a growing focus on global ITAD standards and responsible e-waste processing to ensure consistent practices across international markets. Enterprises are adopting electronic waste processing methods that align with sustainability targets and local regulations, emphasizing waste reduction programs and recycling facility auditing.

- Partnerships and collaborations remain central to market growth. Strategic alliances are enabling ITAD providers to expand capabilities in data sanitization, data security protocols, and environmental compliance. For example, organizations are now prioritizing itad vendor selection and responsible disposal methods that integrate with broader ESG frameworks.

- Another emerging trend is the rise of data center migration as businesses adopt cloud-first strategies. This transition accelerates demand for secure data removal, reuse potential assessment, and high-precision material recovery. Businesses are increasingly looking at the cost recovery potential in remarketing, refurbishment, and resale of retired IT assets.

- As enterprise IT environments become more complex, the role of ITAD service level agreements, data security auditing, and environmental impact assessment is expected to grow, reinforcing ITAD's position as a critical pillar of digital infrastructure management.

What challenges does the IT Asset Disposition (ITAD) Industry face during its growth?

- The lack of awareness regarding IT Asset Disposition (ITAD) practices poses a significant challenge to the industry's growth. By implementing effective ITAD strategies, organizations can maximize the value of their end-of-life IT assets, minimize risks associated with data security, and contribute to the industry's sustainable growth.

- IT asset disposal (ITAD) is a crucial process for businesses to ensure the proper disposal of end-of-life IT equipment while adhering to regulatory requirements and environmental concerns. ITAD services involve data wiping to ensure data security, maintaining a chain of custody, and implementing zero-waste initiatives.

- However, some consumers and organizations may opt for inappropriate disposal methods to save costs, which can lead to potential data breaches and environmental hazards. To mitigate these risks, companies can seek ITAD providers certified with e-Stewards and R2 standards.

- These certifications ensure secure transportation, data wiping, physical security, and proper disposal of IT assets. It is essential for businesses to prioritize ITAD services to maintain their reputation, comply with regulations, and reduce the environmental impact of IT disposal. By partnering with reputable ITAD providers, companies can have peace of mind knowing their IT assets are disposed of responsibly and securely.

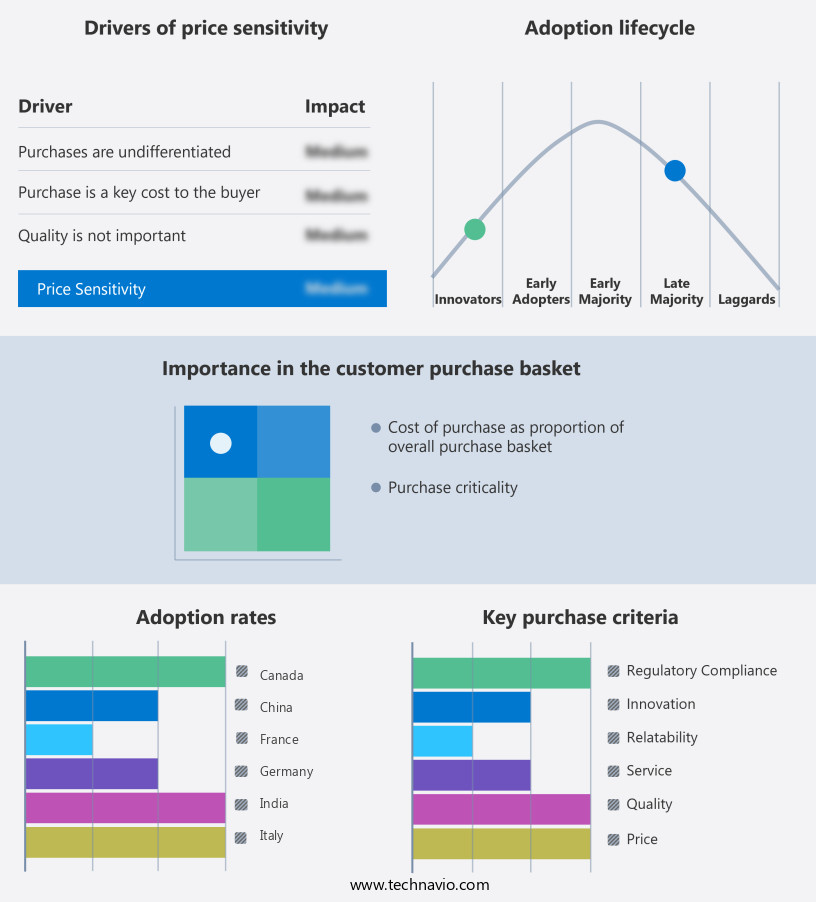

Exclusive Customer Landscape

The it asset disposition (itad) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the it asset disposition (itad) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, it asset disposition (itad) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Iron Mountain Inc. - IT asset disposition (ITAD) services encompass secure data erasure, refurbishment, and recycling of IT equipment, adhering to environmental regulations. This approach enhances search engine visibility and showcases a research analyst's perspective on sustainable IT management. ITAD ensures data security and compliance while contributing to a greener industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Iron Mountain Inc.

- Sims Lifecycle Services

- Apto Solutions

- Arrow Electronics Inc.

- Ingram Micro Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- IBM Corporation

- TES-AMM Pte Ltd.

- E-Waste Systems Inc.

- Blancco Technology Group

- CloudBlue

- ITRenew Inc.

- Lifespan International

- Green IT Disposal

- Sipi Asset Recovery

- Dynamic Lifecycle Innovations

- E-Scrap Solutions

- Seagate Technology Holdings plc

- Wisetek Solutions

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in IT Asset Disposition (ITAD) Market

- In January 2024, TechGiant Corporation, a leading IT solutions provider, announced the launch of its new IT Asset Disposition (ITAD) service, 'GreenTech Recycle,' designed to help businesses securely and sustainably recycle their end-of-life IT equipment (TechGiant Corporation Press Release, 2024).

- In March 2024, DataSecurity Inc. And ITAD specialist, EcoRecycle, joined forces to form a strategic partnership, combining DataSecurity's data destruction expertise with EcoRecycle's ITAD capabilities, aiming to provide comprehensive IT asset management solutions (DataSecurity Inc. Press Release, 2024).

- In May 2024, GlobalTech Holdings, a prominent ITAD company, secured a USD50 million investment from private equity firm, GreenTech Capital, to expand its global footprint and enhance its technology offerings (Bloomberg, 2024).

- In February 2025, the European Union passed the new Circular Economy Act, mandating businesses to implement ITAD solutions and adhere to strict data security and environmental standards when disposing of their IT assets (European Parliament, 2025).

Research Analyst Overview

- The market encompasses the processes and services involved in the disposal of IT equipment, focusing on cost optimization, data security, and asset recovery. Due diligence is crucial in ITAD, ensuring proper data recovery through data wipe verification using data wiping software and destruction verification. Data sanitization tools employ secure erasure methods for mobile device wipe and storage device erasure. Audit trails and compliance reporting are essential for risk mitigation and regulatory adherence. Asset valuation and lifecycle management involve material sorting and logistics networks for end-of-life management. Data center relocation necessitates network disconnection and automated systems for inventory tracking.

- Compliance with industry standards is paramount, as evidenced by certificate of destruction and forensic analysis. Recycling programs ensure responsible disposal, while hardware diagnostics assess the condition of equipment for resale or refurbishment. In the realm of ITAD, companies employ transportation management for efficient and secure equipment transfer. Server retirement entails proper decommissioning and disposal, minimizing environmental impact. Overall, the ITAD market prioritizes data security, cost savings, and regulatory compliance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled IT Asset Disposition (ITAD) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.5% |

|

Market growth 2025-2029 |

USD 16511.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.2 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this IT Asset Disposition (ITAD) Market Research and Growth Report?

- CAGR of the IT Asset Disposition (ITAD) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the it asset disposition (itad) market growth of industry companies

We can help! Our analysts can customize this it asset disposition (itad) market research report to meet your requirements.