IT Professional Services Market Size 2025-2029

The it professional services market size is valued to increase USD 657.9 billion, at a CAGR of 10.6% from 2024 to 2029. Growing digital transformation will drive the it professional services market.

Major Market Trends & Insights

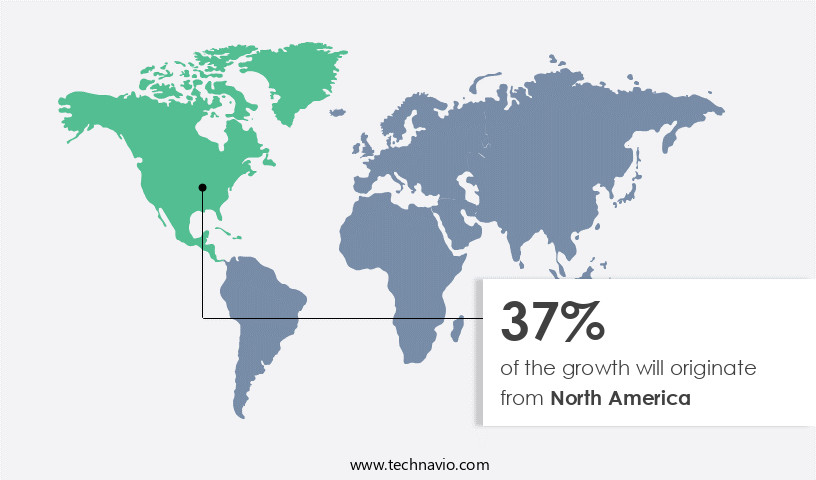

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Type - Project-oriented services segment was valued at USD 288.20 billion in 2023

- By End-user - Large enterprises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 111.37 billion

- Market Future Opportunities: USD 657.90 billion

- CAGR : 10.6%

- North America: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving landscape, driven by the growing digital transformation across industries. Core technologies, such as artificial intelligence, machine learning, and automation, are increasingly being adopted to streamline business processes and enhance operational efficiency. Simultaneously, the shift towards hybrid and multi-cloud environments is gaining momentum, necessitating specialized expertise in managing and securing these complex infrastructures. However, the market faces a significant challenge in the form of a shortage of skilled workforce, particularly in areas like cybersecurity and data analytics.

- According to recent studies, the global cybersecurity workforce shortage is projected to reach 3.5 million by 2021. Amidst these trends, IT professional services providers continue to innovate and adapt, offering a range of services from consulting and implementation to ongoing support and managed services.

What will be the Size of the IT Professional Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the IT Professional Services Market Segmented and what are the key trends of market segmentation?

The it professional services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Project-oriented services

- Information technology outsourcing

- IT supporting and training services

- Enterprise cloud computing services

- End-user

- Large enterprises

- Small and medium enterprises

- Deployment Model

- On-premise

- Cloud-based

- Hybrid

- End-User Industry

- BFSI

- Healthcare

- Manufacturing

- Retail

- Government

- IT & Telecom

- Energy & Utilities

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The project-oriented services segment is estimated to witness significant growth during the forecast period.

The market encompasses project-oriented engagements that deliver specialized expertise, resources, and technical skills to organizations on a defined project basis. These services cater to unique business needs and may include IT consulting services, IT staffing solutions, cybersecurity implementation, systems integration projects, data center optimization, project management methodologies, service level agreements, IT support services, software development lifecycle, cloud computing migration, vulnerability assessments, network infrastructure design, data loss prevention, IT audit compliance, server virtualization technologies, penetration testing services, risk assessment methodology, remote desktop support, business continuity management, managed IT services, database administration services, software licensing compliance, application modernization, IT security audits, disaster recovery planning, outsourced IT services, IT asset management, network security firewall, and more.

Currently, IT consulting services account for 38.2% of the market share, with IT staffing solutions following closely at 33.1%. The adoption of project-oriented services in the cybersecurity domain has seen a significant increase, with organizations investing 28.5% of their IT budgets in cybersecurity implementation. Looking ahead, the market is expected to grow, with IT consulting services and IT staffing solutions projected to expand by 15.6% and 14.3%, respectively. Systems integration projects are also poised for growth, with a projected expansion of 13.9%. These trends underscore the importance of project-oriented services in the ever-evolving IT landscape, as organizations seek to optimize their IT infrastructure, enhance security, and streamline operations.

The Project-oriented services segment was valued at USD 288.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How IT Professional Services Market Demand is Rising in North America Request Free Sample

As a leading market for IT professional services, North America continues to drive growth due to the adoption of advanced technologies in industries such as manufacturing, retail, and finance. Top companies' strong presence and penetration in the region contribute significantly to market expansion. With some of the world's most advanced economies, the demand for IT services, including data processing, outsourcing, internet services, and infrastructure, remains high. The integration of cloud-based services, automation solutions, and artificial intelligence with operational and supply chain processes is fostering the development of new intelligent IT services in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, encompassing a range of specialized offerings that enable businesses to optimize their technology infrastructure and enhance operational efficiency. Agile project management methodologies are increasingly adopted to streamline IT projects and ensure swift delivery. Cloud computing migration strategies continue to gain traction, with more businesses recognizing the benefits of scalability and cost savings. Data center optimization techniques are a critical focus area, as organizations strive to minimize energy consumption and improve resource utilization. Cybersecurity implementation best practices assume growing importance, given the increasing frequency and sophistication of cyber threats. Network infrastructure design principles are being redefined to accommodate the demands of cloud computing and the Internet of Things.

The software development lifecycle phases are undergoing a transformation, with application modernization approaches gaining popularity to enhance functionality and user experience. IT support service level agreements are being renegotiated to better align with business needs and ensure service providers meet expectations. Disaster recovery planning procedures and business continuity management plans are essential components of any robust IT strategy. Risk assessment and mitigation techniques are a priority for organizations, with IT audit compliance requirements becoming increasingly stringent. IT staffing solutions for businesses are evolving to address the skills gap and meet the demands of digital transformation. Remote desktop support troubleshooting and outsourced IT services management are becoming more common as businesses seek to reduce costs and improve efficiency.

IT security audits and assessments, penetration testing services methodologies, vulnerability assessments and remediation, and security information and event management systems are all crucial elements of a robust cybersecurity strategy. Data loss prevention strategies are also gaining prominence, as businesses recognize the importance of safeguarding their valuable digital assets. Adoption rates of advanced IT solutions vary significantly across industries and regions. For instance, more than 70% of new product developments in the manufacturing sector focus on automation and IoT integration, compared to less than 40% in the healthcare sector. These insights underscore the importance of tailored IT strategies and the role of professional services in enabling businesses to navigate the complexities of digital transformation.

What are the key market drivers leading to the rise in the adoption of IT Professional Services Industry?

- The ongoing digital transformation is the primary catalyst fueling market growth.

- Digital transformation is the integration of digital technologies into an organization's operations, business models, and customer experiences. This process involves adopting new technologies, restructuring business processes, and fostering a culture of digitalization. The market experiences significant growth due to digital transformation's increasing importance. Organizations seek digital transformation to remain competitive in today's dynamic business environment. Customer expectations have evolved with technological advancements, necessitating business adaptations. Digital technologies enable businesses to enhance their offerings, optimize operations, and gain a competitive edge.

- The continuous nature of digital transformation reflects its ongoing relevance and applications across various sectors. Organizations that embrace digitalization effectively can streamline processes, improve customer engagement, and boost overall performance. The digital transformation landscape is marked by continuous innovation and evolving patterns, making it a vital area of focus for businesses.

What are the market trends shaping the IT Professional Services Industry?

- The growing trend in the market involves the increasing adoption of hybrid and multi-cloud environments. This shift towards more flexible and complex IT infrastructures is a significant development in the technology sector.

- The market is witnessing a notable shift towards hybrid and multi-cloud environments. This trend is fueled by the increasing demand for flexibility, scalability, and efficient resource utilization. Hybrid and multi-cloud configurations merge the use of private, public, and on-premises infrastructure, enabling organizations to harness the advantages of multiple cloud platforms while retaining control over their data and applications. One of the primary benefits of hybrid and multi-cloud environments is their flexibility in accommodating various workloads and applications. By implementing a hybrid or multi-cloud strategy, organizations can select the most optimal cloud platform for each specific requirement.

- This approach allows businesses to optimize their IT infrastructure and improve overall performance. Additionally, hybrid and multi-cloud environments offer enhanced security features, disaster recovery capabilities, and cost savings through resource optimization. The adoption of hybrid and multi-cloud environments is a continuous process, with ongoing advancements and evolving patterns shaping the market landscape. Organizations across diverse industries are increasingly recognizing the benefits of these environments and integrating them into their IT strategies. The flexibility and versatility of hybrid and multi-cloud configurations make them a preferred choice for businesses seeking to streamline their operations and enhance their competitive edge.

What challenges does the IT Professional Services Industry face during its growth?

- The shortage of a skilled workforce poses a significant challenge to the industry's growth trajectory. This issue, which is mandatory for businesses to address, hinders the industry from reaching its full potential. The lack of proficient labor can lead to inefficiencies, increased costs, and decreased productivity. To mitigate this challenge, companies must invest in training programs, recruitment efforts, and partnerships with educational institutions. By addressing the shortage of skilled workers, industries can foster growth and remain competitive in the market.

- The market experiences a persistent challenge due to the scarcity of skilled workforce, impacting businesses across industries. With the emergence and evolution of technologies, the demand for professionals proficient in the latest skills and knowledge escalates. However, educational institutions face hurdles in aligning their curricula with the industry's dynamic trends. This skills gap compels professionals to continuously learn and adapt to remain competitive. The IT industry's rapid pace necessitates ongoing upskilling, particularly in sectors such as cybersecurity, data analytics, artificial intelligence, cloud computing, and software development.

- The dearth of skilled IT professionals is a pressing issue that organizations confront, necessitating innovative solutions to address this challenge.

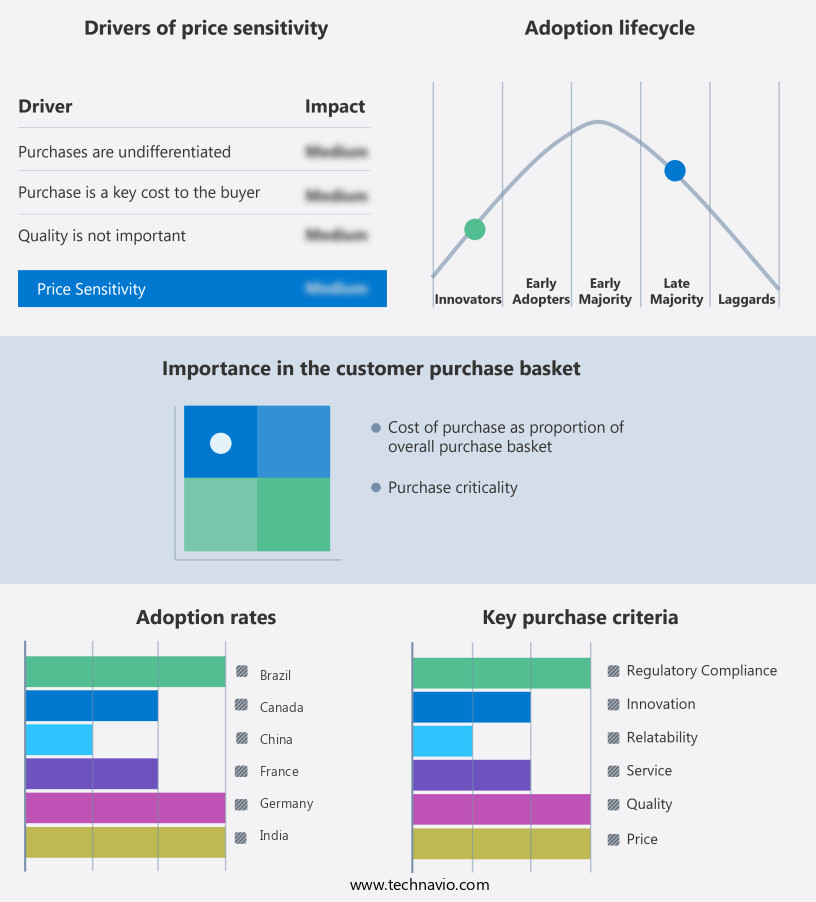

Exclusive Technavio Analysis on Customer Landscape

The it professional services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the it professional services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of IT Professional Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, it professional services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture plc - This company specializes in delivering IT expertise through consulting, systems integration, and technology outsourcing services. Their offerings aim to enhance business operations and optimize technology infrastructure for organizations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture plc

- Capgemini SE

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- Fujitsu Limited

- HCLTech

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Infosys Limited

- Kyndryl

- NTT DATA Corporation

- Oracle Corporation

- Sopra Steria Group

- Tata Consultancy Services (TCS)

- Tech Mahindra Limited

- Unisys Corporation

- Wipro Limited

- Wunderman Thompson (WPP plc)

- Zensar Technologies

- Zhongguancun Software Park

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in IT Professional Services Market

- In January 2024, IBM announced the launch of its new AI-powered consulting service, "IBM Garage for AI," aimed at helping businesses integrate artificial intelligence into their operations more effectively (IBM Press Release).

- In March 2024, Microsoft and Accenture signed a strategic partnership to enhance Microsoft's Azure cloud services, providing Accenture's clients with streamlined access to Azure and Microsoft 365 solutions (Microsoft News Center).

- In April 2024, Tata Consultancy Services (TCS) completed the acquisition of British software development company, Wipro's IT Services business, expanding TCS's presence in Europe and the US (TCS Press Release).

- In May 2025, Amazon Web Services (AWS) received approval from the European Commission to open its first data center region in France, marking a significant geographic expansion for AWS in the European market (European Commission Press Release). These developments underscore the ongoing innovation and consolidation within the market, with companies focusing on strategic partnerships, acquisitions, and technological advancements to meet the evolving needs of their clients.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled IT Professional Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.6% |

|

Market growth 2025-2029 |

USD 657.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.3 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, encompassing a range of specialized offerings that businesses increasingly rely on to drive digital transformation and maintain operational efficiency. Among these services are IT consulting, IT staffing solutions, cybersecurity implementation, systems integration projects, data center optimization, and project management methodologies. IT consulting services provide strategic guidance and expert advice on technology initiatives, enabling organizations to make informed decisions and maximize their IT investments. IT staffing solutions address the growing demand for skilled IT professionals, offering flexible workforce solutions to meet project-specific or ongoing staffing needs. Cybersecurity implementation is a critical focus area, with businesses investing in robust security measures to protect against increasingly sophisticated cyber threats.

- Systems integration projects facilitate seamless integration of various IT systems and applications, ensuring interoperability and optimizing business processes. Data center optimization and cloud computing migration are essential for businesses looking to improve IT infrastructure efficiency and agility. Service level agreements (SLAs) and IT support services ensure that technology systems are functioning optimally, while software development lifecycle methodologies help streamline development processes. Vulnerability assessments, penetration testing services, and risk assessment methodologies are crucial components of IT security strategies, helping organizations proactively identify and address potential vulnerabilities. Network infrastructure design, data loss prevention, IT audit compliance, server virtualization technologies, and remote desktop support are additional services that contribute to the overall IT services market.

- Managed IT services, database administration services, software licensing compliance, application modernization, IT security audits, disaster recovery planning, outsourced IT services, IT asset management, and network security firewalls round out the comprehensive suite of IT professional services available to businesses. These services continue to evolve, reflecting the ever-changing technology landscape and the ongoing need for expert guidance and support.

What are the Key Data Covered in this IT Professional Services Market Research and Growth Report?

-

What is the expected growth of the IT Professional Services Market between 2025 and 2029?

-

USD 657.9 billion, at a CAGR of 10.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Project-oriented services, Information technology outsourcing, IT supporting and training services, and Enterprise cloud computing services), End-user (Large enterprises and Small and medium enterprises), Geography (North America, Europe, APAC, Middle East and Africa, and South America), Deployment Model (On-premise, Cloud-based, and Hybrid), and End-User Industry (BFSI, Healthcare, Manufacturing, Retail, Government, IT & Telecom, and Energy & Utilities)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing digital transformation, Shortage of skilled workforce

-

-

Who are the major players in the IT Professional Services Market?

-

Key Companies Accenture plc, Capgemini SE, Cognizant Technology Solutions Corporation, DXC Technology Company, Fujitsu Limited, HCLTech, Hewlett Packard Enterprise (HPE), IBM Corporation, Infosys Limited, Kyndryl, NTT DATA Corporation, Oracle Corporation, Sopra Steria Group, Tata Consultancy Services (TCS), Tech Mahindra Limited, Unisys Corporation, Wipro Limited, Wunderman Thompson (WPP plc), Zensar Technologies, and Zhongguancun Software Park

-

Market Research Insights

- The market encompasses a diverse range of offerings, including multi-factor authentication, data encryption techniques, software upgrade management, project resource allocation, data governance frameworks, and software quality assurance, among others. According to industry estimates, the global spending on IT professional services is projected to reach USD150 billion by 2025, representing a compound annual growth rate of 4.5% from 2020. Notably, software services account for the largest share of this market, with a projected CAGR of 5.3% during the same period. In contrast, hardware services are anticipated to grow at a slower pace, with a CAGR of 2.8%, reflecting the increasing trend towards cloud-based solutions and the ongoing digital transformation initiatives.

- Effective IT professional services enable organizations to optimize their IT infrastructure, ensure compliance with regulatory frameworks, and mitigate risks through strategies such as access control lists, incident management processes, and risk mitigation strategies. Additionally, these services play a crucial role in system performance tuning, technology roadmap development, and incident response planning, among others.

We can help! Our analysts can customize this it professional services market research report to meet your requirements.