K-12 Game-Based Learning Market Size 2025-2029

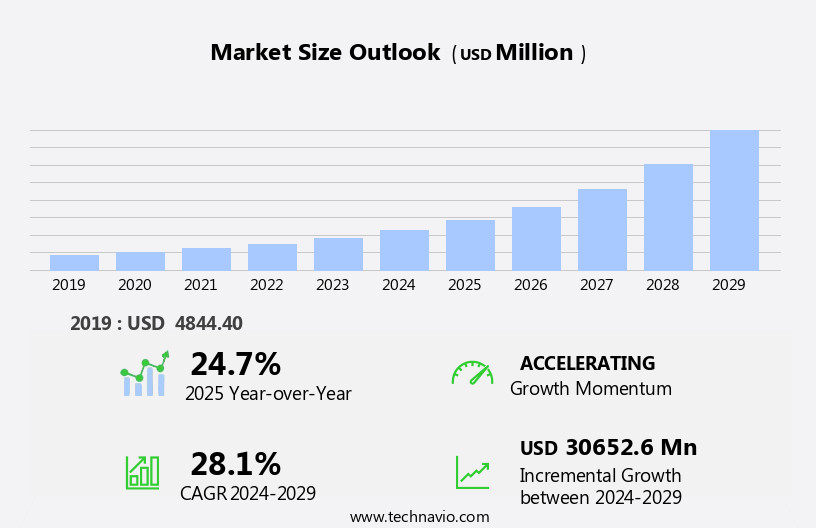

The K-12 game-based learning market size is forecast to increase by USD 30.65 billion, at a CAGR of 28.1% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The increasing importance of STEM (Science, Technology, Engineering, and Mathematics) education is driving market growth, as it provides an engaging and interactive way for students to learn complex concepts In these subjects. Additionally, the rising popularity of mobile technologies among students is fueling market expansion, as game-based education apps and platforms become more accessible and convenient. However, development costs can be a challenge for market participants, as creating high-quality educational games requires significant investment in technology, design, and content creation. Despite this, the benefits of game-based learning, including increased student engagement and improved learning outcomes, make it a worthwhile investment for educators and schools. Overall, the market is poised for continued growth In the coming years.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant segment of the educational technology industry, leveraging engaging multimedia games to enhance teaching and learning experiences. Real-world situations are simulated through various formats, including flashcard games, simulation games, quiz games, and puzzles, both online and offline. This market caters to a diverse audience, including teachers, parents, and educators, who seek technology-driven educational tools to boost student engagement. Advancements in AI, VR technology, and low-cost gaming technology are driving market growth, enabling personalized learning and innovative experiences.

- Simultaneously, the increasing adoption of digital education and remote learning due to the pandemic further accelerates market expansion. Interactive whiteboards and augmented reality are also gaining traction, offering innovative approaches to teaching and learning. However, concerns around data security remain a critical challenge for the market, necessitating strong solutions to protect student information. As the market evolves, it is essential to strike a balance between leveraging advanced technology and ensuring the safety and privacy of students.

How is this Industry segmented and which is the largest segment?

The report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Subject-specific games

- Language learning games

- Others

- School Level

- Middle school level

- High school level

- Elementary school level

- Type

- Educational games

- Simulation-based learning

- Social games

- Others

- Technology Specificity

- Augmented Reality (AR) Games

- Virtual Reality (VR) Games

- Platform

- Mobile Apps

- Web-Based Platforms

- Console-Based Learning

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

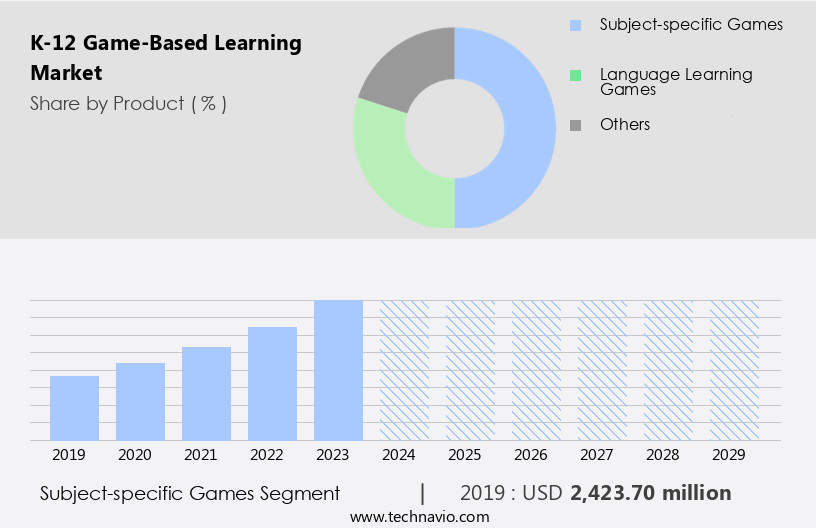

- The subject-specific games segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the integration of technology-driven educational tools in classrooms worldwide. Game-based learning, which utilizes engaging multimedia games to teach real-world situations, has become increasingly popular among teachers, parents, and educators. Companies are developing various types of games, such as Flashcard Games, Simulation Games, Quiz Games, Puzzles, both online and offline, to cater to students from pre-primary to high school. These games offer personalized learning experiences, utilizing AI, VR technology, low-cost gaming technology, and advanced technologies like augmented reality and 3D printing. Digital education solutions, including interactive whiteboards, digital content, and cloud-based solutions, are enhancing student engagement.

Startups are attracting venture capitalists and educational institutions, offering gamification and innovative learning experiences through tablets, consoles, and consoles. STEM education benefits significantly from game-based learning, providing students with a digital future and interactive experiences. The market is expected to continue growing with the integration of new technologies, such as high-speed internet, software, and hardware, into digital learning solutions.

Get a glance at the K-12 Game-Based Learning Industry report of share of various segments Request Free Sample

The subject-specific games segment was valued at USD 2.42 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing emphasis on digital education and the widespread adoption of technology-driven educational tools in schools. With strong digital infrastructure and bring your own device (BYOD) policies, students are using tablets, iPads, and other devices to access interactive digital content, including educational games. The shift towards experiential learning has led educators to incorporate blended learning methodologies, which utilize both traditional teaching methods and game-based learning.

New technologies, such as virtual reality (VR), augmented reality (AR), 3D printing, and AI, are being integrated to create advanced and personalized learning experiences. Additionally, cloud-based solutions, gamification, and low-cost gaming technology are making it more accessible to a larger student population. These factors are driving the growth of the market in North America, benefiting educational institutions, teachers, parents, and students alike.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of K-12 Game-Based Learning Industry?

The growing importance of STEM learning is the key driver of the market.

- It is revolutionizing teaching and learning In the US by integrating engaging multimedia games into the educational landscape. This approach utilizes technology-driven educational tools, such as AI, VR technology, and low-cost gaming technology, to create innovative learning experiences for students. With the rise of remote learning and new technologies like augmented reality, 3D printing, and interactive whiteboards, it has become an essential component of digital education. Teachers, parents, and educators are embracing this innovative method to enhance student engagement and personalize learning experiences. These solutions encompass various formats, including online and offline, simulation games, quiz games, puzzles, flashcard games, and more.

- These games provide students with interactive experiences that help them understand complex concepts in a fun and engaging way. Moreover, this caters to the diverse needs of students in STEM education, offering digital content tailored to their learning styles and abilities. Mobile devices, tablets, consoles, and cloud-based solutions enable students to access educational games from anywhere, making learning more accessible and convenient. Startups are continuously developing new technologies and educational content to cater to the growing demand for personalized learning experiences. Venture capitalists and educational institutions are investing In these innovative companies to ensure students are prepared for the digital future.

What are the market trends shaping the K-12 Game-Based Learning Industry?

The increasing popularity of mobile technologies is the upcoming market trend.

- The market is witnessing a significant shift towards game-based learning, fueled by the increasing use of educational technology and engaging multimedia games. This trend is driven by the need to enhance student engagement and provide real-world situation learning experiences. Teachers, parents, and educators are embracing technology-driven educational tools, such as AI, VR technology, low-cost gaming technology, and augmented reality, to create personalized learning experiences for students. New technologies, including advanced learning experiences through mixed reality, 3D printing, and interactive whiteboards, are being integrated into digital education. Cloud-based solutions, gamification, and digital content are becoming essential components of digital learning solutions.

- Game-based learning startups are emerging, offering online and offline options for High School, Preprimary School, Primary School, Middle School, and other educational institutions. Mobile devices, including tablets and consoles, are being used extensively for online game-based learning. The growing popularity of m-learning and the bring your own device (BYOD) policy are expected to boost sales of applications and software, leading to market growth. The digital future of education is bright, with game-based learning set to revolutionize the way students learn, providing interactive experiences that cater to individual learning styles and preferences. Data security remains a critical concern for educational institutions, and companies are focusing on ensuring data privacy and security for their game-based learning products.

What challenges does the K-12 Game-Based Learning Industry face during its growth?

Development costs is a key challenge affecting the industry growth.

- The market encompasses educational technology that utilizes engaging multimedia games to enhance teaching and learning experiences. Real-world situations are integrated into these games, providing students with personalized learning experiences that boost student engagement. However, the high cost of game development and implementation poses a challenge to the market's growth. While there are free games available online, they often only allow students to progress to a certain level and require specific hardware, such as gaming consoles or high-speed internet, which can be costly for educational institutions and other end-users. New technologies, such as AI, VR technology, augmented reality, 3D printing, and gamification, are transforming digital education by offering innovative learning experiences.

- Cloud-based solutions, interactive whiteboards, digital content, and personalized learning experiences are also integral to the digital future of education. Venture capitalists and educational institutions are investing in startups to provide affordable, effective, and accessible digital learning solutions for K-12 students. Tablets, consoles, and online and offline platforms cater to the diverse needs of students in preprimary school, primary school, middle school, and high school. The market is expected to grow as technology-driven educational tools continue to revolutionize teaching and learning.

Exclusive Customer Landscape

The K-12 game-based learning market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, k-12 game-based learning market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Banzai Labs Inc. - The company offers K-12 game-based learning solutions such as Math Fleet, Sharp Mind and BrainWave.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BrainQuake Inc.

- BreakAway Ltd. Inc.

- Cognitive ToyBox Inc.

- Filament Games

- Google LLC

- iCivics Inc.

- Kahoot ASA

- KILLER SNAILS LLC

- Kuato Studios

- Microsoft Corp.

- MobilizAR Technologies Pvt. Ltd.

- MONKIMUN Inc.

- Paratus Knowledge Ventures Pvt. Ltd.

- Schell Games LLC

- Smart Lumies Inc.

- Think and Learn Pvt. Ltd.

- Thrust Interactive Inc.

- Tinybop Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant and growing segment of the educational technology landscape. This market encompasses a range of engaging multimedia games designed to enhance teaching and learning experiences for students in pre-primary, primary, middle, and high schools. These games provide students with real-world situations that help them understand complex concepts in a fun and interactive way. Teachers and parents have long recognized the potential of technology-driven educational tools to increase student engagement and improve learning outcomes. Game-based learning, in particular, has gained popularity due to its ability to provide personalized learning experiences that cater to individual student needs.

Further, the use of artificial intelligence (AI) and advanced technologies, such as virtual and augmented reality, in game-based learning is becoming increasingly common. These technologies offer new opportunities for creating advanced learning experiences that can help students better understand complex concepts and develop critical thinking skills. Low-cost gaming technology, including tablets and consoles, has made game-based learning accessible to a wider audience. Cloud-based solutions and gamification techniques have also gained traction In the market, allowing for more flexible and customizable learning experiences. The demand for digital education tools, including game-based learning, has been accelerated by the shift towards remote learning due to the COVID-19 pandemic.

In addition, venture capitalists and educational institutions have taken notice, leading to an influx of investment in game-based learning startups. The market is diverse, with a range of offerings for both online and offline learning. Digital content, including educational games, simulations, quizzes, puzzles, and flashcards, can be accessed through high-speed internet connections. Offline game-based learning solutions, such as interactive whiteboards and 3D printing, offer alternatives for schools and students without reliable internet access. The use of game-based learning in STEM education has been particularly effective in engaging students and improving learning outcomes. Personalized learning experiences, which can be facilitated through game-based learning, have been shown to be more effective than traditional classroom instruction.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.1% |

|

Market Growth 2025-2029 |

USD 30.65 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

24.7 |

|

Key countries |

US, China, UK, Germany, Canada, France, Brazil, India, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this K-12 Game-Based Learning Market Research and Growth Report?

- CAGR of the K-12 Game-Based Learning industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the k-12 game-based learning market growth of industry companies

We can help! Our analysts can customize this k-12 game-based learning market research report to meet your requirements.