Kidney Transplantation Therapeutics Market Size 2024-2028

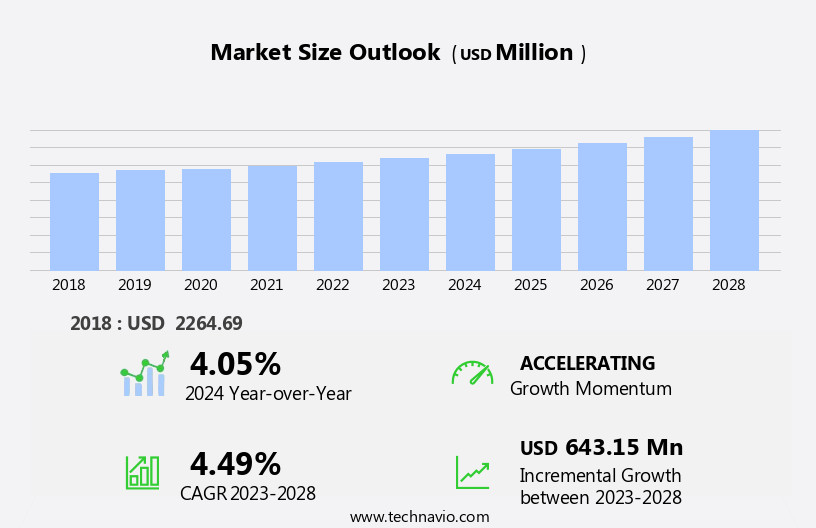

The kidney transplantation therapeutics market size is forecast to increase by USD 643.15 million at a CAGR of 4.49% between 2023 and 2028.

- The market is witnessing significant growth, driven by the rising prevalence of chronic kidney disease (CKD) and renal impairments worldwide. According to the National Kidney Foundation, over 37 million adults in the US alone have CKD, and this number is projected to increase due to the aging population and increasing obesity rates. The high burden of CKD necessitates the need for effective kidney replacement therapies, making kidney transplantation a preferred treatment option. Moreover, the development of novel techniques in kidney transplantation, such as living donor transplants, paired kidney exchange programs, and desensitization therapies, is expanding the pool of potential donors and recipients, further fueling market growth.

- However, the use of immunosuppressants to prevent organ rejection poses significant challenges, including side effects such as infections, malignancies, and cardiovascular diseases. These complications necessitate continuous monitoring and management, creating opportunities for the development of safer and more effective immunosuppressive agents. Companies seeking to capitalize on market opportunities should focus on addressing these challenges by investing in research and development of innovative solutions to improve patient outcomes and reduce the risk of complications.

What will be the Size of the Kidney Transplantation Therapeutics Market during the forecast period?

- The market in the US is experiencing significant growth due to the increasing prevalence of end-stage renal failure and the rising number of deceased organ donors. Chronic kidney disease, high blood pressure, and kidney harm from health conditions such as diabetes and diarrhea are leading causes of kidney failure. Transplantation offers a viable alternative to dialysis, providing improved quality of life and survival rates. However, complications such as kidney transplant rejection, complications from ry, and the need for compatible donor kidneys, immunosuppressants, and postoperative care pose challenges. Donor kidneys undergo rigorous screening, including blood tests and health assessments, to ensure compatibility and reduce the risk of complications.

- Living donors also offer an alternative to deceased donors, but the process involves careful consideration of potential risks and long-term health implications. The market is expected to continue growing due to advancements in surgical techniques, medications, and healthcare provider expertise, leading to improved survival rates and reduced complications. The immune system plays a critical role in the success of a transplant, with the formation of antibodies and the management of edema being key areas of focus. Hydration and nutrition are essential components of pre- and post-transplant care, with medications and immunosuppressants playing a crucial role in managing symptoms and preventing rejection.

How is this Kidney Transplantation Therapeutics Industry segmented?

The kidney transplantation therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Selective cytokine inhibitors

- Immunosuppressive antimetabolites

- Other drug

- Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

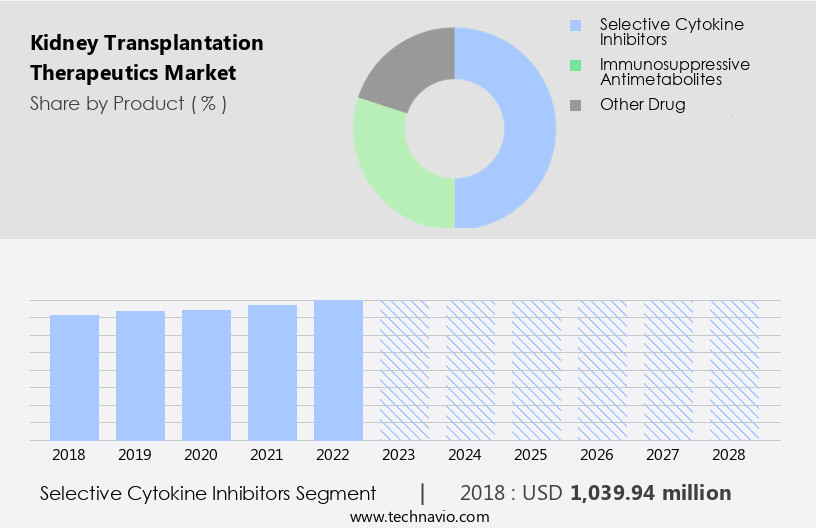

The selective cytokine inhibitors segment is estimated to witness significant growth during the forecast period.

Kidney transplantation is a therapeutic solution for individuals suffering from end-stage renal failure. However, the transplant process carries risks, including infection and immunosuppression. Immunosuppression is necessary to prevent allo-immunity and rejection of the donor kidney. ry involves the use of drugs that inhibit the production and function of cytokines, which are essential for immune response. These cytokines include interleukins, interferons, tumor necrosis factors, colony-stimulating factors, and transforming growth factors. Tacrolimus, a major drug used in kidney transplantation, inhibits T cell activation and reduces the risk of allograft rejection. However, immunosuppression increases the risk of infections, non-melanoma skin cancer, and post-transplant malignancy.

Patients require regular physicals, blood tests, and hydration maintenance. Compatible transplant and tumor response depend on donor kidney quality, tumor-infiltrating cells, and immune checkpoints. Post-transplant care involves immunosuppressants, antibiotics, and medications for health conditions like high blood pressure, diabetes, and nausea. Adherence to medicines and cancer screening is crucial for long-term survival. The kidney transplant market offers various branded and generic drugs, with tacrolimus being the most commonly used due to its superior therapeutic efficacy.

Get a glance at the market report of share of various segments Request Free Sample

The Selective cytokine inhibitors segment was valued at USD 1039.94 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Kidney transplantation is a crucial therapeutic intervention for individuals suffering from end-stage renal failure. In North America, the prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) is significant, leading to a substantial demand for kidney transplants. Advanced healthcare infrastructure, including specialized transplant centers, nephrology units, and well-equipped hospitals, facilitates efficient kidney transplantation procedures and post-transplant care. The pharmaceutical industry in North America is at the forefront of medical research and innovation, resulting in the development of new immunosuppressive drugs, diagnostic tools, and surgical techniques. Immunosuppression is essential to prevent allo-immunity and transplant rejection. However, it increases the infection risk and the possibility of non-melanoma skin cancer, high blood pressure, and other health conditions.

Proper post-transplant care, including physicals, hydration, and medication adherence, is crucial to mitigate these risks. The transplant process involves various stages, including ry, blood tests, and tumor response evaluation. Tumor-infiltrating cells and tumor-associated antigens may pose a risk for post-transplant malignancy. Immunosuppressants, antibiotics, and immune checkpoints play a vital role in managing these risks. Postoperative care includes managing symptoms like edema, nausea, and diarrhea. Diet and nutrition are essential components of post-transplant care, as is close monitoring for allograft rejection and cancer screening. In , the market in North America is driven by the rising incidence of kidney diseases and the availability of advanced healthcare infrastructure and innovative treatments.

The market faces challenges related to infection risk, immunosuppression, and cancer screening, necessitating continuous research and development efforts.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Kidney Transplantation Therapeutics Industry?

- Rising prevalence of CKD and renal impairments is the key driver of the market.

- The market is driven by the rising prevalence of chronic kidney disease (CKD), which affects approximately 8.5%-9.5% of the adult population worldwide. Diabetes, hypertension, vascular disease, and glomerulonephritis are some of the primary causes of CKD. In many underdeveloped and developing countries, glomerulonephritis and interstitial nephritis are the leading causes due to the high prevalence of infections. For instance, infections from Streptococcus species, hepatitis B and C viruses, and human immunodeficiency virus (HIV) are common in South Africa. Although CKD can affect individuals of all ages, it is more prevalent among those aged 65 years and above. The increasing burden of CKD is a significant concern due to its debilitating effects and the high cost of treatment.

- Kidney transplantation is considered the best treatment option for patients with end-stage renal disease, making the market for kidney transplantation therapeutics an essential area of focus for healthcare providers and researchers.

What are the market trends shaping the Kidney Transplantation Therapeutics Industry?

- Novel techniques for kidney transplantation is the upcoming market trend.

- Organ transplantation represents a significant advancement in medical therapy, enhancing the lives of countless patients worldwide. Among various organ transplantation procedures, kidney transplantation holds a prominent position due to the high prevalence of risk factors leading to kidney failure. The medical community's ongoing research and development efforts in the field of regenerative therapies have sparked considerable interest, with potential applications in organ transplantation, including kidney transplantation.

- This innovative approach could revolutionize the medical landscape and improve the overall effectiveness and accessibility of organ transplantation procedures. Kidney transplantation's popularity is a testament to its success in improving patients' quality of life.

What challenges does the Kidney Transplantation Therapeutics Industry face during its growth?

- Side effects of immunosuppressants is a key challenge affecting the industry growth.

- Immunosuppressants, essential drugs used to prevent organ rejection in transplant recipients, offer significant benefits but come with notable side effects. These medications, while effective in reducing the immune response against transplanted organs, can cause prolonged side effects that impact patient compliance. Diarrhea, increased infection risk, nausea, and vomiting are common side effects, while muscle damage and hyperglycemia are more severe complications. Hyperglycemia, a condition characterized by high blood sugar levels, can lead to secondary diabetes. These side effects can significantly hinder patient adherence to the treatment regimen, posing a challenge for the market.

- Immunosuppressants' long-term use can also lead to muscle damage, which can result in decreased muscle function. These complications necessitate continuous monitoring and management, adding to the overall cost and complexity of kidney transplantation therapy.

Exclusive Customer Landscape

The kidney transplantation therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the kidney transplantation therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, kidney transplantation therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - The company specializes in kidney transplantation therapeutics, including 2.0 Synopsis, leveraging advanced technologies to enhance treatment efficacy and patient outcomes. Our solutions prioritize individualized care and evidence-based approaches, aiming to improve accessibility and affordability in the global healthcare landscape.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Asahi Kasei Corp.

- Astellas Pharma Inc.

- B.Braun SE

- Bristol Myers Squibb Co.

- Dr Reddys Laboratories Ltd.

- F. Hoffmann La Roche Ltd.

- Fresenius Medical Care AG and Co. KGaA

- GlaxoSmithKline Plc

- Hansa Biopharma AB

- Novartis AG

- Organ Recovery Systems Inc.

- Pfizer Inc.

- Sanofi SA

- Strides Pharma Science Ltd.

- TFF Pharmaceuticals Inc.

- TolerogenixX GmbH

- TransMedics Inc.

- Transonic Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Kidney transplantation has emerged as a viable solution for individuals suffering from end-stage renal failure. This therapeutic approach involves replacing a diseased kidney with a healthy donor organ to restore renal function. However, the procedure comes with its own set of challenges and risks. One of the primary concerns in kidney transplantation is the risk of infection. Immunosuppression, a necessary component of post-transplant care, leaves patients vulnerable to various infections. ry itself carries an infection risk, and living donors may also transmit infections. Non-melanoma skin cancer is a common infection observed in transplant recipients due to long-term immunosuppression.

High blood pressure is another health condition that requires close monitoring in kidney transplant patients. Pre-transplant physicals and regular post-transplant care help manage blood pressure levels. Proper hydration is essential to maintain kidney function and overall health. Deceased organ donors pose a risk of transmitting diseases, necessitating rigorous screening and testing before transplantation. Blood tests, including tumor-associated antigen tests, are crucial in identifying potential health issues. T lymphocytes, a type of white blood cell, play a significant role in allo-immunity and rejection. Transplant recipients must adhere to a strict regimen of medications to prevent rejection and manage health conditions.

Immunosuppressants, antibiotics, and anti-rejection drugs are common medications used in post-transplant care. Tumor response and tumor-infiltrating cells are essential factors to consider in cancer screening for transplant patients. The healthcare provider's role is crucial in managing post-transplant care. Regular check-ups, monitoring symptoms, and ensuring medicines adherence are essential components of postoperative care. Patients may experience side effects such as diarrhea, nausea, and edema. The immune system plays a pivotal role in kidney transplantation. T cell activation and antibody formation can lead to allograft rejection. Monoclonal antibodies are used to manage these immune responses. Cancer screening is necessary to monitor for post-transplant malignancy, which can impact survival rates.

Diet and nutrition are essential components of post-transplant care. Patients must maintain a healthy diet to support kidney function and overall health. Cancer screening, regular physicals, and adherence to medications are crucial in managing long-term health and ensuring successful kidney transplantation. In , kidney transplantation offers a viable solution for individuals suffering from end-stage renal failure. However, it comes with its own set of challenges and risks, including infection risk, immunosuppression, and allograft rejection. Close monitoring, proper care, and adherence to medications and dietary requirements are essential components of successful post-transplant care.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.49% |

|

Market growth 2024-2028 |

USD 643.15 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.05 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Kidney Transplantation Therapeutics Market Research and Growth Report?

- CAGR of the Kidney Transplantation Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the kidney transplantation therapeutics market growth of industry companies

We can help! Our analysts can customize this kidney transplantation therapeutics market research report to meet your requirements.