Kitchen Appliances Market Size 2024-2028

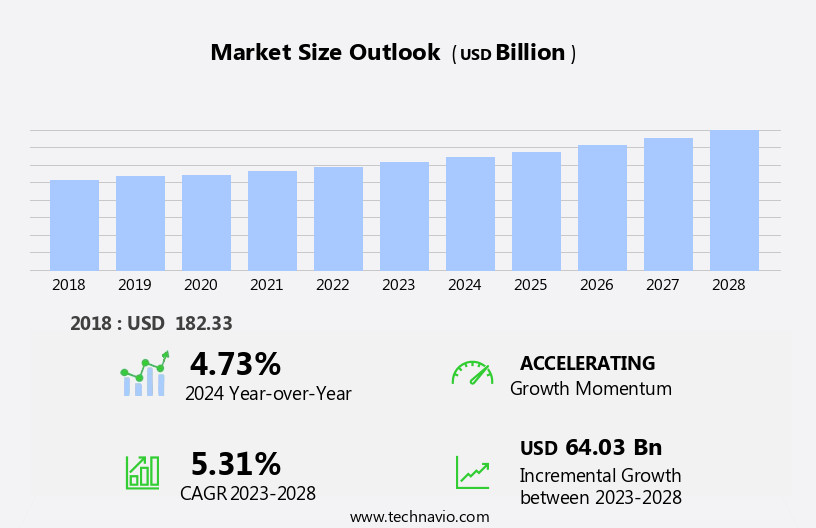

The kitchen appliances market size is forecast to increase by USD 64.03 billion at a CAGR of 5.31% between 2023 and 2028.

What will be the Size of the Kitchen Appliances Market During the Forecast Period?

How is this Kitchen Appliances Industry segmented and which is the largest segment?

The kitchen appliances industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Residential

- Commercial

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Application Insights

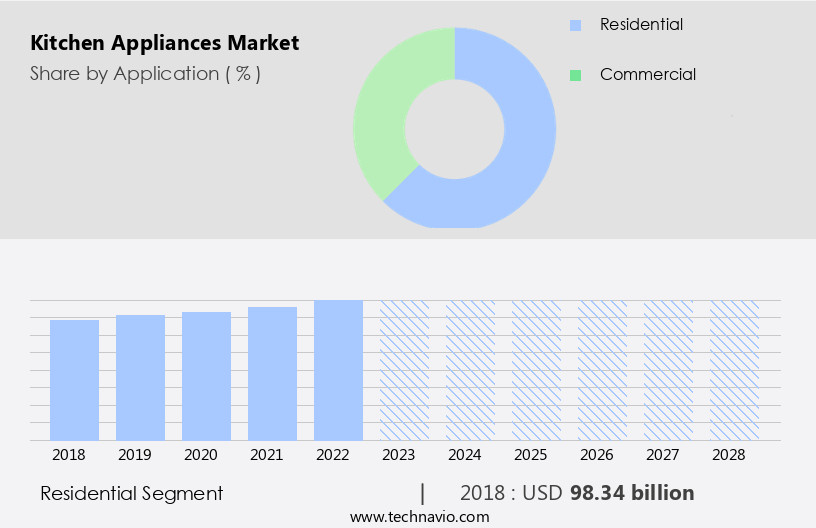

- The residential segment is estimated to witness significant growth during the forecast period.

The residential the market encompasses a range of products such as microwaves, cooktops, ovens, and specialty items. These appliances cater to both manual and smart technologies, streamlining cooking and cleaning tasks. Factors driving market growth include the expanding global population and the rise of dual-income households. The increasing number of households with at least one cooktop is also a significant contributor. Consequently, the growing demand for kitchen appliances from nuclear households will propel market expansion during the forecast period. Energy-efficient and smart home appliances, including refrigerators, dishwashers, and range hoods, are increasingly popular due to their cost savings and convenience.

Additionally, the integration of IoT and connected devices in kitchen appliances is a key trend. The market for kitchen appliances is expected to witness significant growth due to the increasing adoption of technology-driven, high-performing, and multi-purpose gadgets such as induction cookers, air fryers, and food processors. The shift towards sustainable solutions, including renewable energy and solar energy, is also influencing the market. Online shopping and home renovation are major distribution channels, with repair costs and water scarcity influencing consumer behavior.

Get a glance at the Kitchen Appliances Industry report of share of various segments Request Free Sample

The Residential segment was valued at USD 98.34 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

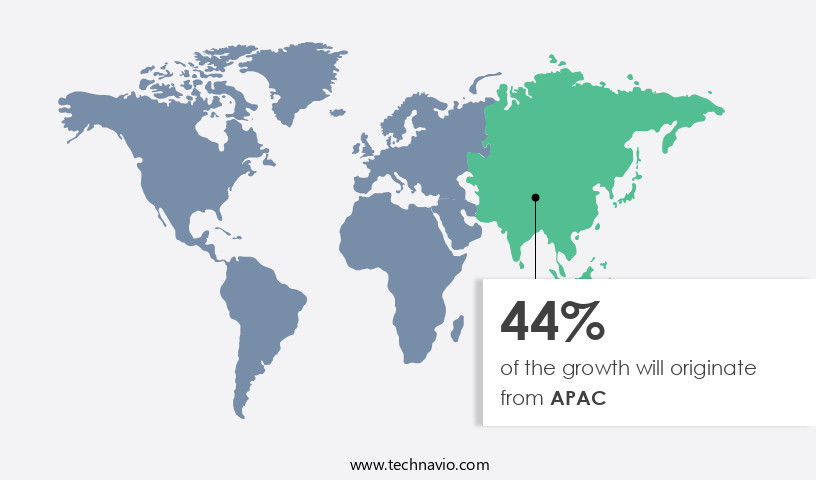

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region dominates The market due to the increasing preference for homemade food and the expanding disposable income of consumers. Rapid urbanization in countries like India, China, Japan, and South Korea fuels the demand for advanced appliances such as refrigerators, dishwashers, and microwaves. The region's hectic lifestyle drives the need for time-saving and user-friendly appliances, contributing to market growth. E-commerce platforms and modular kitchen solutions facilitate the purchase of these appliances, making them accessible to a wider audience. Energy-efficient products, including standalone ovens, cooktops, and smart appliances, cater to the growing concerns of dual-income households and the environment.

The integration of technology, such as IoT, smart homes, and connected devices, adds value to kitchen appliances, making them more desirable. The market also includes conventional and high-performing products, multi-purpose gadgets like grillers, blenders, and air fryers, and home care products. The increasing trend of work-from-home and the need for sustainable solutions further boost the demand for energy-efficient appliances.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Kitchen Appliances Industry?

Growing demand for premium and innovative smart kitchen appliances is the key driver of the market.

What are the market trends shaping the Kitchen Appliances Industry?

Advent of multi-cooking functionalities in smart cooking appliances is the upcoming market trend.

What challenges does the Kitchen Appliances Industry face during its growth?

Fluctuations in raw material prices and operational costs of kitchen appliances is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The kitchen appliances market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the kitchen appliances market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, kitchen appliances market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Beko A and NZ Pty Ltd. - The company caters to the market through its brands Beko, Grundig, Leisure, Blomberg, and Flavel. These brands encompass a comprehensive range of appliances, ensuring consumer choice and innovation. With a focus on energy efficiency, design, and functionality, the company's offerings cater to diverse consumer needs. The brands' product portfolios include refrigerators, cooktops, ovens, dishwashers, and more. By prioritizing quality and technological advancements, the company maintains a competitive edge In the dynamic the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beko A and NZ Pty Ltd.

- BSH Hausgerate GmbH

- Coway Co. Ltd.

- Electrolux AB

- General Electric Co.

- Godrej and Boyce Manufacturing Co. Ltd.

- Gourmia Inc.

- Haier Smart Home Co. Ltd.

- Havells India Ltd.

- Koninklijke Philips N.V.

- LG Electronics Inc.

- MIDEA Group Co. Ltd.

- Miele and Cie. KG

- Newell Brands Inc.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- Smarter Applications Ltd.

- Weber Stephen Products LLC

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Kitchen appliances have become an integral part of modern residential and commercial spaces, catering to the diverse cooking needs of consumers. These high-performing products have evolved significantly over the years, transitioning from conventional to technology-driven appliances. The market for kitchen appliances is characterized by its dynamic nature, driven by various factors. One of the primary factors fueling the growth of the market is the increasing trend towards energy efficiency. With the rising electricity costs, consumers are increasingly opting for energy-efficient products. This has led to the development of smart home appliances that are designed to minimize energy consumption while maximizing performance.

The Internet of Things (IoT) and connected devices have played a pivotal role in this evolution, enabling consumers to monitor and control their appliances remotely. Another factor driving the market is the changing lifestyle trends. With the rise of dual-income households and the increasing popularity of ready-to-eat food, there is a growing demand for appliances that can help save time and effort. Multi-purpose gadgets, such as air fryers, blenders, and food processors, have gained significant traction in recent years. The market for kitchen appliances is also being influenced by the shift towards sustainability. Consumers are increasingly conscious of their carbon footprint and are looking for green solutions.

Renewable energy sources, such as solar energy, are being explored to power kitchen appliances. Induction cookers, for instance, have gained popularity due to their energy efficiency and environmental friendliness. The market for kitchen appliances is also being driven by the infrastructural sector and home renovation. With the increasing focus on modernizing homes, there is a growing demand for smart and innovative kitchen appliances. This has led to the emergence of modular kitchens, which offer a sleek and customizable solution for kitchen spaces. Despite the growth opportunities, the market for kitchen appliances is not without its challenges. Repair costs and water scarcity are two significant challenges that need to be addressed.

The integration of renewable energy sources and the development of energy-efficient appliances can help mitigate these challenges. In conclusion, the market for kitchen appliances is a dynamic and evolving space, driven by various factors, including energy efficiency, lifestyle trends, sustainability, and technological advancements. The market is expected to continue growing, with a focus on developing smart and innovative products that cater to the changing needs of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.31% |

|

Market growth 2024-2028 |

USD 64.03 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.73 |

|

Key countries |

US, China, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Kitchen Appliances Market Research and Growth Report?

- CAGR of the Kitchen Appliances industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the kitchen appliances market growth of industry companies

We can help! Our analysts can customize this kitchen appliances market research report to meet your requirements.