Kombucha Market Size 2025-2029

The kombucha market size is valued to increase USD 7.97 billion, at a CAGR of 23.5% from 2024 to 2029. Health benefits of kombucha will drive the kombucha market.

Major Market Trends & Insights

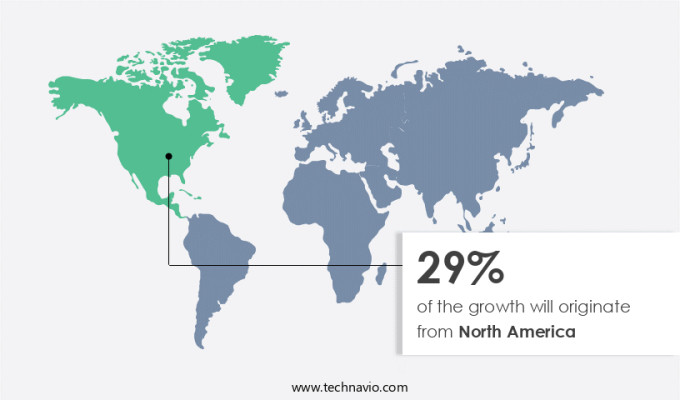

- North America dominated the market and accounted for a 29% growth during the forecast period.

- By Type - Organic segment was valued at USD 1.31 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 566.72 million

- Market Future Opportunities: USD 7967.40 million

- CAGR from 2024 to 2029 : 23.5%

Market Summary

- Kombucha, a fermented tea beverage, has emerged as a significant player in the global beverage market, with an estimated value of USD10.5 billion in 2020. This growth can be attributed to its perceived health benefits and the increasing consumer preference for natural, probiotic-rich drinks. Packaging innovations, such as the use of eco-friendly materials and unique designs, have further fueled the market's expansion. However, challenges persist, including the availability of counterfeit kombucha drinks, which threaten to undermine the industry's credibility. Despite these hurdles, the market continues to evolve, with key players investing in research and development to improve product quality and expand distribution channels.

- The future direction of the market is marked by innovation, sustainability, and a focus on consumer health and convenience.

What will be the Size of the Kombucha Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Kombucha Market Segmented ?

The kombucha industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Organic

- Non-organic

- Distribution Channel

- Offline

- Online

- Ingredient Type

- Yeast

- Bacteria

- Mold

- Others

- Package Type

- Glass Bottles

- Cans

- Draught/Kegs

- Flavor

- Original/Unflavored

- Flavored

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The organic segment is estimated to witness significant growth during the forecast period.

Amidst the growing consciousness towards healthier and more sustainable food choices, the organic the market continues to evolve, with consumers increasingly favoring this probiotic beverage for its perceived health benefits and eco-friendly production methods. The USDA organic certification, which requires at least 95% organic ingredients, direct farm sourcing, and prohibition of synthetic fertilizers, pesticides, and genetically modified organisms, sets a high standard for kombucha brands. In the realm of production, advanced techniques such as automated fermentation control, sensory evaluation methods, and metabolite profiling techniques contribute to product standardization and improved sensory quality attributes. Furthermore, ongoing research explores the optimization of sugar metabolism pathways, carbon source utilization, and nitrogen metabolism for enhanced nutrient utilization efficiency.

Microbial diversity analysis and symbiotic yeast cultures are employed to understand the complex microbial community dynamics and scoby biofilm formation during the tea fermentation process. The integration of byproduct utilization strategies, such as bacterial cellulose production and antioxidant activity assays, adds value to the production process while extending shelf life. The market's continuous evolution underscores the industry's commitment to delivering high-quality, healthful, and sustainable beverages.

The Organic segment was valued at USD 1.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Kombucha Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth due to the increasing preference for functional beverages among consumers. Key contributors to this expansion include the United States, Canada, and Mexico. In the US, there is a growing awareness of health and wellness trends among both youngsters and adults, leading to a rise in kombucha sales. This demographic shift towards healthier lifestyles is driving the consumption of kombucha as an alternative to sugary drinks.

Furthermore, the US market for functional foods and beverages is expanding, with an increasing number of consumers seeking healthier options. Overall, the North American the market is poised for continued growth, reflecting the region's evolving beverage landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market has experienced significant growth in recent years, driven by consumer demand for healthier and more natural beverage options. The unique flavor profile of kombucha is largely influenced by the starter culture used in its production. This symbiotic community of bacteria and yeast imparts distinct tastes and aromas, making each batch distinct. Fermentation time plays a crucial role in determining the acidity level of kombucha. Longer fermentation periods result in higher acidity, while shorter periods yield a sweeter taste. Temperature also affects microbial growth during fermentation, with optimal conditions typically ranging between 25-30°C. Sugar concentration is another critical factor in kombucha production, as it influences both yield and final product characteristics. Analyzing the microbial community composition provides valuable insights into the fermentation process, allowing for optimization and improvement. Antioxidant capacity is a key attribute of kombucha, with studies suggesting potential health benefits. Sensory evaluation is essential for assessing product quality, while determination of shelf life stability ensures consumer safety. Identification of key flavor compounds can guide production processes, while methods for improving probiotic content enhance nutritional value. Sustainable production practices are increasingly important in the market. These include optimization of fermentation parameters for quality, methods for controlling microbial contamination, and evaluation of consumer acceptance of different products. Comparison of various fermentation technologies and techniques for characterizing bacterial cellulose can lead to innovation and process efficiency. Byproduct utilization is another area of focus, with potential applications in food, cosmetics, and other industries. Development of novel fermentation strategies and techniques for improving process efficiency continue to drive growth in the market. Packaging plays a significant role in preserving product quality and extending shelf life, making it an essential consideration for producers.

What are the key market drivers leading to the rise in the adoption of Kombucha Industry?

- The primary factor driving the market is the acknowledged health benefits associated with consuming kombucha.

- Kombucha, a fermented tea beverage, has gained significant attention due to its health benefits. The drink's production involves a symbiotic culture of bacteria and yeast, resulting in a probiotic beverage that supports gut health and alleviates various digestive disorders. Two essential components of Kombucha, detoxifier glucuronic acid and digestive enzymes, contribute to its digestive advantages. Glucuronic acid binds toxins and facilitates their elimination through the kidneys, reducing the liver's burden.

- Additionally, the presence of digestive enzymes enhances the breakdown of proteins and saccharides, optimizing the digestive system's efficiency. This beverage's detoxification and hepato-protective properties make it a popular health choice.

What are the market trends shaping the Kombucha Industry?

- Packaging innovations and marketing initiatives are the emerging trends in the market. Marketing strategies are becoming more sophisticated with each passing day, while packaging designs continue to evolve to meet consumer demands and expectations.

- Packaging innovations have significantly influenced the evolving nature of the market. Companies are differentiating their products through advanced packaging solutions. For instance, Health-Ade introduces customized bottles with squared corners and new taglines. Healthy Brands Collective utilizes amber glass to safeguard probiotics from damaging light. These packaging advancements expand brand appeal among retailers and consumers. Additionally, marketing initiatives have been a driving force in the market.

- Leading players, such as Reed and Health-Ade, employ integrated marketing communications through various channels like newspapers, magazines, and social media platforms, including YouTube and Facebook, to boost the popularity of their kombucha offerings.

What challenges does the Kombucha Industry face during its growth?

- The proliferation of counterfeit kombucha beverages poses a significant challenge to the industry's growth trajectory. This issue undermines consumer trust and confidence in the authenticity and quality of kombucha drinks, potentially hindering the industry's expansion.

- The market experiences a complex landscape due to the prevalence of counterfeit products. These imitations negatively impact market expansion and contribute to fragmentation. Counterfeit kombucha products, which lack quality and are priced lower than authentic ones, are increasingly being sold, particularly through e-commerce channels. According to recent estimates, up to 10% of kombucha products sold online may be counterfeit. This issue poses a significant challenge for genuine companies, as consumers often cannot discern between authentic and counterfeit products.

- The presence of these counterfeit items erodes brand credibility and market share for legitimate kombucha sellers. As a professional and knowledgeable assistant, it's crucial to maintain a formal tone when addressing the evolving nature and applications of the market.

Exclusive Technavio Analysis on Customer Landscape

The kombucha market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the kombucha market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Kombucha Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, kombucha market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bucha Brew Kombucha - This company specializes in producing a range of Kombucha beverages, including Kombucha Air, Kombucha Fire, Kombucha Sovereign, and Kombucha Legacy, offering consumers diverse flavor choices within the fermented tea category. The company's commitment to quality and innovation sets it apart in the beverage industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bucha Brew Kombucha

- Brew Dr. Kombucha

- Clearly Kombucha (acquired by Health-Ade)

- Equinox Kombucha

- Fix8 Kombucha

- GT's Living Foods LLC

- Hain Celestial Group, Inc. (Celestial Seasonings, Reed's Ginger Brew - relevant for beverage market trends)

- Health-Ade Kombucha

- Humm Kombucha LLC

- KeVita (PepsiCo, Inc.)

- Kombucha Wonder Drink (Reed's, Inc.)

- København Kombucha

- Læsk

- Lo Bros Kombucha

- MOMO Kombucha

- Remedy Drinks

- Revive Kombucha

- Rise Kombucha

- The H Factor (Sparkling Probiotic Tea)

- VIGO Kombucha

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Kombucha Market

- In January 2024, GT's Living Foods, a leading kombucha brand, announced the launch of its new line of organic and raw kombucha beverages, expanding its product portfolio and catering to the growing demand for healthier and organic beverage options (GT's Living Foods Press Release).

- In March 2024, PepsiCo, a global food and beverage corporation, entered the market through the acquisition of KeVita, a major player in the space, bolstering its presence in the healthier beverage segment (Bloomberg).

- In July 2024, Boston Beer Company, the largest brewer in the United States, reported a 24% increase in kombucha sales, demonstrating the significant growth potential of this market (Boston Beer Company Quarterly Report).

- In May 2025, The Kraft Heinz Company and PepsiCo, two industry giants, announced a strategic partnership to co-manufacture and distribute each other's kombucha brands, aiming to optimize production and distribution costs while expanding their market reach (The Kraft Heinz Company Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Kombucha Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.5% |

|

Market growth 2025-2029 |

USD 7967.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

21.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovative approaches shaping its landscape. Sensory evaluation methods play a crucial role in ensuring consistent product quality, as sugar metabolism pathways are optimized through automated fermentation control. Acetic acid fermentation, a key process, is subject to product standardization methods and continuous fermentation systems. Microbial diversity analysis is essential for understanding the complex ecosystems involved in kombucha production. Packaging material selection and shelf life extension are critical considerations, as carbon source utilization and nutrient utilization efficiency are maximized. Bacterial cellulose production and flavor compound biosynthesis contribute to the unique sensory qualities of this beverage.

- Quality control parameters, byproduct utilization strategies, and tea polyphenol extraction are essential for maintaining product consistency and enhancing health benefits. PH control fermentation and symbiotic yeast cultures are employed for fermentation optimization. Probiotic bacterial strains and organic acid production add value to the market, while microbial identification methods and process optimization modeling facilitate efficient production. Microbial succession patterns and microbial community dynamics influence the tea fermentation process, with ph control fermentation and nitrogen metabolism playing significant roles. Fermentation optimization strategies, such as scoby biofilm formation and antioxidant activity assay, ensure optimal product quality and consumer satisfaction.

- The market is expected to grow by over 15% annually, driven by consumer demand for healthier, naturally fermented beverages.

What are the Key Data Covered in this Kombucha Market Research and Growth Report?

-

What is the expected growth of the Kombucha Market between 2025 and 2029?

-

USD 7.97 billion, at a CAGR of 23.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Organic and Non-organic), Distribution Channel (Offline and Online), Geography (North America, Europe, APAC, Middle East and Africa, and South America), Ingredient Type (Yeast, Bacteria, Mold, and Others), Package Type (Glass Bottles, Cans, and Draught/Kegs), and Flavor (Original/Unflavored and Flavored)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Health benefits of kombucha, Availability of counterfeit kombucha drinks

-

-

Who are the major players in the Kombucha Market?

-

Bucha Brew Kombucha, Brew Dr. Kombucha, Clearly Kombucha (acquired by Health-Ade), Equinox Kombucha, Fix8 Kombucha, GT's Living Foods LLC, Hain Celestial Group, Inc. (Celestial Seasonings, Reed's Ginger Brew - relevant for beverage market trends), Health-Ade Kombucha, Humm Kombucha LLC, KeVita (PepsiCo, Inc.), Kombucha Wonder Drink (Reed's, Inc.), København Kombucha, Læsk, Lo Bros Kombucha, MOMO Kombucha, Remedy Drinks, Revive Kombucha, Rise Kombucha, The H Factor (Sparkling Probiotic Tea), and VIGO Kombucha

-

Market Research Insights

- The market for functional beverages, specifically kombucha, continues to evolve as consumers seek out healthier alternatives to traditional drinks. According to industry reports, sales of kombucha in the United States grew by 25% in 2020, driven by increasing consumer preference for probiotic-rich, naturally fermented beverages. Furthermore, the market is expected to grow at a steady pace, with a projected compound annual growth rate of 15% through 2027. Microbial safety and quality assurance are crucial aspects of kombucha production. Producers employ sensory evaluation panels to ensure consistent product quality and taste, while also implementing process automation and cost optimization measures to maintain sustainable production.

- The use of microbial consortia in starter culture preparation enhances product diversity and improves yield, contributing to the industry's growth. Functional beverages, including kombucha, offer numerous health benefits, such as antioxidant compounds and probiotic properties. These benefits, combined with the growing consumer demand for natural, sustainable, and locally produced goods, make the market an exciting and continuously evolving sector.

We can help! Our analysts can customize this kombucha market research report to meet your requirements.