Light-Emitting Diode (Led) Grow Lights Market Size 2024-2028

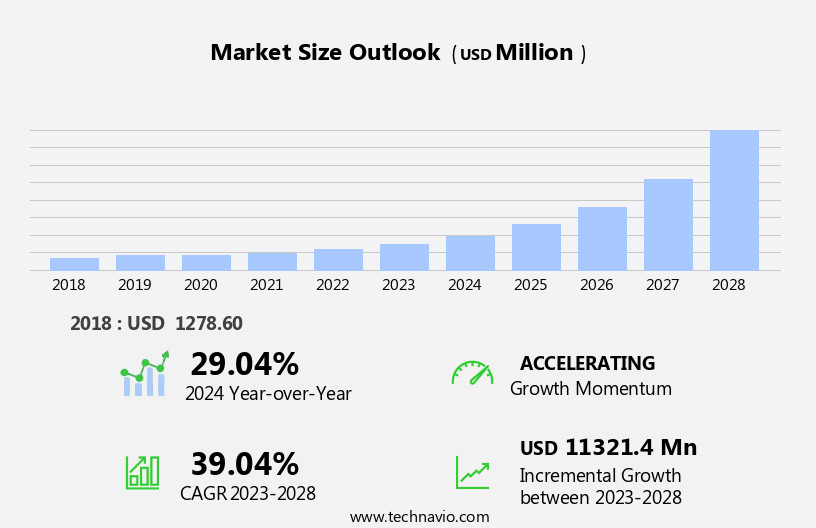

The light-emitting diode (led) grow lights market size is forecast to increase by USD 11.32 billion at a CAGR of 39.04% between 2023 and 2028.

What will be the Size of the Light-Emitting Diode (Led) Grow Lights Market During the Forecast Period?

How is this Light-Emitting Diode (Led) Grow Lights Industry segmented and which is the largest segment?

The light-emitting diode (led) grow lights industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Commercial greenhouses

- Vertical farming

- Indoor farming

- Others

- Power Rating

- Low power (lesser than 100 W)

- Medium power (100-300 W)

- High power (greater than 300 W)

- Geography

- Europe

- UK

- North America

- Canada

- US

- APAC

- China

- South America

- Middle East and Africa

- Europe

By Application Insights

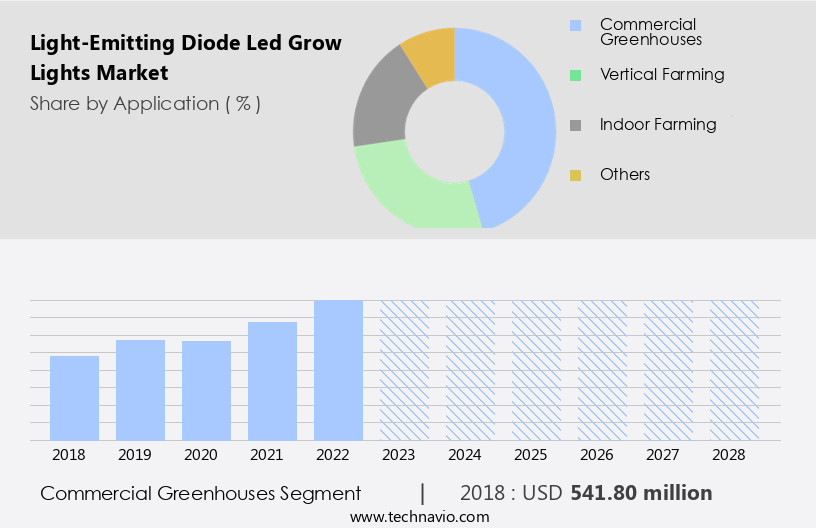

- The commercial greenhouses segment is estimated to witness significant growth during the forecast period.

Commercial greenhouses, characterized by their transparent glass or plastic roofs, enable year-round production of fruits, flowers, and vegetables. These structures, available in various sizes, utilize advanced technology such as microprocessors and sensors for temperature and irrigation control. The adoption of LED grow lights in greenhouse operations has surged due to their energy efficiency and ability to optimize plant growth. LED lights, an eco-friendly technology, offer customizable spectra and adjustable light intensity, enhancing photosynthesis and crop yield. The shift towards sustainable agriculture, controlled environment agriculture, and urban farming has fueled the demand for LED grow lights in greenhouses. This technology, a smart investment for commercial growers, offers long-term energy savings and reduced electricity consumption.

Fresh produce, a critical component of food security, benefits significantly from these agricultural techniques, mitigating the impact of environmental factors and urbanization on arable land. LED technology, a game-changer in lighting, offers power consumption advantages over traditional lighting alternatives such as fluorescent lights, incandescent lamps, and High Intensity Discharge (HID) lights.

Get a glance at the Light-Emitting Diode (Led) Grow Lights Industry report of share of various segments Request Free Sample

The Commercial greenhouses segment was valued at USD 541.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market for LED grow lights is experiencing significant growth due to the increasing adoption of vertical farming and horticulture in countries like the Netherlands. With a strong presence of automated commercial greenhouses, Europe is a global leader In the export of various horticultural produce, including tomatoes, potatoes, onions, and vegetables. These climate-controlled farms, spread over large acres, enable optimal plant growth through controlled environmental factors. The integration of LED grow lights offers energy efficiency and customizable spectrum, enhancing photosynthesis and improving crop yield. As urbanization reduces arable land, indoor farming and hydroponic systems are gaining popularity, further fueling the market's growth.

The long-lasting and energy-efficient nature of LED technology makes it an eco-friendly alternative to traditional lighting like fluorescent lights, incandescent lamps, and High Intensity Discharge. The market's expansion is expected to continue as LED lights offer flexibility for new installations and retrofits, catering to various agricultural techniques and applications, including turf and landscaping, research purposes, and smart greenhouses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Light-Emitting Diode (Led) Grow Lights Industry?

Growth in indoor farming is the key driver of the market.

What are the market trends shaping the Light-Emitting Diode (Led) Grow Lights Industry?

Innovation and investments in greenhouse horticulture startups is the upcoming market trend.

What challenges does the Light-Emitting Diode (Led) Grow Lights Industry face during its growth?

High installation and setup costs is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The light-emitting diode (led) grow lights market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the light-emitting diode (led) grow lights market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, light-emitting diode (led) grow lights market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Advanced Grow Lights American Co. - The LED grow light market encompasses advanced lighting solutions, including the FC 4800 480W, FC 6500, and FC 8000 Commercial 800W LED grow lights. These innovative lighting systems utilize Light Emitting Diodes (LEDs) to provide optimal conditions for plant growth. With energy efficiency and long-lasting performance, LED grow lights have gained significant traction In the horticulture industry. These solutions cater to various applications, from home gardening to large-scale commercial cultivation. LED grow lights deliver consistent light spectra, ensuring optimal photosynthesis and promoting healthy plant growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Grow Lights American Co.

- Biological Innovation and Optimization Systems LLC

- Black Dog Grow Technologies Inc.

- Bridgelux Inc.

- Controlled Environments Ltd.

- Dool Industries

- General Electric Co.

- GrowRay Lighting Technologies

- Heliospectra AB

- Kessil

- Kind LED Grow Lights

- LED Hydroponic Ltd.

- OSRAM Licht AG

- Samsung Electronics Co. Ltd.

- SANlight GmbH

- Senmatic AS

- Shenzhen Grow LED Technology Co. Ltd.

- Signify NV

- SMART Global Holdings Inc.

- Valoya Oy

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for LED grow lights has experienced significant growth in recent years due to the increasing demand for sustainable and energy-efficient agricultural techniques. These lighting solutions have become increasingly popular in various controlled environments, including indoor farms, greenhouses, and vertical farms, as they provide optimal conditions for plant growth. LED grow lights offer several advantages over traditional lighting sources such as fluorescent lights, incandescent lamps, high-intensity discharge (HID) lamps, and halogens. They are known for their energy efficiency, long lifespan, and customizable spectrum, which can be tailored to specific plant growth requirements. The ability to optimize the light spectrum and intensity for various crops has led to increased crop yield and improved fresh produce quality.

This is particularly important in urban areas where arable land is limited, and vertical farming has gained popularity as a solution for food security. Moreover, LED grow lights have gained traction In the horticulture industry due to their eco-friendly nature. They consume less electricity compared to traditional lighting sources, making them a cost-effective and sustainable option for commercial greenhouses and hydroponic systems. The increasing urbanization trend has led to a growing demand for LED grow lights in urban farming applications. These lights enable the cultivation of fresh produce in urban areas, reducing the need for long-distance transportation and contributing to food security.

The LED grow light market is segmented based on installation types, including retrofit and new installations. Retrofit installations involve the replacement of existing lighting systems with LED grow lights, while new installations refer to the integration of LED grow lights into new agricultural infrastructure. Smart LED grow lights have gained popularity in recent years due to their energy efficiency and the ability to be controlled via Wi-Fi. These lights can be customized to specific plant growth requirements and offer real-time monitoring capabilities, ensuring optimal growing conditions and reducing the need for manual intervention. The increasing focus on environmental factors and the adoption of eco-friendly technologies have further fueled the growth of the LED grow light market.

Energy-efficient LED technology offers a long-lasting solution for indoor gardening and hydroponic systems, reducing the need for frequent replacements and minimizing waste. In conclusion, the global LED grow light market is expected to continue its growth trajectory due to the increasing demand for sustainable and energy-efficient agricultural techniques. The ability to optimize plant growth conditions, reduce electricity consumption, and offer long-lasting solutions make LED grow lights an attractive option for various controlled environments, including indoor farms, greenhouses, and vertical farms.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.04% |

|

Market growth 2024-2028 |

USD 11321.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.04 |

|

Key countries |

US, Canada, The Netherlands, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Light-Emitting Diode (Led) Grow Lights Market Research and Growth Report?

- CAGR of the Light-Emitting Diode (Led) Grow Lights industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the light-emitting diode (led) grow lights market growth of industry companies

We can help! Our analysts can customize this light-emitting diode (led) grow lights market research report to meet your requirements.