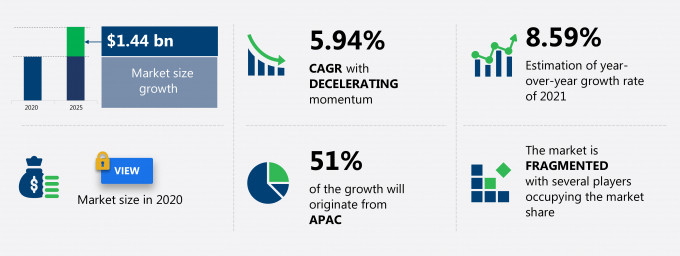

The LED industrial lighting market share is expected to increase by USD 1.44 billion from 2020 to 2025, and the market’s growth momentum will decelerate at a CAGR of 5.94%.

This LED industrial lighting market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers LED industrial lighting market segmentations by product (lamps and luminaires) and geography (APAC, Europe, North America, South America, and MEA). The LED industrial lighting market report also offers information on several market vendors, including Acuity Brands Inc., Bridgelux Inc., Cree Lighting, Dialight Plc, Eaton Corp. Plc, Hubbell Inc., Koninklijke Philips NV, OSRAM GmbH, Wipro Ltd., and Zumtobel Group AG among others.

What will the LED Industrial Lighting Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the LED Industrial Lighting Market Size for the Forecast Period and Other Important Statistics

LED Industrial Lighting Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The phasing out halogen, incandescent, fluorescent, and hid lamps is notably driving the LED industrial lighting market growth, although factors such as high cost of implementing LEDs may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the LED industrial lighting industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key LED Industrial Lighting Market Driver

One of the key factors driving the LED industrial lighting market growth is the phasing out halogen, incandescent, fluorescent, and HID lamps. Several countries across the globe have placed bans on the use of halogen lamps to promote the growth of LEDs for their inherent energy-saving feature. Halogen lamps consume much more power than LEDs; they also have a larger carbon footprint. Several companies have stopped the manufacturing of halogen, fluorescent, and incandescent lights due to the increasing adoption of LEDs across the globe. Moreover, government bodies in various countries are focusing on phasing out halogen lights to reduce carbon emissions. For example, in June 2021, the Department for Business, Energy and Industrial of the UK announced to ban the sales of halogen lightbulbs in the UK market from September 2021, with an aim to cut over 1.25 million tons of carbon emissions per year. Thus, the phasing out of halogen, incandescent, and fluorescent lamps is expected to fuel the growth of the global LED industrial lighting market during the forecast period.

Key LED Industrial Lighting Market Trend

Increasing interest in CSP LED lighting for industrial applications is the major trend influencing LED industrial lighting market growth. CSP LED lighting module is an LED module in which a single chip has a direct-mountable package, which is the same size as the chip. The use of CSP LEDs for high-bay and low-bay lighting is further garnering more attention as they are small in size and provide high illumination levels. Spotlights are strong, focused lights that are used to illuminate a particular spot for making an object or a person conspicuous from the surroundings. CSP LED lighting modules can also be used for spotlights, mainly because CSP LEDs can provide much brighter light and take up a fraction of the space required for installing the luminaires. This is possible as CSP LED lighting modules are almost the same size as the chip and do not have any bulky exterior packaging. Hence, there will be an increasing interest in adopting CSP technology for the manufacturing of LED lights to be used extensively for industrial lighting applications.

Key LED Industrial Lighting Market Challenge

High cost of implementing LEDs is one of the key challenges hindering the LED industrial lighting market growth. The initial cost required to integrate LED lighting into manufacturing plants and production facilities is exorbitant. This prevents firms from integrating LEDs into their plants, and these firms prefer other types of lighting such as CFL, LFL, and HID. These end-users prefer the use of traditional lighting sources over LEDs as they have a lower initial cost.The assembly process for an LED is carried out manually as it is a complicated procedure. A clearly defined standard procedure for manufacturing LEDs on machines has not been developed. LEDs require a conducting material, usually aluminum, to dissipate heat, which can cost over $3. The addition of external LED drivers (if required) further adds to the cost. Although LEDs are more efficient and have a better and higher ROI, high initial investments limit the growth opportunities of the global LED industrial lighting market. Thus, end-users prefer to use HIDs, which can meet immediate lighting requirements at a fraction of the cost.

This LED industrial lighting market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global LED industrial lighting market as a part of the global electrical components and equipment market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the LED industrial lighting market during the forecast period.

Who are the Major LED Industrial Lighting Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Acuity Brands Inc.

- Bridgelux Inc.

- Cree Lighting

- Dialight Plc

- Eaton Corp. Plc

- Hubbell Inc.

- Koninklijke Philips NV

- OSRAM GmbH

- Wipro Ltd.

- Zumtobel Group AG

This statistical study of the LED industrial lighting market encompasses successful business strategies deployed by the key vendors. The LED industrial lighting market is fragmented and the vendors are adopting organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Acuity Brands Inc. - The company offers led industrial lighting products such as Linear high bays, low bays, strip lights and others.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The LED industrial lighting market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

LED Industrial Lighting Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the LED industrial lighting market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for LED Industrial Lighting Market?

For more insights on the market share of various regions Request for a FREE sample now!

51% of the market’s growth will originate from APAC during the forecast period. China and Japan are the key markets for LED industrial lighting market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

The presence of several manufacturing facilities owned by numerous OEMs worldwide will facilitate the LED industrial lighting market growth in APAC over the forecast period. This market research report entails detaiLED information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the outbreak of COVID-19 in the region forced various manufacturing facilities in APAC to temporarily shut down, which resulted in reduced revenue for several companies. This led to the postponement of the expansion and renovation of manufacturing facilities in APAC, thereby reducing the demand for LED industrial lighting during the forecast period. However, the initiation of large-scale vaccination drives and the lifting of lockdown restrictions in the first half of 2021 led to the resumption of industrial operations in the region.

What are the Revenue-generating Product Segments in the LED Industrial Lighting Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The LED industrial lighting market share growth by the lamps will be significant during the forecast period. One of the key reasons for the growth of this segment is the increasing number of regulations set forth by countries, which are limiting the use of traditional lighting and promoting the growth of LED lamps.

Besides the above-mentioned factors, the post COVID-19 impact has brought forth a slowdown in or fast tracked the demand for the service or product. This report provides an accurate prediction of the contribution of all the segments to the growth of the LED industrial lighting market size and actionable market insights on post COVID-19 impact on each segment.

|

LED Industrial Lighting Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 5.94% |

|

Market growth 2021-2025 |

$ 1.44 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

8.59 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 51% |

|

Key consumer countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiLED |

Acuity Brands Inc., Bridgelux Inc., Cree Lighting, Dialight Plc, Eaton Corp. Plc, Hubbell Inc., Koninklijke Philips NV, OSRAM GmbH, Wipro Ltd., and Zumtobel Group AG |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this LED Industrial Lighting Market Report?

- CAGR of the market during the forecast period 2021-2025

- DetaiLED information on factors that will drive LED industrial lighting market growth during the next five years

- Precise estimation of the LED industrial lighting market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the LED industrial lighting industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detaiLED information on vendors

- Comprehensive details of factors that will challenge the growth of LED industrial lighting market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch