Light-Emitting Diode (LED) Market Size 2025-2029

The light-emitting diode market size is forecast to increase by USD 264.1 million at a CAGR of 19.2% between 2024 and 2029.

- The global LED market is experiencing significant growth, driven by the increasing adoption of energy-efficient lighting technologies and the high traction of intelligent lighting systems. Energy savings and environmental sustainability are key priorities for businesses and consumers alike, leading to a shift away from traditional lighting sources towards LED technology. Moreover, the integration of IoT and AI capabilities in LED lighting systems is revolutionizing the way lighting is used and managed, offering new opportunities for cost savings, energy optimization, and enhanced user experiences. However, the high average cost per LED fixture remains a challenge for market penetration, particularly in price-sensitive markets.

- To capitalize on this market opportunity, companies should focus on developing cost-effective solutions while continuing to innovate in areas such as design, connectivity, and energy efficiency. By staying abreast of market trends and addressing the challenges, businesses can effectively navigate the dynamic LED market landscape and position themselves for long-term success.

What will be the Size of the Light-Emitting Diode (LED) Market during the forecast period?

- The LED market encompasses a diverse range of applications, including LED lighting, displays, signage, strips, backlighting, grow lights, floodlights, tubes, and more. This market continues to experience growth due to the numerous benefits of LED technology, such as energy efficiency, longer lifespan, and versatility. According to industry reports, the global LED market is projected to reach a significant size by 2025, driven by increasing demand for energy-efficient solutions and continuous innovations in LED design, engineering, and materials. LED applications span various sectors, including commercial, residential, industrial, and outdoor lighting, as well as display and signage industries. Ongoing research and development efforts are focused on enhancing the performance, affordability, and customization of LED solutions, further expanding their market reach and potential.

How is this Light-Emitting Diode (LED) Industry segmented?

The light-emitting diode (LED) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Luminaires

- Lamps

- Application

- General lighting

- Automotive lighting

- Backlight

- Others

- Distribution Channel

- Offline

- Online

- Type

- SMD LEDs

- High-power LEDs

- Through-hole LEDs

- RGB LEDs

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- France

- Germany

- Italy

- UK

- North America

- US

- Canada

- South America

- Brazil

- Middle East and Africa

- UAE

- APAC

By Product Insights

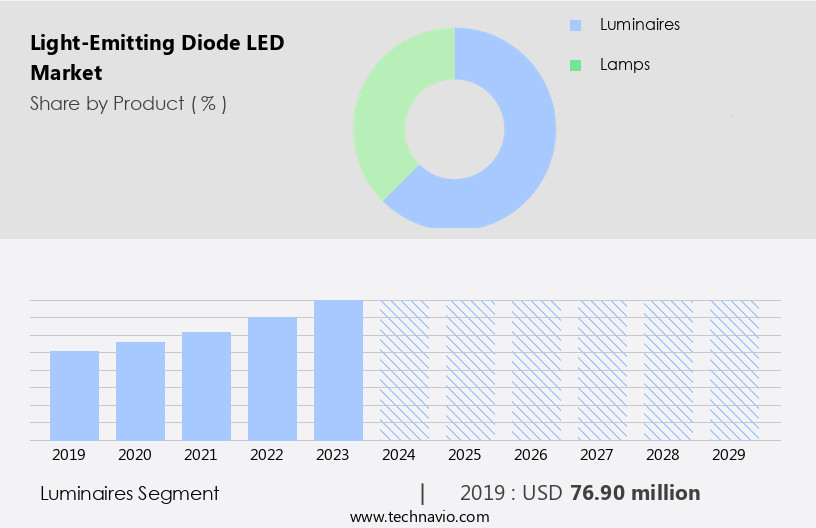

The luminaires segment is estimated to witness significant growth during the forecast period.

LED technology has revolutionized the lighting industry with its energy-efficient and cost-effective solutions. LED luminaires, including downlights, troffers, roadway fixtures, outdoor lighting, and others, are increasingly adopted across various sectors such as residential, office, retail, and industrial. LED luminaires offer numerous benefits, including longer lifespan, reduced energy consumption, and lower maintenance costs. Traditional luminaires, such as incandescent and fluorescent, have limitations like frequent replacement due to continuous switching, the need for external ballasts, and the presence of toxic mercury. LED luminaires, on the other hand, do not require external ballasts and have a longer lifespan, making them a more cost-effective and environmentally-friendly alternative.

The LED value chain includes LED chips, materials, components, drivers, controllers, systems, and modules. LED innovations continue to advance, leading to the development of LED displays, signage, backlighting, grow lights, floodlights, tubes, panels, screens, strips, and headlights. The adoption of LED technology is expected to continue, driven by its energy efficiency and cost savings.

Get a glance at the market report of share of various segments Request Free Sample

The Luminaires segment was valued at USD 76.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant growth due to the increasing demand for energy-efficient lighting solutions from the residential and commercial sectors. With the region becoming a hub for industries such as retail, hospitality, and healthcare, and the setting up of offices by multinational companies, the need for cost-effective and long-lasting LED lighting solutions is on the rise. Moreover, the development of smart infrastructure in several countries in the region, driven by improving IT infrastructure, is further fueling market growth. The construction market is also expanding, and governments' investments in infrastructure projects present substantial opportunities for the LED industry.

This trend is leading to increased demand for LED bulbs, fixtures, panels, displays, signage, street lights, strips, drivers, backlighting, grow lights, floodlights, tubes, downlights, headlights, and other LED innovations. The benefits of LED technology, including energy efficiency and environment-friendliness, make it an attractive alternative to traditional incandescent light sources. The LED value chain comprises various components, such as LED chips, materials, controllers, systems, modules, and design and engineering solutions, all contributing to the advancements in LED technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Light-Emitting Diode (LED) Industry?

- The growing adoption of energy-efficient lighting technologies is the key driver of the market. The global lighting market is experiencing significant growth due to the increasing demand for energy-efficient solutions. Given that lighting accounts for approximately 20% of global electricity production, governments worldwide are prioritizing the promotion of energy-efficient lighting technologies. In some regions, the use of traditional incandescent bulbs has been banned, leading to a rise in demand for alternatives such as halogen, Compact Fluorescent Lamps (CFL), Light Emitting Diodes (LED), and Lighting Fiber (LFL). Moreover, the growing consciousness towards energy conservation has fueled the adoption of energy-efficient lighting technologies, particularly LEDs, which consume up to 75% less energy than incandescent bulbs and can last up to 25 times longer.

- This market trend is expected to continue as consumers and businesses seek to reduce their carbon footprint and save on energy costs.

What are the market trends shaping the Light-Emitting Diode (LED) Industry?

- The growing traction of intelligent lighting systems is the upcoming market trend. The digital transformation of the lighting industry is gaining momentum with the integration of intelligent lighting systems and controls. Energy efficiency and cost savings are key drivers in the market, leading to the increasing adoption of LED technology. Intelligent lighting systems incorporate sensors for occupancy and daylight harvesting, enabling automatic adjustments to lighting levels based on natural light availability and room usage.

- These systems also offer wireless controls for customized lighting settings and power management. By adapting to changing space requirements, intelligent LED lighting solutions are becoming essential in commercial buildings. The integration of advanced technology in lighting products enhances their functionality and efficiency, making them a valuable investment for businesses. The market for LED lighting solutions is expected to grow further, driven by continuous research and production advancements. LED grow lights are increasingly popular in horticulture, while LED signage and LED backlighting are common in advertising and digital displays. LED floodlights offer excellent outdoor illumination, and LED tubes are a cost-effective replacement for traditional incandescent bulbs. Overall, the LED market is poised for continued growth, driven by its numerous advantages and applications.

What challenges does the Light-Emitting Diode (LED) Industry face during its growth?

- The high average cost per fixture is a key challenge affecting the industry growth. LED Market Dynamics: Despite the global decline in Average Selling Prices (ASPs) of LED lighting products, the high initial cost per fixture remains a significant barrier to adoption. This cost includes the expense of LED fixtures and related wiring, as well as labor costs. In newer homes, wiring is less of a concern, but older homes may necessitate electrical system renovations for safe LED bulb installation, further increasing costs.

- These factors contribute to the continued challenge of widespread LED market penetration. This affordability, coupled with the energy savings and longer lifespan, makes LED an attractive alternative to traditional lighting sources. LED's versatility extends beyond general illumination applications. In display backlighting applications, LEDs offer several advantages, including higher brightness, longer lifespan, and improved color accuracy compared to other backlighting technologies. Additionally, LEDs are used in signage and advertising, where their ability to display vibrant colors and high brightness is essential. LED's environmental friendliness is another factor contributing to its market growth. Unlike traditional lighting sources, such as incandescent bulbs, which contain hazardous materials like mercury, LEDs are free of such substances.

Exclusive Customer Landscape

The light-emitting diode (LED) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the light-emitting diode (led) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, light-emitting diode (led) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

SMART Global Holdings Inc.- The company offers LED such as DL DR6BD14AWG, DL DR6BD14KKG, and DL DR6BD14WWE.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuity Brands Inc.

- ams OSRAM AG

- Bridgelux Inc.

- Dialight PLC

- Eaton Corp. plc

- Ennostar Inc.

- EVERLIGHT ELECTRONICS CO. LTD.

- General Electric Co.

- GrowRay Lighting Technologies

- Havells India Ltd.

- LITE ON Technology Corp.

- Lumileds Holding BV

- Nichia Corp.

- Samsung Electronics Co. Ltd.

- Seoul Semiconductor Co. Ltd.

- Sharp Corp.

- Signify NV

- SMART Global Holdings Inc.

- Toyoda Gosei Co. Ltd.

- Zumtobel Group AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global LED market encompasses a diverse range of applications, from general illumination to display backlighting and signage. This market's growth is underpinned by the technological advantages of LED lighting, which offers energy efficiency, longer lifespan, and cost-effectiveness compared to traditional incandescent light sources. LED technology, a semiconductor-based lighting solution, converts electrical energy into light through the emission of photons. Its versatility allows for various forms of LED products, including bulbs, fixtures, panels, screens, street lights, strips, and tubes, among others. The value chain of the LED market comprises several stages, from the production of LED chips to the manufacturing of LED components, systems, and solutions.

LED's energy efficiency is a significant factor driving its adoption in various sectors. Traditional lighting sources, such as incandescent bulbs, consume a substantial amount of electrical energy and emit a considerable amount of heat. In contrast, LEDs convert a large portion of electrical energy into light, making them more energy-efficient and environmentally friendly. Furthermore, LEDs have a longer lifespan, reducing the frequency of replacements and associated costs. LED's cost-effectiveness is another critical factor contributing to its market growth. While the production cost of LED chips has decreased significantly over the years, advancements in LED design, engineering, and manufacturing processes have led to more affordable LED products.

This makes LED a more sustainable and eco-friendly lighting solution. In summary, the global LED market is driven by the technological advantages of LED lighting, including energy efficiency, longer lifespan, and cost-effectiveness. Its versatility and environmental friendliness have led to its adoption in various sectors, from general illumination to display backlighting and signage. As LED technology continues to advance, it is poised to become the dominant lighting solution in the global market. The LED market is witnessing significant growth with various applications such as LED signage, LED strips, LED backlighting, LED grow lights, LED floodlights, and LED tubes, leading the demand. LED drivers are an essential component in LED lighting systems, ensuring efficient power management. LED research and developments continue to advance, leading to the production of innovative LED materials and modules. Engineering advancements in LED technology result in energy savings, longer lifespan, and improved color rendering. LED benefits, including energy efficiency and eco-friendliness, make it a preferred choice for numerous industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

244 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.2% |

|

Market growth 2025-2029 |

USD 264.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.7 |

|

Key countries |

China, US, Japan, India, Germany, South Korea, Brazil, UK, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Light-Emitting Diode (LED) Market Research and Growth Report?

- CAGR of the Light-Emitting Diode (LED) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the light-emitting diode (led) market growth of industry companies

We can help! Our analysts can customize this light-emitting diode (led) market research report to meet your requirements.