Lidding Films Market Size 2024-2028

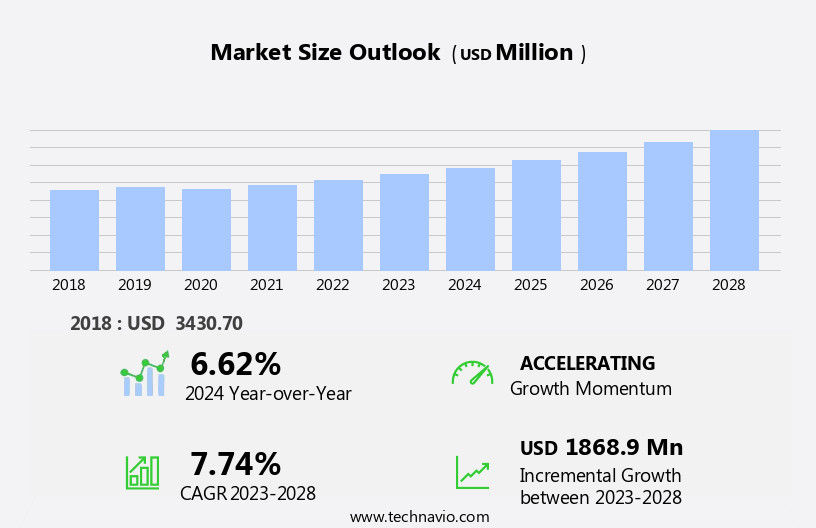

The lidding films market size is forecast to increase by USD 1.87 billion at a CAGR of 7.74% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for improved protective packaging solutions in various industries. In the food sector, there is a rising focus on extending the shelf life of perishable items such as soups, snacks, and condiments using aluminum and polyethylene lidding films. Furthermore, the personal care and pharmaceutical packaging industries are adopting bioplastics, such as polyethylene terephthalate and polypropylene, for e-commerce and Horeca applications due to their sustainability benefits.

- However, stringent regulations on the manufacture of plastic packaging are posing challenges to market growth. In the US, the trend towards online grocery shopping and the increasing popularity of flexible packaging for snacks, condiments, and cosmetics are expected to drive market demand.

What will be the Size of the Lidding Films Market During the Forecast Period?

- The market encompasses specialized films used to seal and protect ready-to-eat food goods, primarily withIn the food packaging industry. This market caters to various sectors, including processed foods, horeca industry, and food services. Lidding films are essential for preserving the freshness and quality of food products, offering features such as microwave cooking compatibility, peelability, resealability, and high-barrier properties. The global packaging industry's growth is driving market expansion, with ecommerce and online grocery shopping gaining traction. Consumers' increasing preference for convenience and the rise of mobile shopping apps further fuel market demand. Raw resources for lidding films include polyethylene terephthalate (PET), polyethylene, and aluminum.

- Market trends include the development of biodegradable lidding films to address environmental concerns. Lidding films come in various forms, such as peelable, resealable, breathable, and high-barrier, catering to diverse food packaging needs. Polymer types, including plastic polymers and PET, are used to create these films, with anti-fog qualities ensuring optimal product presentation. The market is expected to maintain a steady growth trajectory, reflecting the evolving needs of the food industry and consumer preferences.

How is this Lidding Films Industry segmented and which is the largest segment?

The lidding films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food and beverage

- Pharmaceutical

- Personal care and cosmetics

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By End-user Insights

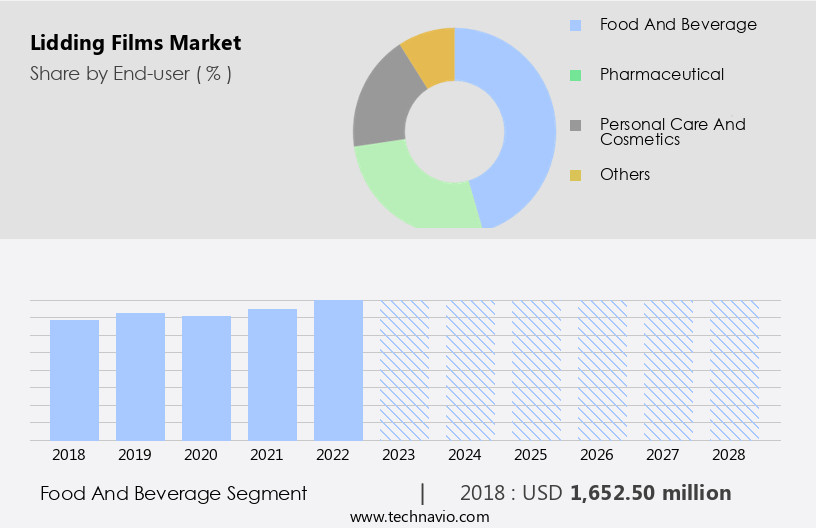

The food and beverage segment is estimated to witness significant growth during the forecast period. The market is driven by the increasing demand for packaged food and beverages. With the rise in agricultural production and advancements in food processing technology, the food and beverage industry is expanding in various regions. Consequently, food and beverage exports have grown significantly, particularly to North America, the Middle East, and Southeast Asia. To ensure secure and hygienic transportation of these products, high-quality packaging, including lidding films, is essential. Lidding films offer benefits such as moisture, light, and oxygen protection, as well as customized product presentation. In addition, the trend towards on-the-go foods, snacks, and dairy products has increased the demand for convenient and portable packaging solutions.

The market for lidding films is further propelled by the growing popularity of eCommerce, mobile shopping apps, HoReCa industry, and food services sector. The use of biodegradable lidding films and recyclable materials is also gaining traction due to increasing environmental concerns and food safety laws. The market for lidding films is segmented into polyethylene terephthalate (PET), polypropylene (PP), and polyvinyl chloride (PVC), among others. Key materials include peelable, resealable, breathable, high-barrier, and anti-fog qualities. The market is expected to grow as international trade continues to increase and consumers demand longer shelf life and improved product presentation.

Get a glance at the share of various segments. Request Free Sample

The Food and beverage segment was valued at USD 1.65 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing steady growth, driven by the increasing consumption of ready-to-eat food goods and processed foods. The US and Canada are the primary contributors to this market's revenue growth. The shift towards convenience and on-the-go consumption patterns is fueling the demand for lidding films in various applications such as cups, trays, cans, and bottles. Additionally, the healthcare sector in North America is witnessing significant growth, leading to increased demand for pharmaceutical, personal care, and cosmetics packaging solutions. The use of lidding films In these sectors ensures product presentation, moisture, light, and oxygen protection, adhering to food safety laws.

The global packaging industry is also witnessing a shift towards recyclable and biodegradable materials, with lidding films made of polypropylene, polyethylene, and biodegradable polymers gaining popularity. The eCommerce, HoReCa industry, food services sector, and online grocery shopping are other significant end-users of lidding films. The market is expected to continue its growth trajectory due to the increasing demand for high-barrier lidding films for long-distance food distribution and the integration of advanced material science technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Lidding Films Industry?

Rising focus on improving shelf life of products is the key driver of the market.

- Shelf life is the extent to which a product can be stored before it is used or consumed. The increase in the shelf life of products helps manufacturers keep them for sale for a longer time, thereby reducing the wastage of the product. The increase in shelf life also aids in the transportation and export of perishable products such as food, beverages, and medicines to different places without any damage. Lidding films are used to improve the shelf life of products. They also help prevent spoilage of food products by creating a tight seal that keeps air, moisture, and other substances from entering the packaging.

- In the case of lidding films, shelf life extension is achieved using modified atmosphere packaging (MAP). The use of MAP allows the air in the package to be replaced with a different, fixed mixture of gases, while the use of lidding films prevents the gas from leaking out of the package. Some vendors of lidding films are focusing on offering new products that have an extended shelf life. For instance, in March 2024, Parkside launched its Popflex lidding film a recyclable product for fresh produce packers and growers. The rise in the availability of such new products with added features is likely to increase the demand for lidding films during the forecast period

What are the market trends shaping the Lidding Films market?

Increasing adoption of bioplastics is the upcoming market trend.

- Rising concerns for the sustainability of the environment are driving the demand for bioplastic materials in packaging industry. Bioplastic lidding films are made from biodegradable materials, such as cellulose. Moreover, plastics such as polyethylene made from renewable resources such as bioethanol can also be used as raw materials for packaging products. These plastics are derived from renewable biomass sources or biodegradable sources. As a result, bioplastic films are compostable or biodegradable and have a negligible carbon footprint compared to conventional plastic materials. The production of bioplastics consumes 60% less energy than that needed to produce petroleum-based plastics. Bioplastics also emit lesser greenhouse gases than fossil fuel-based plastics.

- The growing environmental concerns among people and government organizations are increasing the focus toward biopolymer-based plastics. For example, FKuR Kunststoff GmbH (FKuR Kunststoff) offers a wide range of bioplastics-based stretch and shrink films such as Green LDPE SBF 0323 HC, Green LDPE SBF 0323/12HC, Green LLDPE SLH 118, Green LLDPE SLH 218, Green LLDPE SLL 118, and Green LLDPE SLL 318. The rising use of bioplastic packaging will influence lidding films to move toward bioplastics slowly. However, in recent past years, the adoption of bioplastic packaging has had been slow because of the higher preferable characteristics of conventional plastic over bioplastics. Continuous development of new products by polymer manufacturers is also one of the main trends in the market. Product developments by some polymer manufacturers will also encourage other polymer manufacturers to introduce innovative products to remain competitive in the market during the forecast period. Thus, the emergence of bioplastics will drive the growth of the market during the forecast period

What challenges does the Lidding Films Industry face during its growth?

Stringent regulations on manufacture of plastic packaging is a key challenge affecting the industry growth.

There are various stringent regulations that the manufacturers must follow while manufacturing and marketing lidding films. Regulatory organizations such as the US Environmental Protection Agency (EPA) have implemented various stipulations for the market. To be used for packaging operations, packaging companies must comply with the following regulations and standards in different countries:

- The US EPA has established the Organic Chemicals, Plastics, and Synthetic Fibers (OCPSF) Effluent Guidelines and Standards (40 CFR Part 414), which apply to the process of wastewater discharge after the manufacture of the products or product groups listed in the rayon fibers, other fibers, thermoplastic resins, thermosetting resins, and specialty organic chemicals sub-categories.

- In Germany, food packaging materials must have ISEGA Forschungs-und Untersuchungsgesellschaft mbH certificate of conformity, stating that the product complies with Germany's Lebensmittel- und Futtermittelgesetzbuch (LFGB), the appropriate Bundesinstitut für Risikobewertung (BfR) recommendations, and Regulation No. 1935/2004 on the use of materials and articles intended to come into contact with food.

- The British Retail Consortium (BRC) and the Institute of Packaging (IoP) have collaboratively created the BRC/IoP Global Standards for Packaging and Packaging Materials. The BRC/IoP certifications for any packaging company imply that the quality and safety of packaging provided by the company is recognized by the BRC/IoP Global Standards for Packaging and Packaging Materials.

Exclusive Customer Landscape

The lidding films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lidding films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lidding films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - Lidding films are a crucial component In the food packaging industry, ensuring the protection of quality and extended shelf life for various food products, including condiments, pudding, and soups. These films serve as a protective barrier against contaminants, moisture, and oxygen, thereby maintaining the freshness and integrity of the contained food. The use of advanced materials and technologies in lidding films enables manufacturers to address specific product requirements, such as heat sealability, transparency, and microwaveability. As a result, food products packaged with lidding films can retaIn their taste, texture, and nutritional value for an extended period.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Berry Global Inc.

- Coveris Management GmbH

- Ester Industries Ltd

- FFP Packaging Ltd.

- FLAIR Flexible Packaging Corp.

- Garware Hi Tech Films Ltd.

- Golden Eagle Extrusions, Inc

- Impak Films Pty. Ltd

- KM Packaging Services Ltd

- Multi Plastics Inc.

- Plastopil Hazorea Co. Ltd.

- ProAmpac Holdings Inc.

- Sappi Rockwell Solutions Limited

- Sealed Air Corp.

- Toray Industries Inc.

- Transcendia Inc.

- UFlex Ltd.

- Vishakha Polyfab Pvt. Ltd.

- Wipak Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The ready-to-eat food goods sector has witnessed significant growth in recent years, fueled by the increasing demand for convenience and on-the-go consumption. Food packaging plays a crucial role in ensuring the safety, freshness, and presentation of these products. Lidding films, specifically, have gained prominence In the food packaging industry due to their versatility and functionality. Lidding films are thin, flexible, and heat-sealable materials used to seal various types of food containers, such as cups, trays, cans, and bottles. These films offer numerous benefits, including moisture, light, and oxygen protection, extended shelf life, and product presentation. The global packaging industry has seen a shift towards more sustainable and eco-friendly solutions, with biodegradable lidding films gaining popularity.

Biodegradable films are derived from renewable raw resources and can decompose naturally, reducing waste and minimizing environmental impact. Polyethylene terephthalate (PET), polypropylene (PP), and polyvinyl chloride (PVC) are commonly used polymers In the production of lidding films. Each polymer offers unique properties, such as high-barrier qualities, peelability, resealability, and breathability. The food, beverages, pharmaceutical, personal care & cosmetics industries are significant consumers of lidding films. The cups segment, in particular, has seen substantial growth due to the increasing popularity of single-serve coffee and beverage containers. The horeca industry and food services sector also utilize lidding films extensively, as they offer convenience and practicality for food distribution and presentation.

Online grocery shopping and e-commerce have further boosted the demand for lidding films, as they enable long-distance food distribution and the preservation of product freshness. Aluminum lidding solutions and recyclable packaging solutions have emerged as viable alternatives to traditional lidding films, offering improved sustainability and reduced environmental impact. High-barrier lidding films are also gaining traction due to their ability to extend shelf life and maintain product freshness. The market dynamics of the lidding films industry are influenced by various factors, including food safety laws, international trade, and material science advancements. The industry is expected to continue evolving, with a focus on developing innovative and sustainable solutions that cater to the evolving needs of consumers and industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.74% |

|

Market growth 2024-2028 |

USD 1.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.62 |

|

Key countries |

US, UK, China, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Lidding Films Market Research and Growth Report?

- CAGR of the Lidding Films industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lidding films market growth of industry companies

We can help! Our analysts can customize this lidding films market research report to meet your requirements.