Life Science And Chemical Instrumentation Market Size 2024-2028

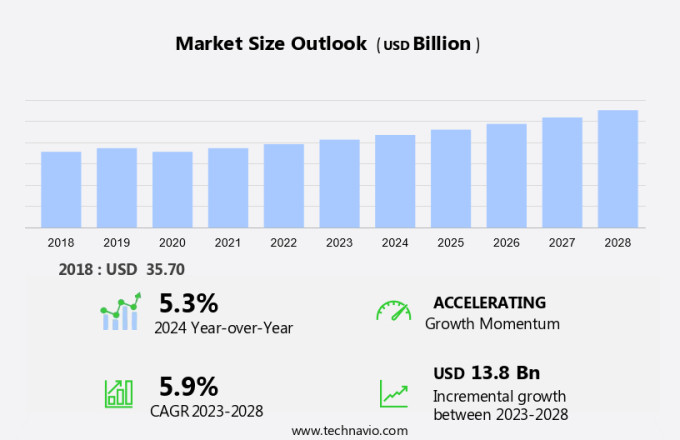

The life science and chemical instrumentation market size is forecast to increase by USD 13.8 billion at a CAGR of 5.9% between 2023 and 2028.

- The market is experiencing significant growth due to increasing investments in research and development, particularly in the healthcare sector for clinical trials and diagnostics. Technological advancements in medical devices, such as the use of microtiter trays and automation in spectroscopy, centrifuges, and PCR, are driving innovation in research applications. However, the market faces challenges including the shortage of skilled professionals and the need for environment conservation efforts in the production and disposal of chemicals and protein-related products. To remain competitive, companies must stay abreast of these trends and invest in research and development to meet the evolving needs of the industry.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant advancements driven by the increasing demand for innovative technologies in research applications, disease diagnostics, and drug discovery. This sector encompasses various sub-markets, including metabolomics, genomics, nanotechnology, and proteomics, among others. Quality control is a crucial aspect of life science research, and the market is witnessing a growing trend towards automation in healthcare and laboratory settings. Precision medicine, clinical research, and diagnostic laboratories are increasingly relying on advanced instrumentation for purity analysis, particle analysis, and biosensors to ensure accurate results. The biopharmaceutical industry is a significant contributor to the life science instrumentation market, with a focus on drug delivery, therapeutic antibodies, and biomarker discovery.

- Innovations in areas such as microfluidics, high-throughput screening, and spectroscopy are driving growth in this sector. Private funding and research grants continue to play a vital role in driving innovation and investment in the life science instrumentation market. Areas of focus include infectious diseases, cell analysis, and point-of-care diagnostics, where rapid and accurate testing is essential. Nanotechnology is a rapidly evolving field within life science instrumentation, with applications in drug delivery, disease diagnostics, and material science. Protein-related products and immunoassays are also seeing significant growth due to their role in biomarker discovery and therapeutic development.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Research

- Clinical and diagnostics

- Geography

- North America

- Canada

- US

- Europe

- Germany

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

- The research segment is estimated to witness significant growth during the forecast period.

Life science and chemical instrumentation play a pivotal role in various industries, including healthcare research organizations, contract research companies, pharmaceutical and biotech firms, clinical and diagnostic laboratories, and university research institutes. The selection of appropriate life science and chemical instruments is contingent upon the diagnostic technologies being employed. With the continuous growth in clinical research investments, the demand for analytical chemistry instruments is anticipated to rise accordingly. Analytical chemistry has proven instrumental in identifying proteins and scrutinizing the composition of food materials and forensic samples.

Further, technological advancements have led to the development of sophisticated instruments such as Next-Generation Sequencing (NGS) and microscopy tools, which have significantly enhanced the precision and accuracy of analysis. Safety is a critical concern in the use of life science and chemical instruments, and manufacturers prioritize designing instruments that meet stringent safety standards. The importance of maintaining these instruments to ensure optimal performance and minimize costs cannot be overstated. As the demand for advanced analytical capabilities grows, the life science instruments market is poised for steady expansion.

Get a glance at the market report of share of various segments Request Free Sample

The research segment was valued at USD 18.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is witnessing significant growth due to its extensive applications. This technology is utilized in various sectors such as final product testing, pharmaceuticals, environmental monitoring, and food testing. The increasing prevalence of chronic diseases and the subsequent demand for drug discovery are key factors fueling the market expansion. Additionally, the ongoing efforts to develop advanced drug assessment procedures for complex medications have led to the innovation of sophisticated chemical methods in this domain. Gas chromatography, a prominent technique in chemical instrumentation, plays a crucial role in the identification and quantification of different components in various samples, including those related to human immunodeficiency virus (HIV) research.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Life Science And Chemical Instrumentation Market ?

Increasing investments in life science research is the key driver of the market.

- The market plays a pivotal role in various sectors, including forensics, biotechnology, environment, agriculture, chemicals, food and beverage, and pharmaceuticals. Among these, the biotech and pharmaceutical industries are expected to drive market growth. The intensified research initiatives in industrialized nations will indirectly fuel the demand for life science and chemical instruments. During the COVID-19 pandemic, the biological sciences industry has taken center stage. Traditional competitors have joined forces to accelerate research and develop the fastest new vaccine. Collaborations between governments, health systems, payers, retail pharmacies, and organizations with the pharmaceutical industry have become increasingly common to facilitate extensive distribution and management.

- In the realm of analytical instrumentation, piezo devices, actuators, valves, and superior-speed cameras are essential tools in the analysis of liquid compounds. These instruments are indispensable in pharmaceutical applications, where precise measurements and quick results are crucial. The chemical instruments industry caters to the needs of the pharmaceutical sector by providing advanced technologies for drug discovery and development. Food safety concerns and chronic diseases are significant challenges that the market addresses. By providing accurate and reliable analytical data, these instruments enable the development of safer and more effective treatments and food products. The market's continued growth is a testament to its importance in ensuring public health and safety.

What are the market trends shaping the Life Science And Chemical Instrumentation Market?

Technological advancements is the upcoming trend in the market.

- The market is driven by continuous technological innovations, particularly in areas such as clinical trials and research applications. companies are investing in the development of advanced tools, including microtiter trays, centrifuges, PCR systems, protein-related products, and spectroscopy equipment, to enhance research capabilities. For instance, software advancements have enabled the analysis of large datasets derived from small sample sizes, making research more efficient and informative. In 2021, ReturnSafe and Becton Dickinson and Co. Collaborated to offer COVID-19 testing management solutions for employers.

- Environmental conservation is also a significant consideration in the development of these instruments, with companies focusing on energy efficiency and waste reduction. In conclusion, the market is poised for growth due to its role in facilitating groundbreaking research and technological advancements.

What challenges does Life Science And Chemical Instrumentation Market face during the growth?

The shortage of skilled professionals is a key challenge affecting the market growth.

- The market faces challenges due to insufficient resources for research activities and limited awareness among healthcare professionals in certain regions. Developing countries, including South Africa, Colombia, Turkey, and Mexico, experience a shortage of skilled healthcare personnel, which can be attributed to inadequate resources, poor healthcare infrastructure, and low healthcare expenditures. Moreover, these countries lag behind in the adoption of advanced technologies and devices due to insufficient investments by government organizations in upgrading healthcare facilities. These factors may hinder the growth of the market during the forecast period. In the realm of pharmaceutical research, technological advancements continue to shape the landscape, with flow cytometry and robotic equipment playing pivotal roles.

- Flow cytometry enables the analysis of laboratory samples, while robotic equipment streamlines processes, increasing efficiency and reducing human error. Technological innovations in areas such as tomography and solenoids further expand the market's potential applications. Food safety is another significant area where life science and chemical instrumentation are indispensable. The demand for reliable and accurate testing methods to ensure food safety continues to grow, driving market expansion. As the need for advanced technologies and devices in various industries increases, the market is poised for growth.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Bruker Corp.

- Chai Inc.

- Danaher Corp.

- Embi Tec

- F. Hoffmann La Roche Ltd.

- Hitachi Ltd.

- Illumina Inc.

- Materion Corp.

- Merck KGaA

- Metrohm AG

- Perkin Elmer Inc.

- Repligen Corp.

- Sartorius AG

- Shimadzu Corp.

- Thermo Fisher Scientific Inc.

- Waters Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The life sciences sector is witnessing significant growth due to the increasing focus on research and development in pharmaceuticals and biotechnology. Chemical instruments play a crucial role in this industry, enabling the analysis of various liquid compounds and the identification of proteins and other molecular structures. Piezo devices, actuators, valves, and solenoids are essential components of these instruments, used in applications ranging from pharmaceutical research to food safety. Technological advancements in analytical instrumentation, such as superior-speed cameras and flow cytometry, have revolutionized the way research is conducted. These instruments are used in the analysis of clinical trials, protein identification, and purity testing, among others. Robotic equipment and automation have further streamlined the process, reducing the need for skilled professionals and minimizing human error. The pharmaceutical industry's focus on chronic diseases, drug validation, and disease therapy has led to increased spending on life science instruments.

Additionally, the food industry also invests heavily in these instruments to ensure food safety and quality control. Environmental conservation is another area where chemical instruments are making a significant impact, with applications in the analysis of pesticides and other pollutants. Maintenance costs and the cost of ownership are critical factors in the adoption of life science instruments. Integrated chromatography systems, ultra-fast liquid chromatography, and gas chromatography are some of the instruments that have gained popularity due to their cost-effectiveness and ease of use. The use of AI in life science instruments is gaining momentum, with applications in protein analysis, drug approvals, and infectious diseases. The forensic industries and NGS are other areas where these instruments are making a significant impact. Overall, the life science instruments market is expected to grow significantly due to the increasing demand for analytical instruments in various industries and the continuous technological advancements in this field.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market Growth 2024-2028 |

USD 13.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

US, Germany, China, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch