Loan Servicing Software Market Size 2025-2029

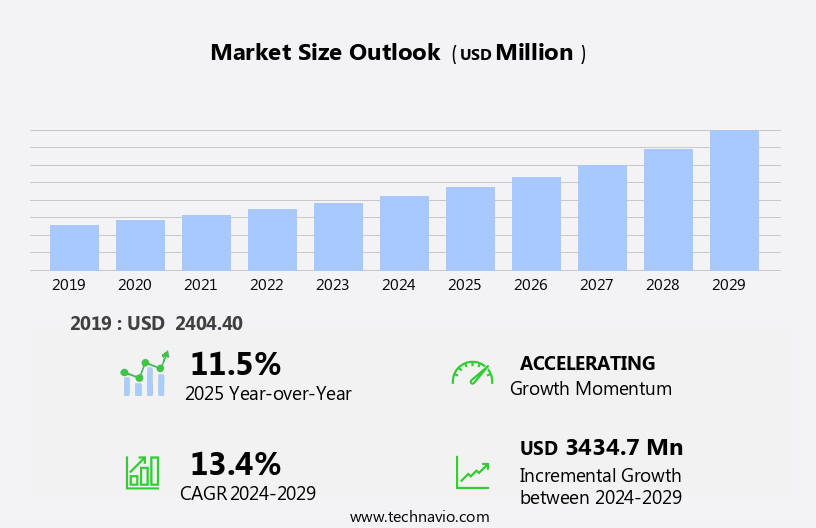

The loan servicing software market size is forecast to increase by USD 3.43 billion, at a CAGR of 13.4% between 2024 and 2029.

- The market is driven by the increasing demand for efficiency in lending operations. Lenders seek to streamline their processes and reduce operational costs, making automated loan servicing solutions increasingly valuable. Strategic partnerships and acquisitions among market participants further fuel market expansion, as they collaborate to offer comprehensive solutions and expand their reach. Creditworthiness is assessed using credit scoring algorithms, alternative data sources, and AI, ensuring lenders mitigate default risk. However, the market faces challenges from open-source loan servicing software, which can offer cost-effective alternatives to proprietary solutions.

- As competition intensifies, companies must differentiate themselves through superior functionality, customer service, and integration capabilities to maintain market share. To capitalize on opportunities and navigate challenges effectively, market players should focus on continuous innovation, strategic partnerships, and robust customer support.

What will be the Size of the Loan Servicing Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the need for system scalability, regulatory reporting, and enhanced user experiences. Loan servicers seek solutions that seamlessly integrate escrow management, automated payment processing, machine learning, and predictive analytics. Hybrid loan servicing models, which combine on-premise and cloud-based systems, are gaining popularity. Loan portfolio management, loan servicing workflow, and loan origination systems are key areas of focus. Mobile loan servicing and loan servicing consulting are also important, as servicers strive for increased efficiency and improved customer communication management. Risk management, data migration, API integration, and document management are essential components of modern loan servicing solutions.

Default management, foreclosure management, and audit trail are also critical, ensuring regulatory compliance and data integrity. Loan servicing reporting, fraud detection, and loan servicing analytics are crucial for effective decision-making. User experience and loan servicing training are also prioritized, as servicers aim to provide exceptional customer satisfaction. Artificial intelligence and machine learning are transforming loan servicing, enabling predictive analytics and automated loan modification processing. Regulatory reporting and system scalability remain top priorities, as servicers navigate the evolving loan servicing landscape.

How is this Loan Servicing Software Industry segmented?

The loan servicing software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Banks

- Credit unions

- Mortgage lenders

- Brokers

- Others

- Deployment

- Cloud-based

- On-premises

- Component

- Software

- Services

- Sector

- Large enterprises

- Small and medium enterprises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

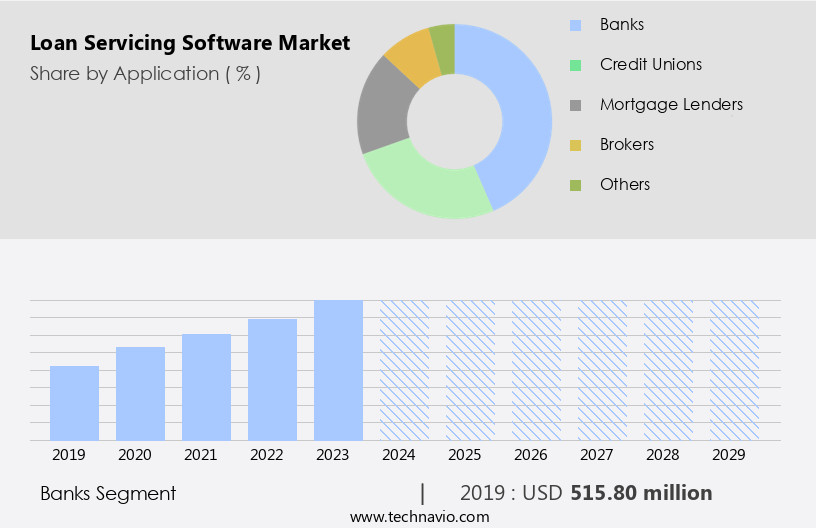

By Application Insights

The banks segment is estimated to witness significant growth during the forecast period.

Loan servicing software is a crucial component of loan origination and servicing technologies (LOS) utilized by banks and financial institutions (BFSI). This software streamlines daily operations by enabling BFSI to accept loan applications online through their websites. The convenience of digital applications aligns with customers' preferences for using the Internet and smartphones. LOS solutions offer features such as EMI calculators, loan eligibility ready reckoners, and document checklists, facilitating a seamless application process 24/7. Pre-configured workflows for credit scoring, document checklist, and approvals significantly reduce turnaround time, enhancing operational efficiency by up to 50%. Escrow management, automated payment processing, and loan portfolio management are integral functions of loan servicing software.

Machine learning and predictive analytics optimize risk management, while user experience and document management ensure customer satisfaction. Cloud-based loan servicing and mobile loan servicing cater to the evolving needs of customers. Loan servicing consulting and automation services help institutions optimize their loan servicing processes. Risk management, data migration, and API integration are essential for maintaining data integrity and system scalability. Regulatory compliance, audit trail, and data security are crucial elements ensuring regulatory reporting and maintaining trust with customers. Loan origination systems, foreclosure management, customer communication management, loan modification processing, loan servicing metrics, and fraud detection are additional features that enhance the functionality of loan servicing software.

Hybrid loan servicing and user interface design further improve the user experience. Artificial intelligence and machine learning technologies are increasingly being integrated into loan servicing software to automate tasks and improve decision-making processes. Loan servicing training ensures that staff are equipped with the necessary skills to effectively utilize the software.

The Banks segment was valued at USD 515.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

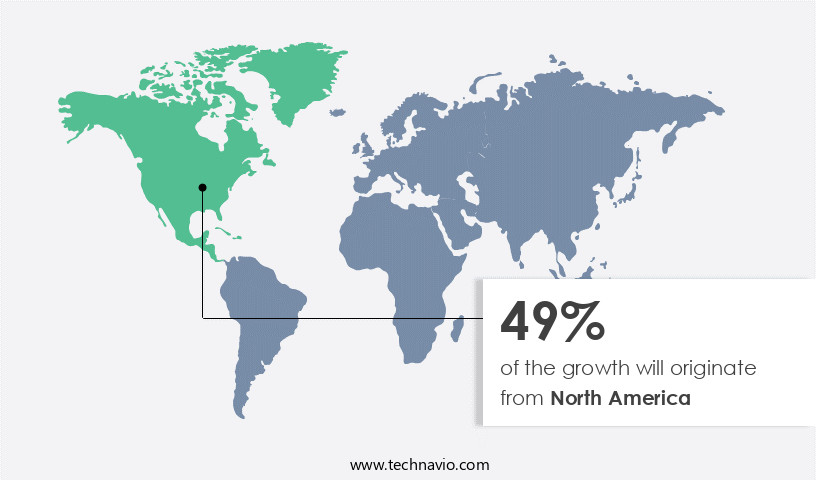

North America is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, financial institutions such as commercial and retail banks, credit unions, mortgage lenders, and other lending organizations are increasingly adopting loan servicing software to optimize their loan processes, save time, and reduce costs. This trend is observed among both large organizations and Small and Medium Enterprises (SMEs). Major banking and financial institutions in the region, including Wells Fargo and Co., The PNC Financial Services Group Inc., Bank of America, JPMorgan Chase and Co., and Citigroup, manage a significant portion of the loan volume. These organizations utilize loan servicing software to manage various loan types, access servicing information, and monitor payment history, escrow and tax information, investor reports, and borrower payments.

Additionally, they leverage features such as automated payment processing, machine learning, predictive analytics, and risk management to enhance operational efficiency and mitigate risks. Other functionalities, such as mobile loan servicing, customer communication management, loan origination systems, and document management, further streamline the loan servicing process. Furthermore, cloud-based loan servicing, loan servicing consulting, loan servicing automation, and loan modification processing enable greater flexibility and scalability. Compliance with regulatory requirements, data security, and data integrity are also critical considerations. Loan servicing software also offers features like audit trail, fraud detection, loan servicing reporting, and regulatory reporting to ensure transparency and accountability.

As the market evolves, hybrid loan servicing, user interface, and user experience are gaining importance to provide a seamless experience for users. Loan servicing metrics and artificial intelligence are also being adopted to enhance performance and productivity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Loan Servicing Software Industry?

- The significant demand for efficiency in lending operations serves as the primary market driver.

- Loan servicing software has become a crucial tool for banking and financial institutions to optimize their loan servicing processes. This technology enables efficient customer communication management, allowing for timely and accurate interaction with borrowers. It also offers cloud-based loan servicing solutions, ensuring accessibility and flexibility for institutions. The adoption of loan servicing software enhances operational efficiency by automating routine tasks, creating an audit trail for regulatory compliance, and ensuring data security. Furthermore, advanced features such as loan servicing reporting, fraud detection, and loan servicing analytics provide valuable insights for institutions to make informed decisions. Data integrity is a top priority for financial institutions, and loan servicing software ensures data accuracy and consistency throughout the loan lifecycle.

- Compliance with regulatory requirements is also simplified with the software's ability to generate detailed reports and maintain an audit trail. In conclusion, the adoption of loan servicing software is essential for banking and financial institutions to streamline their loan servicing processes, improve customer communication, enhance operational efficiency, and ensure regulatory compliance. With features such as fraud detection, loan servicing reporting, and analytics, institutions can make data-driven decisions and maintain the highest level of data security.

What are the market trends shaping the Loan Servicing Software Industry?

- The formation of strategic partnerships and executions of acquisitions among market participants is a prevailing market trend. This approach enables organizations to expand their reach, enhance their capabilities, and strengthen their competitive positions.

- In The market, competition among participants is significant, leading companies to pursue strategic partnerships and acquisitions with software providers, technology firms, and platform companies. These collaborations facilitate product development, geographical expansion, and access to advanced technology. For instance, in April 2024, PrivoCorp, a prominent mortgage processing outsourcing service provider, announced a strategic partnership with Calyx Software, a pioneer in loan origination platforms. This alliance will enhance PrivoCorp's offerings by integrating Calyx's technology into its mortgage processing services, providing clients with a more comprehensive solution. Additionally, these collaborations enable companies to explore new markets and revenue streams, ensuring they remain competitive in the market.

- Furthermore, loan servicing software solutions are increasingly incorporating advanced technologies like system scalability, regulatory reporting, hybrid loan servicing, user interface (UI), loan modification processing, loan servicing metrics, and artificial intelligence (AI) to streamline operations and improve customer experience. Companies investing in these technologies will gain a competitive edge in the market.

What challenges does the Loan Servicing Software Industry face during its growth?

- The growth of the loan servicing industry is confronted with a significant challenge from open-source software solutions, which pose a threat to industry expansion.

- The market faces a significant challenge from the availability of free and open-source loan servicing solutions. These software applications, developed by organizations or communities, offer cost-effective alternatives to commercial loan servicing software. However, they come with limitations in terms of functionality and advanced features. Organizations using open-source software must customize the software or pay extra for additional functions. Moreover, they are responsible for providing technical support in case of errors. Some popular open-source loan servicing software solutions include Apache Fineract, Online Lending Software, Trakker, and Turnkey-Lender. While these solutions can save organizations money, they may not provide the same level of customer satisfaction and automation as commercial loan servicing software.

- Advanced features such as escrow management, loan servicing workflow, automated payment processing, machine learning, and predictive analytics are often not available in open-source solutions. Organizations must weigh the cost savings against the potential loss in functionality and advanced features when considering open-source loan servicing software.

Exclusive Customer Landscape

The loan servicing software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the loan servicing software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, loan servicing software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abrigo - The company specializes in providing loan servicing software solutions, including Lending and Credit Risk Software.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abrigo

- Applied Business Software Inc.

- C Loans Inc.

- Constellation Software Inc.

- Cyrus Technoedge Solutions Pvt. Ltd.

- DownHome Solutions

- Fidelity National Information Services Inc.

- Financial Industry Computer Systems Inc.

- Fiserv Inc.

- Graveco Software Inc.

- ICE Mortgage Technology Inc.

- LOAN SERVICING SOFT INC.

- Nortridge Software LLC

- Nucleus Software Exports Ltd.

- Oracle Corp.

- PCFS Solutions

- Q2 Holdings Inc.

- Shaw Systems Associates LLC

- Sopra Banking Software

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Loan Servicing Software Market

- In January 2024, Finastra, a leading provider of financial software, announced the launch of Fusion Loan IQ, an advanced loan servicing software solution designed to automate and streamline loan servicing processes for financial institutions (Finastra Press Release, 2024). This new offering aims to enhance operational efficiency and improve customer experience.

- In March 2024, Black Knight Financial Services, a prominent player in the mortgage technology industry, entered into a strategic partnership with Fannie Mae to provide the Single-Family Servicing Platform (SFSP) to Fannie Mae's servicers (Black Knight Press Release, 2024). This collaboration allows Black Knight to offer SFSP to a broader customer base, expanding its market presence.

- In April 2025, Fiserv, a global leader in financial services technology, completed the acquisition of Modo Labs, a mobile application development company, to strengthen its digital capabilities and enhance its loan servicing software offerings (Fiserv Press Release, 2025). The acquisition is expected to provide Fiserv with advanced mobile technology and a team of experienced developers.

- In May 2025, the Consumer Financial Protection Bureau (CFPB) announced new regulations aimed at improving transparency and accountability in loan servicing practices (CFPB Press Release, 2025). These regulations include requirements for clear communication with borrowers and timely processing of loan modifications. This policy change is expected to significantly impact the market, as providers must adapt to meet the new requirements.

Research Analyst Overview

- In the dynamic loan servicing market, opportunities abound for businesses seeking to optimize their loan servicing operations and deliver superior quality to borrowers. A well-crafted loan servicing agreement sets the foundation for successful partnerships, while adherence to stringent loan servicing regulations and compliance ensures trust and transparency. Innovative loan servicing technologies streamline processes, enhance performance, and reduce risk, making it essential for businesses to stay informed about the latest trends. Servicing fees, sales, and marketing are critical components of loan servicing growth. Effective risk management and robust security measures safeguard against potential threats. Loan servicing solutions that prioritize governance and support help businesses navigate the complexities of the industry.

- As the loan servicing landscape evolves, businesses must adapt to new challenges, including increased competition, changing consumer expectations, and evolving regulatory requirements. By embracing innovation, focusing on performance, and maintaining a customer-centric approach, loan servicing providers can thrive in this competitive market. Loan servicing performance, compliance, and governance are key drivers of success in the industry. As businesses explore new opportunities, they must prioritize these areas to ensure they deliver value to their clients and remain competitive in the market. By staying informed about the latest trends and best practices, loan servicing providers can position themselves for long-term growth and success.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Loan Servicing Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.4% |

|

Market growth 2025-2029 |

USD 3434.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.5 |

|

Key countries |

US, Japan, Canada, UK, France, China, India, Germany, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Loan Servicing Software Market Research and Growth Report?

- CAGR of the Loan Servicing Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the loan servicing software market growth of industry companies

We can help! Our analysts can customize this loan servicing software market research report to meet your requirements.