Loose Leaf Paper Market Size 2024-2028

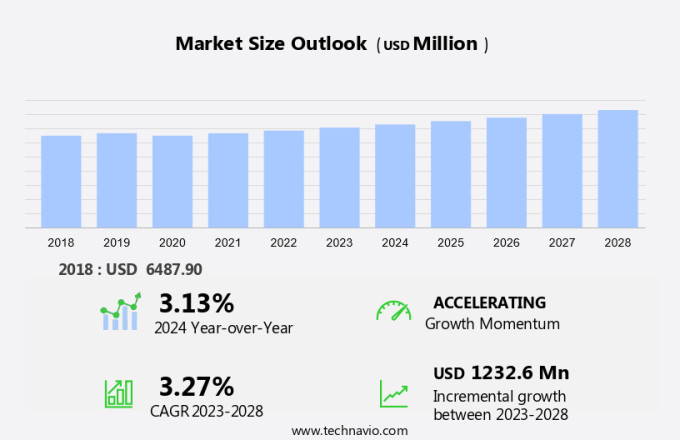

The loose leaf paper market size is estimated to grow by USD 1.23 billion at a CAGR of 3.27% between 2023 and 2028. The education sector is experiencing significant growth, leading to an increased demand for innovative and personalized learning solutions. EdTech companies are responding to this trend by offering customized educational products that cater to the unique needs of individual learners. Additionally, corporations are recognizing the importance of continuous learning and development for their workforce, resulting in a surge in demand for corporate training programs. EdTech companies are meeting this need by providing flexible, accessible, and effective training solutions that can be easily integrated into the corporate environment. These offerings include interactive e-learning modules, virtual classrooms, and AI-powered personalized learning platforms. By focusing on product personalization and catering to the growing demand from the education and corporate sectors, EdTech companies are poised for continued success in the digital age.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market encompasses a wide range of paper products, including notepads, binders, folders, and scratch pads. These papers come in various sizes, styles, and designs, such as horizontal blue lines, light pink borderlines, and unlined. Notable types include three-hole punched sheets for use with ring binders, as well as wide ruled and college ruled for writing and note-taking. Beyond traditional uses, loose leaf paper finds applications in industries like education, where bulk purchases are common. Recycled materials are increasingly popular, reflecting growing environmental consciousness. Minerals like Calcium, Phosphorus, and Potassium are sometimes added to paper for specific uses, such as in medicines or plant-based products. Urbanization and development in emerging economies are driving demand for loose leaf paper. Fitness chains and artists also use these papers for their respective needs. Rolls of paper are another variant, often used for drafting or large-scale projects. Overall, the loose leaf paper market caters to diverse needs, offering a versatile and essential product for both personal and professional use. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The growth in education sector is notably driving market growth. The education sector serves as a significant consumer of loose leaf paper, primarily utilized for note-taking and writing purposes. The expansion of this market can be attributed to the increasing number of educational institutions and rising student enrollment worldwide. Developing economies, such as India, China, and the US, have witnessed a notable growth in educational infrastructure and governmental support, leading to an increase in the establishment of schools and universities. In India, for instance, enrollment in government schools for girls and boys in classes I and II grew by 9% and 14%, respectively, over the last decade.

Furthermore, the health care market represents another substantial application area for loose leaf paper. Mineral supplements, such as those containing Vitamin B, Vitamin D, Calcium, Phosphorus, and Potassium, are often distributed in plant-based packaging, including loose leaf paper. The youth population, particularly in urbanizing regions, is increasingly focusing on fitness and wellness, driving demand for medicines and supplements, thereby fueling the loose leaf paper market's growth. Fitness chains and wellness centers are also contributing to the market's expansion by using loose leaf paper for record-keeping and documentation. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The increasing demand for recycled loose leaf paper is the key trend in the market. The market is witnessing a significant trend towards the use of recycled materials for manufacturing paper products. Developing and developed economies, including the US and China, are major contributors to this trend, with a high demand for recycled paper in applications such as loose leaf paper, newsprint, and packaging. The health care market is another key industrial application for loose leaf paper, with the demand driven by the need for record keeping and documentation. Recycled paper is an eco-friendly alternative to virgin paper, made from plant-based materials that contain essential minerals like Vitamin B, Vitamin D, Calcium, Phosphorus, and Potassium.

Also, these minerals are beneficial for both the environment and human health. With the increasing urbanization and growing youth population, the demand for fitness chains and plant-based products is on the rise, further boosting the demand for recycled loose leaf paper. The recycling of paper products is a sustainable solution to the environmental concerns arising from the use of plastics and non-recyclable materials. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The increasing number of digital platforms across the world is the major challenge that affects the growth of the market. The global market is experiencing a decline due to the widespread adoption of digital technologies. Industrial applications, such as document storage and communication, have been significantly impacted by the rise of digital gadgets like computers, laptops, and smartphones. The health care market, which is a major consumer of loose leaf paper for recording patient records, is also transitioning to digital platforms.

Additionally, the trend towards plant-based products and minerals like Vitamin B, Vitamin D, Calcium, Phosphorus, and Potassium in medicines is reducing the demand for loose leaf paper. Urbanization and the growing youth population in developing economies are contributing to the increasing use of fitness chains and other digital platforms, further reducing the need for paper products. These factors are expected to challenge the growth of the loose leaf paper market in the coming years. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovatorâs stage to the laggardâs stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ACCO Brands Corp. - The company offers mead losse paper college ruled 200 sheets for notetaking, in-class assignments, homework, and more.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACCO Brands Corp.

- Etranger di Costa Rica Co. Ltd.

- Exacompta Clairefontaine SA

- KOKUYO Co. Ltd.

- LIHIT LAB

- Maruman

- Sinar Mas

- Speedball Art Products Co. LLC

- The ODP Corp.

- W.W. Grainger Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Distribution Channel

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses the sales of individual sheets or rolls of paper intended for use in loose leaf binders, folders, and scratch pads. In 2023, offline sales channels dominated the market, accounting for a significant share. This segment includes transactions made through physical stores such as departmental stores, supermarkets, hypermarkets, specialty stores, and company-operated outlets. The convenience of direct interaction between customers and retailers, along with the wide availability of resources and manpower, contributes to the growth of offline sales.

Get a glance at the market share of various regions Download the PDF Sample

The offline segment accounted for USD 4.50 billion in 2018. The education sector's expansion, driven by the increasing number of educational institutions and student enrollment, fuels the demand for loose leaf paper. Offline stores offer a diverse selection of products, enabling users to compare and choose based on their preferences. Consumers can opt for various types of loose leaf paper, including notebook paper with horizontal blue lines, light pink borderlines, and unruled sheets. Additionally, there is a growing trend towards ecologically responsible goods, with an increasing number of manufacturers using recycled materials. E-commerce platforms and online sales have gained popularity, particularly among artists and students. However, offline sales channels remain essential due to their accessibility and the ability to touch and feel the products before purchasing. Distribution channels include supply chain systems, which ensure the timely transportation and availability of loose leaf paper. As consumers' lifestyles evolve and digitalization continues to impact the stationery industry, distribution channels must adapt to meet changing demands.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

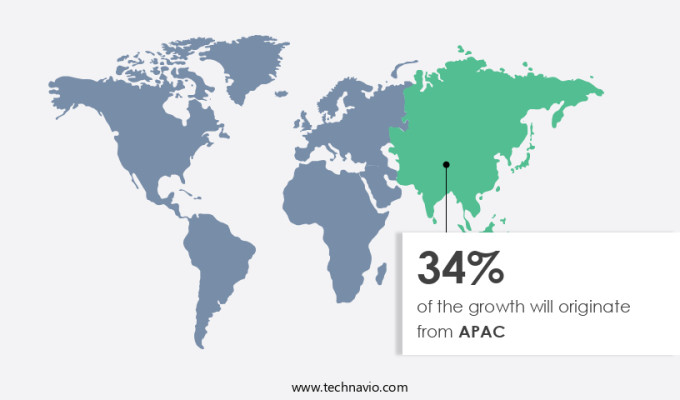

APAC is estimated to contribute 34% to the growth of the global market during the market forecast period. Technavioâs analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market encompasses a range of products, including notebook paper, binder sheets, folders, and scratch pads, catering to various consumer preferences. Notebook paper comes in different ruled formats, such as wide ruled, college ruled, and un ruled, with features like three holes for use in ring binders. Artists often opt for bulk purchases of plain, unlined paper rolls. Binder sheets, available in three-hole punched or ring binder compatible versions, are popular among students and educational institutions for writing activities.

Folders with light pink borderlines and horizontal blue lines are commonly used for organizing loose leaf paper in a neat and orderly manner. Eco-conscious consumers prefer recycled materials, leading to an increase in the production and availability of recycled loose leaf paper. Ecologically responsible goods are increasingly being sold on e-commerce platforms, supplementing sales from traditional stationery stores. The scale of production and manpower requirements for loose leaf paper depend on the resource availability and the supply channel system. Distribution channels include both online platforms and brick-and-mortar stores, with digitalization influencing the market dynamics. Loose leaf paper is used extensively in educational institutions for various writing activities, with students being the primary consumers. The yellow color is often associated with school notebooks, while blue lines are preferred for academic work. The market for loose leaf paper continues to evolve, adapting to changing consumer preferences and lifestyle trends.

Segment Overview

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

You may also be interested in:

- Food Wrapping Paper Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

- Printing and Writing Paper Market Analysis APAC, Europe, North America, South America, Middle East and Africa - US, China, India, Japan, Germany - Size and Forecast

- Paper and Paperboard Container and Packaging Market by Product, End-user, and Geography - Forecast and Analysis

Market Analyst Overview

Notebooks,Binders, and More Loose leaf paper, a versatile stationery product, encompasses a range of paper types including notebook paper, binder paper, and folder paper. These papers come in various sizes, designs, and formats such as three holes, horizontal blue lines, and light pink borderlines. Artists and students are major consumers of loose leaf paper, often making bulk purchases for writing activities. Ecologically responsible goods made from recycled materials have gained popularity among consumers, influencing the market. Educational institutions remain a significant market for loose leaf paper due to their extensive use in classrooms and administrative offices. The scale of production is driven by manpower availability, resource availability, and the supply channel system. Loose leaf binders, ring binders, and scratch pads are popular formats, with wide ruled, college ruled, and un ruled being common. The market is witnessing a shift towards digitalization, with e-commerce platforms and online sales gaining traction. Yellow is a popular color for loose leaf paper, while stationery stores continue to be major distribution channels. The lifestyle of students and the availability of distribution channels significantly impact market trends. The market is expected to grow as consumers continue to prioritize convenience, affordability, and eco-friendly options. The use of loose leaf paper in various industries, including education, art, and business, ensures its relevance in the modern world.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 1.23 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.13 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 34% |

|

Key countries |

US, China, Germany, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ACCO Brands Corp., Etranger di Costa Rica Co. Ltd., Exacompta Clairefontaine SA, KOKUYO Co. Ltd., LIHIT LAB, Maruman, Sinar Mas, Speedball Art Products Co. LLC, The ODP Corp., and W.W. Grainger Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the marketâs competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies