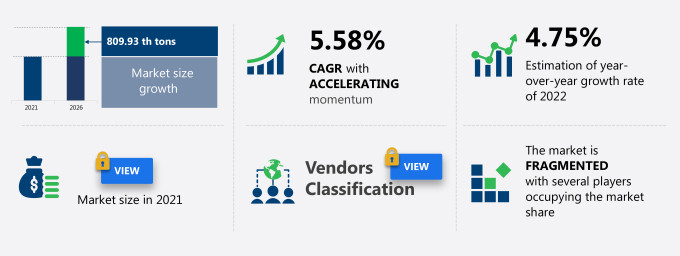

The lubricants market share in India is expected to increase by 809.93 thousand tons from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 5.58%.

This lubricants market in India research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers the lubricants market in India segmentation by product (mineral oil-based lubricants, synthetic lubricants, and bio-based lubricants) and application (automotive oils, industrial oils, process oils, metalworking fluids, and greases). The India lubricants market report also offers information on several market vendors, including Bharat Petroleum Corp. Ltd., BP Plc, Exxon Mobil Corp., Gulf Oil Lubricants India Ltd., Indian Oil Corp. Ltd., Oil, and Natural Gas Corp. Ltd., Royal Dutch Shell Plc, Tide Water Oil Co. Ltd., TOTAL SE, and Valvoline Inc. among others.

What will the Lubricants Market Size in India be During the Forecast Period?

Download the Free Report Sample to Unlock the Lubricants Market Size in India for the Forecast Period and Other Important Statistics

Lubricants Market In India: Key Drivers, Trends, and Challenges

The increasing demand from end-user industries is notably driving the lubricants market growth in India, although factors such as fluctuations in crude oil prices may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the lubricants industry in India. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Lubricants Market Driver in India

The increasing demand from end-user industries is one of the key drivers supporting the lubricants market growth in India. In the construction industry, lubricants are used in construction equipment owing to their anti-wear characteristics, resistance to corrosion, and others. Hydraulic fluids made from lubricants are used in earthmoving equipment such as crawler excavators, mini excavators, and others because of their excellent energy transmission capacity. Additionally, they are also used to increase the drain/re-greasing intervals of the equipment, lubrication efficiency, and the wear resistance of friction pairs, as well as to enhance the lifespan of the equipment. They are used as hydraulic fluids, compressor oils, and others in the steel industry for various applications. Equipment such as blast furnaces, continuous castings, and others require lubricants to reduce downtime and increase operational efficiency. Such factors will drive market growth during the forecast period.

Key Lubricants Market Trend in India

The rising adoption of synthetic lubricants is another factor supporting the lubricants market growth in India. Synthetic lubricants that offer better performance can be against corrosion & oxidation. They have resistive to a wide range of temperature from -60°C to a high temperature like 450 °C and more. It also increases the service life of lubricants by 4-8 times longer than petroleum lubricants. Significantly, they have better performance when compared to mineral lubricants. Using synthetic lubricants result in longer machinery life because less wear results in more production during the life of machine and tools. Thus, the adoption of synthetic lubricants will significantly increase lubricants' market share growth during the forecast period.

Key Lubricants Market Challenge in India

The fluctuations in crude oil prices is hindering the lubricants market growth in India. The increasing prices of crude oil in India have adversely affected the manufacturers and end-users. Fluctuations in crude oil prices are a major factor that causes volatility in raw material prices. Synthetic lubricants are primarily derived from hydrocarbons which is derived from petroleum. Synthetic esters, PAOs, phosphate esters, glycols, and other silicate esters obtained from petroleum are a few other major sources of construction lubricants. Volatility in raw material prices can hinder the growth of the lubricants market in India as it adversely affects the supply and profit margins of manufacturers.

This lubricants market in India analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the lubricants market in India as a part of the global specialty chemicals market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the lubricants market in India during the forecast period.

Who are the Major Lubricants Market Vendors in India?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Bharat Petroleum Corp. Ltd.

- BP Plc

- Exxon Mobil Corp.

- Gulf Oil Lubricants India Ltd.

- Indian Oil Corp. Ltd.

- Oil and Natural Gas Corp. Ltd.

- Royal Dutch Shell Plc

- Tide Water Oil Co. Ltd.

- TOTAL SE

- Valvoline Inc.

This statistical study of the India lubricants market encompasses successful business strategies deployed by the key vendors. The lubricants market in India is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- BP Plc - The company offers lubricant products that includes gasoline, kerosene, distillate fuel oils, residual fuel oils, lubricants, and many more, under the brand name of BP Plc.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The lubricants market in India forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Lubricants Market in India Value Chain Analysis

Our report provides extensive information on the value chain analysis for the lubricants market in India, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the specialty chemicals market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Support activities

- Innovations

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

What are the Revenue-generating Product Segments in the Lubricants Market in India?

To gain further insights on the market contribution of various segments Request for a FREE sample

The lubricants market share growth in India by the mineral oil-based lubricants segment will be significant during the forecast period. The high demand for mineral oil-based lubricants can be attributed to their low cost and easy accessibility. Mineral oil-based lubricants are derived from naturally occurring petroleum or crude oil by distillation, solvent extraction, and cracking. One of the main advantages of using mineral oil-based lubricants is that they are manufactured on a large scale during petroleum refining and, therefore, are cost much less than synthetic and bio-based lubricants. such factors are expected to drive the segment's growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the lubricants market size in India and actionable market insights on post COVID-19 impact on each segment.

You may be interested in:

Lubricants market for Mining and Quarry Applications - The market share is expected to increase by 261.92 thousand tons from 2020 to 2025, and the market's growth momentum will accelerate at a CAGR of 3.69%.

Marine Lubricants market - The market share is expected to increase to USD 819.71 million from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 2.55%.

Lubricants market - The market share is expected to increase by USD 6.22 million from 2020 to 2025, and the market's growth momentum will accelerate at a CAGR of 3.33%.

|

Lubricants Market Scope in India |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.58% |

|

Market growth 2022-2026 |

809.93 th tons |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.75 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Bharat Petroleum Corp. Ltd., BP Plc, Exxon Mobil Corp., Gulf Oil Lubricants India Ltd., Indian Oil Corp. Ltd., Oil and Natural Gas Corp. Ltd., Royal Dutch Shell Plc, Tide Water Oil Co. Ltd., TOTAL SE, and Valvoline Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Lubricants Market in India Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive lubricants market growth in India during the next five years

- Precise estimation of the lubricants market size in India and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the lubricants industry in India

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of lubricants market vendors in India

We can help! Our analysts can customize this report to meet your requirements. Get in touch