Lubricants Market Size 2025-2029

The lubricants market size is valued to increase by USD 26.7 billion, at a CAGR of 3.5% from 2024 to 2029. Increasing demand for lubricants from end-user industries will drive the lubricants market.

Major Market Trends & Insights

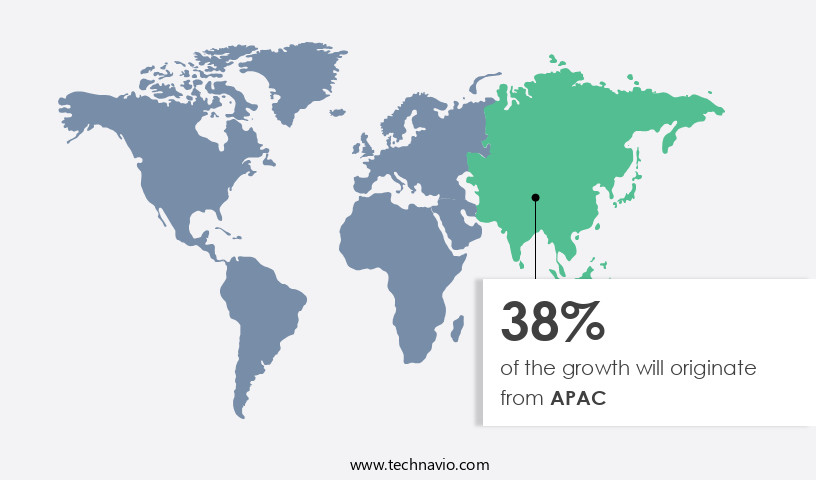

- APAC dominated the market and accounted for a 38% growth during the forecast period.

- By Application - Automotive oils segment was valued at USD 71.80 billion in 2023

- By Product - Mineral oil-based lubricants segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 31.96 billion

- Market Future Opportunities: USD 26.70 billion

- CAGR from 2024 to 2029 : 3.5%

Market Summary

- The market experiences continuous expansion due to the escalating demand from various end-user industries, including automotive, manufacturing, and power generation. One significant trend shaping this sector is the increasing adoption of bio-based lubricants, which offer environmental benefits and improved performance. These eco-friendly alternatives have gained traction, especially in industries striving for sustainability. Crude oil price fluctuations significantly impact the market, as petroleum-derived lubricants account for a substantial portion of the overall demand. The market's size was valued at USD 165.5 billion in 2020, according to market research. As industries adapt to the evolving market landscape, they seek advanced lubricant solutions to enhance efficiency, reduce downtime, and ensure optimal performance.

- Innovations in lubricant technology, such as nanotechnology and synthetic lubricants, are driving growth in the market. These advancements offer improved wear protection, increased energy efficiency, and extended lubricant life. As industries continue to prioritize productivity and sustainability, the market is poised for continued expansion.

What will be the Size of the Lubricants Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Lubricants Market Segmented?

The lubricants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive oils

- Industrial oils

- Process oils

- Metalworking fluids

- Greases

- Product

- Mineral oil-based lubricants

- Synthetic lubricants

- Bio-based lubricants

- Grade Type

- Group II

- Group III

- Group I

- Group IV

- Group V

- End-user

- Transportation

- Manufacturing

- Construction

- Mining

- Agriculture

- Others

- Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Retail

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The automotive oils segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, fueled by the increasing production and demand for vehicles, particularly in developing countries like China, India, Brazil, and Indonesia. This expanding automotive sector relies heavily on lubricants, which are essential for reducing friction and wear in various automotive applications, such as engine oils, hydraulic fluids, and gear lubricants. The market is witnessing a shift towards synthetic lubricants, including synthetic esters and synthetic lubricants, due to their superior performance under extreme pressure and high temperatures. These advanced lubricants offer enhanced wear protection, oxidation inhibition, and viscosity control. Moreover, the demand for biodegradable lubricants and those with improved rheological properties is on the rise, driven by environmental concerns and the need for improved tribology testing and oil analysis.

The Automotive oils segment was valued at USD 71.80 billion in 2019 and showed a gradual increase during the forecast period.

According to recent industry reports, the market is projected to grow, reaching a market size of USD 212.4 billion by 2026. This growth is attributed to the increasing demand for high-performance lubricants, the ongoing research and development in lubricant technology, and the expanding automotive and industrial sectors.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Lubricants Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific region is experiencing significant growth, driven by the high consumption of lubricants in industries such as automotive, construction, and refining. Key countries contributing to this demand include China, India, Japan, and South Korea. The region's market is well-diversified due to the rapid industrialization, expansion of the business sector, and the presence of numerous regional and local companies. The automotive industry is the primary driver of this growth, as the region's increasing vehicle production and sales contribute significantly to the demand for lubricants.

In October 2023, HPCL and Chevron introduced Caltex lubricants, including Havoline and Delo, to the Indian market, further boosting the regional demand. The market in the region is expected to maintain its robust growth trajectory in the coming years.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for efficient and high-performance products in various industries. Extreme pressure lubricant properties are essential for applications in heavy-duty industries such as mining and construction, where equipment experiences high loads and temperatures. Synthetic ester lubricants, with their superior chemical stability and excellent performance in extreme conditions, are gaining popularity in these applications. In the automotive sector, gear lubricant viscosity selection and engine oil performance parameters are critical factors in ensuring optimal machinery operation. High-temperature grease formulations are also essential for industries such as steel manufacturing and aerospace, where equipment operates under extreme conditions. Lubricant additive interactions play a significant role in enhancing the performance of industrial lubricants. Additives such as antioxidants, anti-wear agents, and corrosion inhibitors help extend the life of machinery and reduce maintenance costs. Environmental concerns have led to the increasing demand for biodegradable lubricants. These eco-friendly alternatives offer significant environmental benefits, including reduced carbon footprint and minimal impact on aquatic life. Metalworking fluid composition analysis is essential to ensure the effective use of biodegradable lubricants and prevent contamination. Hydraulic fluid contamination control is crucial in ensuring the longevity and efficiency of hydraulic systems. Regular monitoring and maintenance of hydraulic fluids can help prevent costly repairs and downtime. Industrial lubricant selection criteria include factors such as operating temperature, load capacity, and environmental considerations. Proper lubricant selection can lead to increased machinery efficiency, reduced maintenance costs, and improved overall performance.

What are the key market drivers leading to the rise in the adoption of Lubricants Industry?

- The primary factor fueling market growth is the escalating demand for lubricants from various end-user industries.

- The market extends beyond the automotive sector, with significant demand emerging from the construction, steel and cement, wind energy, agriculture, mining and oil drilling, marine, and aerospace industries. In the construction industry, lubricants' anti-wear properties, resistance to corrosion, superior lubricity, water tolerance, and filterability make them indispensable in construction equipment. Hydraulic fluids, derived from lubricants, enhance the energy transmission capacity in earthmoving machinery like crawler excavators, mini excavators, wheeled excavators, wheeled dozers, and skid-steer loaders.

- The steel and cement industry relies on lubricants to extend drain/re-greasing intervals, improve lubrication efficiency, boost wear resistance of friction pairs, and prolong equipment lifespan.

What are the market trends shaping the Lubricants Industry?

- The emergence of bio-based lubricants represents a significant market trend. This shift towards sustainable and eco-friendly alternatives is gaining momentum in various industries.

- The market is witnessing a significant shift towards the adoption of bio-based lubricants. These eco-friendly alternatives, derived from renewable sources, offer numerous advantages over their petroleum-based counterparts. Bio-based lubricants provide a cleaner, less toxic work environment, resulting in improved safety for engine and hydraulic system workers. Moreover, they require less maintenance, storage, and disposal, leading to cost savings over the product lifecycle. The environmental benefits of bio-based lubricants are also noteworthy. They produce fewer emissions, have higher flashpoints, and exhibit constant viscosity.

- Companies are increasingly focusing on reducing bioaccumulation and eco-toxicity to minimize adverse environmental impacts. By using bio-based lubricants, pollution from stormwater, engine leaks, and hydraulic systems can be significantly reduced. This trend is expected to continue as the demand for sustainable and eco-friendly solutions grows.

What challenges does the Lubricants Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- Lubricants, derived primarily from the refining of crude oil, hold a significant position in various industries. Mineral oil-based lubricants dominate the global market, with the oil and gas sector serving as a primary supplier of the raw materials. The cost of marine lubricants is influenced by fluctuations in global crude oil prices, which directly affect the manufacturers' revenue and profit margins. For instance, the increase in global crude oil demand and the subsequent decrease in its supply led to a surge in prices.

- This volatility in raw material prices can significantly impact the market, as manufacturers rely heavily on these resources for production. The market's evolving nature underscores the importance of maintaining a robust supply chain and adaptability to price fluctuations.

Exclusive Technavio Analysis on Customer Landscape

The lubricants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lubricants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Lubricants Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, lubricants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BP p.l.c. - The company specializes in providing advanced lubricant solutions for heavy-duty vehicles and machinery.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BP p.l.c.

- Chevron Corporation

- China Petrochemical Corporation (Sinopec)

- ConocoPhillips

- Exxon Mobil Corporation

- FUCHS PETROLUB SE

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd.

- JX Nippon Oil & Energy Corporation

- Lukoil Oil Company

- Motul S.A.

- Petronas Lubricants International

- Phillips 66

- Quaker Houghton

- Royal Dutch Shell plc

- SK Lubricants Co. Ltd.

- TotalEnergies SE

- Valvoline Inc.

- Viscosity Oil Company

- YPF S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lubricants Market

- In January 2024, Shell announced the launch of its new line of synthetic lubricants, Helix Ultra, designed for heavy-duty applications, aiming to enhance engine performance and reduce emissions (Shell press release).

- In March 2024, ExxonMobil and Chevron Phillips Chemical Company LLC entered into a strategic collaboration to produce and market base stocks for lubricant manufacturing, strengthening their market presence (ExxonMobil press release).

- In April 2024, Fuchs Petrolub SE, a leading lubricant supplier, acquired Lukoil Lubricants, expanding its market share in Eastern Europe and the CIS region (Fuchs Petrolub SE press release).

- In May 2025, TotalEnergies secured regulatory approval for its new lubricant blending plant in the United States, increasing its production capacity and enhancing its presence in the North American market (TotalEnergies press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lubricants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 26.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and the diverse requirements of various sectors. Extreme pressure additives, such as synthetic esters, play a crucial role in enhancing the performance of lubricants in high-stress applications. For instance, in the metalworking industry, the use of high-performance lubricants with antiwear additives has led to a significant reduction in friction and wear, resulting in increased productivity and cost savings. Moreover, the ongoing challenge of lubricant degradation necessitates continuous research and development in the industry. Vegetable oils, for instance, are gaining popularity as biodegradable alternatives to traditional mineral oil-based lubricants. However, their use requires careful consideration of their rheological properties and viscosity modifiers to ensure optimal performance in various applications.

- Industry experts anticipate that the market will grow at a robust pace in the coming years, with estimates suggesting a growth rate of over 5% annually. This growth is attributed to the increasing demand for high-temperature lubricants, hydraulic fluids, and industrial lubricants, among others. In the realm of tribology testing and oil analysis, advanced techniques are being employed to assess the performance and longevity of lubricants. For example, elastohydrodynamic lubrication and boundary lubrication testing help evaluate the lubricity enhancement of various lubricant formulations. Additionally, the use of base oils and additive packages, such as oxidation inhibitors and pour point depressants, plays a vital role in ensuring the viscosity index and overall performance of lubricants.

- In the realm of food-grade lubricants, synthetic lubricants are increasingly being adopted due to their superior wear protection properties. These lubricants are essential in the food processing industry, where the need for efficient, clean, and safe operations is paramount. In conclusion, the market is a dynamic and ever-evolving landscape, with ongoing research and development efforts focused on addressing the unique challenges of various sectors. Whether it's the use of extreme pressure additives in high-stress applications or the adoption of biodegradable lubricants for environmental sustainability, the industry continues to push the boundaries of innovation.

What are the Key Data Covered in this Lubricants Market Research and Growth Report?

-

What is the expected growth of the Lubricants Market between 2025 and 2029?

-

USD 26.7 billion, at a CAGR of 3.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Automotive oils, Industrial oils, Process oils, Metalworking fluids, and Greases), Product (Mineral oil-based lubricants, Synthetic lubricants, and Bio-based lubricants), Grade Type (Group II, Group III, Group I, Group IV, and Group V), Geography (APAC, Europe, North America, Middle East and Africa, and South America), End-user (Transportation, Manufacturing, Construction, Mining, Agriculture, and Others), and Distribution Channel (Direct Sales, Distributors/Wholesalers, Retail, and Online)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for lubricants from end-user industries, Fluctuations in crude oil prices

-

-

Who are the major players in the Lubricants Market?

-

BP p.l.c., Chevron Corporation, China Petrochemical Corporation (Sinopec), ConocoPhillips, Exxon Mobil Corporation, FUCHS PETROLUB SE, Idemitsu Kosan Co.,Ltd., Indian Oil Corporation Ltd., JX Nippon Oil & Energy Corporation, Lukoil Oil Company, Motul S.A., Petronas Lubricants International, Phillips 66, Quaker Houghton, Royal Dutch Shell plc, SK Lubricants Co. Ltd., TotalEnergies SE, Valvoline Inc., Viscosity Oil Company, and YPF S.A.

-

Market Research Insights

- The market for lubricants is a dynamic and ever-evolving entity, encompassing a diverse range of applications and requirements. Two key aspects of this market are the ongoing efforts to minimize wear rate and mitigate environmental impact. For instance, a recent study revealed that implementing optimized handling procedures and lubricant formulations led to a 15% reduction in equipment downtime and a 10% decrease in energy consumption.

- Moreover, industry experts anticipate a 5% annual growth rate over the next decade, driven by advancements in additive chemistry and increasing demand for high-performance lubricants. These trends underscore the market's continuous evolution and the importance of staying informed about the latest developments.

We can help! Our analysts can customize this lubricants market research report to meet your requirements.