Luxury E-Tailing Market Size 2024-2028

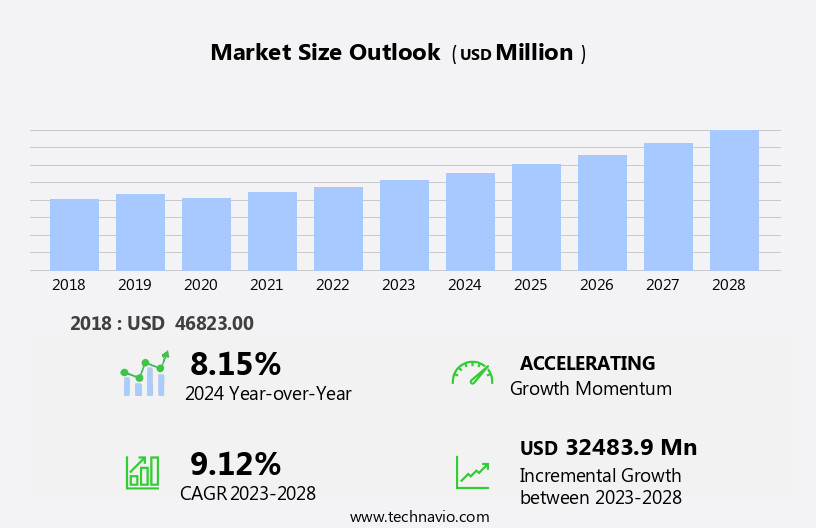

The luxury e-tailing market size is forecast to increase by USD 32.48 billion, at a CAGR of 9.12% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising trend of online spending and the increasing penetration of smartphones. These factors have led to an increase in consumer preference for purchasing luxury goods through digital channels. However, the market faces stiff competition from offline retailers, who continue to dominate the luxury goods sector. To remain competitive, luxury e-tailers must focus on multichannel marketing strategies, leveraging both online and offline channels to reach consumers. Additionally, providing exceptional customer service and ensuring product authenticity are crucial challenges for luxury e-tailers, as consumers demand a seamless shopping experience and assurance of authenticity when purchasing high-end items online.

- Brands such as Net-a-Porter, Farfetch, and Yoox have successfully navigated these challenges by offering personalized shopping experiences, expedited shipping, and robust authentication processes. To capitalize on the market's potential, companies must continue to innovate and differentiate themselves through superior customer service, authenticity guarantees, and strategic multichannel marketing initiatives.

What will be the Size of the Luxury E-Tailing Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Customer service chatbots facilitate seamless interactions, while mobile commerce optimization caters to the growing number of shoppers using mobile devices. Customer relationship management systems enable personalized engagement, and fraud detection systems ensure secure transactions. Shipping and logistics are optimized through order management systems and data analytics dashboards, providing real-time visibility into inventory levels and delivery statuses. International shipping options expand reach, and omnichannel retail strategies offer a seamless shopping experience across channels. Virtual try-on technology and augmented reality shopping enhance the customer experience, while luxury product photography showcases offerings in high definition.

- Personalization engines and e-commerce personalization cater to individual preferences, driving conversion rate optimization. Influencer marketing strategies and social commerce integration broaden reach, and AI-powered recommendations suggest relevant products. Website performance monitoring ensures a smooth shopping journey, and high-value product display captures attention. Luxury brand storytelling and secure payment gateways build trust, and customer loyalty programs retain shoppers. Supply chain optimization and returns management processes streamline operations, and search engine optimization increases visibility. Three-dimensional product visualization and luxury packaging solutions complete the luxury shopping experience, setting the stage for continued innovation in the dynamic luxury e-commerce landscape.

How is this Luxury E-Tailing Industry segmented?

The luxury e-tailing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Personal luxury

- Food and wine

- Home accessories

- Channel

- Multibrand

- Monobrand

- Geography

- North America

- US

- Europe

- France

- Italy

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

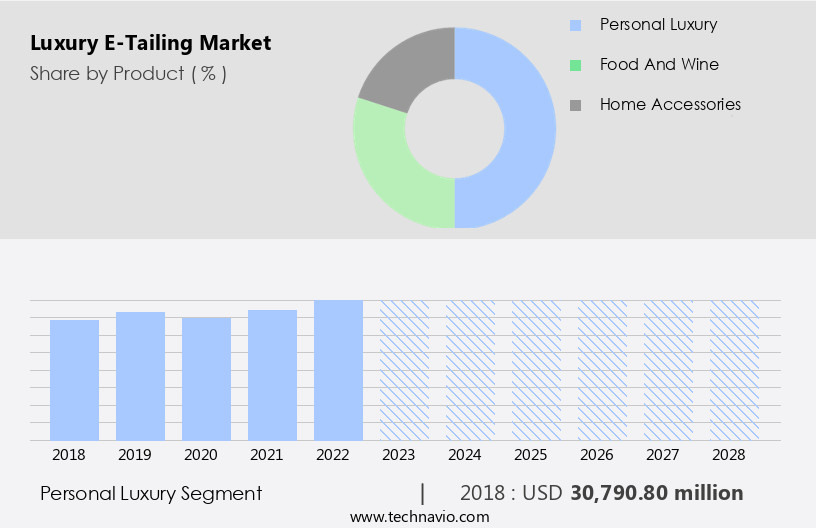

The personal luxury segment is estimated to witness significant growth during the forecast period.

In the market, customer service chatbots facilitate seamless interactions, enhancing the shopping experience. Mobile commerce optimization is a priority, catering to the growing number of smartphone users. Customer relationship management systems enable personalized engagement, while fraud detection ensures secure transactions. Shipping and logistics solutions optimize delivery times, and international shipping options expand reach. An omnichannel retail strategy integrates online and offline channels, with order management systems streamlining operations. Data analytics dashboards provide valuable insights, informing supply chain optimization and inventory management. Virtual try-on technology and 3D product visualization offer immersive shopping experiences. Luxury e-commerce platforms prioritize personalization engines and e-commerce personalization.

Customer loyalty programs and conversion rate optimization strategies retain customers. Influencer marketing and luxury brand storytelling boost sales, while secure payment gateways assure customer confidence. Search engine optimization and returns management processes enhance customer service. Augmented reality shopping and luxury packaging solutions add value to the overall experience. AI-powered recommendations and website performance monitoring ensure a seamless user journey. Luxury goods inventory is managed efficiently, and email marketing automation maintains consistent communication. Overall, the market is evolving, with a focus on enhancing customer experience, optimizing operations, and ensuring security.

The Personal luxury segment was valued at USD 30.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

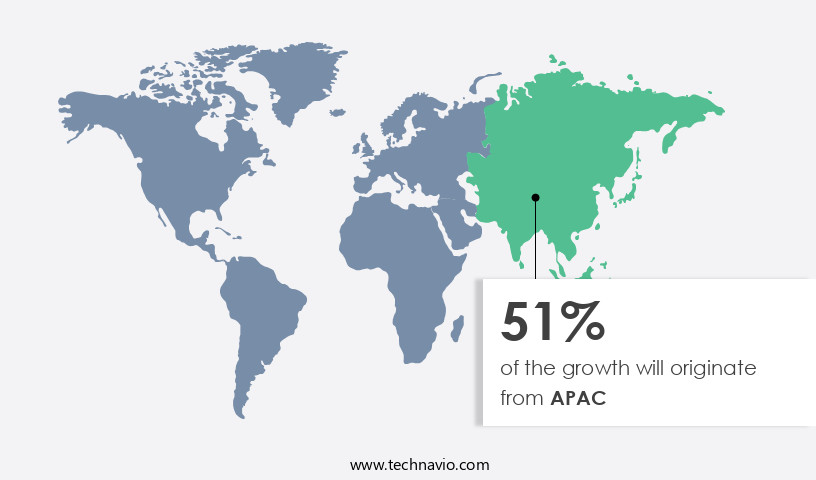

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is poised for substantial growth during the forecast period. Globalization has facilitated the trade of luxury goods worldwide, creating numerous avenues for their import and export. The expansion of the real estate sector, particularly in the residential and commercial spheres, serves as a significant catalyst for the market's growth in this region. Japan, China, and South Korea are the leading contributors to the market's revenue.

China, the world's most populous country, is undergoing rapid urbanization, leading to a surge in demand for real estate. Consequently, the online furniture market in China is expected to thrive, contributing to the overall growth of the market in the Asia Pacific region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market, a significant and continually evolving segment of the retail industry, encompasses the sale of high-end, premium products through digital channels. This market caters to consumers seeking a refined shopping experience, focusing on convenience, personalization, and exclusivity. With considerations like expedited shipping, secure payment gateways, and seamless user experiences becoming increasingly important, luxury e-tailers employ various strategies to meet these demands. Key areas involve the implementation of advanced technologies such as artificial intelligence and machine learning to enhance customer service and personalization. Through methods such as chatbots and recommendation engines, these technologies help luxury e-tailers deliver tailored shopping experiences that cater to each customer's unique preferences. Furthermore, luxury e-tailers often invest in high-quality visual content and immersive product presentations to showcase their offerings in the best possible light. Moreover, the market players focus on providing a sense of exclusivity by offering limited-edition collections, collaborations, and personalized services. These initiatives aim to create a strong emotional connection with customers, fostering brand loyalty and repeat purchases. Additionally, luxury e-tailers often partner with logistics companies to ensure swift and discreet delivery, further enhancing the overall shopping experience. In conclusion, the market continues to grow and adapt to the changing needs of affluent consumers. By embracing advanced technologies, offering personalized services, and delivering an exclusive shopping experience, luxury e-tailers can differentiate themselves from their competitors and thrive in this dynamic market.

What are the key market drivers leading to the rise in the adoption of Luxury E-Tailing Industry?

- The concurrent increase in online spending and smartphone penetration serves as the primary catalyst for market growth.

ai_test_driver_explanation_gai.multili

What are the market trends shaping the Luxury E-Tailing Industry?

- Multichannel marketing is an emerging trend in marketing, which involves reaching customers through multiple channels to provide a seamless and integrated customer experience. This approach allows businesses to engage with their audience in a more comprehensive and effective manner.

- Influencer marketing strategies have become essential for luxury brands looking to increase their online presence and reach a wider audience. Social media platforms, such as Facebook, Twitter, Instagram, and YouTube, serve as valuable tools for companies to showcase their premium cosmetics products and engage with consumers. For instance, Nykaa's successful influencer marketing campaign in February 2023, aimed at launching and promoting its clay it cool mask range, demonstrates the power of influencer collaborations. The growing popularity of social commerce integration and the increasing use of AI-powered recommendations further enhance the shopping experience for consumers. companies prioritize high-value product display, ensuring website performance monitoring to maintain a seamless user experience.

- Luxury goods inventory management is crucial for companies to maintain stock levels and meet consumer demand. Email marketing automation is another effective strategy for engaging with customers and driving sales. Augmented reality shopping experiences offer an immersive and harmonious shopping journey, allowing consumers to virtually try on products before making a purchase. These strategies, coupled with the increasing penetration of the Internet and smartphones, have contributed significantly to the sales volume and revenue growth of market companies.

What challenges does the Luxury E-Tailing Industry face during its growth?

- The growth of the industry is significantly impacted by rigorous competition from traditional sales channels, which poses a substantial challenge.

- The market encompasses high-value product categories such as personal care, wine, spirits, home décor, home furnishings, and furniture. Consumers often prefer purchasing these items from physical stores due to the ability to inspect products before buying and address queries on the spot. However, the shift to online shopping is gaining momentum, driven by innovative strategies like influencer marketing and social commerce integration. Luxury product photography, a crucial aspect of e-commerce, showcases items in an immersive and harmonious manner, enabling consumers to make informed decisions. AI-powered recommendations based on browsing and purchase history further enhance the shopping experience.

- Social media platforms are increasingly being used for luxury product promotion and sales, with social commerce integration allowing seamless transactions. Website performance monitoring ensures a seamless shopping experience, while high-value product display and email marketing automation cater to the unique needs of luxury consumers. Augmented reality shopping is also gaining popularity, allowing consumers to virtually try on or visualize products before purchasing. Despite concerns around cybersecurity, the convenience and accessibility offered by online shopping continue to attract consumers. The market is dynamic, with trends such as these shaping its growth.

Exclusive Customer Landscape

The luxury e-tailing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury e-tailing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury e-tailing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASOS Plc - This luxury e-commerce platform specializes in the online sale of men's and women's clothing, providing a premium shopping experience for global consumers. Through extensive research, I've identified the company's focus on high-end fashion, exceptional customer service, and strategic marketing efforts that differentiate it from competitors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASOS Plc

- Authentic Brands Group LLC

- Bed Bath and Beyond Inc.

- Burberry Group Plc

- Chanel Ltd.

- Charms and Chains

- Compagnie Financiere Richemont SA

- Crate and Barrel

- Harrods Ltd.

- Hennes and Mauritz AB

- Hermes International SA

- Hudsons Bay Co.

- Inter IKEA Holding B.V.

- Kering SA

- Luxuryperfume.com Inc

- LVMH Group.

- Moda Operandi Inc.

- Nordstrom Inc.

- Ralph Lauren Corp.

- SDI (Brands 2) Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury E-Tailing Market

- In January 2024, Neiman Marcus, a leading luxury department store, announced the launch of its revamped digital platform, "NM Marketplace," in collaboration with Shopify Plus. This partnership aimed to bring over 100 independent luxury brands to Neiman Marcus' online shoppers, expanding their product offerings and enhancing the customer experience (Neiman Marcus Press Release).

- In March 2024, Farfetch, the luxury fashion platform, secured a strategic investment of USD800 million from Alibaba Group, strengthening its position in the global luxury e-commerce market. This partnership allowed Farfetch to leverage Alibaba's logistics network and reach a broader customer base (Bloomberg).

- In May 2024, Richemont, the Swiss luxury goods conglomerate, acquired a 40% stake in Yoox Net-A-Porter Group for â¬2.1 billion. This acquisition allowed Richemont to expand its digital presence and bolster its e-commerce capabilities, merging Yoox Net-A-Porter's expertise with its own luxury brands (Reuters).

- In April 2025, Gucci, the iconic Italian luxury fashion brand, unveiled its new virtual store on Roblox, a popular gaming platform. This innovative move allowed Gucci to reach a younger demographic and showcase its products in a unique, interactive way, marking a significant step forward in luxury e-tailing's technological advancements (Gucci Press Release).

Research Analyst Overview

The market continues to evolve, with innovative applications emerging across various sectors. E-commerce security protocols and customer data privacy remain paramount, ensuring a secure and private shopping experience. High-end fashion e-tailers invest in virtual styling services and mobile app development to enhance the personalized shopping journey. Global e-commerce strategies encompass search engine optimization, luxury product catalogs, and sales conversion funnels to reach a wider audience. Luxury retail technology, such as inventory management tools and luxury customer support, streamline operations and elevate the brand reputation. Online luxury retailers leverage rich media content and exclusive brand experiences to engage customers, while premium customer service and digital marketing analytics drive sales.

Omnichannel customer journeys integrate website accessibility features and luxury goods distribution, creating seamless shopping experiences. Social media marketing and brand reputation management further expand reach and influence. E-commerce website design plays a crucial role in the success of luxury brands, with a focus on luxury market segmentation and branding. Sales conversion funnels and luxury retail technology optimize the customer experience, while online luxury retailers continually refine their strategies to cater to evolving consumer preferences. The ongoing unfolding of market activities and evolving patterns underscores the dynamic nature of the luxury e-tailing landscape.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury E-Tailing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.12% |

|

Market growth 2024-2028 |

USD 32483.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.15 |

|

Key countries |

China, US, Japan, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury E-Tailing Market Research and Growth Report?

- CAGR of the Luxury E-Tailing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury e-tailing market growth of industry companies

We can help! Our analysts can customize this luxury e-tailing market research report to meet your requirements.