Luxury Eyewear Market Size 2025-2029

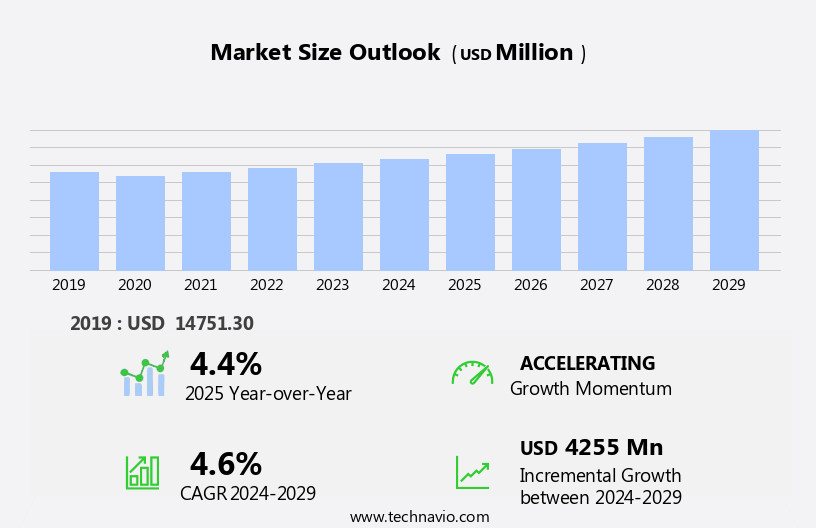

The luxury eyewear market size is forecast to increase by USD 4.26 billion at a CAGR of 4.6% between 2024 and 2029.

- The market exhibits significant growth potential, driven by the increasing trend of eyewear as a fashion statement and the continuous innovation and portfolio extension leading to product premiumization. The utility of eyewear as both a functional accessory and a style element has made it a desirable investment for consumers. Additionally, the integration of Augmented Reality (AR) and Virtual Reality (VR) technologies is redefining the consumer experience, enabling virtual try-ons and enhancing the shopping journey. This digital enhancement not only increases customer engagement but also supports more informed purchasing decisions, particularly in online settings. Moreover, the rise of smartwatches and connected wearables is contributing to cross-category interest, with brands exploring synergies between watch and eyewear collections to provide tech-enabled lifestyle solutions.

- However, the market faces notable challenges. The persistent threat from counterfeit products undermines brand reputation and consumer trust. To mitigate this, brands must prioritize authenticity, transparency, and brand protection through technologies like blockchain and secure packaging. The industry is also susceptible to economic fluctuations and shifting consumer preferences, demanding that companies remain agile and responsive to market trends. To fully capitalize on emerging opportunities and effectively navigate these challenges, market players should highlight product innovation, develop strategic collaborations, and continue investing in cutting-edge technologies to deliver differentiated, high-value offerings in both eyewear and watch segments.

What will be the Size of the Luxury Eyewear Market during the forecast period?

- The market in the US is experiencing significant growth, driven by increasing consumer preferences for high-end frames and advanced lens technologies. Half-rim frames, wayfarer sunglasses, square sunglasses, oversized sunglasses, and aviator sunglasses continue to dominate the market, with tinted lenses, bifocal lenses, and multifocal lenses gaining popularity among aging consumers. Full-rim frames and rimless frames also remain popular choices, while hydrophobic coating, gradient lenses, ophthalmic lenses, mirrored lenses, prescription sunglasses, and progressive lenses add value to the market. Eyewear care is a crucial aspect of the market, with storage cases, cleaning solutions, and scratch resistance becoming essential features.

- Impact resistance, anti-glare lenses, and anti-fog coating are other key trends, ensuring superior comfort and functionality. Additionally, lens coatings, cat-eye sunglasses, and various types of frames cater to diverse consumer preferences. Advanced technologies, such as hydrophobic coating, scratch resistance, impact resistance, and anti-glare lenses, contribute to the growth of the market. Consumers are increasingly seeking eyewear that offers superior protection, durability, and visual clarity. Furthermore, the integration of technology, such as blue light filtering lenses, is expected to drive market growth in the future. In summary, the US market is witnessing substantial growth, fueled by consumer demand for high-quality frames and advanced lens technologies.

- Brands offering innovative designs, superior craftsmanship, and cutting-edge technology are likely to capture a larger market share. Additionally, the integration of technology and customization options is expected to further boost market growth.

How is this Luxury Eyewear Industry segmented?

The luxury eyewear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Eyeglasses

- Sunglasses

- Price

- Premium

- Mid-range

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- Japan

- South Korea

- North America

By Type Insights

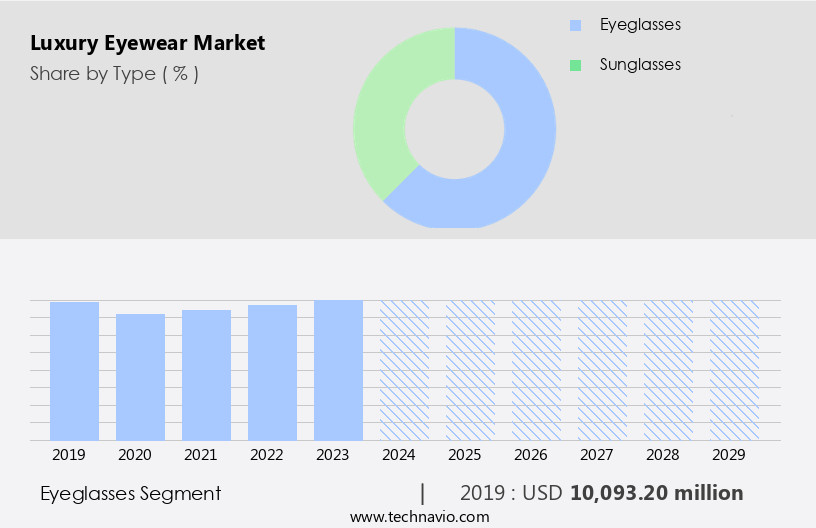

The eyeglasses segment is estimated to witness significant growth during the forecast period. The global luxury eyeglass market witnesses continuous growth in developed regions like North America and Europe, with countries such as the US, Japan, the UK, France, Italy, Spain, Canada, and Germany leading the way. This market encompasses both eyeglass frames and glasses. While refractive eye correction surgeries and contact lenses have gained popularity, the demand for aesthetically pleasing frames persists. Fashion accessories, including eyewear, are increasingly in demand. The business-to-consumer (B2C) e-commerce sector significantly influences the market, offering convenience and a comprehensive shopping experience through detailed catalogs and virtual reality technology. High-end materials, such as metals, are frequently used to create statement pieces, including prescription eyewear, that cater to brand loyalty and offer UV protection, polarized lenses, anti-reflective coatings, and eco-friendly materials.

Exclusive designs, custom eyewear, and limited edition collections cater to style icons and fashion trends. Celebrity endorsements and collaborations with luxury brands further boost the market. Artificial intelligence and augmented reality technologies are revolutionizing the industry, enabling virtual try-on features and personalized frames. Online eyewear retailers cater to the convenience of customers, while eyewear boutiques offer a more traditional, hands-on shopping experience. Handmade eyewear and designer eyewear continue to attract consumers seeking unique and ethical sourcing options. Photochromic lenses, high-index lenses, and other advanced lens technologies further enhance the functionality and appeal of luxury eyewear.

The Eyeglasses segment was valued at USD 10.09 billion in 2019 and showed a gradual increase during the forecast period.

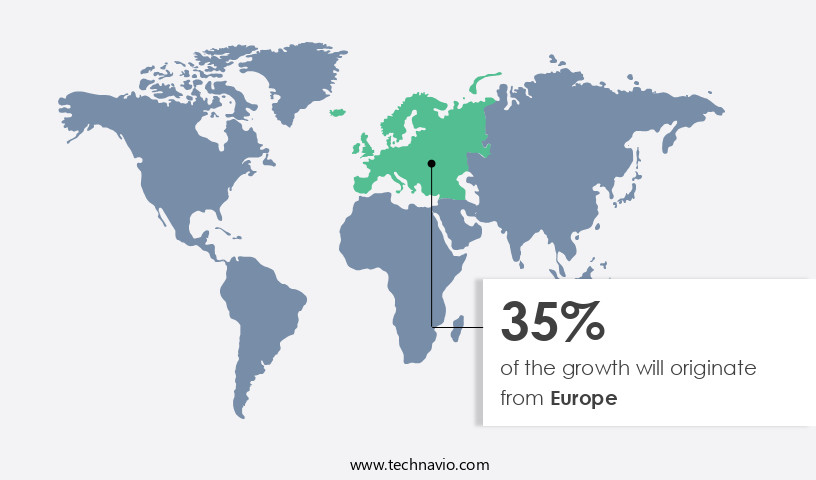

Regional Analysis

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, North America holds a significant position, with the US being a major contributor to its revenue. The presence of a substantial high-net-worth individual (HNI) population in countries like the US fuels the sales of luxury eyewear in this region. Fashion consciousness among consumers, particularly those aged 15-64 years, is a primary driver for the market's growth in North America. Luxury eyewear encompasses various trends and offerings, such as high-end materials, statement pieces, UV protection, prescription eyewear, ethical sourcing, exclusive designs, polarized lenses, celebrity endorsements, artificial intelligence, custom eyewear, eyewear boutiques, virtual reality, personalized frames, designer eyewear, luxury brands, 3D printing, anti-reflective coatings, eco-friendly materials, virtual try-on, handmade eyewear, eyewear trends, augmented reality, online eyewear retailers, fashion accessories, limited edition, style icons, photochromic lenses, and high-index lenses.

Brand loyalty and the allure of exclusive designs attract consumers to invest in luxury eyewear. The integration of advanced technologies like artificial intelligence and virtual reality enhances the shopping experience, providing a more personalized and experience. Moreover, the increasing popularity of fashion accessories, especially among the younger demographic, further bolsters the market's growth. Eco-friendly materials and ethical sourcing are gaining traction as consumers become more conscious of their environmental impact. Limited edition and collaborations with style icons add to the exclusivity and desirability of luxury eyewear. Photochromic lenses and high-index lenses cater to the specific needs of consumers, further broadening the market's scope.

The market in North America is driven by the region's substantial HNI population, fashion consciousness, and the integration of advanced technologies. The market offers a wide range of products, including high-end materials, statement pieces, and personalized frames, catering to diverse consumer preferences and needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Luxury Eyewear Industry?

- Innovation and portfolio expansion, through the introduction of premium products, are essential drivers for market growth. By continuously enhancing offerings and elevating product tiers, companies can cater to diverse customer segments and secure a competitive edge. The market necessitates continuous innovation to cater to customers' desire for unique and high-quality products. Brands play a pivotal role in differentiating themselves from competitors, as they strive to project their true value to brand-conscious consumers.

- LUXOTTICA GROUP currently dominates the market, leveraging its premium brand image to justify higher prices. Market players focus on enhancing product quality and effective branding to gain a competitive edge. Consumers seek innovative designs and superior craftsmanship, making it crucial for companies to invest in research and development to meet evolving demands. The market requires a strategic approach to branding and product development to cater to discerning consumers and maintain market leadership.

What are the market trends shaping the Luxury Eyewear Industry?

- The growing importance of eyewear as a fashion statement is a notable market trend, with consumers increasingly prioritizing stylish designs and innovative frames in addition to functional vision correction. Luxury eyewear continues to evolve with manufacturers and designers introducing new styles, shapes, sizes, colors, and structural orientations. Consumers now have the freedom to choose eyeglasses and sunglasses based on their specific needs and occasions, such as office wear, casual wear, party wear, and beachwear.

- Prescription sunglasses have gained significant traction, with many consumers owning two pairs for daily use â one for regular prescription eyeglasses and another for prescription sunglasses. Young adults, particularly teenagers, are the primary target market for fashionable luxury sunglasses, as they enhance the wearer's style statement. The market is driven by continuous product innovation and improvement, offering consumers a wide range of options to suit their preferences and lifestyles.

What challenges does the Luxury Eyewear Industry face during its growth?

- The proliferation of counterfeit products poses a significant threat to the industry, impeding its growth and undermining consumer trust. The market experiences significant growth due to the increasing trend towards fashionable accessories and the rising demand for these products. However, this market segment faces a challenge from the proliferation of counterfeit eyewear, particularly in developing regions. E-commerce platforms have expanded the reach of these counterfeit products, making it difficult for consumers to distinguish between authentic and imitation items.

- This lack of trust in e-commerce sites can deter potential customers and negatively impact sales. Companies invest in advertising and promotion campaigns to retain and attract customers, but these efforts come with substantial costs that can impact profitability. Despite these challenges, the market continues to grow, driven by the enduring appeal of fashionable eyewear and the efforts of companies to differentiate themselves and protect their brand image.

Exclusive Customer Landscape

The luxury eyewear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury eyewear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury eyewear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alcon Inc. - The company offers innovative eye care products including contact lenses, eye care products, LASIK and refractive technology, among others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcon Inc.

- Arias Eyewear

- Astra Lifestyle

- Burberry Group Plc

- Carl Zeiss AG

- Charmant Inc.

- Concept Eyewear

- Cutler and Gross Ltd.

- Eleganzo Inc.

- EssilorLuxottica

- Fielmann AG

- Kering SA

- Marchon Eyewear Inc.

- Marcolin Spa

- Maybach Eyewear

- Safilo Group S.p.A

- Silhouette International Schmied AG

- SUNGLASSCURATOR

- Titan Co. Ltd.

- Vision Nexgen

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Eyewear Market

- In Q1 2025, Italian luxury brand, Bulgari, introduced its latest eyewear collection, "Bulgari Vision," featuring high-end frames crafted from precious metals and gemstones. This launch underscores the brand's commitment to combining Italian craftsmanship with cutting-edge technology (Bulgari Press Release, 2025). In H2 2024, luxury eyewear manufacturer Oliver Peoples collaborated with Google to integrate Google's smart lens technology into their frames. This partnership marked a significant step towards merging fashion and technology in the luxury eyewear segment (Oliver Peoples Press Release, 2024).

- In Q3 2023, French luxury conglomerate LVMH acquired the Italian eyewear brand Maison Alaïa, expanding its presence in the market. This acquisition strengthened LVMH's position as a key player in the luxury goods sector (LVMH Press Release, 2023). In H1 2022, Swiss luxury watch maker Rolex, announced its entry into the eyewear market with the launch of its first-ever collection of sunglasses and optical frames. This strategic expansion allowed Rolex to broaden its offerings and cater to the growing demand for luxury eyewear (Rolex Press Release, 2022). These developments demonstrate the dynamic nature of the market, with brands continuously innovating, collaborating, and expanding to cater to the evolving needs and preferences of consumers.

- According to Technavio's market report, the market is expected to grow at a CAGR of over 5% during the forecast period, driven by the increasing popularity of luxury eyewear, rising disposable income, and the growing trend of wearing sunglasses as a fashion statement (Technavio, 2022).

Research Analyst Overview

The market continues to experience dynamic growth, driven by various factors that cater to consumers' evolving needs and preferences. One significant trend in this sector is the increasing demand for high-end materials and exclusive designs. Optical frames crafted from precious metals, such as gold and platinum, and acetate, a cellulose derivative known for its rich colors and texture, are becoming increasingly popular. Another trend that is gaining traction is the integration of advanced technologies into luxury eyewear. UV protection, polarized lenses, and anti-reflective coatings are no longer considered add-ons but essential features for discerning consumers. Brands are also exploring the use of artificial intelligence and virtual reality to offer personalized frames and virtual try-on experiences.

Brand loyalty remains a crucial factor in the market. Consumers are willing to pay a premium for designer eyewear and statement pieces that reflect their personal style and status. Ethical sourcing and eco-friendly materials are also becoming essential considerations for many consumers, with some opting for handmade eyewear or eyewear boutiques that prioritize sustainability and transparency. Limited edition and collaborative collections with celebrities and style icons continue to generate buzz in the market. These collaborations often result in unique and coveted pieces that sell out quickly. However, some luxury brands are also focusing on creating timeless designs that transcend trends and seasons.

Custom eyewear and 3D printing are also emerging trends in the market. These technologies allow for greater customization and personalization, catering to consumers' individual needs and preferences. Photochromic lenses and high-index lenses are also gaining popularity, offering convenience and functionality for those with prescription requirements. Augmented reality and virtual try-on technologies are revolutionizing the way consumers shop for eyewear. These technologies enable consumers to try on frames virtually, offering a more and convenient shopping experience. Online eyewear retailers are also investing in these technologies to offer a more personalized and seamless shopping experience. Fashion accessories, such as eyewear, continue to be a significant part of consumers' wardrobes.

Luxury brands are responding to this trend by offering a wide range of styles and designs that cater to various tastes and preferences. From classic and understated to bold and statement-making, there is a luxury eyewear option for every consumer. The market is a dynamic and evolving space, driven by various factors, including advanced technologies, materials, and consumer preferences. Brands that can offer high-quality, exclusive designs, and personalized experiences are likely to succeed in this competitive market. The future of luxury eyewear is likely to be shaped by continued innovation, sustainability, and a focus on the consumer experience.

Dive into Technavio's research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Eyewear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 4.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, France, Germany, Canada, UK, China, Mexico, Japan, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury Eyewear Market Research and Growth Report?

- CAGR of the Luxury Eyewear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury eyewear market growth and forecasting

We can help! Our analysts can customize this luxury eyewear market research report to meet your requirements.