Luxury Massage Chair Market Size 2025-2029

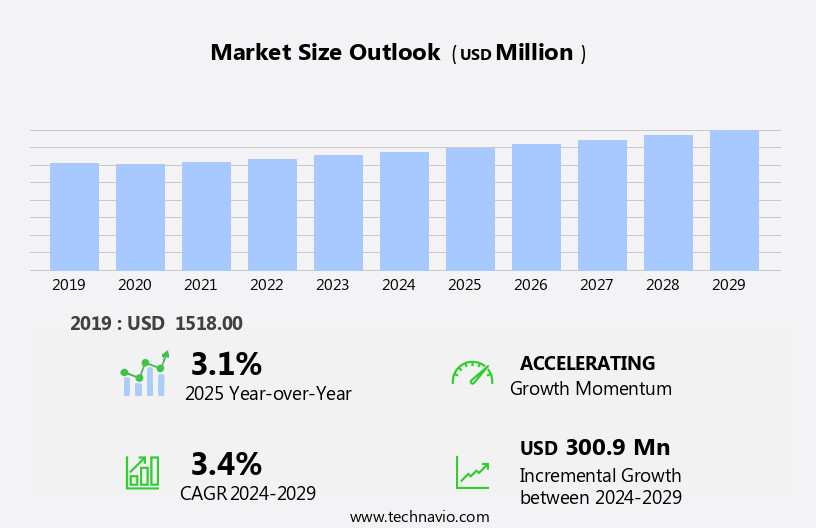

The luxury massage chair market size is forecast to increase by USD 300.9 million at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of work-related stress and the subsequent demand for effective stress-relieving solutions. This trend is further bolstered by the rising popularity of Shiatsu massage chairs, which offer a unique combination of deep tissue massage and pressure point therapy. However, market participants face challenges in managing the increasing prices of raw materials and the complexity of supply chain operations.

- These factors necessitate strategic sourcing and efficient logistics management to maintain competitiveness in the market. Companies seeking to capitalize on opportunities in this market should focus on innovation in massage technologies, while also addressing the challenges of raw material costs and supply chain complexities through strategic partnerships and operational efficiencies.

What will be the Size of the Luxury Massage Chair Market during the forecast period?

- The market continues to evolve, with dynamic market trends shaping its growth across various sectors. Mental well-being and self-care have emerged as key drivers, with e-commerce playing a significant role in making these products accessible to a wider audience. Zero-gravity technology, aromatherapy, and heat therapy are popular features that cater to the needs of those seeking relaxation and stress relief. Commercial users, including offices and healthcare facilities, have embraced massage chairs as an essential tool for managing demanding work schedules and societal pressures. Traditional massage chairs have given way to advanced models, with robotic massage chairs and inversion massage chairs leading the charge.

- Neck, shoulder, and back pain are common concerns addressed by these chairs, while shiatsu and acupressure techniques offer targeted relief. The aging population's increasing need for physical well-being solutions has fueled the demand for massage chairs. Advanced features like Bluetooth connectivity, voice-activated controls, and airbags cater to the diverse needs of users. Specialty stores and e-commerce platforms alike offer a range of massage chair models, from FFL brands to high-end offerings, ensuring customers have access to the best options for their unique requirements. Luxury massage chairs now integrate various massage techniques, including kneading, rolling, and tapping, to provide a comprehensive therapeutic experience.

- Chronic pain conditions, such as reduced mobility, are also addressed through specialized designs. The ongoing evolution of this market ensures that massage chairs continue to offer innovative solutions for enhancing quality of life and addressing the ever-growing need for stress relief and relaxation.

How is this Luxury Massage Chair Industry segmented?

The luxury massage chair industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Residential

- Commercial

- Product Type

- Full body massage chairs

- Zero gravity massage chairs

- Heated massage chairs

- Inversion massage chairs

- Technology Specificity

- 2D Rollers

- 3D Rollers

- 4D Rollers

- Airbag Massage

- Performance Features

- Zero Gravity

- Heat Therapy

- Bluetooth Connectivity

- Body Scanning

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various distribution channels, with offline retail formats, such as specialty stores, dealers, hypermarkets, supermarkets, brand-owned retail stores, and department stores, accounting for a substantial portion of sales. However, customer preferences are evolving, leading to a decline in offline sales due to the convenience and accessibility of online shopping. In response, companies are collaborating with local retailers and employing innovative marketing strategies to boost sales. Zero-gravity technology, aromatherapy, vibration, reflexology, and various massage techniques like Shiatsu, tapping, and acupressure are popular features in luxury massage chairs, catering to mental well-being, stress relief, and physical well-being. Heated massage chairs and air massage systems provide additional benefits like heat therapy, improved blood circulation, and reduced muscle tension.

The e-commerce sector is gaining traction, with companies like JSB Healthcare and Arogya Health Care offering Bluetooth connectivity, voice-activated controls, and various massage chair models online. The aging population and individuals with chronic pain conditions are significant target demographics, driving demand for these chairs. Robotic massage chairs, inversion massage chairs, and massage chairs with airbags and rolling features are other popular categories in the market. Commercial users, including physiotherapy centers and spas, also contribute to the market's growth. Societal pressures, demanding work schedules, and societal expectations for self-care are factors contributing to the increasing popularity of luxury massage chairs as essential wellness products.The market is expected to continue evolving, with new features and technologies being introduced to cater to diverse customer needs.

The Offline segment was valued at USD 1299.30 million in 2019 and showed a gradual increase during the forecast period.

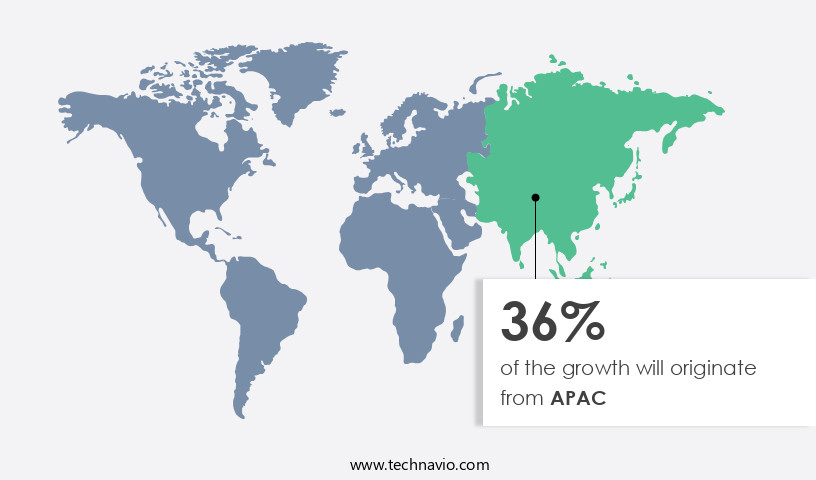

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the European market, luxury massage chairs hold a significant share due to the increasing focus on mental well-being and self-care. Central and Eastern Europe's growing awareness of massage's potential benefits is driving this trend. Major contributors to the European the market include Germany, France, the UK, Italy, Spain, and Russia. Commercial establishments in these countries are installing these chairs to enhance customer experiences and attract more business. For instance, The Amsterdam Airport Schiphol offers Shiatsu massages using Massage-O-Matic BV chairs, which provide privacy during sessions, adding to the overall comfort and relaxation. Additionally, the aging population and societal pressures leading to stress-related health issues contribute to the demand for these chairs.

The E-commerce sector, including JSB Healthcare and Arogya Health Care, also plays a crucial role in the market's growth, making these chairs accessible to a wider audience. Various massage techniques, such as Zero-gravity recline, heat therapy, airbags, and compression, cater to diverse needs. Inversion Massage Chairs, Robotic Massage Chairs, and Traditional Massage Chairs, among others, are popular choices. Air massage systems and physiotherapy techniques offer additional benefits, such as improved blood circulation and muscle tension relief. The E-commerce segment, including FFL Brands and Voice-activated controls, enables customers to purchase these chairs conveniently. Overall, the European the market continues to evolve, catering to the needs of both Commercial and Residential Users.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Luxury Massage Chair Industry?

- The increasing demand for effective stress-relieving solutions in the workforce serves as the primary market driver.

- The e-commerce industry has witnessed a significant surge in demand for wellness products, including luxury massage chairs, as people prioritize mental well-being and seek relief from the physical and emotional stress caused by demanding work schedules and family responsibilities. These chairs offer various features such as Zero-gravity technology, Aromatherapy, vibrators, Reflexology, Shiatsu massage, Acupressure, and Heated Massage Chairs to stimulate blood circulation, alleviate pain, and promote relaxation.

- The use of these chairs releases endorphins and serotonin, hormones that enhance relaxation and mental wellness. The growing health consciousness and the need for effective stress relief solutions have fueled the popularity of massage chairs in both residential and commercial settings.

What are the market trends shaping the Luxury Massage Chair Industry?

- The growing popularity of Shiatsu massage signifies a significant market trend in the health and wellness industry. This traditional Japanese massage technique, which involves using finger pressure on specific points along the body's energy pathways, is gaining increasing recognition for its numerous health benefits.

- Luxury massage chairs in the E-commerce sector are gaining popularity as people prioritize self-care and stress relief in their busy lives. These chairs incorporate Shiatsu massage techniques, a Japanese therapy using fingers, thumbs, and palms for stretching and joint manipulation. While not proven to cure diseases, Shiatsu massages are known for their stress-reducing effects and enhancement of overall health and vitality. Due to the complexity of mastering Shiatsu techniques, manufacturers design electric massage chairs with this concept. These chairs offer various massage techniques for the back and legs, promoting improved blood circulation and relaxation.

- With Bluetooth connectivity, users can control their massage experience from a smartphone, adding to the convenience and personalization. As societal pressures continue to mount, the demand for high-quality massage chairs as a means of self-care and stress management increases.

What challenges does the Luxury Massage Chair Industry face during its growth?

- The escalating costs of raw materials and the intricacy of supply chain operations pose significant challenges to the industry's growth trajectory.

- The market faces challenges due to the volatile costs of raw materials and assembly components, which may hinder market expansion during the forecast period. Key raw materials, including steel, plastics, textiles, wood particleboard, and cartons, experience frequent price fluctuations. Notably, steel, wood, chipboard, timber, foam, polish chemical materials, color paints, hardware, and aluminum are essential components in manufacturing massage chairs. The escalating prices of these materials may negatively impact market growth. Moreover, the depletion of forests worldwide has adversely affected timber production, which is a significant concern for the industry. Despite these challenges, the market continues to prioritize consumer well-being by offering various features such as heat therapy, reduced mobility assistance, shiatsu kneading, and voice-activated controls.

- Brands like Arogya Health Care, FFL Brands, and Robotic Massage Chairs cater to this demand through Specialty Stores and E-commerce segments. Inversion Massage Chairs, which focus on targeting the feet, are also gaining popularity.

Exclusive Customer Landscape

The luxury massage chair market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury massage chair market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury massage chair market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

OSIM International Pte Ltd. - The company specializes in high-end massage chairs, featuring innovative designs and advanced technology. Among its offerings are the Casada Medissa, Casada DreamWave, and Casada Medissa 2.0 models. These chairs deliver a luxurious and rejuvenating massage experience, incorporating various techniques to target muscles and promote relaxation. The Casada Medissa boasts a sleek design and intuitive controls, while the Casada DreamWave provides a more dynamic massage experience with its 3D rollers. The Casada Medissa 2.0 integrates the latest technology for customizable massages, ensuring a personalized experience for each user. With a commitment to quality and innovation, the company continues to push the boundaries of massage chair technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- OSIM International Pte Ltd.

- Panasonic Corporation

- Human Touch LLC

- Infinity Massage Chairs

- Cozzia USA

- Kahuna Massage Chair

- Bodyfriend Co. Ltd.

- Luraco Technologies Inc.

- Ogawa World USA

- Fujiiryoki Co. Ltd.

- Inada Co. Ltd.

- Titan Chair LLC

- Synca Wellness

- Relax The Back Corporation

- Massage Chair Relief

- Brookstone

- Sharper Image

- HoMedics LLC

- Zyllion Inc.

- BestMassage

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Massage Chair Market

- In January 2024, Infinity Massage Chairs, a leading luxury massage chair manufacturer, introduced their new flagship model, the "Serenity Pro," featuring advanced AI technology and a space-saving design (Infinity Massage Chairs Press Release). This innovation sets a new standard in the market, enhancing user experience and customization.

- In May 2025, Ogawa Corporation, a prominent player in the luxury massage chair industry, partnered with a renowned wellness spa chain, creating an exclusive collaboration to offer their customers a unique in-chair spa experience (Ogawa Corporation Press Release). This strategic partnership aims to expand their reach and cater to the growing demand for luxury wellness services.

- In August 2024, Sunpure Technology Co. Ltd., a Chinese massage chair manufacturer, raised USD50 million in a Series C funding round led by Sequoia Capital China (Crunchbase). The investment will be used to accelerate product development, expand production capacity, and strengthen its global market presence.

- In December 2025, the U.S. Food and Drug Administration (FDA) granted clearance for the use of heat therapy in luxury massage chairs, opening up new opportunities for manufacturers to incorporate this feature into their products (FDA Press Release). This regulatory approval marks a significant shift in the market, providing consumers with additional health benefits.

Research Analyst Overview

In the market, chronic diseases such as diabetes and hypertension, driven by sedentary lifestyles and lifestyle diseases, have fueled demand for therapeutic relaxation solutions. Online communities have emerged as a platform for sharing experiences and recommendations, influencing market trends towards healthcare integration. Medtronic plc, a leading medical technology company, has entered the market with advanced massage chairs offering medical benefits. Research published on BMC (Biomed Central) underscores the role of massage chairs in managing orthopedic conditions and cardiovascular diseases. The service segment, including consultation services and professional services, is gaining traction in fitness centers, health clubs, and fitness world.

PowerMax Fitness and Life Fitness, major fitness equipment providers, offer massage chairs as part of their product lines. Functional food, dietary supplements, protein supplements, and functional beverages are complementary offerings in the market. Equipment cost and deceptive marketing prices remain concerns for potential buyers, emphasizing the need for transparency. Cardiovascular training equipment, strength training equipment, surgical equipment, and other massage equipment are alternative investments for those seeking holistic wellness solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Massage Chair Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 300.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Germany, UK, Canada, France, China, Italy, The Netherlands, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury Massage Chair Market Research and Growth Report?

- CAGR of the Luxury Massage Chair industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury massage chair market growth of industry companies

We can help! Our analysts can customize this luxury massage chair market research report to meet your requirements.