Marine Biotechnology Market Size 2025-2029

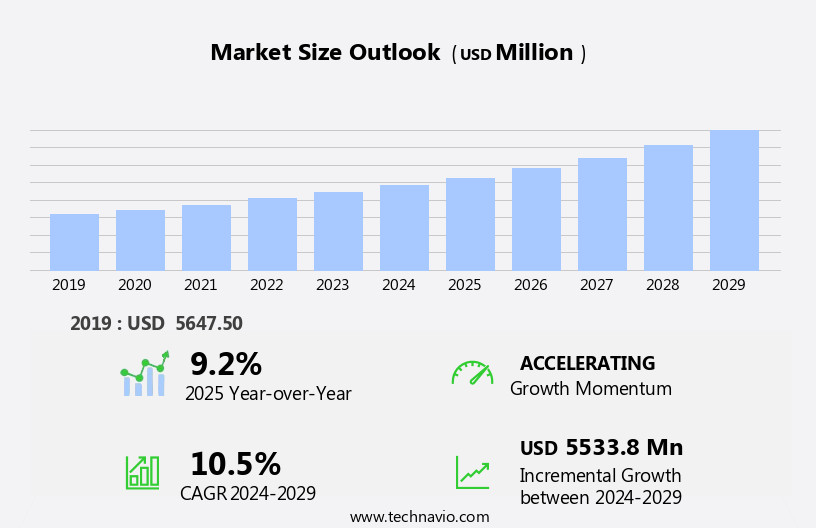

The marine biotechnology market size is forecast to increase by USD 5.53 billion at a CAGR of 10.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for sustainable biofuels and the urgent need to address climate change. This sector holds immense potential as marine organisms offer a rich source of bioactive compounds and renewable resources. However, the market is not without challenges. Legal and ethical issues surrounding the use of marine organisms and their genetic material remain a concern, necessitating stringent regulatory frameworks. Another trend in the market is the use of transgenic animals for producing recombinant proteins, which holds immense potential for the production of pharmaceuticals and industrial enzymes. Companies operating in this space must navigate these complexities to capitalize on the opportunities presented by this dynamic market. The trend towards developing eco-friendly technologies and products, coupled with advancements in genetic engineering and bioprospecting, is expected to fuel market growth.

- Strategic partnerships, collaborations, and investments in research and development will be key to staying competitive in this evolving landscape. Companies seeking to capitalize on the opportunities in Marine Biotechnology must remain agile, innovative, and committed to sustainable practices to succeed in this market.

What will be the Size of the Marine Biotechnology Market during the forecast period?

- The market encompasses a diverse range of applications, from the exploration and utilization of marine bacteria and fungi for biofouling control and the production of bioactive peptides, lipids, and natural products, to the application of biotechnology tools such as high-throughput screening, synthetic biology, gene expression, and next-generation sequencing. This burgeoning industry also includes the development of bioprocess engineering and bioreactor design for the production of biocatalysts, as well as the implementation of bioremediation technologies for marine pollution control. Sustainable fisheries, marine ecosystem restoration, oceanographic modeling, and marine environmental monitoring are further areas of focus. Synthetic biology-enabled products, such as genome editing and marker-assisted breeding, further accelerate the development of new traits.

- Additionally, marine biotechnology is exploring new frontiers in marine bioenergy, carbon sequestration, policy, ethics, and education. The market's growth is driven by the vast potential of the marine environment as a source of novel biological compounds and processes, as well as the increasing demand for sustainable and eco-friendly solutions to global challenges. For instance, vaccines and antibiotics are being developed using these technologies to improve animal health and productivity.

How is this Marine Biotechnology Industry segmented?

The marine biotechnology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Healthcare products

- Energy and environment management products

- Food and cosmetics products

- Type

- Bio active substance

- Bio materials

- Others

- Source

- Algae

- Marine fungi

- Corals and sponges

- Marine viruses

- Others

- Technology

- Isolation and cultivation of microorganisms

- Culture-independent techniques

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

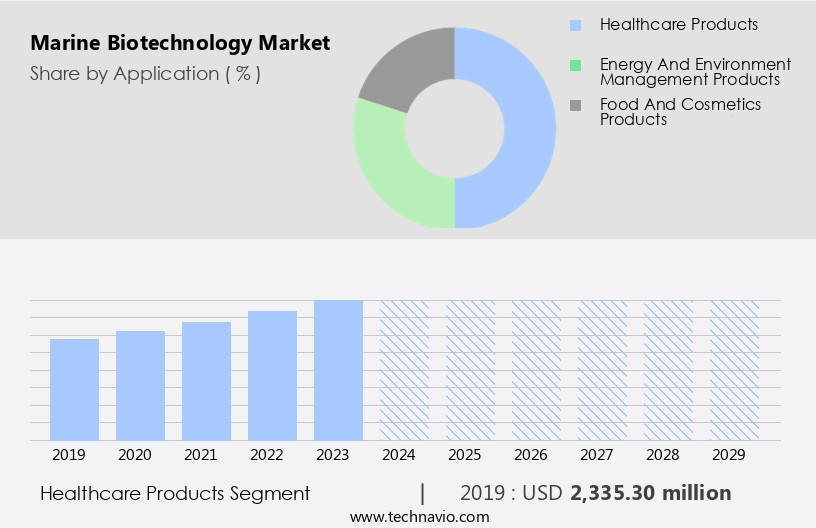

By Application Insights

The healthcare products segment is estimated to witness significant growth during the forecast period. Marine biotechnology is a dynamic and innovative field that offers significant potential for the discovery and development of new bioactive compounds. These compounds, derived from marine invertebrates, algae, and microorganisms, differ from their terrestrial counterparts and hold promise as novel medicines. For instance, marine-derived drugs include an antibiotic produced from fungi, two anti-cancer and herpes virus treatments from a sponge, and a painkiller from a snail that is 10,000 times more potent than morphine without its side effects. The marine invertebrate, Bugula neritina, is a potential source for a leukemia drug. Marine genomics, microbiology, and enzymology are key areas of research that contribute to the discovery of these bioactive compounds.

Furthermore, marine biotechnology has applications in sustainable aquaculture, bioremediation, biofuel production, and biomaterials. The industry is driven by advancements in gene editing, biotechnology platforms, and pharmaceutical development. Biotechnology investments and regulations play a crucial role in the growth and sustainability of this industry. Marine biotechnology solutions offer innovative ways to address various challenges, from healthcare to environmental sustainability. This technology plays a crucial role in enhancing agricultural productivity and sustainability by reducing the reliance on chemical pesticides and herbicides.

Get a glance at the market report of share of various segments Request Free Sample

The Healthcare products segment was valued at USD 2.34 billion in 2019 and showed a gradual increase during the forecast period.

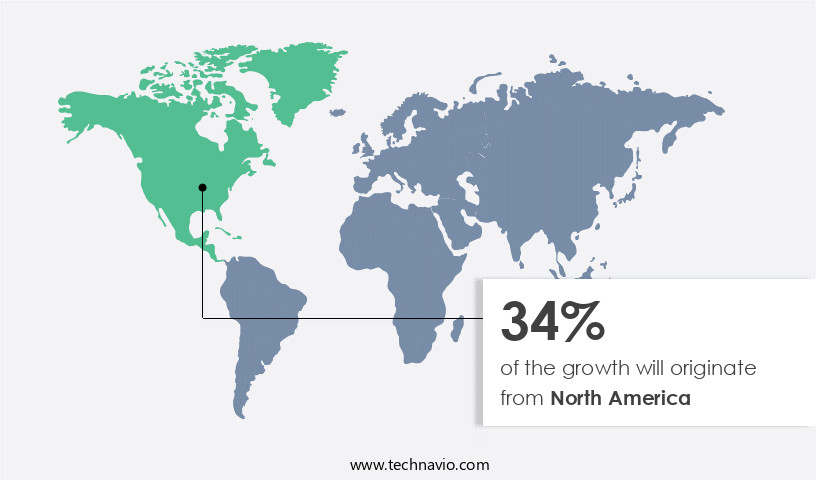

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is primarily driven by the US, which is home to numerous pharmaceutical companies, including Novartis, Pfizer, and Roche. These firms utilize marine biotechnology products, such as recombinant proteins and growth hormones, for pharmaceutical development. The US also houses prominent marine biotechnology research institutions, such as the Scripps Institution of Oceanography, the University of California, San Diego, Colorado State University, and the University of Delaware. These centers contribute significantly to marine biotechnology research, fostering innovation in areas like marine genomics, marine drugs, and marine microbiology. Additionally, the market encompasses sectors like algae biotechnology, seaweed cultivation, marine enzymes, biofuel production, marine microorganisms, and marine biomaterials.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Marine Biotechnology Industry?

- Increase in demand for biofuel is the key driver of the market. The global energy landscape is undergoing a significant shift as the demand for sustainable and renewable energy sources continues to rise. According to research, biomass derived from various forest, agriculture, and aquatic sources is emerging as a promising feedstock for producing various biofuels, including biodiesel, bioethanol, biohydrogen, bio-oil, and biogas. This transition is driven by several factors, including the scarcity of fossil fuels, the need for energy security, increasing petroleum-based fuel prices, and the growing concern over global warming. For instance, the United States, in particular, recorded a biofuel consumption of 72.12 million metric tons in 2023, with ethanol being the primary biofuel. The shift towards renewable energy sources presents a significant opportunity for market participants to contribute to a sustainable future while also addressing the energy demands of a growing global population. Products span a wide range, from biotechnology applications in pharmaceutical development to environmental remediation solutions. Biotechnology companies and investors are increasingly recognizing the potential of this sector, leading to significant investments in research and development. Regulations and policies play a critical role in shaping the industry.

What are the market trends shaping the Marine Biotechnology Industry?

- Increasing concern about climate change is the upcoming market trend. The escalating issue of greenhouse gas (GHG) emissions, primarily from industrial activities, has become a significant concern for the global community. In 2024, GHG emissions from fossil fuels reached a record high of 37.4 billion metric tons, marking a 0.8% increase from the previous year. This increase in emissions contributes to altering weather patterns, rising sea levels, and decreased agricultural yields, leading to potential species extinction. Consequently, the global push towards reducing GHG emissions has intensified, with a focus on decreasing the reliance on fossil fuels and transitioning to renewable energy sources. This shift is crucial for mitigating the environmental impact of industrial activities and safeguarding the planet's biosphere. Gene editing and biotechnology platforms are essential tools for advancing research in this area, leading to new discoveries and applications. Sustainable aquaculture is another important aspect of marine biotechnology, offering solutions for producing seafood in an environmentally responsible manner. Marine conservation and oceanographic research are also integral components, ensuring the long-term sustainability of marine resources.

What challenges does the Marine Biotechnology Industry face during its growth?

- Legal and ethical issues associated with marine biotechnology is a key challenge affecting the industry growth. Marine biotechnology, a subfield of biotechnology, holds immense potential in addressing various challenges and benefiting humanity. However, it is not without its complexities. The manipulation of marine organisms' genomes raises ethical and legal concerns, as people perceive the risks as high. The long-term effects of products are largely unknown, leading to distrust among users and hindering adoption. Moreover, the study and utilization of resources from different countries pose challenges. A country rich in marine life and resources may not welcome foreign entrants for research, creating barriers. These factors, among others, necessitate a thoughtful and ethical approach to marine biotechnology. It is crucial for stakeholders to address these challenges and work collaboratively to ensure the responsible and sustainable use of marine resources for the betterment of humanity. Industrial applications span from sustainable aquaculture and marine conservation to oceanographic research, environmental remediation, and biotechnology platforms. Market dynamics are influenced by biotechnology investments, policy, ethics, and innovations. Key areas of focus include genetic engineering, biotechnology patents, and regulations. The industry offers services, training, consulting, and conferences to facilitate growth and advancement in this field.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air Liquide SA - SEPPIC, a subsidiary of the company, specializes in marine biotechnology innovations. They leverage the power of the ocean to develop sustainable and effective solutions for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- Aker BioMarine ASA

- AlgaEnergy SA

- Archer Daniels Midland Co.

- BASF SE

- CoDo International Ltd.

- Cyanotech Corp.

- FMC Corp.

- Geomarine Biotechnologies

- Glyco Mar Ltd.

- J M Huber Corp.

- KD Pharma Group

- Lonza Group Ltd.

- Marinomed Biotech AG

- Marinova Pty Ltd.

- Marshall Marine Products

- New England Biolabs Inc.

- PharmaMar SA

- Prolume Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Marine biotechnology is a dynamic and rapidly evolving field that leverages the unique biological resources of the ocean to develop innovative products and solutions. This sector encompasses various areas of research and application, including bioactive compounds derived from marine organisms, marine genomics, and marine drugs. Marine biotechnology also extends to the development of technologies such as anti-fouling coatings, algae biotechnology, and seaweed cultivation. These applications offer significant potential for industrial biotechnology, particularly in the production of marine enzymes and biofuels. Moreover, marine microbiology plays a crucial role, providing insights into the diverse microorganisms found in marine environments. Vaccine Development, Antibiotic Development, Nutritional Supplements, Flower Culturing, Biofuels, and other applications are expanding the market's reach.

Ethical considerations are also essential, ensuring that the benefits are maximized while minimizing potential risks and negative impacts on marine ecosystems. Biotechnology innovations continue to emerge, offering promising solutions to various challenges. From marine biomaterials and biotechnology services to biotechnology consulting and training, the applications of marine biotechnology are vast and diverse. Marine biotechnology is a dynamic and innovative field that offers significant potential for developing sustainable and environmentally responsible solutions. From bioactive compounds and marine drugs to sustainable aquaculture and industrial biotechnology, the applications of marine biotechnology are vast and diverse. As research and development continue to advance, we can expect to see new and exciting applications and innovations emerge. In the microbes segment, the focus is on the development of beneficial microbes for use in agriculture, such as those used in precision farming and flower culturing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.5% |

|

Market growth 2025-2029 |

USD 5.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.2 |

|

Key countries |

US, Germany, China, Canada, Japan, UK, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Marine Biotechnology Market Research and Growth Report?

- CAGR of the Marine Biotechnology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the marine biotechnology market growth of industry companies

We can help! Our analysts can customize this marine biotechnology market research report to meet your requirements.