Medical Devices Market Size 2025-2029

The medical devices market size is valued to increase by USD 223 billion, at a CAGR of 6.5% from 2024 to 2029. Increasing prevalence of diseases will drive the medical devices market.

Major Market Trends & Insights

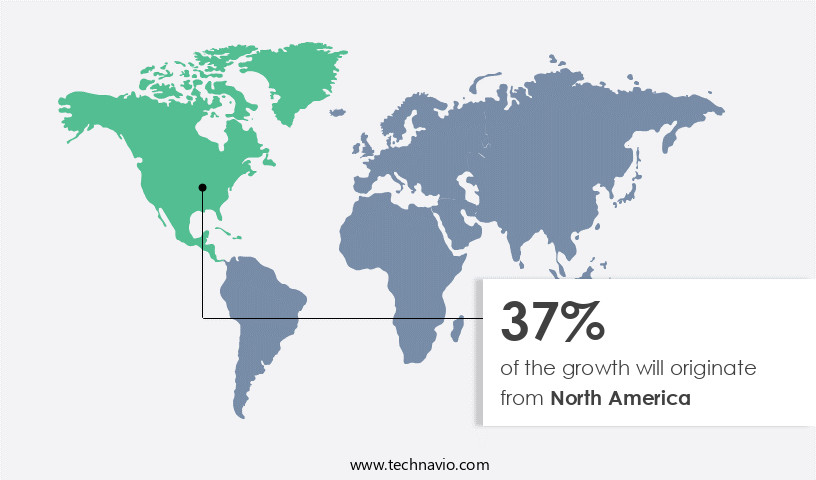

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By End-user - Hospitals and ASCs segment was valued at USD 380.90 billion in 2023

- By Product Type - Diagnostic devices segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 64.11 billion

- Market Future Opportunities: USD 223.00 billion

- CAGR : 6.5%

- North America: Largest market in 2023

Market Summary

- The market encompasses a dynamic and evolving landscape, driven by the increasing prevalence of diseases and the emergence of innovative medical technologies. Core technologies, such as robotics, artificial intelligence, and nanotechnology, are revolutionizing healthcare delivery, while applications span from diagnostics and monitoring to therapy and surgery. Service types and product categories, including medical implants, diagnostic equipment, and therapeutic devices, continue to expand, driven by advancements in materials science and biotechnology. Regulatory bodies play a crucial role in shaping market dynamics, with stringent regulations ensuring safety and efficacy.

- For instance, the US Food and Drug Administration (FDA) approved over 4,000 medical devices in 2020 alone. Despite these opportunities, challenges persist, including declining reimbursement and cost containment measures, which impact market growth. Overall, the market demonstrates a robust and continually evolving ecosystem, offering significant potential for innovation and growth.

What will be the Size of the Medical Devices Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Medical Devices Market Segmented and what are the key trends of market segmentation?

The medical devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Hospitals and ASCs

- Clinics

- Others

- Product Type

- Diagnostic devices

- Therapeutic devices

- Monitoring devices

- Assistive and rehabilitation devices

- Others

- Application

- Cardiovascular

- Orthopedic

- Diagnostic imaging

- Dental

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals and ascs segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of technologies and applications, with hospitals and Ambulatory Surgical Centers (ASCs) representing a significant and growing sector. Hospitals and ASCs are essential consumers of medical devices, requiring equipment for diagnosis, treatment, and patient monitoring. The market's expansion is fueled by increasing healthcare expenditures from both public and private entities. Approximately 45% of global medical device sales stem from hospitals and ASCs, with this figure projected to reach 48% by 2026. Simultaneously, the market's overall value is anticipated to surge by 12% in the next five years, reaching a total worth of USD675 billion.

Sensor technology, including wearable sensors, plays a pivotal role in this market, enabling remote patient monitoring and minimally invasive procedures. Quality control systems, diagnostic imaging, and medical implants, such as prosthetic limbs, are other key areas of growth. Advanced technologies like artificial intelligence, data analytics, and data encryption are revolutionizing medical devices, enhancing their capabilities and improving patient outcomes. Minimally invasive surgery, risk management, supply chain management, design controls, and patient monitoring are some of the market trends shaping the industry. Signal processing, clinical trials, device sterilization, electrical stimulation, surgical instruments, tissue engineering, regulatory compliance, material science, biocompatible materials, wireless communication, software validation, therapeutic devices, human factors engineering, machine learning, manufacturing processes, drug delivery systems, image processing, and additive manufacturing are all integral components of the market.

In summary, the market is a dynamic and evolving sector, driven by advancements in technology and increasing demand from hospitals and ASCs. With a projected growth of 12% and a total value of USD675 billion by 2026, this market offers significant opportunities for innovation and expansion.

The Hospitals and ASCs segment was valued at USD 380.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Medical Devices Market Demand is Rising in North America Request Free Sample

The US, as the largest the market globally, contributes significantly to North America's revenue, with Canada following closely. With over 6,500 companies, most of which are small and medium-sized enterprises, the US is also the world's largest consumer of medical devices. Major export markets include EU countries and Japan. The US market's dominance is expected to persist, given its substantial consumer base and advanced healthcare infrastructure.

Currently, Baxter International Inc. (Baxter), Becton, Dickinson, and Co. Are notable US medical device companies. The US market's continuous growth is driven by factors such as an aging population, increasing prevalence of chronic diseases, and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of innovative technologies, from biocompatible polymer selection for medical implants to surgical robot precision control algorithms and advanced image processing techniques in diagnostics. This market is characterized by continuous advancements in areas such as drug delivery system design optimization, patient monitoring system data security protocols, and wearable sensor data analytics. Three-dimensional printed orthopedic implant designs and minimally invasive surgical instrument designs are revolutionizing healthcare, offering improved patient outcomes and reduced recovery times. The market's focus on remote patient monitoring systems usability and clinical trial data management systems reflects the growing importance of data-driven healthcare.

Medical device cybersecurity threats necessitate robust risk management frameworks, design controls, and human factors considerations in medical device development. Electrical stimulation parameters optimization and image analysis algorithms in medical imaging, along with signal processing techniques in biomedical sensors, are key areas of research and development. Wireless communication protocols in medical devices enable seamless integration and data sharing, enhancing patient care and facilitating collaborative healthcare networks. The market's industrial application segment accounts for a significantly larger share compared to the academic segment, reflecting the growing adoption of advanced medical technologies in clinical settings. Adoption rates of minimally invasive surgical instruments are nearly double those of traditional instruments, underscoring the market's shift towards less invasive procedures and improved patient experiences.

This dynamic market presents numerous opportunities for innovation and growth, making it an exciting space for businesses and investors alike.

What are the key market drivers leading to the rise in the adoption of Medical Devices Industry?

- The escalating incidence of diseases serves as the primary catalyst for market growth.

- In response to the increasing prevalence of various medical conditions, the demand for medical devices continues to grow. Chronic diseases such as diabetes, cardiovascular diseases, respiratory disorders, and cancer have seen a rise in global incidences, necessitating ongoing monitoring and management. These conditions call for medical devices like glucose monitors, blood pressure monitors, and respiratory therapy equipment. Moreover, an aging population contributes to the demand for medical devices addressing age-related issues, including joint replacements, hearing aids, and assistive devices. The continuous evolution of medical technology and the development of innovative devices further fuel this demand.

- Medical devices play a crucial role in improving patient outcomes, enhancing quality of life, and reducing healthcare costs.

What are the market trends shaping the Medical Devices Industry?

- The emergence of innovative medical technologies is mandated by current market trends. This sector is experiencing significant advancements.

- In the realm of medical technology, several innovations are transforming healthcare delivery, with regenerative medicine, surgical robots, liquid biopsy, and wearable medical devices leading the charge. Regenerative medicine, which repairs or replaces damaged human cells, tissues, and organs using therapeutic stem cells, tissue engineering, and artificial organ production, is gaining significant attention. For example, Harvard Apparatus Regenerative Technology (HART) introduced a regenerated airway transplant using a synthetic scaffold, paving the way for similar organ transplants like lungs and hearts. Three-dimensional (3D) bioprinting, or additive manufacturing, is being adopted for producing regenerative medicines due to its ability to control the size, shape, pore size, geometry, and mechanical properties of products.

- These advancements contribute to enhanced diagnosis and treatment of various diseases, underscoring the dynamic and evolving nature of the medical technology market.

What challenges does the Medical Devices Industry face during its growth?

- The implementation of cost containment measures and decreasing reimbursements pose a significant challenge to the industry's growth trajectory.

- The US healthcare market is undergoing significant changes as government entities and insurers implement cost-containment measures to curb spending. These initiatives include limiting reimbursements for certain procedures, tying compensation to outcomes, and transitioning to population health management (PHM). For example, the Sunshine Act, which requires manufacturers reporting annual spending on physicians and educational activities to the Centers for Medicare & Mederships (CMS), significantly impacts medical communications and clinical data collection.

- This shift in regulations affects approximately 1.3 million physicians and teaching hospitals in the US, requiring them to comply with reporting requirements. The ongoing evolution of cost-containment measures and regulations underscores the importance of staying informed in the dynamic healthcare landscape.

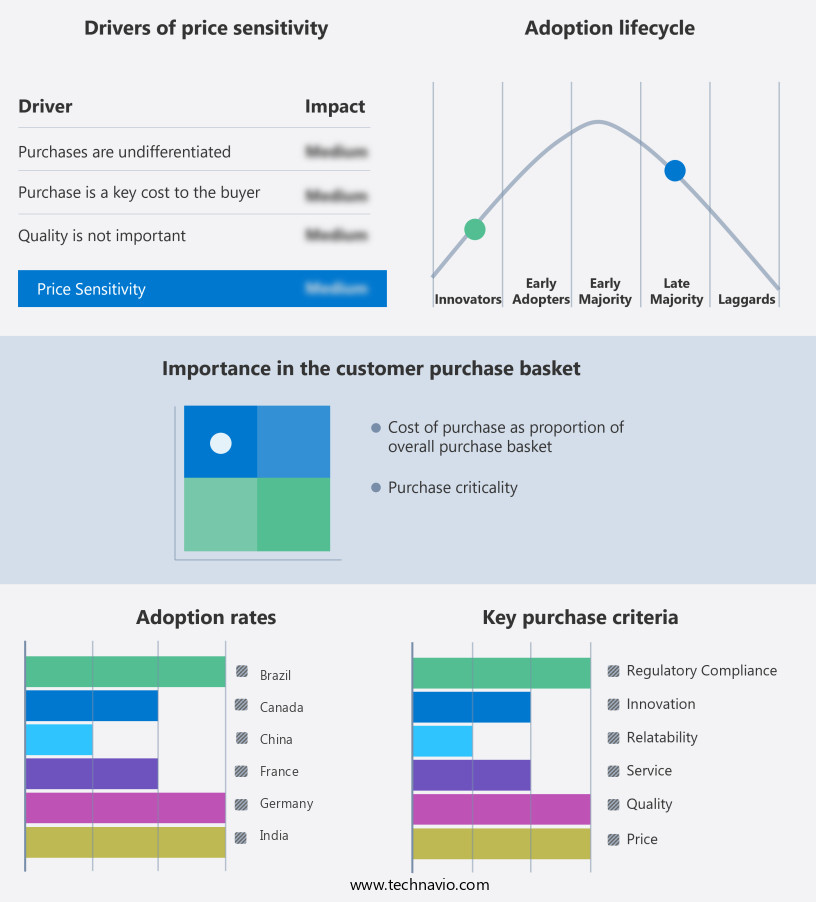

Exclusive Customer Landscape

The medical devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Medical Devices Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in the development and commercialization of advanced medical devices, including the Accent 3 CRT-D System and Assurity MRI SureScan Pacemaker, enhancing patient care through innovative technology and clinical effectiveness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- B.Braun SE

- Baxter International Inc.

- Becton Dickinson and Co.

- Boston Scientific Corp.

- Canon Inc.

- Cardinal Health Inc.

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- Fresenius SE and Co. KGaA

- General Electric Co.

- Johnson and Johnson Services Inc.

- Koninklijke Philips NV

- Medtronic Plc

- Nihon Kohden Corp.

- Olympus Corp.

- Siemens AG

- Smith and Nephew plc

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Devices Market

- In January 2024, Medtronic, a leading medical device company, announced the launch of its new cardiac monitoring system, "Guardian Monitoring System," designed for remote patient monitoring of heart failure patients. This innovative solution, which received FDA approval in late 2023, allows healthcare providers to monitor patients' heart function from a distance, reducing hospital readmissions and improving patient outcomes (Medtronic Press Release, 2024).

- In March 2024, Siemens Healthineers and Philips signed a strategic partnership to jointly develop and market advanced imaging technologies. This collaboration aims to combine Siemens Healthineers' expertise in imaging technology with Philips' strengths in data analytics and connected care solutions, creating more comprehensive healthcare solutions for hospitals and clinics (Siemens Healthineers Press Release, 2024).

- In May 2024, Abbott Laboratories completed the acquisition of St. Jude Medical, a leading medical device manufacturer, for approximately USD25 billion. This acquisition significantly expanded Abbott's portfolio in the cardiovascular and neuromodulation markets, making it a major player in the medical devices industry (Abbott Laboratories SEC Filing, 2024).

- In February 2025, the European Union granted marketing authorization for Boston Scientific's new transcatheter aortic valve replacement (TAVR) system, the Lotus Edge. This approval marked the first TAVR system to receive CE marking with both a self-expanding and a balloon-expanding valve option, expanding Boston Scientific's product offerings and strengthening its position in the European market (Boston Scientific Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

256 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 223 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, Japan, Germany, Canada, UK, China, France, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and innovative landscape of medical technology, two emerging trends are significantly shaping the industry's future: sensor technology and 3D printing. Sensor technology, a critical component of advanced medical devices, continues to evolve, with wearable sensors gaining popularity for real-time patient monitoring. Quality control systems are enhanced through these sensors, ensuring precise diagnostic imaging and accurate medical implants. Meanwhile, 3D printing is revolutionizing the production of prosthetic limbs, surgical instruments, and even medical implants, enabling customized solutions and minimizing invasive procedures. The integration of artificial intelligence and data analytics in medical devices is further transforming the sector, with data encryption ensuring patient privacy and security.

- Risk management and supply chain management are optimized through design controls and patient monitoring systems, allowing for efficient and effective healthcare delivery. Signal processing and clinical trials are streamlined with advanced software validation and device sterilization techniques. The fusion of electrical stimulation and surgical instruments enhances therapeutic devices, while human factors engineering and machine learning improve the user experience. Manufacturing processes are refined with tissue engineering and additive manufacturing, and regulatory compliance is ensured through material science and biocompatible materials. Wireless communication and image processing enable remote patient monitoring, while data encryption and software validation maintain data security.

- The market continues to evolve, with ongoing advancements in minimally invasive surgery, drug delivery systems, and regulatory compliance. In summary, sensor technology and 3D printing are driving the market forward, with advancements in areas such as quality control systems, diagnostic imaging, and minimally invasive surgery. The integration of artificial intelligence, data analytics, and other technologies is further transforming the sector, ensuring continuous innovation and improved patient care.

What are the Key Data Covered in this Medical Devices Market Research and Growth Report?

-

What is the expected growth of the Medical Devices Market between 2025 and 2029?

-

USD 223 billion, at a CAGR of 6.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by End-user (Hospitals and ASCs, Clinics, and Others), Product Type (Diagnostic devices, Therapeutic devices, Monitoring devices, Assistive and rehabilitation devices, and Others), Application (Cardiovascular, Orthopedic, Diagnostic imaging, Dental, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing prevalence of diseases, Declining reimbursement and cost containment measures

-

-

Who are the major players in the Medical Devices Market?

-

Abbott Laboratories, B.Braun SE, Baxter International Inc., Becton Dickinson and Co., Boston Scientific Corp., Canon Inc., Cardinal Health Inc., Danaher Corp., F. Hoffmann La Roche Ltd., Fresenius SE and Co. KGaA, General Electric Co., Johnson and Johnson Services Inc., Koninklijke Philips NV, Medtronic Plc, Nihon Kohden Corp., Olympus Corp., Siemens AG, Smith and Nephew plc, Stryker Corp., and Zimmer Biomet Holdings Inc.

-

Market Research Insights

- The market encompasses a diverse range of technologies, from laser surgery equipment to implantable sensors, rehabilitation devices, and surgical robotics. According to industry estimates, this sector is expected to reach USD690 billion by 2027, representing a significant growth from its current value. Clinical effectiveness and safety are paramount in this industry, with quality assurance processes such as process validation, software testing, and biocompatibility testing ensuring the highest standards. Incorporating advanced technologies like wireless communication, network security, and data integrity plays a crucial role in enhancing device functionality and improving patient outcomes. For instance, wireless technologies enable real-time monitoring of implantable sensors, while data security measures protect sensitive patient information.

- Moreover, regenerative medicine and drug eluting stents are revolutionizing treatment methods in orthopedics and cardiology, respectively. Rapid prototyping and production efficiency also contribute to the market's continuous evolution, allowing for the development and manufacture of innovative medical devices more efficiently.

We can help! Our analysts can customize this medical devices market research report to meet your requirements.