Metallocene Polyethylene Market Size 2024-2028

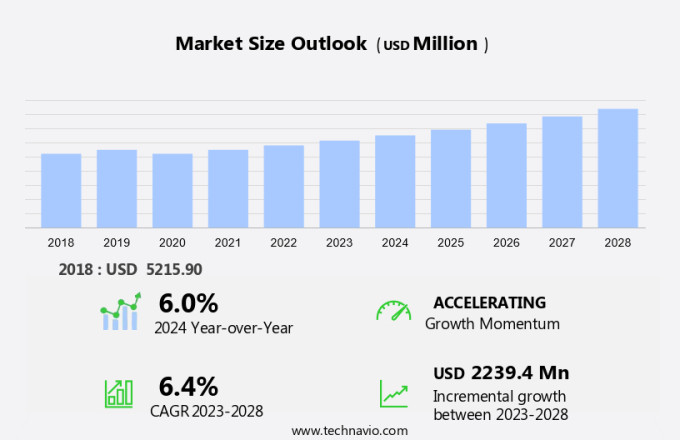

The metallocene polyethylene market size is forecast to increase by USD 2.24 billion at a CAGR of 6.4% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for high-performance plastic materials in various industries especially in pharmaceutical packaging. mPE offers superior properties such as increased toughness, sealing capabilities, and shrink characteristics, making it an ideal choice for packaging materials, extrusion coating, and injection molding applications. In the packaging sector, mPE is gaining popularity for its excellent barrier protection properties, particularly in food and pharmaceutical industries. The shift from traditional packaging materials to flexible plastic options is a major market driver. However, the volatility in raw material prices poses a challenge to market growth. mPE's exceptional puncture resistance and ability to withstand sealing temperatures make it an excellent choice for film and toy packaging applications as well. The emergence of recyclable packaging films is another trend that is expected to boost the market growth in the coming years.

What will be the Size of the Market During the Forecast Period?

- Metallocene polyethylene is a type of polyethylene that is produced using a unique catalyst system, resulting in polyethylene with improved mechanical properties and enhanced performance. The market is witnessing significant growth due to its unique properties and increasing demand in various industries. MPE offers several advantages over traditional polyethylene types such as high-density polyethylene (HDPE) and low-density polyethylene (LDPE). Its superior mechanical properties include increased strength, improved impact resistance, and enhanced chemical resistance. These properties make MPE an ideal choice for various applications, particularly in the packaging industry. Packaging is a critical industry that relies heavily on the performance and properties of the materials used. MPE's excellent mechanical properties make it an excellent choice for packaging applications. Its high damage resistance and product protection capabilities ensure that the packaged goods reach their destination safely and undamaged. Additionally, MPE's excellent barrier properties help extend the shelf life of food products, ensuring their freshness and safety. MPE's environmental sustainability is another factor driving its market growth. The circular economy is a growing trend in various industries, and MPE's recyclability makes it an attractive choice for companies looking to reduce their environmental footprint. Moreover, the development of biodegradable plastics based on MPE is an emerging trend, offering a sustainable alternative to traditional plastic packaging. MPE's manufacturing process involves compounding, which involves blending and processing the polymer to achieve the desired properties.

- The demand for MPE is driven by several factors, including its superior mechanical properties, environmental sustainability, and increasing demand for lightweight packaging. The packaging industry is undergoing significant innovation, with a focus on automation, efficiency, and product safety. MPE's properties make it an excellent choice for these applications, ensuring that packaging solutions are cost-effective, efficient, and safe. In conclusion, the market is experiencing significant growth due to its unique properties and increasing demand in various industries, particularly in the packaging sector. Its superior mechanical properties, environmental sustainability, and manufacturing processes make it an attractive choice for companies looking for high-performance, cost-effective, and sustainable packaging solutions. The future of the market looks promising, with ongoing research and development in material science and polymer processing driving innovation and growth.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Films

- Sheets

- Injection molding

- Others

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Application Insights

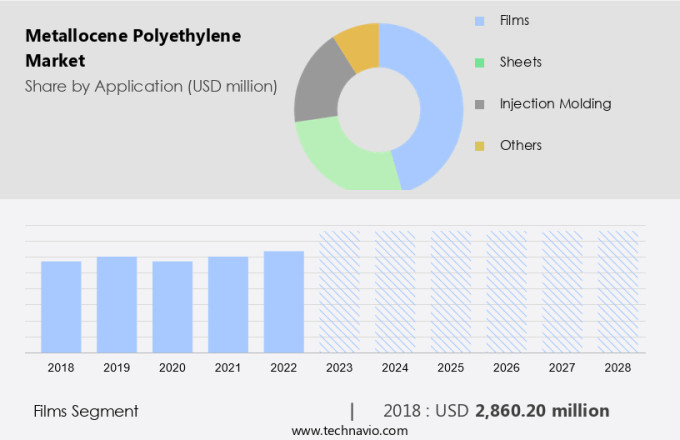

- The films segment is estimated to witness significant growth during the forecast period.

The market for Metallocene Polyethylene (mPE) has seen significant growth in various applications due to its superior properties, particularly in the realm of packaging. In 2021, films held the largest market share in mPE consumption. The shift towards mPE-based packaging films as a replacement for traditional packaging materials, such as PVC, LDPE, and PET, is a key factor driving this segment's growth. The food industry is a significant consumer of mPE-based packaging films. These films are commonly used for packaging meat, meat products, fruits, and vegetables. Both mono and multi-layered packaging films are widely utilized for a diverse range of food items, including fresh produce, baked goods, frozen food, and meat and poultry products.

Further, the food industry is a significant consumer of mPE-based packaging films. These films are commonly used for packaging meat, meat products, fruits, and vegetables. Both mono and multi-layered packaging films are widely utilized for a diverse range of food items, including fresh produce, baked goods, frozen food, and meat and poultry products. Hence, such factors are fuelling the growth of this segment during the forecast period..

Get a glance at the market report of share of various segments Request Free Sample

The films segment was valued at USD 2.86 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

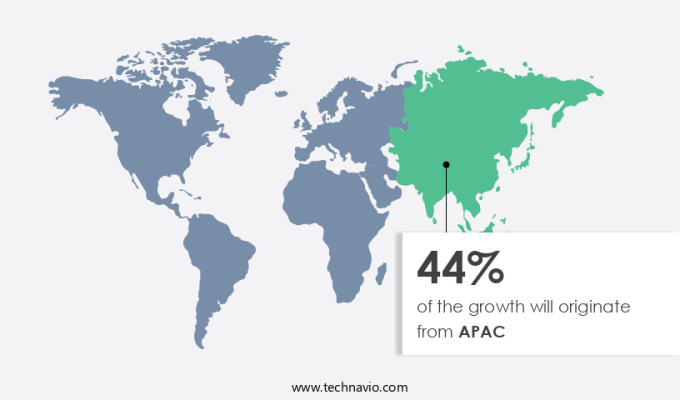

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Metallocene Polyethylene (mPE) is experiencing increasing usage in the Asia Pacific (APAC) region, with key contributors being India and China. In APAC, mPE is primarily utilized in packaging films and injection molding applications. The market's growth can be attributed to mPE's superior properties, such as enhanced endurance under pressure, tear resistance, and puncture resistance. For example, Lumicene, an mPE produced by TotalEnergies SE, has a tensile strength exceeding 55 megapascals (MPa), compared to the average tensile strength of low-density polyethylene (LDPE) films, which ranges from 8-15 MPa. Furthermore, the consumption of metallocene linear low-density polyethylene (mLLDPE) is lower than that of conventional LLDPE to produce the same amount of packaging films, making mLLDPE a more cost-effective alternative. Technological advancements in catalyst technology and the polymerization process continue to improve the durability and versatility of mPE, expanding its use in various industries, including single-use packaging for perishable items and mulching films for agriculture.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Metallocene Polyethylene Market?

Shifting from rigid packaging to flexible plastic packaging is the key driver of the market.

- In today's market, industries including food and beverage, healthcare, personal care, and others are transitioning from traditional rigid packaging to flexible plastic alternatives. Flexible packaging provides numerous advantages, such as ease of use, durability, and lightweight properties. Unlike rigid packaging made of glass or metal, Flexible plastic packaging is less susceptible to damage and corrosion. One of the primary reasons for this shift is the high tensile strength and barrier properties of flexible plastic. For instance, certain products, like juice, wine, and milk, necessitate a certain level of oxygen protection. Flexible plastic packaging can effectively provide this protection against moisture while maintaining the product's aroma, much like glass packaging.

- Flexible plastic packaging is also widely used in various applications, such as hoses, cables, healthcare, agriculture, disposable diapers, wet wipes, and both rigid and flexible food packaging. In healthcare, it is used for medical tubing and pharmaceutical packaging. In agriculture, it is used for silage bags and agricultural films. In the automotive industry, it is used for fuel and coolant hoses. In the food industry, it is used for both rigid and flexible food packaging, offering benefits such as improved organoleptic properties and extended shelf life.

What are the market trends shaping the Metallocene Polyethylene Market?

The emergence of recyclable packaging films is the upcoming trend in the market.

- The demand for metallocene polyethylene, a type of high-performance polyethylene, has grown significantly due to its superior mechanical properties. This material offers excellent tensile strength, making it an ideal choice for various applications such as deep freeze packaging, industrial liners, and heavy-duty bags. In the packaging industry, metallocene polyethylene is widely used in rigid packaging and food containers, ensuring the preservation of moisture-sensitive items. Moreover, the use of metallocene polyethylene extends to sectors like agriculture, where it is employed for producing moisture-barrier films for protecting crops from environmental factors. In the plumbing industry, this material is used for manufacturing pipes and fittings due to its excellent processability and resistance to chemicals.

- The increasing focus on sustainability and reducing plastic waste has led to a wave in the demand for recyclable packaging. Companies are introducing initiatives to increase the use of recyclable packaging and decrease their overall usage of plastic. For instance, Moy Park Ltd., a leading food processing company, launched a campaign in March 2019, aiming to reduce its packaging usage by 5% year-over-year while increasing the use of recyclable packaging by the same percentage. In conclusion, metallocene polyethylene offers numerous benefits, including superior mechanical properties, moisture barrier, and processability, making it a preferred choice for various industries. The growing emphasis on sustainability and reducing plastic waste is further fueling the demand for this high-performance plastic.

What challenges does Metallocene Polyethylene Market face during the growth?

Volatility in raw material prices of mPE is a key challenge affecting the market growth.

- The Metallocene Polyethylene (mPE) market is subject to considerable volatility due to the influence of ethylene prices on production costs. Ethylene, the primary raw material for mPE, is derived from petrochemicals and is susceptible to price fluctuations caused by various factors, such as geopolitical instability, shifts in global oil production, and alterations in demand for oil-based products. This price instability poses a challenge for mPE manufacturers, as it affects profitability and hinders the implementation of consistent pricing strategies. Sudden increases in raw material costs can prompt price adjustments, potentially leading to decreased demand in price-sensitive industries, including packaging, construction, and automotive.\

- Alternative materials or suppliers may be sought by buyers in response. MPE is utilized in various applications, such as shrink film, wire and cable insulation, silage, tubing, greenhouse film, tunnels, non-packaging films, bale wrap, and medical gowns. In the healthcare sector, mPE is used for producing stretch film for gowns due to its excellent clarity, strength, and elongation properties. Manufacturers of mPE must navigate the unpredictability of raw material prices to maintain profitability and meet the demands of diverse industries. The volatility in ethylene prices can impact the entire value chain, from upstream raw material suppliers to downstream end-users.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chevron Corp.

- DL Chemical

- Dow Inc.

- Exxon Mobil Corp.

- Hanwha Corp.

- INEOS Group Holdings S.A.

- LG Chem Ltd.

- Lotte Corp.

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- PetroChina Co. Ltd.

- Petroleo Brasileiro SA

- PETRONAS Chemicals Group Berhad

- PTT Global Chemical Public Co. Ltd.

- Ravago

- Repsol SA

- Saudi Basic Industries Corp.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Metallocene polyethylene (MPE), a type of high-performance polyethylene, is gaining significant traction in various industries due to its superior mechanical properties and enhanced processing capabilities. This advanced polyethylene variant offers improved tensile strength, toughness, and impact resistance compared to standard polyethylene. MPE finds extensive applications in diverse sectors such as deep freeze packaging, industrial liners, food containers, plumbing products, and heavy-duty bags. Its excellent moisture barrier properties make it an ideal choice for packaging perishable items, ensuring product freshness. In the realm of rigid packaging, MPE's high endurance and pressure resistance make it suitable for use in automotive, pharmaceuticals, and heavy-duty industrial parts.

Furthermore, its sealing properties and shrink characteristics make it a popular choice for various packaging materials, including extrusion coating, shrink film, and non-packaging films. MPE's superior barrier protection and toughness also make it an excellent option for applications in agriculture, such as mulching films, silage bags, and greenhouse films. Additionally, it is used in various industries like healthcare, cable, and automotive for producing items like medical gowns, hoses, and operation covers. The MPE production process involves the use of catalyst technology and the polymerization process with hexene as a comonomer, resulting in a polymer with enhanced properties. The technological improvements in MPE production have led to its use in various applications, including lightweight packaging, flexible food packaging, and even disposable items like diapers and wet wipes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 2.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.0 |

|

Key countries |

China, US, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch